What is the meaning of Tax?

Taxes are considered to be the “cost of living in a society”. Tax is a mandatory fee imposed upon individuals or corporations by the Central and the State Government to help build the economy of a country by meeting various public expenses. Taxes are broadly divided into two categories:

- Direct taxes

- Indirect taxes

Types of Taxes

Let us understand two the types of taxes in detail:

1. Direct Tax

It is a tax levied directly on a taxpayer who pays it to the Government and cannot pass it on to someone else. Direct Taxes are referred to taxes that are charged directly on the income or wealth of a person. The person who pays direct tax to the government cannot recover it from somebody else. In easy words, burden of direct tax cannot be shifted.

Some of the important direct taxes imposed in India are mentioned below:

- Income tax

- Corporate tax

- Security transaction tax

- Gift tax

- Wealth tax etc.

2. Indirect Tax

It is a tax levied by the Government on goods and services and not on the income, profit or revenue of an individual and it can be shifted from one taxpayer to another.

Some of the important indirect taxes imposed in India are mentioned below:

- Goods and service taxes

- Custom duty

- Central excise duty etc.

Types of Direct Taxes

Moving further, let us now understand each type of direct taxes in detail.

1. Income Tax

An Income tax is a tax charged on individuals or entities in respect of the income or profits earned by them (commonly called taxable income).

- Income Tax is a tax paid directly to the government based on the respective income or profit.

- Income tax is collected by the Government of India and is undoubtedly the most important source of revenue for the Indian Government.

- The Government utilizes the taxes in order to meet its objectives which include fulfilling the development and defense needs of the country, creating new employment opportunities, building infrastructure, and so on.

- Income tax means "individual income taxes", paid by employees or other people who earn income. However, companies, estates, trusts, and many other types of entities also pay income taxes based on revenue or income.

Income Tax Rules, 1962

The administration of direct taxes is looked after by the central board of direct taxes (CBDT).

- The CBDT is empowered to make rules for carrying out the purposes of the Act.

- For the proper administration of the Income Tax Act, 1961, the CBDT frames rules from time to time. These rules are collectively called Income Tax Rules, 1962.

- Rules also have “sub-rules”, “provisos”, and “explanations”.

- The proviso to Rule/Sub-rule spells out the exception to the limits, conditions, guidelines, and basis of valuation, as the case may be, spelled out in the Rule/Sub-rule.

- The explanation clarifies the purposes of the Rule.

- It is important to keep in mind that along with the Income Tax Act, 1961, these rules should also be studied for better clarity.

Circulars, Notifications, and Case Laws

Let us understand what are circulars, notifications, and case laws that come under Income Tax.

Circulars

- Circulars are issued by the CBDT from time to time to deal with certain specific problems and to clarify doubts regarding the scope and meaning of certain provisions of the Act.

- Circulars are issued for the guidance of the officers and/or taxpayers.

- The department is bound by the circulars. While such circulars are not binding on the taxpayer, they can take advantage of beneficial circulars.

Notifications

Notifications are issued by the Central Government to give effect to the provisions of the Act. The CBDT is also empowered to make and amend rules for the Act by the issue of notifications that are binding on both the department and the taxpayer.

Case Laws

Case Laws refer to the decision given by courts for matters brought to their notice. The study of case laws and the unavoidable part of the study of Income Tax Law as a law can be interpreted differently by different persons. Therefore it is essential to keep an eye on the judgments made by the court. Hence the judiciary will hear the disputes between the taxpayer and the department and give decisions on various issues.

Who should pay Income Tax?

Income tax is a tax charged on the total income of the previous year of every “person”. A person includes:

- An Individual

- A Hindu Undivided Family (HUF)

- A Company

- A Firm

- An Association of Person (AOP) or Body of Individuals (BOI), whether incorporated or not

- A Local Authority

- Every artificial judicial person not falling in classes mentioned above.

What is the procedure for calculation of total income?

The procedure for calculation of total income is as follows:

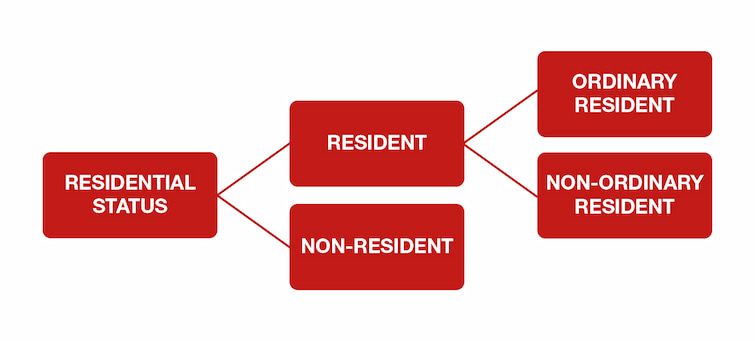

Step 1 - Determination of Residential Status:

The residential status of a person has to be determined to ascertain which income is to be included in computing the total income of such person.

