What is term insurance? How do premium calculators help?

The term insurance, also known as a term plan, provides coverage to the nominee in the unfortunate event of death of the life insured during the policy term (duration of the policy). At the time of purchase, the coverage amount is determined (known as a sum assured). Since it is a pure risk coverage plan, if the policyholder is alive till the end of the policy term, the customer will have to forego the coverage.

These days, companies like Future Generali India Life Insurance offer term plans with a return of premium option, where if the life insured is alive till the end of the policy term all the premiums are returned. There is no premium rate, rather, a fixed premium amount is decided based on the sum assured, policy term, type of policy, age of the life insured, and many such factors.

What is a life insurance term plan premium calculator?

Also called a term plan premium calculator or a term insurance premium calculator, this is a specially built and customised tool. It helps calculate the estimated monthly or annual premium you are required to pay towards the policy.

When looking to acquire a term insurance policy, the life insurance term plan premium calculator can help estimate the premiums and decide whether the policy is affordable. Thus, they are simple to use and remarkably useful to insure yourself if you have budget constraints.

How does a life insurance term plan premium calculator work?

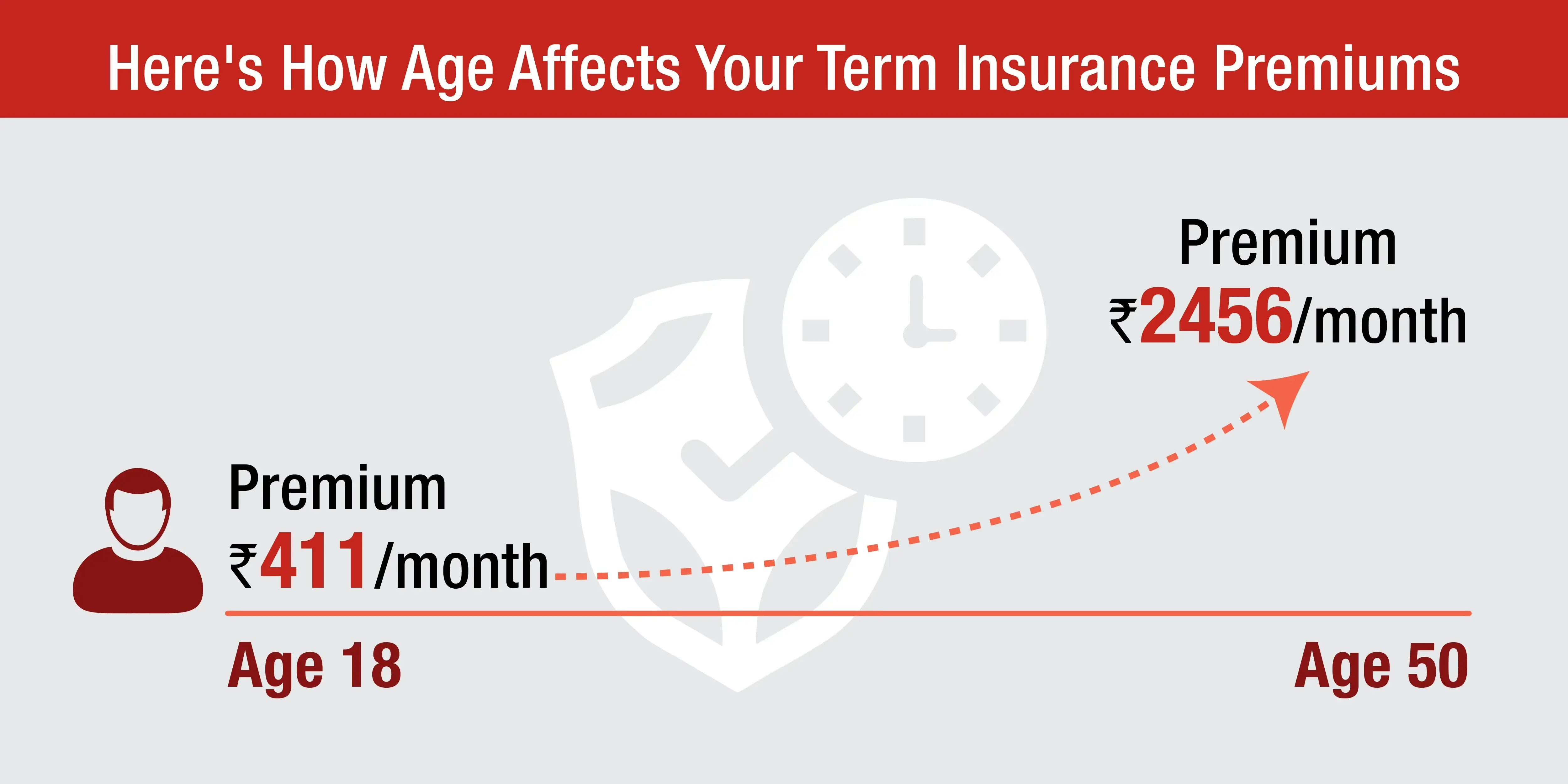

The premium rate for a term insurance plan is decided by the plan selected and the applicant's qualifications. In general, premium rates for younger insurance purchasers are lower than those for people in their 50s. Compared to older insurance buyers, young policyholders are deemed healthier and fitter and are at a lower risk for the insurer.

Furthermore, a variety of factors influence the policy's premium rate. As a prospective policyholder, you may use the term insurance calculator to find the most advantageous plan at a low premium cost. As you change the criteria involved in the computation, the term insurance premium will also vary. Additionally, while using the life insurance term plan premium calculator, you must submit the following information:

- ● Age of the applicant

- ● Name of the plan

- ● Term and frequency of premium payments

- ● Occupation

- ● Previous medical history

- ● Physical stature

- ● Smoking behaviours, etc.

Term insurance comes in a variety of forms. The premiums vary based on the plan you choose. As a result, there are many term insurance calculators for various types of term policies.

Different types of term insurance calculators

There are various types of term insurance calculators based on the below plans:

1. Level term plans

Level term life insurance plans have a fixed sum assured that does not vary during the life of the policy. These are the most basic term policies, and the premiums must be calculated using a basic term insurance calculator.

2. Increasing term plans

