Getting diagnosed with Cancer is really heart breaking, and because of our lifestyle and surroundings, the risk of getting Cancer is on an all-time high. Cancer cases in India is skyrocketing and nobody is safe. The most demoralizing part about Cancer is that it not only affects your health but also puts a major burden on your financial status. However, the financial burden that you face can be eased with the help of a Cancer insurance. A cancer insurance policy by Future Generali will help you stay financially and psychologically secure in case you or a family member of yours is diagnosed with Cancer.

Benefits offered under various Plan Options.

Free Look Period: In case you disagree with any of the terms and conditions of the policy, you can return the policy to the company within 15 days (30 days if policy is sold through direct marketing mode) of its receipt for cancellation, stating your objections. Future Generali will refund the policy premium after the deduction of stamp duty charges, medical expenses, if any and proportional risk premium for period of cover, if any.

If the Policy is opted through Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:-

Surrender Value:

The policy acquires a Surrender Value immediately after payment of single premium. The policyholder may terminate the policy anytime by surrendering the policy for a surrender value.

For single premium option, surrender benefit is equal to single premium including extra premium for substandard lives, if any (exclusive of Goods & applicable Tax) multiplied by guaranteed surrender value (GSV) factor as given below:

| Policy Year of Surrender | Guaranteed Surrender Value Factor as a percentage of Premium |

| 1 | 56% |

| 2 | 42% |

| 3 | 28% |

| 4 | 14% |

| 5 | NIL |

No Surrender Benefit shall be payable if policy is surrendered in the last policy year.

Grace Period:

You get a grace period of 30 days for annual mode / 15 days for monthly mode from the premium due date to pay your missed premium. During this grace period, you will continue to be insured and be entitled to receive the benefits. If a valid claim arises under the policy during the Grace Period, but before the payment of due premium, the claim will be honoured. In such cases, the due premium will be deducted from the benefit payable.

Tax Benefits:

The Premium(s) paid by you are eligible for tax benefit as may be available under the provisions of Section(s) 80D as applicable. For further details, consult your tax advisor. Tax benefits are subject to change from time to time.

Target Group

For the customers who want to financially protect themselves and their family from the medical and non medical expenses that are incurred in case Cancer is diagnosed and also save taxes

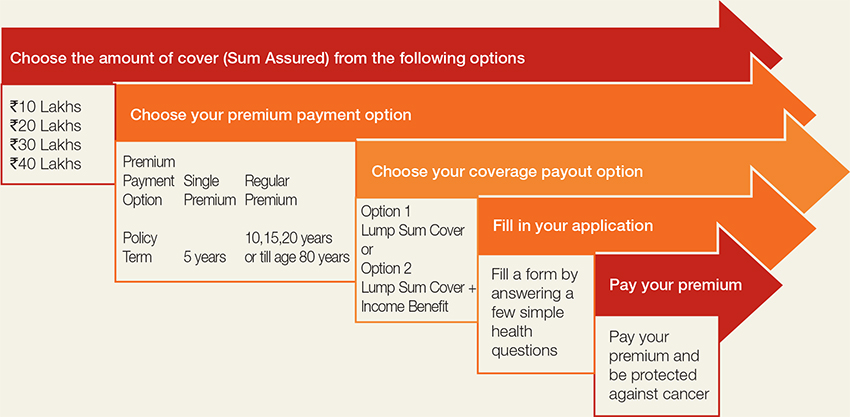

Applying for Future Generali Cancer Protect Plan is extremely easy. Simply go online and get yourself a Cancer insurance plan cover just with the help of few simple steps. The process is extremely hassle-free and quick.

| Entry Age (as on last birthday) | For Major lives : 18 years to 65 years For Minor lives# :1 year to 17 years |

||

| Premium Payment frequency & Policy Term | Regular premium | Single premium | |

| For Major lives - 10 years, 15 years, 20 years or 80 years minus age at entry. For Minor lives - 18 minus age at entry or 10 years, whichever is higher Maximum coverage Age is 80 years |

5 years | ||

| Sum Assured | For Major lives : Rs.10 lakhs, Rs.20 lakhs, Rs.30 lakhs and Rs.40 lakh For Minor lives: Rs. 10 lakhs |

||

| Premium payment mode | Regular Premium – Annual and Monthly Single Premium – One time payment |

||

| #Policy on Minor Life can be taken only when either one of the parent or legal guardian has also taken cover under Future Generali Cancer Protect Plan | |||

No benefit is payable under the Plan for any Minor stage Cancer, and Major stage Cancer, resulting directly or indirectly from or caused or contributed by (in whole or in part) any of the following:

i. Sexually Transmitted Disease

ii. Any congenital conditions; or

iii. Any pre-existing diseases (as defined above)

iv. Intoxication by alcohol or narcotics or drugs not prescribed by a Registered Medical Practitioner.

v. Nuclear, biological or chemical contamination (NBC).

The following are excluded under Major Stage Cancer:

I. Tumours showing the malignant changes of carcinoma in situ & tumours which are histologically described as premalignant or non-invasive, including but not limited to: Carcinoma in situ of breasts, Cervical dysplasia CIN-1, CIN -2 & CIN-3.

II. Any skin cancer other than invasive malignant melanoma

III. All tumours of the prostate unless histologically classified as having a Gleason score greater than 6 or having progressed to at least clinical TNM classification T2N0M0.

IV. Papillary micro - carcinoma of the thyroid less than 1 cm in diameter

V. Chronic lymphocyctic leukaemia less than RAI stage 3

VI. Microcarcinoma of the Bladder

Pre-existing diseases

Pre-existing Disease means any condition, ailment, injury or disease:

Reinstatement means the revival of policy post expiry of grace period

Future Generali Cancer Protect Plan (UIN: 133N063V03)

Future Group’s and Generali Group’s liability is restricted to the extent of their shareholding in Future Generali India Life Insurance Company Limited.

Tax benefits are as per Income Tax Act 1961 and are subject to any amendment made thereto from time to time You are advised to consult your tax consultant

For more details on this product including risk factors, terms and conditions, please read the sample policy document / brochure carefully and/or consult your Advisor and/or visit our website before concluding a sale.

The fine print in a policy can come in the way of making an informed purchase. We’ve simplified the fine print into big print.

Read the terms and conditions carefully. Ensure that your current health, occupation or lifestyle habits do not exclude you from getting the policy benefits.

Do's and don’ts to protect your life insurance policy from unauthorised elements posing as company representatives.

Find out how prepared you are to meet your financial goals, with our FutureReady calculator.

Buying a life insurance policy without asking your advisor the right questions is as good as crossing a road blindfolded.