Originally Published at: https://www.adgully.com/with-the-pandemic-customers-prefer-guaranteed-savings-plans-over-ulips-rakesh-wadhwa-97461.html

Future Generali India Life Insurance Company Limited is a joint venture between three leading groups: Future Group – a leading retailer in India, Generali Group – a global insurance group that features among top 50 smartest companies in the world, and Industrial Investment Trust Limited – a leading investment company. With operations spread across 136 branches and a complete range of simplified solutions for the financial security of customers and enterprises, the company aims to become the first choice by delivering relevant and accessible insurance solutions.

The pandemic has generally alerted people when it comes to both health and life insurance. Today, the company has seen growth pick up across most markets present and a couple of large metros. As life insurance is driven by the strength of its vast distribution the company has focussed and expanded their distribution footprint and penetrated in more towns and smaller markets. Recently, the company has tied up with a well-established co-operative bank in the Northern region to reach in smaller markets and offered customers simple and easy to understand insurance solutions. Educating and engaging with customers has been the primary focus besides ensuring that the right set of products and cohesive customer experience is delivered with their data and digital technology.

The insurance market has been in the growth trajectory, companies today are more agile to win customers. To understand how companies are planning their marketing strategy both short term and long term, Adgully spoke to Rakesh Wadhwa, Chief Marketing Officer, Future Generali India Life Insurance Co Ltd.

The pandemic has disrupted globally and there is some kind of fear in peoples minds. Has the pandemic prompted people to protect themselves and go for Life Insurance cover? Have you seen any surge happening for Future Generali India in the last few months?

The pandemic has forced people to think about the fragility of life and the burden of healthcare costs that can fall on any family if they are not financially well prepared. As the situation persists, we see more customers reflecting on their financial preparedness for meeting their life goals, leading to an increase in enquiries for life insurance cover, especially term insurance and critical illness insurance. The other development we note is that as customers have become more cautious about spending, they prefer guaranteed savings plans over ULIPs. Consequently, our proprietary channels have delivered growth in business despite the slowdown in the industry.

Where is the growth coming for Future Generali India in terms of markets? Are smaller towns looking at Life Insurance policies in a big way? Is there any focussed marketing strategy that is being adopted to tap the smaller markets?

We see growth pick up across most markets we are present in, say a couple of large metros. Life Insurance is driven by the strength of its distribution and over the last year, as was the case in previous years, we focused on expanding and deepening our distribution footprint. We opened new branch offices and also accessed new/ smaller markets through our partnership distribution that has helped us carry forward the momentum. We have recently tied up with a well-established co-operative bank in North India, which will further extend our reach in smaller markets and offer unserved customers simple, easy to understand insurance solutions. We work very closely with our partners and distributors to enable their success through the right set of products, tailored processes, and cohesive customer experience driven by data and digital technology.

How has digital helped you stay engaged with your business partners and your sales agents during the lockdown? How are you keeping them motivated and sharing knowledge and running your sales training program?

Having embarked on an ambitious Digital Transformation three years back, we had digitised most of our front end and back end processes before the pandemic struck. However, the pace of augmentation of initiatives and digital adoption has increased dramatically in the last 6 months. Our digital-first thinking paid off in these very turbulent times as we were able to put the required business continuity protocols, WFH infrastructure support, data security protocols, expanded cloud services into action in a matter of few days. We launched a full-stack Digital Sales Kit for our sales teams covering activity monitoring, video-based solicitation tools, quote generation, paper-less contracts, video-based client verification, and mobile-based training and broadcast in only 2 weeks. So, come April, we were geared to operate across all branches and partnerships with all services ported to digital platforms.

We also launched a truly novel initiative called BOLT, whereby our intelligent underwriting algorithm identified customers who could be offered any of our products through the agent/ distributor, without having to fill long forms or conduct a medical examination. With our enhanced digital payments ecosystem, customers could complete the transaction in a few minutes and have the policy issued to them within one day. As for training our sales teams, we had earlier launched a mobile based e-learning/ video-based platform with the capability to address thousands of distributors. This platform helps us deliver, monitor, and personalise learning programs at scale.

Your Masters Speak program generated good visibility. How long do you plan to continue the same and how has it benefited the brand in the last few months?

Truth be told, I am overwhelmed with the response we have received for Masters Speak from customers, distributors, and industry fraternity. When I conceptualised this program, my team instantly felt that this is the right thing to do. The goal was not to advertise, but to empower people with answers in these unprecedented and uncertain times. The guiding factor here was one of the core values of our brands – “Live The Community”. We listened to our customers and distributors intently and felt the anxiety that was building up in their minds during the extended lockdowns. We knew no one person could have even a meaningful perspective leave alone all the answers about life post COVID, hence we put together a stellar ensemble of global leaders, thinkers, authors, and luminaries to share their wisdom and perspective with our audience. So far, we have held over 30 sessions that have been attended by over 2.8 million viewers. Thanks to our community support partners, we continue to receive extraordinary organic reach and engagement during the sessions and shall continue this program as long as the audience gets to benefit from it. Since these sessions are about an hour or so long, we will be creating short-form content and share on our social channels for the audience who may not have the time or chance to attend these sessions.

Good customer care helps build brand loyalty. How have you addressed the customer pain points and grievances, especially when the helpline services were not fully functional due to the pandemic?

Allow me to share an interesting statistic with you – We have seen a 50 per cent improvement in R-NPS since the beginning of the year and our (renewal) persistency numbers have grown strongly despite pandemic enforced lockdown across the country.

I can attribute this to 3 things:

- Our digital readiness – 95% of all customer transactions can be done on our self-service platforms like a customer portal, mobile app, Whatsapp. Also, our contact centre was WFH ready in a matter of a few weeks.