In the case of an individual, the duration for which he is present in India determines his residential status. Based on the time spent by him, he may be classified as:

- Resident and ordinarily resident,

- Resident but not ordinarily resident, or

- Non-resident

Determination of Residential Status.

Determination of Residential Status.Step 2 – Heads of Income

A person may earn income from different sources. For example:

- Sachin is a salaried individual who earns income by way of salary.

- He also receives interest from a bank savings account/fixed deposits.

- In Sachin’s case, he has invested in shares. Hence, he receives dividend income too. In future, when he sells these shares, he may earn a profit on such sale.

- He also owns a residential property that he has let out, Sachin also earn rental income.

In this case, since there are many heads of income, it's important to under the nature of income so that it can be taxed under the respective head.

Classification of Income Tax Heads

Income is divided in five different heads, such as follows:

- Income from Salary

- Income from House Property

- Income from Profits and Gains of Profession or Business

- Income from Capital Gains

- Income from Other Sources

Let us understand each of these heads in detail.

1. Income from Salary

An Income can be taxed under the head "Salary" if:

- There is a relationship of an employer and employee between the payer and the payee.

- If this relationship does not exist, then the income would not be deemed to be income from salary.

- An employer will be liable to deduct the TDS of the employee according to his/her tax bracket and pay it to the government.

Where, “Salary” includes:

- Wages;

- Any Annuity or Pension;

- Any Gratuity;

- Advance Salary paid;

- Fees, Commission, Perquisites, Profits in place of or in addition to Salary or Wages;

- Annual accretion to the balance of Recognized Provident Fund;

- Leave Encashment;

- Transferred balance in Recognized Provident Fund;

- Contribution by Central Government or any other employer to its employee’s pension account as mentioned in Section 80CCD

Calculation of Income from Salary

| Particulars | Amount (₹) |

|---|---|

|

Basic Salary |

xxx |

|

Add: |

|

|

1. Fees, Commission, and Bonus |

xxx |

|

2. Allowances |

xxx |

|

3. Perquisites |

xxx |

|

4. Retirement Benefits |

xxx |

|

5. Fees, Commission, and Bonus |

xxx |

|

Gross Salary |

xxx |

|

Less: Deductions from Salary |

|

|

1. Entertainment Allowance u/s 16 |

(xxx) |

|

2. Professional Tax u/s 16 |

(xxx) |

|

Net Salary |

xxx |

Suggested Read: How to Calculate Income Tax on Salary with Example.

2. Income from House Property

An amount of money received by the landlord from a tenant in exchange for using the property is called rental income. Here, property refers to:

- Any building including a house, office building, warehouse, or

- Any land attached to the building like a compound, garage, car parking space, etc.

Different types of house property (like rental or self-occupied property) are taxed differently.

Rent received from tenant to landlord is considered as Income from House Property in the hands of the landlord and he has to include it in his income while filing his Income Tax Return. Classification of income has a significant impact on your tax while filing ITR. The classifications are as follows:

- Income from house property;

- Even classified as ‘business income’ if the owner’s primary business is letting out property.

Suggested Read: How to calculate income from house property.

3. Income from Profits and Gains of Profession or Business

Any income shown in profit and loss account after taking into account all the allowed expenditures by a taxpayer. The income also includes both positive (profit) and negative (loss) incomes. Here is a list of the income chargeable under the head:

- Profits earned by the taxpayer during the assessment year

- Profits on income by an organization

- Profits on sale of a certain license

- Cash received by an individual on export under a government scheme

- Profit, salary, or bonus received as a result of a partnership in a firm

- Benefits received in a business

4. Income from Capital Gains

Any profits or gains arising from the transfer of a capital asset effected in the previous year will be chargeable to income-tax under the head 'Capital Gains'. Such capital gains is considered as the income of the previous year in which the transfer took place.

There are two types of capital gains such as follows:

- Short Term Capital Gains - An asset held for a period of 36 months or less is a short-term capital asset. The criteria of 36 months have been reduced to 24 months for immovable properties such as land, building and house property from FY 2017-18.

- Long Term Capital Gains - Capital assets that are held for more than 36 months qualify to be termed as long term capital assets. From FY 2017-18, in case of immovable property being land, building or house property, if they are held for more than 24 months, they are termed as long term capital assets i.e. any immovable property will attract long term capital gains tax, if sold after holding for 24 months or more from April 1st, 2017.

