Why should you invest in ULIPs?

Education costs have gone up due to inflation. If you look into admission fees for engineering colleges or for getting an MBA, a degree would cost around 30 lakhs and 50-60 lakhs respectively. Most of a parent’s savings and earnings go into their child’s education. If that doesn’t suffice, children are forced to take out student loans. Estimates show that more than one million students are staggering in debt from student loans.

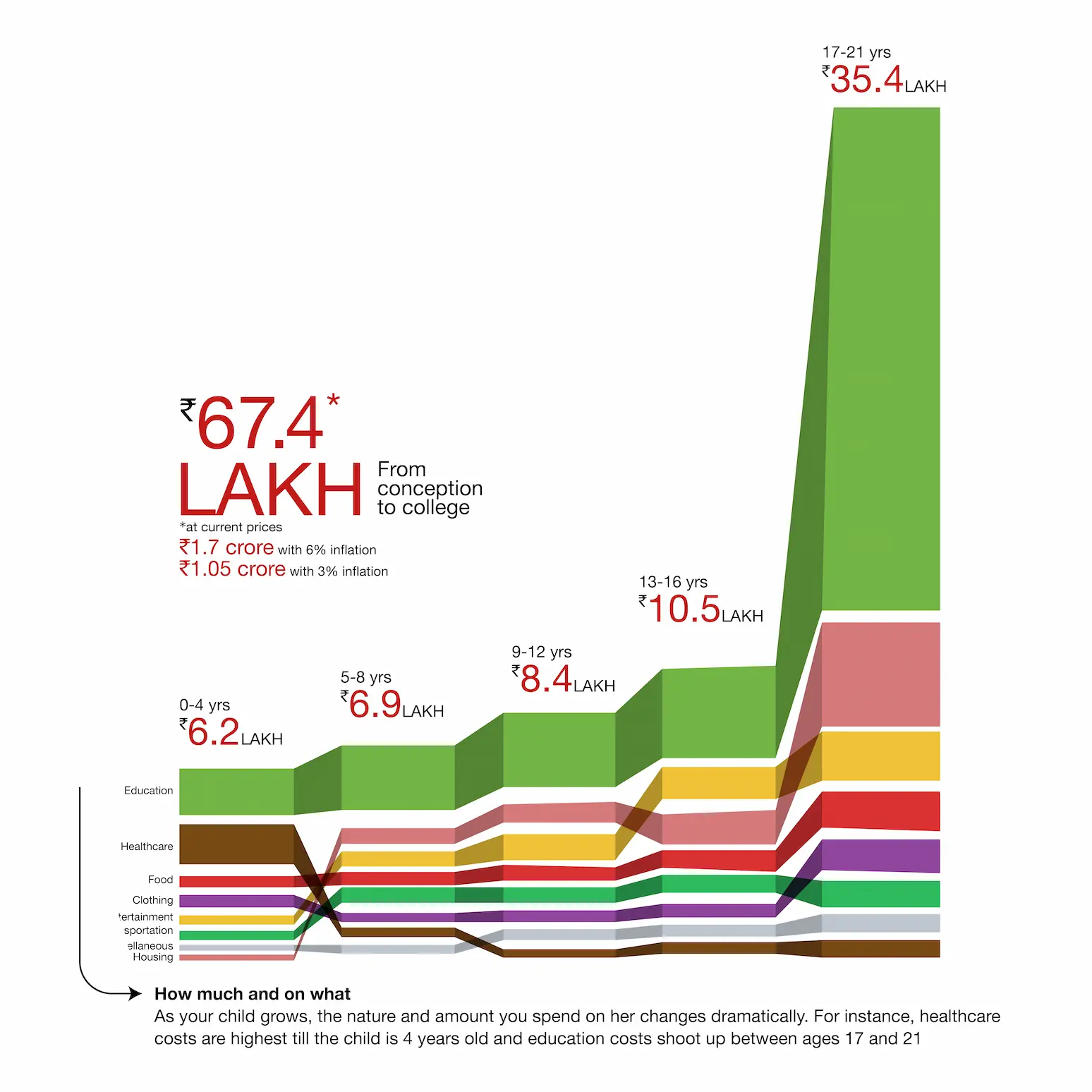

Child Education Cost. Source: TOI

Child Education Cost. Source: TOIWhat are the benefits of investing in ULIPs?

Investing in your child’s future is key to keeping it financially secure. With child ULIP plans you have the benefit of both insurance and investment. They take care of your child in your absence. In case of an emergency, you can be assured that your child’s future is secured. If you’re worrying about the affordability of , you can make small investments and get larger returns as small fractions of your money will grow into a lump sum when compounded. This amount will ease your financial burden and can be withdrawn in partial amounts, if you need them to help your child secure major milestones in his/her life.

There are ULIPs that cater to your child’s education only. ULIP child education plans focus on your child’s education needs, depending on investments based on your financial capacities and monetary goals. You can withdraw the amount partially, as per your requirements.

An added advantage to ULIPs comes with tax benefits is that they come with tax benefits as well.

So, if you are thinking, “Should I invest in ULIPs for my children?”, the answer is yes. Child ULIP plans help you create a corpus that will fund your child’s education as well as marriage. In case the insured expires, the assured sum will go to the child.

Eligibility: Child ULIP plans allow you to invest once you fulfill the criteria of minimum and maximum requirement for age as per the policy. Your age must fall in the range that is required by the terms and conditions of the policy at the policy’s maturity.

In order to apply for a policy, you will have to submit the following documents:

- A proposal or application for insurance.

- Age proof

- KYC documents like - Identity proof, address proof, etc.

Other Documents

The Insurance Company may call for additional information or documents depending upon the amount of cover applied, the premium that you will be paying and your profile, including but not limited to your lifestyle, habits, family history etc.

Investments in ULIPs

Being a parent means having a huge responsibility on your shoulders. You have to be efficient in managing your finances to secure what’s best for your child. Child ULIP plans come with a number of benefits like building corpus, life insurance, death cover and others.

You do get maturity benefits from child ULIP plans; the assured sum comes to the parent or guardian and on their demise it is handed over to the child. They also waive off your future premiums and on your behalf the insurance company continues to invest this money.

In general, portfolio switching between debt and equity is also possible in ULIPs, but it mostly depends on your risk appetite and knowledge about market performance. On the other hand, though it has been mentioned here that you can partially withdraw money before maturity, you must know that that may force you to lose a portion of your returns. You must abide by the lock-in period which is normally 5 years from the starting date of the ULIP. After the lock-in period, you can surrender the policy and the stamp duty and related expenses for maintaining and issuing the same will be deducted by the insurance company.

Comments