- Home

- Insurance Plans

- combo-solutions-insurance-plans

- Guaranteed Income Solution

This advertisement is designed for combination of benefits of two individual and separate products named (1) Future Generali Assured Income Plan (UIN: 133N054V04) and (2) Future Generali New Assure Plus (UIN: 133N065V02). These products are also available for sale individually without the combination offered/suggested. This benefit illustration is the arithmetic combination and chronological listing of combined benefits of individual products. The customer is advised to refer to the detailed sales brochure of respective individual products mentioned herein before concluding the sale.

FUTURE GENERALI GUARANTEED INCOME SOLUTION

We all dream of a financially secure future with a steady income, the ability to fulfil our family’s dreams, a home to call our own, an annual vacation and a comfortable retirement. But what it takes to achieve all this has become more challenging with the times.

It would be a double delight if someone can guarantee a regular flow of income along with a potential of growth of our savings. While it takes dedicated planning and self-discipline, but with the right saving instrument, the journey towards achieving our financial goals becomes faster. It becomes further easier with a partner who can take the burden of changing market conditions off our back and help us financially secure our present and future.

Presenting the Future Generali Guaranteed Income Solution – a combination of life insurance plans that equip you not only with an additional income to meet your regular needs but also create a sizeable wealth corpus to achieve your planned milestones. You can now be Future Ready to ensure growth and protection for your family.

Key Benefits of GUARANTEED INCOME SOLUTION

Get total capital protection with a potential upside++ through a combination of guaranteed** and non-guaranteed life insurance plans

Get a life cover to safeguard your family's financial milestones

Get guaranteed** income for 15 years^ plus a guaranteed lump sum with potential upside++ at the end of 30 years

Flexibility to take a loan# against the policy in case of any emergency

Get tax benefits as per the prevailing laws+

- Min. Entry Age5 years

- Max. Entry Age40 years

- Premium Payment Term15 years

- Minimum

Premium (excl.taxes)₹ 70,000 - Premium Payment Frequency Annual

How does this solution work?

This solution is a combination of two plans:

- Future Generali Assured Income Plan - An Individual, Non-linked, Non-participating (Without Profits), Savings, Life Insurance Plan.

- Future Generali New Assure Plus - An Individual, Non-Linked, Participating (With Profits),Savings, Life Insurance Plan.

The premium you decide to pay is distributed equally between these two plans.

Future Generali Assured Income Plan pays a regular income^ after the premium payment term including an additional benefit## with the last instalment and Future Generali New Assure Plus pays you a guaranteed** plus non-guaranteed maturity benefit at the end of the benefit term of 30 years.

++Through bonus (if declared). **Provided you have paid all due premiums on time. ^After the completion of the premium payment term. #You may avail a loan after your Policy acquires surrender value. Your loan amount can be up to 85% of the surrender value. +Tax benefits are as per the Income Tax Act 1961, and are subject to the amendments made thereto from time to time. You are advised to consult your tax consultant. ##Additional benefit depends upon the life assured’s age at entry.

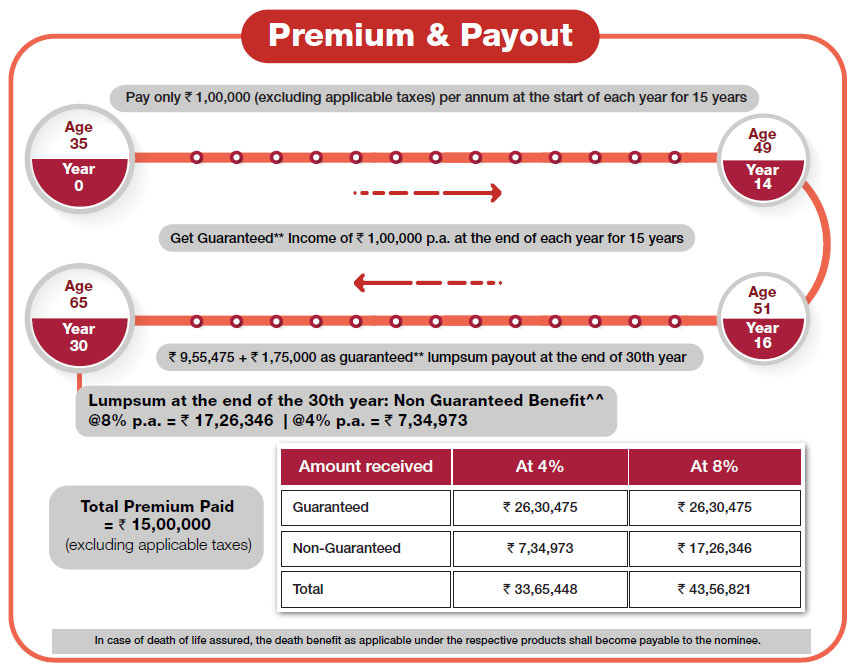

Let’s understand the working of this solution using an example

Suresh Kumar

Suresh KumarAge 35

Income Solution

Return

ReturnMarket

Conservative

Conservative- Guaranteed Income

- Guaranteed Maturity Benefit

- Upside Through Bonuses

@8% p.a. = ₹ 17,26,346 | @4% p.a. = ₹ 7,34,973

= ₹15,00,000 (Excluding applicable taxes)

- Amount received

- At 4%

- At 8%

- Guaranteed

- ₹ 26,30,475

- ₹ 26,30,475

- Non-Guaranteed

- ₹ 7,34,973

- ₹ 17,26,346

- Total

- ₹ 33,65,448

- ₹ 43,56,821

In case of death of life assured, the death benefit as applicable under the respective products shall become payable to the nominee.

The premium mentioned above is for a normal standard male excluding taxes/ loading/rider premium. **Provided you have paid all due premiums on time. ^^Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your life insurance company. If your policy offers guaranteed benefits then these will be clearly marked "guaranteed" in the illustration table. If your policy offers variable benefits then the illustration will show two different rates of assumed future investment returns, of 8% p.a. and 4% p.a. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance.

DISCLAIMERS

Future Generali Assured Income Plan (UIN: 133N054V04) is an individual, non-linked, non-participating (without profits), savings, life insurance plan. Future Generali New Assure Plus (UIN: 133N065V02) is an individual, non-linked, participating (with profits), savings, life insurance plan.For illustration, we have combined the premiums payable and benefits that you may receive under each plan of this solution. To know the details of individual products please go through the “Benefit Illustration” of each product. This is not a product brochure. Please read product brochures of Future Generali Assured Income Plan and Future Generali New Assure Plus to fully understand the features, benefits, exclusion, risk factors, product terms and conditions. The individual products under this solution have certain product features which offer options beyond the ones assumed in the benefit illustrations shown here. The customer can apply for above mentioned plans individually and opt for product features or options beyond the ones provided in the illustration shown here. Maturity benefits are available only if all the premiums are paid as per the premium payment term and the policy is in-force till the completion of entire policy term. Future Generali Guaranteed Income Solution is only the name of the combination solution and does not in any way indicate the quality of the contract, its prospects or returns. It is suggested that you undergo suitability test before making a purchase. Future Group’s and Generali Group’s liability is restricted to the extent of their shareholding in Future Generali India Life Insurance Company Limited. Future Generali India Life Insurance Co. Ltd. (IRDAI Regn. No. 133) (CIN: U66010MH2006PLC165288). Regd. & Corporate Office Address: Future Generali India Life Insurance Co. Ltd, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S. Marg, Vikhroli (W), Mumbai - 400083 | Email: care@futuregenerali.in | Call us at 1800 102 2355 | Website: life.futuregenerali.in | ARN: ADVT/Comp/2021-22/April/010