Budgeting is the first step towards financial success. Making money is just one part of the economic game.The second and equally important part is to manage one's finances. Lack of planning, however, is a plan for a financial disaster.

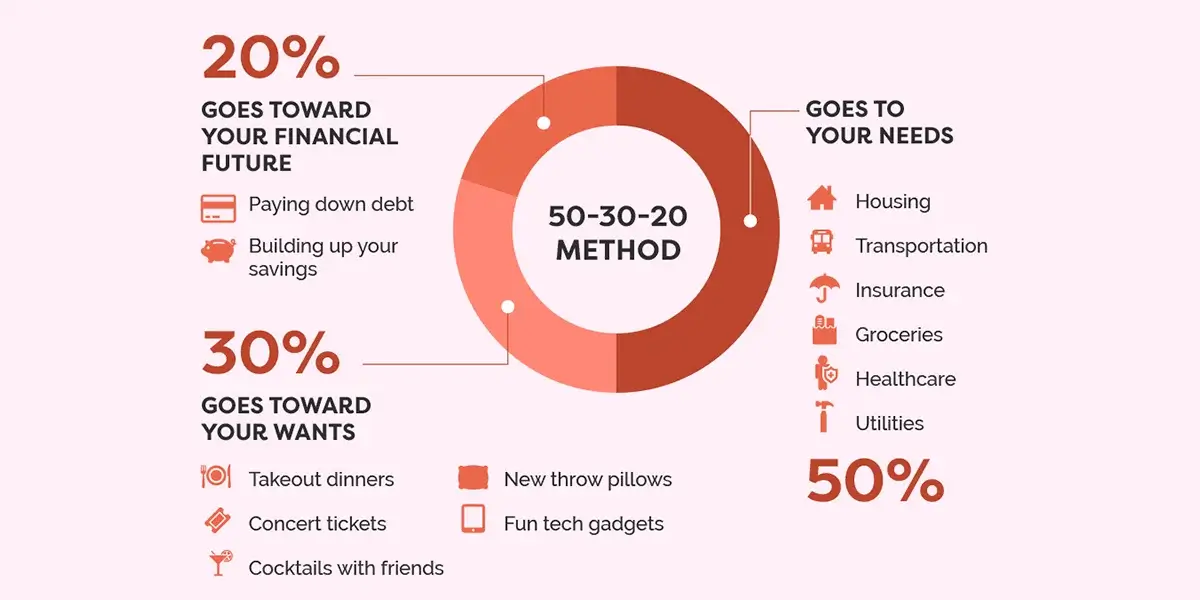

What is the 50/20/30 budget rule?

The 50/20/30 rule simplifies the allocation of your finances after deducting the taxes. There are three categories.

These categories include money spent on the NEEDS, WANTS, and SAVINGs of the person.

Image Source - https://www.glowhabits.com/50-30-20-budgeting

Image Source - https://www.glowhabits.com/50-30-20-budgetingThe 50% of Your Income - NEEDs

Firstly, it is essential to fulfill the necessities of an individual, so 50% of your income should go towards such needs.

- Paying for insurance, rent, electricity bills, spending on groceries, etc., are basic needs as they are essential for survival.

- A term life insurance becomes of utmost importance as it is one of the basic needs and responsibilities of a person to protect his/her family from unforeseen financial crises.

The 30% of Your Income - WANTs

30% of the income goes towards the wants of the individual. This includes:

- Entertainment

- Taking vacation(s)

- Shopping

- Buying a car, etc.

The 20% of Your Income - SAVINGs

The remaining 20% of the income goes towards savings. Savings does not mean storing money in a savings account.

Savings means utilizing the free money to work for you by investing it in the best possible way.

How Can Life Insurance Make Your Money Work for You?

To your surprise, here’s where insurance can play a leading role if you choose your investment wisely depending on your risk appetite and the financial responsibility at a given point in time.

For individuals with low or medium risk appetite or wanting to bring balance to their portfolio then Guaranteed Return Plans are the best option for you. Insurance saving plans not only offer guarantee on the premium you pay today but also on the premiums that you promise to pay in future. One can also look at participating policies which have a minimum guaranteed amount payable upon death or maturity and have a potential to get an upside by way of bonuses.

For individuals having high risk appetite, the guaranteed return plans can work as a hedging tool. They can also look at Unit Linked Insurance Plans which not only allow them to choose funds as per risk appetite for the investible proportion of premium but can also move between funds (switch) with changing risk appetite or market conditions.

Most important, irrespective of the type of product you choose, Life Insurance cover will be in-built to ensure your loved ones are protected in case of an untoward incident.

Insurance plans are seen as a tax2 efficient method for long term savings.

Summing Up

The 50 20 30 rule, in short, is about correctly allocating your money to your wants, needs and investments. With life insurance you can get your needs and savings right! What are you waiting for, click here to connect with our financial advisor NOW!

Disclaimers

- Tax benefits are subject to change in law from time to time. You are advised to consult your tax

Comments