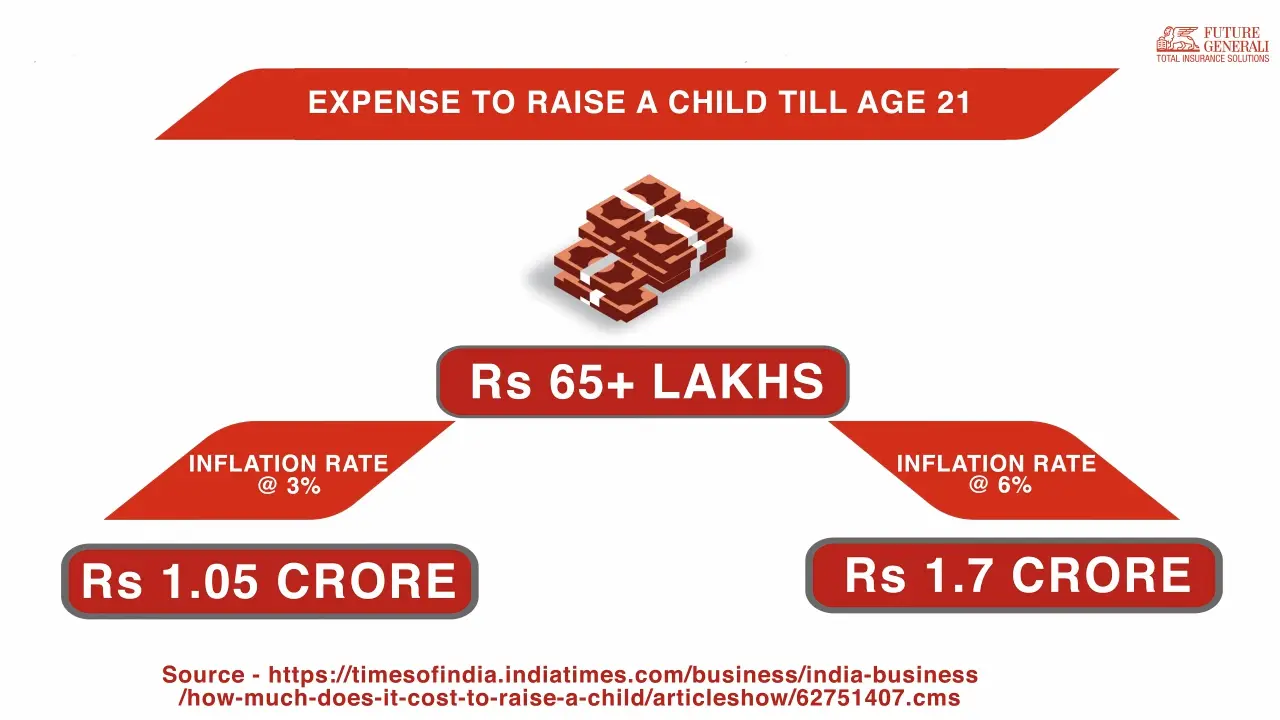

The Cost of Raising a Child

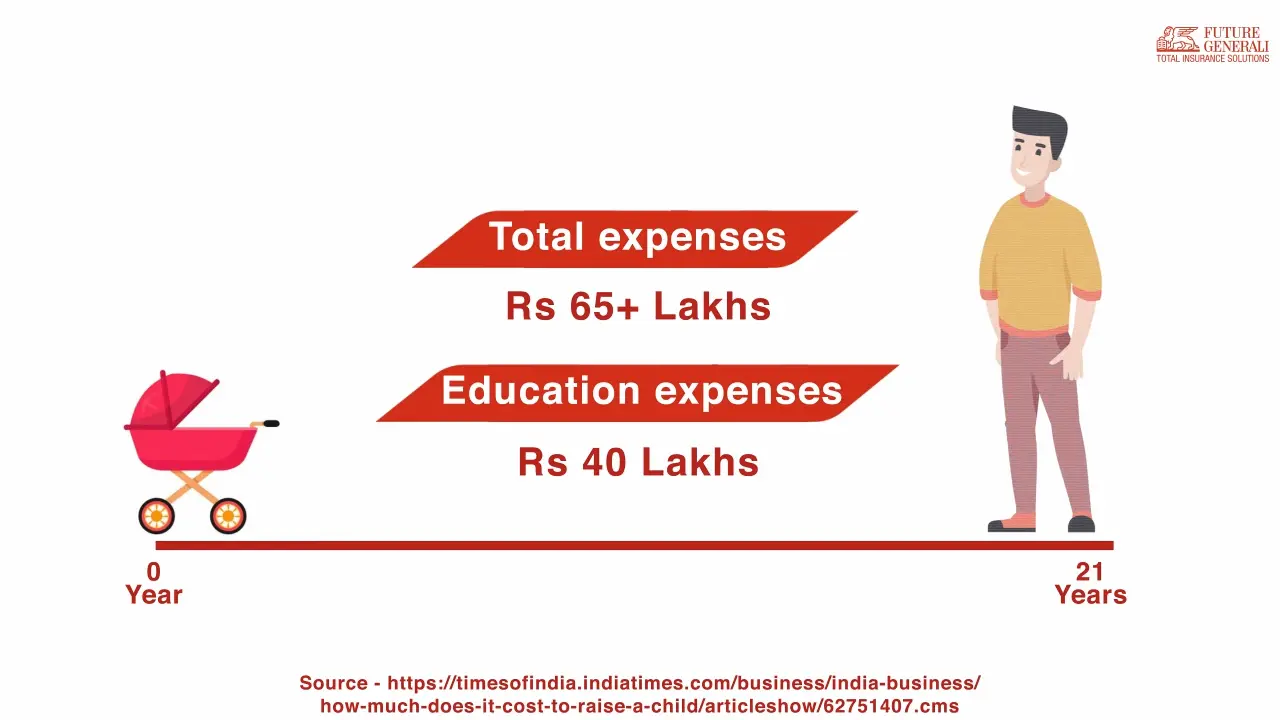

There are many costs associated with raising a child. The cost of raising a child up until the age of 21 can be staggering, according to a survey done by the Times of India. It might be a staggering 1.7 crores, assuming a 6% inflation rate. To cover these costs and make sure your child's requirements are met, financial planning is important.

Understanding the Major Expenses

Even though the overall cost could seem expensive, it's critical to understand how expenses are distributed. With almost 59% of all costs going towards education, it becomes clear that this is the most important expense. This indicates that roughly 40 lakhs of the 67 lakhs that are assumed will go towards your child's education in school, at the university, and in college.

How to choose the Right Child Education Plan

Choosing a child education plan can be based on 4 simple questions as follows:

-

What should be my tenure to save for my child’s career goals?

The major education milestone of a child starts when they complete their 12th. At this point in time, your child is likely to be 17 or 18 years of age. As a parent, you should plan the period of your investment linked to the age of your child, and it is recommended that you save until your child turns 17 years of age.

-

How should I decide on the amount required for my child’s education?

The first and foremost thing is to identify the funds required currently for higher education. This will help you estimate the amount required in the future, which is calculated by inflating the current cost of education for the defined period. A simple thumb-rule to estimate this cost for the desired course is by doubling the current amount after a period of 10 years. A financial advisor can help you estimate the amount needed for your child depending on their age and the current inflation. However, the other important consideration is also the amount you can afford. It is recommended that you save at least 5-10% of your monthly salary towards your child’s education.

-

When and how will this money be required for my child?

Up to class 12th, education expenses form a part of the monthly household expenses. It is post class 12 that the expenses rise sharply and cannot be met through the routine monthly household expenses. Professional education like medical science, engineering, computer science, and MBA cost higher. Your child’s first important education milestone is when they are completing graduation. Most graduation courses vary from 3 years to 5 years. You can safely assume that you will need money for 4 years. Also, keep in mind that a higher sum of money is required immediately after the child finishes their 12th board exams, usually for application fees to various courses, entrance exams, hostel fees, travel, etc.

-

Will my family and child be secured if I am not around?