The following assets qualify to be termed as long term capital assets if they are held for more than 12 months:

- Equity or preference shares of a company which is listed on recognized stock exchange of India

- Securities such as debentures, bonds, government securities, etc., listed on a recognized stock exchange in India

- Units of UTI

- Units of equity oriented mutual funds

- Zero coupon bonds

Suggested Read:

5. Income from Other Sources

Any income that is not eligible for tax under any other head of income and cannot be excluded from the total income is taxed as residual income under the head "Income from Other Sources".

The following three conditions must be satisfied according to Section 56 of the Income Tax Act for an income to qualify as income from other sources.

- Income is generated.

- Any other provision of the Income Tax Act does not exempt such income.

- Income from such sources cannot be claimed as salary, house property income, profits and gains from business or profession, or capital gains.

Moving forward to the third step in the procedure of calculation of income tax.

While filing your income tax returns, there is an option to choose between old tax regime and new tax regime. Let us understand the difference between the two regimes.

Step 3 – Choose between Old Tax Regime and New Tax Regime

Under the old tax regime, the tax slabs have high tax rates, but the taxpayer has the option to claim various tax deductions, exemptions, and allowances through which they can plan and save taxes easily.

Whereas, under the new tax regime, the number of tax slabs are more, followed by less tax rates in these slabs. Moreover, the tax deductions, allowances, and exemptions that were being used by taxpayers in the old regime won’t be available in the new regime.

Here is a comparison between the old tax regime and new tax regime slabs and rates:

| Tax Slab(₹) | Old Tax Rates | New Tax Rates |

|---|---|---|

|

0 – 2,50,000 |

0% |

0% |

|

2,50,000 – 5,00,000 |

5% |

5% |

|

5,00,000 – 7,50,000 |

20% |

10% |

|

7,50,000 – 10,00,000 |

20% |

15% |

|

10,00,000 – 12,50,000 |

30% |

20% |

|

12,50,000 – 15,00,000 |

30% |

25% |

|

15,00,000 & above |

30% |

30% |

Suggested Read: Old vs New Tax Regime – Which One Can Help You Save More Tax?

Example - Taxpayer with Net Income of ₹ 12.5 lakhs

Based on the tax slabs mentioned above for the income of ₹ 12.5 lakhs the old tax regime rate is 30% and new tax regime rate is 25%. Let us now calculate the total tax to be paid after considering deductions available under the old tax regime.

| Particulars | Old Tax Regime (₹) | New Tax Regime (₹) |

|---|---|---|

|

Annual Income |

12,50,000 |

12,50,000 |

|

Taxable Income |

12,50,000 |

12,50,000 |

|

Less : Standard Deduction |

- 50,000 |

- |

|

Deductions u/s 80C |

− 1,50,000 |

- |

|

Exemptions u/s 80D* |

− 75,000* |

- |

|

Taxable Income |

9,75,000 |

12,50,000 |

|

Total Taxable Income |

1,11,800 (Approx.) |

1,30,000 |

*assuming for self and dependent parents being senior citizens ₹ 25,000 and ₹ 50,000 respectively.

In this case, the old tax slab works better. Opting for the old tax regime instead of the new regime will result in lower taxes.

What are the deductions available under the Old Tax regime?

The tax system in India is progressive, meaning that as taxpayers' income increases, they end up paying higher taxes. Whereas, the taxpayers who fall into the low to medium tax brackets can save a significant amount of money.

Tax slabs help determine the total taxable income during a fiscal year. However, before you start calculating your taxes, you need to know the income on which tax will be calculated. This is because earned income is not the same as taxable income

Deduction under Section 80C

| Eligible Taxpayer | Individual and HUF |

|---|---|

|

Investments and Conditions |

To take advantage of Section 80C, the taxpayer must invest and make certain payments as follows:

Each of the above investments and payments has its own lock-in period, interest rate, and other requirements to qualify for deduction under Section 80C. |

|

Amount of Deduction |

The maximum deduction under Section 80C is ₹ 1,50,000, subject to Section 80CCE. |

Step 4 – Calculate the Tax Deducted at Source (TDS)

TDS is Tax Deducted at Source. It means that the tax is deducted by the person making payment. The payer has to deduct an amount of tax based on the rules prescribed by the income tax department.

For instance, an employer will estimate the total annual income of an employee and deduct tax on his income if his taxable income exceeds ₹ 2,50,000. Tax is deducted based on which tax slab you belong to each year.

