India is a vibrant democracy with more than 2500 political parties*. A citizen of India can exercise his voting power to support a party of his choice during elections. Apart from this, one can also extend financial support to political parties, and in the process, save tax on the amount donated for this purpose.

Who can you donate to?

A political party duly enlisted as per Section 29A of Representation of the People Act (1951).

A non-profit organisation such as an electoral trust formed under Section 8 of the 2013 Companies Act. The trust acts as a channel to receive funds that are passed on to the respective party later.

Who can claim tax deduction?

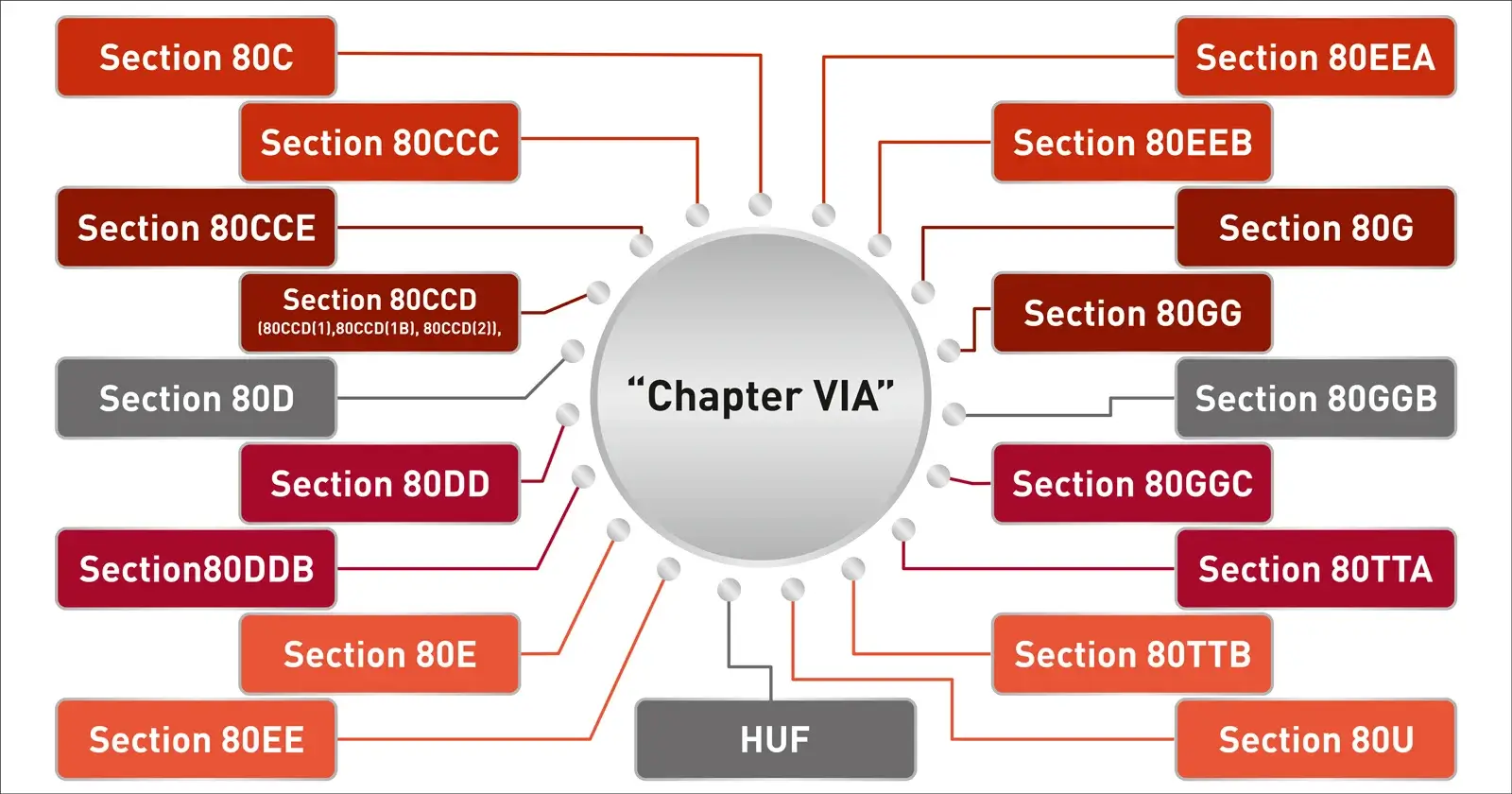

Tax benefits on donations to political parties are available under two sections - namely 80GGB and 80GGC.

Deduction under Section 80GGB - Eligible Tax payer – Any Indian company that contributes to a political party or an electoral trust registered in India is eligible for a deduction for the amount paid.

Deduction under Section 80GGC - Eligible Tax payer – All taxpayers, other than an Indian companies, local authorities, and artificial juridical persons wholly or partly funded by the government.

Note: The person claiming tax benefit should not be associated with a local authority or be a legal person that receives funds from the government.

What modes of payment can be used to make contributions?

Tax benefits on donations to political parties under both 80GGB and 80GGC are not available on cash or kind contributions. This means a cheque, demand draft and electronic transfer should be your preferred mode for donating if you’re looking for a tax deduction. This ensure transparency in funding during the elections.

What is the maximum amount of deduction available under Sections 80GGC and 80GGB?

Both individuals and companies can claim deduction on 100% of the amount donated by them to a political party under Section 80GGC and 80GGB respectively. The entire contribution is allowed for a tax deduction if it is not more than the taxable income of the eligible taxpayer.

This helps lower the total taxable income considerably, thus helping them save tax.

Rules for companies to avail tax benefits on donations to political parties

The following rules must be followed by India companies to avail tax benefits under Section 80GGB for contributions/ donations to political party:

- There is no maximum applicable limit on the contributions made to political parties, under Section 80 GGB of the Income Tax Act.

- But as per the Companies Act 2013, companies can contribute up to 7.5% of their annual net profit (three years average).

- It is necessary that the respective company discloses the amount contributed and the name of the political party in its “Profit and Loss account” for the said financial year.

- The name of the political party and the amount given as donation should be duly disclosed by the company in its profit and loss account book. However, only the amount paid needs to be recorded for a contribution made through electoral bonds.

- An advertisement from a company on any media such as print, broadcast or social which a party in politics owns, would be recognized as a donation as per section 80 GGB. This automatically makes it eligible for tax deduction.

- A company can extend its support to any number of political parties. However, all contributions made are added up to avail tax benefit.

- There are certain exceptions to the contributions made under Section 80 GGB:

- A Public Sector Enterprise

- A company that has an age of three years or less

Conclusion

Everyone has the right to donate to the political parties of their choosing and to claim income tax benefits for doing so. The only thing to keep in mind is that the record must be kept properly. The company or individual must follow all of the rules outlined in the Income Tax Act of 1961. The Income Tax Department has the authority to reject a claim for a deduction if the procedure is not followed correctly. You can get expert information on the numerous under deductions available by contacting our qualified financial consultants.

One must produce the following documents which are required to avail the tax deduction.

The receipt issued by political party or electoral trust to produce a proof of the amount contributed. It should contain the name, address, PAN, TAN (Tax Deduction and Collection Account Number), registration number of the party/ trust, name of the donor, mode of payment and the amount donated in words and numbers.

The Income Tax Return form is required to be filled up and submitted. The above details would be necessary for the same.

Comments

P