An expanding or increasing term plan is when the sum guaranteed rises by a specified percentage each year. The premium does not change even when the coverage does. On the other hand, the premium is calculated so that it covers the expense of increased coverage. Separate term insurance calculators are used for these policies, which compute premiums based on rising coverage levels.

Quick Link: Future Generali Flexi Online Term Plan

3. Decreasing term plans

Decreasing term plans are the polar opposite of growing term plans. Every year, the amount promised under these programs decreases. These programs are frequently accompanied by loans to meet decreasing liabilities. These policies also require a separate term insurance calculator to calculate the annual set payment, which must be paid even if the coverage decreases.

4. Return of premium plans

When these return of premium plans reach maturity, the premiums paid are reimbursed. As a result, these plans offer a maturity benefit. The premiums for these plans are calculated using a return of premium term insurance calculator since the premiums are greater than standard term insurance policies.

Quick link: Term Insurance with Return of Premium Calculator - Life Insurance Premium Calculator

FGILI offers various plans like single-premium term insurance plans, unit-linked insurance plans (ULIPs), health insurance, child plans, and retirement plans. They also offer group insurance plans. Some group insurance plans are Future Generali Sampoorn Loan Suraksha, Future Generali Group Leave Encashment Plan, etc.

Advantages of life insurance term plan premium calculators

Before you acquire a term insurance plan, you should utilize a term insurance calculator for the following reasons:

- ● The calculator provides an accurate calculation of the premium due. As a result, you may assess the term insurance plan's cost before purchasing it.

- ● Using the term insurance calculator, you can compare the premium prices of various term plans.

- ● The calculator is simple to use and helps you make strategic decisions with no hassles.

- ● The term insurance calculator is available for no charge.

- ● The premium computed by the calculator is dynamic. It varies as you update the coverage specifics.

Conclusion

Term life insurance is a way to show your family how much you care. It's about following through on commitments and fulfilling the promise of taking care of loved ones, shielding them from severe financial instability in uncertain times. If you are worried about premiums, use a life insurance term plan premium calculator to get an idea.

Life insurance coverage is essential at all stages of life. At various periods of your life, you may invest in multiple life insurance plans to increase your wealth and safeguard your family from any financial difficulty. You can explore the different life insurance plans offered by FGILI to choose the one that caters to the needs of your loved ones.

Sources:

- 1.https://www.policybazaar.com/life-insurance/term-insurance-calculator/

- 2.Image source - https://www.policybazaar.com/life-insurance/term-insurance-calculator/

Compliance Code: ADVT/Comp/2021-22/November/314

Comments