The Income Tax Act allows you a variety of deductions that can assist you lessen your income tax. There are a number of approved investments and expenses that you can deduct from your taxable income. Your taxable income decreases as these investments and expenses are subtracted from your income. As your taxable income falls, you will have to pay less tax.

What is Section 80 CCD (1B)?

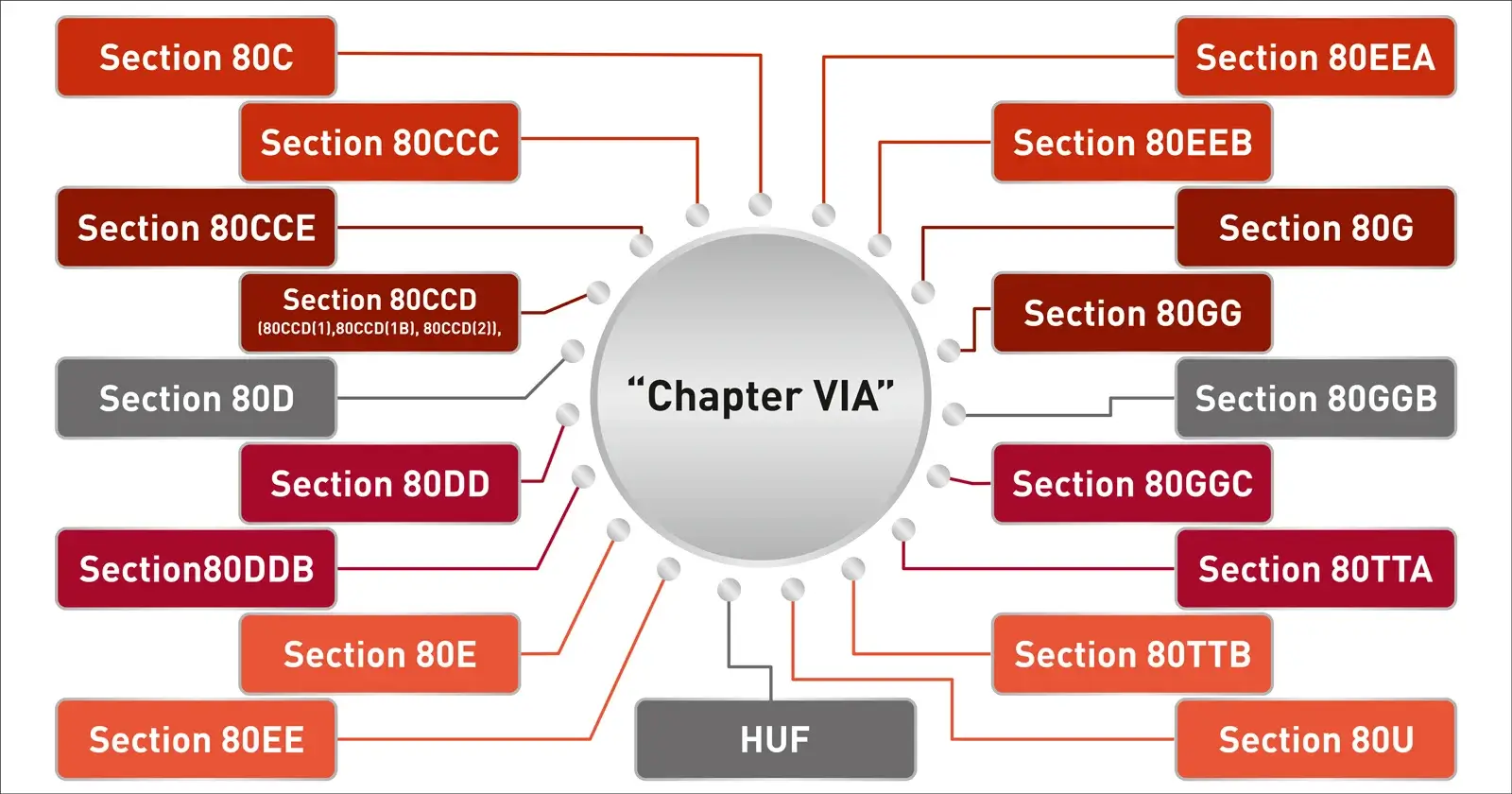

When it comes to deductions, Chapter VI A of the Income Tax Act covers some of the most popular ones. Section 80 deductions are included in this chapter. Section 80C is the most-opted tax saving tool that allows taxpayers to deduct up to ₹ 1,50,000 from various investments and expenses.