Similarly, if you earn interest from a Fixed Deposit, the bank also deducts TDS. Since the bank does not know your tax slabs, they usually deduct TDS @ 10%, unless you haven’t mentioned your PAN (in that case a 20% TDS may be deducted).

Suggested Read: TDS Rate Chart.

Income Tax Return Filing Due Dates FY 2021-22 (AY 2022-23)

The due dates of filing return of income by Individuals and HUF - For FY 2021-22 (AY 2022-23) is as follows:

| Category of Taxpayer | Due Date for Tax Filing- FY 2021-22* (Unless extended) |

|---|---|

|

Individual / HUF/ AOP/ BOI (books of accounts not required to be audited) |

31st July 2022 |

|

Businesses (Requiring Audit) |

31st October 2022 |

|

Businesses (Requiring TP Report) |

30th November 2022 |

Important Income Tax Return Filing Due Dates for FY 2021-22 (AY 2022-23)

Whenever we talk about income tax, there are certain compulsory tax formalities that need to be followed within the specified due dates, such as filing of income tax returns, paying advance tax on time, etc.

Here is the tax calendar for the FY 2021-22 (AY 2022-23):

| Due Date | Tax Due |

|---|---|

|

15th June 2022 |

Due date for the first instalment of advance tax for the FY 2022-23 |

|

31st July 2022 |

Income tax return filing for FY 2021-22 for individuals and entities not liable for tax audit and who have not entered into any international or specified domestic transaction |

|

15th September 2022 |

Due date for the second instalment of advance tax for the FY 2022-23 |

|

30th September 2022 |

Submission of audit report (Section 44AB) for AY 2022-23 for taxpayers liable for audit under the Income Tax Act. |

|

31st October 2022 |

ITR filing for taxpayers requiring audit (not having international or specified domestic transactions). |

|

31st October 2022 |

Submission of audit report for AY 2022-23 for taxpayers having transfer pricing and specified domestic transactions |

|

30th November 2022 |

ITR filing for taxpayers requiring audit (not having international or specified domestic transactions). |

|

15th December 2022 |

Due date for the third instalment of advance tax for the FY 2022-23 |

|

31st December 2022 |

Last date for filing a belated return or revised return for FY 2021-22. |

|

15th March 2023 |

i. The fourth instalment of advance tax due for the FY 2022-23 ii. The due date for the whole amount of advance tax for FY 2020-21 for taxpayers covered under the presumptive scheme of Section 44AD and 44ADA . |

Suggested Read:

Tax Rebate

The word “rebate” literally means “refund”. Hence Income tax rebate is the refund on taxes if the taxpayer has paid more than the taxable amount. To claim income tax refund, the taxpayer has to file an Income Tax rebate within the specified period.

The term “income tax rebate” has gained popularity after the recent provisions of “Section 87A” of the Income Tax Act in India.

Rebate u/s 87A

The rebate under Section (u/s) 87A helps a resident taxpayer to reduce their income tax liability.

“Your total taxable income shall not exceed the threshold limit.” Meaning - Only taxpayers falling under the specified threshold limit can claim the benefit of rebate under Section 87A.

Rebate u/s 87A for the Financial Year (FY) 2021-22 [Assessment Year (AY) 2022-23]

The amount of rebate under Section 87A for FY 2021-22 (AY 2022-23) has been kept unchanged under both the old tax regime and new tax regime. A resident taxpayer having taxable income up to ₹ 5,00,000 will get a tax rebate of ₹ 12,500 or equal to the amount of tax payable (whichever is lower).

How much rebate is allowed under Section 87A?

If an individual’s total taxable income is up to ₹ 5,00,000 then he will get the tax benefit of (whichever is lower):

- ₹ 12,500

OR

- The amount of tax payable

What is the total taxable Income for claiming Rebate under Section 87A?

The total taxable income for claiming rebate under Section 87A

=

Gross Total Income – deductions under Section 80C to 80U

For example:

To understand the calculation of total taxable income for rebate under Section 87A:

Mr. Sharma, a 28-year-old resident individual has:

|

Total Income |

₹ 5,75,000 |

|

Life Insurance policy taken under Section 80C |

₹ 1,50,000 |

|

Health Plans taken under Section 80D |

₹ 25,000 |

What will be the total taxable income of Mr. Sharma for AY 2021-22?

Solution: Total Taxable income of Mr. Sharma will be:

|

Total Income |

₹ 5,75,000 |

|

Less: Life Insurance policy taken under Section 80C |

₹ 1,50,000 |

|

Less: Health Plans taken under Section 80D |

₹ 25,000 |

|

Total Taxable Income (TTI) |

₹ 4,00,000 |

Since, his Total Taxable Income is below the threshold limit of ₹ 5,00,000, hence taxpayer Mr. Sharma is eligible for claiming rebate under Section 87A.