- Well-co-ordinated outreach program involving all channels of communication with customers, including agents and partners. We called out 10,000 customers proactively to inform them of their policy coverage and enquire if any help is needed.

- Our NPS program – It is a community-driven program that engages the entire organisation in delivering customer satisfaction. As part of the program, we proactively identify pain points and systematically eliminate them to ensure we don’t have repeat failures.

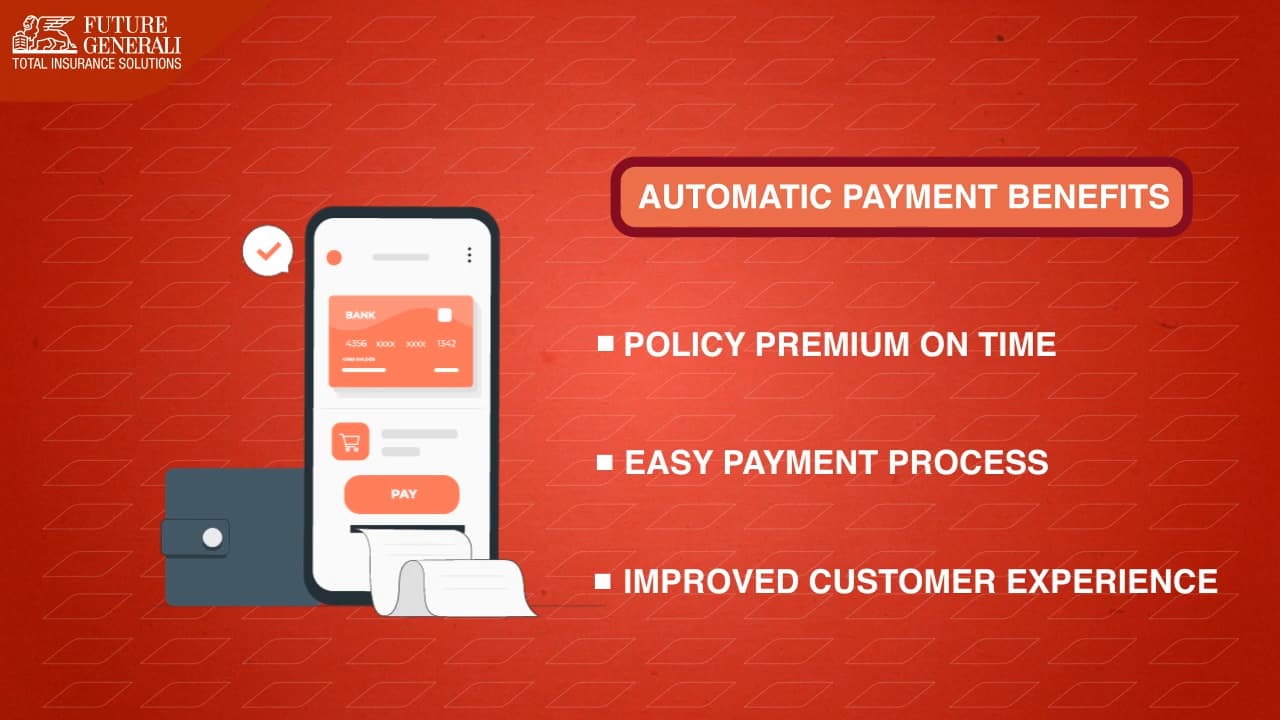

Also, I must give due credit to all our teams who have shown amazing resilience and alacrity in responding to adversity. Therefore, as the pandemic hit us, we were swift enough and expand our service ecosystem by providing an enhanced payment ecosystem, launched an upgraded mobile app with state of the art UI/UX, added services in vernacular (8 languages), enabled e-NACH service for new business and renewals, launched e-policy kit to name a few. All these initiatives were executed basis customer pain points that we identified through our NPS program.

What has been your overall media strategy for your campaigns? Digital has accelerated and is a key medium for customer engagement, how have you deployed digital to stay engaged with your stakeholders and your audiences?

Our media strategy squarely focuses on digital channels and we have doubled down on that. I would not hesitate to add that it is a focused, high sweat, long haul, keep the wins strategy. As a brand, we stand for prevention and protection with customers’ well-being at the heart of all our engagements. We want to be Lifetime Partner for our customers and distributors, which mandates us to operate from a place of authenticity, ownership, and empathy. Once you have the purpose clear, messaging becomes clear no matter what media you choose.

Guided by this very purpose, we have been ahead of the curve as far as the pandemic is concerned. So far, we have launched 3 phases of our engagement campaign – The first one started with busting myths around the Coronavirus, remedies, precautions, etc. We launched a 24/7 helpline and curated authentic content on social channels for our customers to provide them fact-based information. The second phase began with the announcement of the first lockdown in March. We launched #LockInGoodHabits, intending to motivate our stakeholders and customers to stay safe and healthy at home. Series of live video workshops and happiness coaching sessions were curated, reaching out to over 20 million audience. The third phase began with Masters Speak as unlocking was announced to address the anxiety about the future of jobs, businesses, lifestyle, finances, etc. We are preparing for the fourth phase of the campaign now. More on that as we go along.

With the festive season here, will it bring cheer to the Insurance industry? Are you planning to leverage the festivity with any promotions and launch of new products?

Unlike other consumer retail businesses, Life Insurance business is not augmented by festivals as such, but it does provide an apt occasion for the brand to be a part of customers’ celebrations. Festivals always bring positive energy and vibrancy in our society, however, we must be cognizant that the pandemic is far from over, therefore, as a responsible brand we will continue to emphasise the need to stay healthy and safe. We will have a message for sure that builds on our position as conveyed above. We have recently launched a new guaranteed savings product and expect that to perform well.

Comments