Similarly, another part of Chapyer VIA is Section 80 CCD (1B). It gives an additional deduction of ₹ 50,000 over and above the ₹1,50,000 deduction permitted under Section 80C. If you invest in the Government of India's National Pension Scheme (NPS), you can claim a deduction under Section 80 CCD (1B).

Are you familiar with the concept of NPS investment? Let's take a quick look at it:

What is NPS scheme?

The Government's National Pension Scheme is an investment scheme that helps with retirement planning. When you are working, you can invest in this scheme, and it will build a corpus for your retirement. This corpus can then be used to provide you with annuity payments (regular income).

What is the eligibility and requirements to open an NPS account?

The National Pension Scheme is open to both residents and non-residents. The investor should be between the age group of 18 and 60. However, in the case of NRIs, if the NRI's citizenship changes after investing in the scheme, the scheme will be cancelled.

Individuals who want to open an NPS account must do the following:

- Complete KYC verification. For this, they will need:

- Identity proof (like Aadhaar card, PAN card, passport, driving license or voter's ID)

- Address proof

- Age proof

- Passport photograph

- Deposit cheque for offline method

- Provide a Permanent Retirement Account Number

Investing in NPS

An individual can make NPS investments through financial institution that serve as a Point of Presence (POP). Almost every bank and non-banking financial company can function as a POP. These POPs have collect the investors' NPS deposits through specialised branches. The specialised branches are known as Point of Presence Service Providers or POP- SP.

The list of POP-SPs may be found at https://www.npscra.nsdl.co.in/pop-sp.php, the scheme's official website.

To invest in the scheme, you must submit a completed registration form, as well as proof of identification, age, and address.

What are the different types of NPS accounts?

There are two accounts to choose from when investing in the National Pension Scheme. The following are the accounts:

Tier I account

- If you want to invest in the National Pension Scheme, you must first open a Tier I Account (it is a compulsory account).

- This account requires a minimum one-time investment of ₹500 and a yearly investment of ₹1000.

Tier II Account

- After you have invested in the Tier I Account, you can invest in the Tier II Account if you wish to.

- Tier II Accounts require a minimum one-time investment of ₹250. There is no requirement for a minimum annual investment.

- However, a minimum deposit of ₹ 1000 is required to open the account.

How to make withdrawal from NPS scheme?

When you reach the age of 60, your NPS account matures. Withdrawals from the National Pension Scheme nearing this age would be subject to certain conditions. These conditions apply to Tier I Account investments. Withdrawals are allowed without limitation in Tier II accounts.

There are two types of withdrawals: partial withdrawal and full withdrawal. Let's have a look at the terms and conditions for both of these withdrawals.

Full Withdrawal

- Before reaching the age of 60, you can close your NPS investment.

- When you do so, you can take out 20% of the accumulated corpus as a lump sum, while the rest 80% is used to pay annuities.

- Tax-free income is allowed on 20% of the lump sum withdrawn.

- However, the annuity pay-outs are subject to taxes.

Partial withdrawals

- After two years of investing in the NPS scheme, partial withdrawals are allowed.

- It is possible to withdraw up to 25% of the total collected funds.

- Withdrawals are only permitted for specific purposes such as wedding expenses, medical emergencies, home finance, and so on.

- During the investment period of the scheme, up to three partial withdrawals are allowed, with a 5-year break between each withdrawal.

- The partial withdrawal amount is allowed as a tax-free benefit.

Maturity of the NPS Scheme

- The NPS scheme matures when you reach the age of 60.

- A lump sum payment of 60% of the collected amount is available upon maturity.