This is the most important question while planning for your child’s education. Education should remain uninterrupted even after the death of the parent. Child plans offered by various life insurance companies score higher than other alternatives such as fixed deposits and mutual funds because they offer a significant amount of structured protection, which helps the family in case of the death of the earning parent. A good child insurance plan offers a lump-sum payment on the death of the policyholder, but the policy does not end. Also, all future premiums are waived, and the insurance company continues investing this money on behalf of the policyholder. There is an amount given to the child every year to fund the school education, along with the money pre-decided for specific milestones towards higher education. In this way, the parent ensures that their child's needs are taken care of even when they are not around.

The Solution - Future Generali Assured Education Plan

It's crucial to think about appropriate financing requirements if you want to handle the costs of your child's education properly. The Future Generali Assured Education Plan from Future Generali India Life Insurance does just that by assisting parents in making regular savings for their children's future. This plan offers several advantages, such as:

- Systematic Savings: Until the child is 17, parents can save money in a planned manner to provide for their child's education.

Future Generali Assured Education Plan

Future Generali Assured Education Plan - Guaranteed Payouts: It offers you three options to receive Guaranteed payouts depending on your child's education milestones so that you receive the money when it is actually needed. These payments may be made in one lump sum or in accordance with the set payment schedule, depending upon the chosen option.

Future Generali Assured Education Plan Guaranteed Payouts

Future Generali Assured Education Plan Guaranteed Payouts - Empower your Child’s Dream: Make sure that even in your absence, your child's educational goals are never compromised. Future Generali Assured Education Plan offers continuous assistance for your child's education, guaranteeing their unwavering aspirations. Even in your absence the plan continues and offers guaranteed benefits, assuring a bright future for your child and giving them the tools, that they need to achieve all their goal. No matter what life throws at you, your child's education will always be supported with our Assured Education plan.

Watch the Video

Having a child is without a doubt one of the most important decisions you will ever make. Are you financially ready?

Setting long-term goals and arranging funds should be a parent's top priorities. Watch as Happy Singh offers a few tips to help parents make financial plans for that.

Conclusion

Planning for your child's future is a responsibility that requires diligent financial preparedness. By understanding the significant expenses associated with raising a child and opting for suitable financial solutions like Future Generali Assured Education Plan, you can ensure your child's educational needs are met without undue stress. Start your financial planning today and secure a bright and worry-free future for your little one.

Disclaimers: For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the policy document and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. You are advised to consult your tax consultant. Future Group’s and Generali Group’s liability is restricted to the extent of their shareholding in Future Generali India Life Insurance Company Limited.

Source -

Source -  Source -

Source -

Comments