Have you ever wondered what value the all-hardworking tax you paid holds in government spending?

It's a sure bet at some point in life you have contemplated this thought.In this article, you will learn a bit more on how the government spends your tax money.

Any amount paid in taxes is income to the government. Every nation's everyday expenses depend entirely on the nation's taxpayers. Hence, the government announces an annual union budget in the parliament.

Sources of Revenue

Capital receipts, Non-tax receipts, and tax receipts are the major categories of revenue receipts. In terms of government revenue, taxpayers contribute almost 53.77%, capital receipts make up 33.57%, and nontax revenue makes up 12.66% (3). Depending on the amount of taxes collected, governments can decide how the funds will be spent1. It gets 53 paise out of every rupee it receives in direct and indirect taxes2.

What Happens to the Taxpayer’s Money?

Taxpayer's money is mainly divided into the following categories:

#1. Payment of Interest

The Central government spends the lion's share of its total expenditure towards payment of interest every year. When the government takes a loan, it has to pay interest on such credit. For fiscal 2020-21, interest on debts will be paid with 23.31% of the budget.3

#2. Defense Allocation

Your money also helps pay for the country's defense and security-related expenditure. India is one of the world’s largest importers of weapons.

- Approximately 11.1%, which is Rs 3.4 crores, of the annual union budget is allocated for the country's defense.

- About 35% of the defense budget goes for capital spending, which includes the expansion of the military and the modernization of existing weapons.

- The remaining proportion goes towards running the forces' daily expenses.

Thus, taxpayers' money helps strengthen the country's defense mechanism and security.

#3. Government and Welfare Schemes

Government spending kind of is split between for all intents and purposes several schemes, generally such as healthcare, education, fairly social security, and others. The really central sponsored schemes (CSS), which particularly are implemented by the state but funded by the Centre.

#4. Subsidies

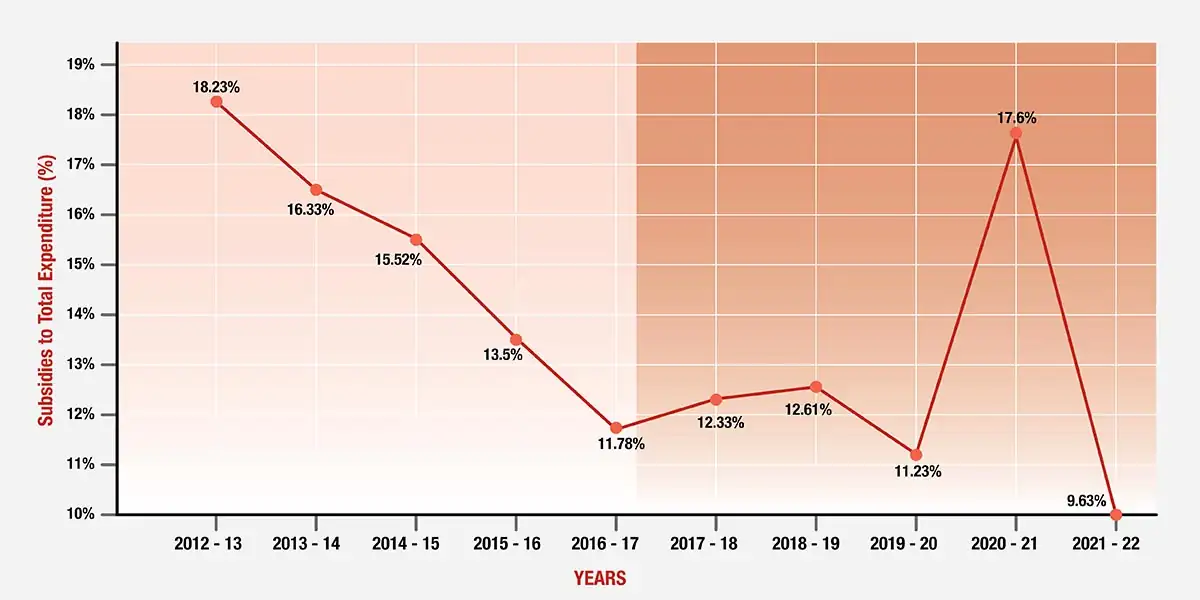

All goods or services provided below cost to certain sections of the population are subsidies (e.g., fertilizers, train tickets, LPG, metro rail fares). The chart shows how much it spends on subsidies as a percentage of its total spending.

Government Subsidies

Government Subsidies#5. Pension

In order to demonstrate its responsibility as an employer, the government provides pensions to its retired employees. Pensions are another major expense. After retirement, former government employees and former military personnel receive a pension. Approximately 6.42% of the government's income is used to pay pensions.

#6. Transfer to the States and Union Territories

The central government gives approximately 8% in the form of grants and transfers to the union territories and states for emergency management and development.

--

Conclusion

- For the overall development of the country, every individual who earns income must pay taxes.

- The government uses the money received to improve infrastructure, provide public health care services, and develop rural areas.

- Every individual and company will benefit if they pay their taxes on time every year because this will allow the government to establish profitable schemes and infrastructure.

- The government allows various economic ways to save tax such as life insurance products. To know more, speak to our financial advisor.

Comments

V