- The remaining 40% of the amount would thereafter used to provide annuity payments.

- The lump sum benefit would be tax-free for you.

- While the annuity pay-outs you receive would be taxed as per the income tax slab rates you fall into.

Tax deduction under Sections 80C, 80CCD and 80CCD (1B)

Let’s go through various tax-saving tools that can help you claim tax deductions:

Section 80C

You avail tax deduction of up to ₹150,000 by investing in Section 80C options such as life insurance policy, ULIPs PPF, EPF, and so on.

Suggested Read: All Tax-Saving Options under Section 80C

Section 80CCD

- NPS investments are eligible for deductions under Section 80CCD.

- Under this Section, you can claim tax deduction of up to ₹150,000 in NPS contributions from your taxable income.

- This deduction, however, would include Section 80C deductions as well. This means that if you have previously invested ₹ 1,00,000 in Section 80C investments, you can claim an extra ₹ 50,000 deduction under Section 80CCD NPS investments.

Section 80CCD (1B)

The government has added a sub-section under Section 80 CCD to increase the popularity of the National Pension Scheme.

- This sub-section (1B) allows for an additional deduction of ₹ 50,000 for contributions to the National Pension Scheme.

So, if you have ₹150,000 in Section 80C investments, you can still invest up to ₹ 50,000 in NPS plus claim a tax-deduction of ₹ 50,000 under Section 80 CCD (1B).

As a result, the total deduction available is up to ₹ 2,00,000.

Section 80CCD (2) - Tax Benefits under the Corporate Sector

Corporate investors can take advantage of a tax break benefit by investing in the NPS scheme.

- If an employer pays up to 10% of the employee's basic salary (including Dearness Allowance) to an NPS scheme, the contribution is tax-free under Section 80 CCD (2).

- As long as the contribution is limited to 10% of the salary, there would be no limit to the exemption available.

Section 80CCD (2) - Tax benefits under the Government Undertaking

Taxpayers who work for the government (central government only until 1st April 2020, and if both central and state government after 1st April 2020, as revised by Union Budget 2022) can avail a tax benefit for investing in the NPS scheme.

If the employer, i.e. the government, contributes up to 14% of the employee's basic salary (including Dearness Allowance) to an NPS scheme for the employee, the employer's contribution is tax-free under Section 80 CCD (2).

Tax Benefits for Employees

- The NPS tax rebate could be huge for employees, or salaried individuals. This holds true for people in the 30% tax bracket.

- The tax benefit from the National Pension System under Section 80 CCD(1B) alone can save you taxes of ₹15,600 in a year.

- The total tax deduction of ₹2,000,000 available under Sections 80CCD (1), 80CCD (2), and 80 CCD(1B) can save an individual in the highest tax bracket up to 62,400 in a year.

Other Tax Benefits under National Pension Scheme

Other than the annual tax deductions available under Sections 80C and 80CCD (1B), some investors may be eligible for additional NPS deduction benefits. Other tax benefits of the NPS include:

- On Partial Withdrawal - An investor can withdraw up to 25% of the corpus from the NPS Tier I account after three years of investing for specific purposes such as medical treatment costs, children's higher education, marriage, and so on. This withdrawal is tax-free.

- On Returns - NPS Tier I account returns are not taxable until they reach maturity. This means that any market-linked returns you earn may be tax-free.

- On Maturity - Up to 60% of the corpus can be taken in a bulk amount once an investor reaches the age of 60. The remaining 40% must be spent on annuities. Both of these pay-outs are tax-free.

For instance, if an investor has a total corpus of ₹20,00,000 at 60, up to ₹12,00,000 can be withdrawn. The remaining ₹8,00,000 is spent on annuities, which will provide a retirement income.

What are the documents required to claim tax benefit under Section 80 CCD(1B)?

The following documentation must be submitted in order to obtain the tax benefits listed above:

- The proof of investment that is the transaction statement.

- The contribution receipt for the Tier I account, which is available from your online NPS account.

- To obtain the receipt:

- Under 'View'

- Click 'Statement of Voluntary Contribution under National Pension System (NPS)'

- Click on ‘Download’

- To obtain the receipt:

What are the benefits for existing NPS subscribers?

In addition to the ₹150,000 tax deduction under Section 80C, existing NPS subscribers can take advantage of the deduction under Section 80CCD(1B). Section 80CCD allows them to deduct an additional ₹50,000 from their contribution (IB). They can claim some of their NPS contribution in 80C and the rest in 80CCD(1B), maximising the ₹2,00,000 tax deduction. Here are several NPS tax advantages:

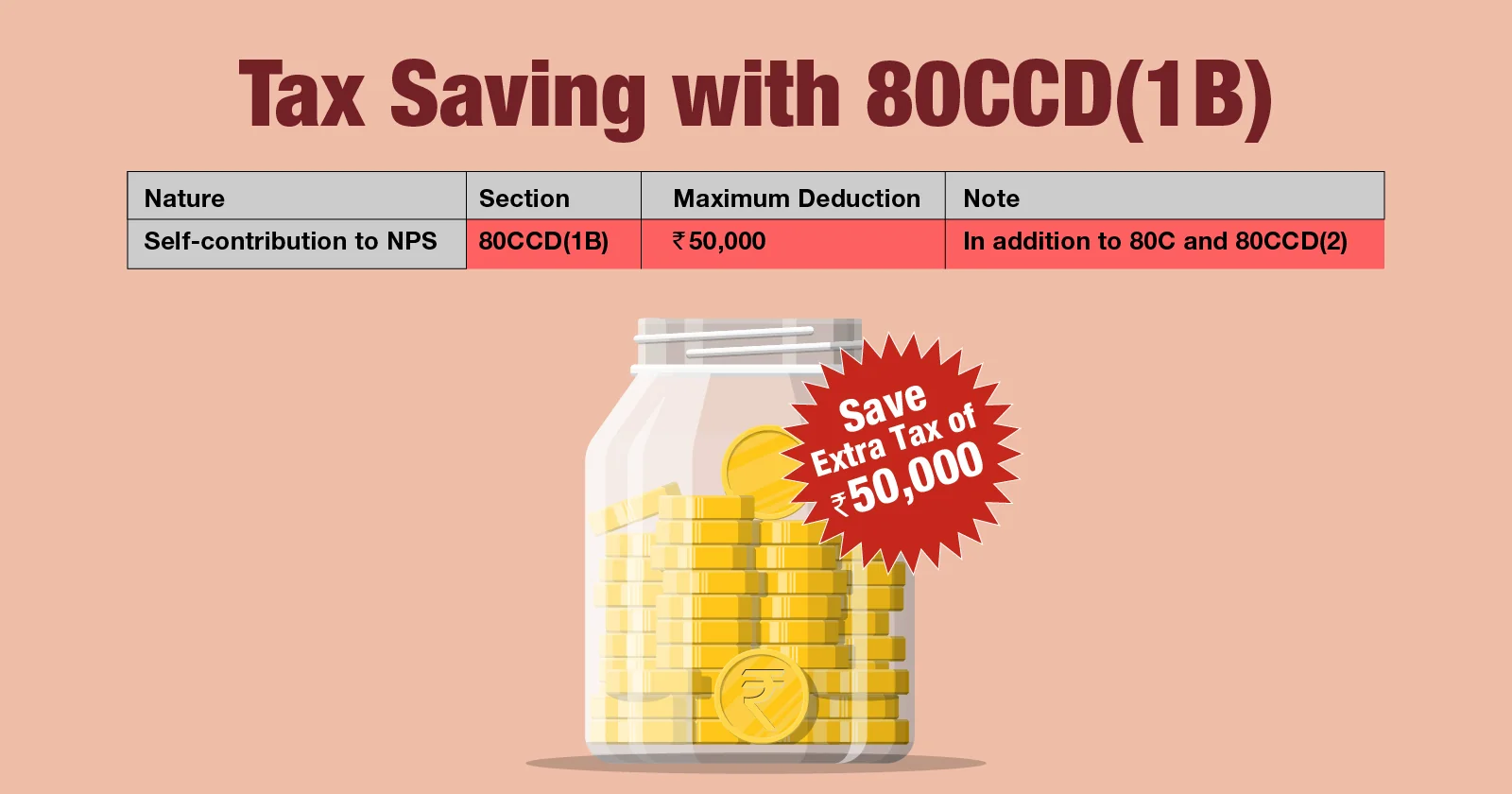

| Nature | Section | Maximum deduction | Note |

|---|---|---|---|

|

Deduction for employer contribution |

80CCD(2) |

10% of salary (no monetary limit) |

Outside of 80C and 80CCD(1B) limits |

|

Deduction for employee’s contribution |

80CCD(1) |

10% of salary, max up to ₹1,50,000 |

Within Section 80C |

|

Self-contribution to NPS |

80CCD(1B) |

Rs.50,000 |

In addition to 80C and 80CCD(2) |

Note: With effect from 1 April 2019, the Central Government's contribution to NPS for its employees has been doubled to 14%. If your employer contributes to NPS and you do as well, you can take advantage of all three deductions indicated above to maximise your tax savings.

What is the relationship between Section 80CCC and Section 80CCD?

Section 80CCD allows for tax benefits on investments made under the National Pension Scheme, which is a retirement savings scheme.

Section 80CCC, on the other hand, permits a tax deduction for contributions to some pension funds.

However, while Section 80CCD provides for an extra deduction of up to ₹ 50,000 for NPS, Section 80CCC limits the deduction to ₹1,50,000, which includes the Section 80C deduction.

Both sections, however, have one thing in common: they allow deductions for investments made for retirement planning.

Important points to consider for Section 80CCD (1B)

Here are some points to keep in mind about claiming a deduction under Section 80CCD (1B):

- Contributions to a Tier I Account would only be eligible for a Section 80CCD deduction (1B) of Rs 50,000.

- Tier II investments are not eligible for tax deductions under Section 80CCD(1B)

- Section 80CCD (1B) allows both salaried and self-employed individuals to claim a deduction.

- To claim the deduction, the required investment documentation must be provided.

- Partial withdrawals are permitted under the NPS, although they are subject to certain conditions.

- If the taxpayer passes away and the nominee decides to shut the NPS account, the sum received by the nominee is tax-free.

- In case only partial withdrawal(s) made, then only 25% of the contribution is tax-free.

- Only 40% of the entire sum is tax-free if the taxpayer is an employee and decides to close the NPS account or opt out of NPS.

- When the taxpayer reaches the age of 60, he or she can withdraw 60% of the entire value as tax-free income. If the remaining 40% is utilised to purchase an annuity plan, it is also tax-free. Section 80CCD (1B) provides an outstanding opportunity to reduce your tax bill greatly. This manner, you can lower your current tax bills while also working toward building a sizable retirement fund. Before taking any action connected to your NPS account regarding Section 80CCD (1B), bear the factors listed above in mind.

What is the Advantage of EEE in NPS?

In India, the EEE (exempt-exempt-exempt) tax status for financial products is tempting. An investment must meet the following criteria to be considered an EEE:

- Be eligible for a tax deduction from your annual pay or income up to the amount invested

- Gains or interest on the investment amount are tax-free.

- Should not be taxable upon maturity

NPS investments had an EET tax status prior to the 2019 Union Budget. This meant that a portion of the maturity amount, up to 20% of the corpus, was taxed when withdrawn as a lump payment. The entire 60% corpus withdrawal was rendered tax-free in the 2019 Union Budget.

NPS enjoys the EEE (exempt-exempt-exempt) status in India because tax exemptions now apply to the investment amount, corpus growth, and maturity amount (to some extent). It is one of only a few financial products that has this advantage.

You must, however, note that taxation will not be zero as the remaining 40% of the corpus has to be invested in an immediate annuity scheme for receiving pensions. The pension amount is taxable according to your income slab. Also, with the NPS becoming an EEE product, this investment is now at par with other long-term investment products like Public Provident Fund (PPF) and Employees Provident Fund.

Comments