2. Wealth Tax

Let us understand the second type of direct tax i.e., is the wealth tax.

What is Wealth Tax?

A wealth tax is a direct tax aimed at reducing wealth inequality. Unlike Income Tax which is levied on the income of taxpayer, wealth tax is levied on the wealth of the taxpayer. Wealth Tax is governed by Wealth Tax Act, 1957.

It is levied on the net worth of ultra-wealthy people, corporations, and Hindu Undivided Families (HUFs).

Though partnership firm is not liable to wealth tax, the value of the assets held by the firm is to be calculated and this will be distributed between the partners on the basis of profit/sharing ratio and will be subject to wealth tax in the hands of partners.

Similarly, in case of Association of Persons (AOP), the assets are charged to wealth tax in the hands of members.

Wealth tax was primarily intended to tax the ultra-wealthy people who had accumulated wealth through inheritance or their own efforts and thus had to contribute more to the public coffers. On earnings of exceeding ₹30 lakh per annum, an individual, a Hindu Undivided Family, or a company had to pay a wealth tax of 1%. The net wealth is determined on a valuation date which is generally 31st March of every year and on that wealth tax @1% is levied.

Individuals Who Are Not Required to Pay Wealth-Tax

Following individuals are not required to pay wealth-tax:

- Any company registered under Section 25 of the Companies Act;

- Any co-operative society;

- Any social club;

- Any political party;

- A mutual fund specified under Section 10(23D) of the Income-tax Act; and

- Reserve Bank of India

Wealth Tax Rules

One of the most important factors in determining a person's wealth tax liability was their residence status. On their global assets, resident Indians were required to pay a wealth tax. Non-resident Indians and foreigners, on the other hand, were only required to pay wealth tax on their holdings in India. A non-resident Indian's assets would not be free from wealth tax if he returned to India.

Assets Covered under Wealth Tax

The following assets are covered under Wealth tax:

- Building, Land or Apartment subject to the conditions as prescribed therein

- Motor Cars

- Jewelry, bullion, furniture, utensils or any other article made wholly or partly of gold, silver, platinum

- Yachts, boats and aircrafts

- Urban land subject to the conditions as prescribed therein

- Deemed assets

- Cash

How to Calculate Wealth Tax

Here’s how to calculate wealth tax:

| Particulars | Amount (₹) |

|---|---|

|

Deemed wealth |

xxx |

|

Less: Exempt assets |

xxx |

|

Less: Debt relating to asset |

xxx |

|

Total |

xxx |

Why Was the Wealth Tax Abolished?

Here’s why wealth tax was abolished:

- Increased Sales - By abolishing wealth tax and changing it with extra surcharge, the authorities has amassed sales really well worth over ₹9000 Crore on the grounds that 2015.

- Simple Tax Methods - The Indian authorities desired to simplify methods for simpler monitoring and beautify transparency with appreciate to the complicated nature of Indian Tax Law.

- Easier and Easy Taxation Machine - By abolishing wealth tax, the authorities has decreased the scope of a few taxpayers taking undue benefit of the loopholes with inside the Wealth Tax Act.

- Administrative Burden - Taxpayers needed to price their belongings as according to the Wealth Tax Rules to compute their internet wealth. For positive belongings consisting of jewelery, taxpayers needed to attain a valuation document from a registered valuer.

- Additional Reporting - Taxpayers will must do a little extra reporting of data of their profits tax returns in phrases of list out their belongings and liabilities.

Wealth Tax Exemptions

- A precise residence or a part of the residence or a plot of land (now no longer exceeding 500 square meters) in case of Individual or HUF.

- The hobby of someone with inside the coparcenary assets of any HUF of which he's a member or the houses as a place of work or profession.

- Any assets held with the aid of using the taxpayer below accept as true with or different felony duty for any public cause of a charitable or non-secular nature in India.

- Jewelry in ownership of a former ruler of a princely State, now no longer being his private assets, which has been acknowledged with the aid of using the Central Government as an heirloom earlier than 1-4-1957 or with the aid of using the CBDT after 1-4-1957.

- Certain belongings belonging to someone of Indian foundation or an Indian citizen who changed into dwelling overseas and now returning with a goal of completely dwelling in India is exempt difficulty to sure situations as in step with the law.

- Investment in securities with inside the shape of shares, bonds, devices of mutual finances and devices of gold deposit schemes.

Who were liable to pay wealth tax?

An individual, a Hindu Undivided Family, or a company with net worth above ₹ 30 lakhs were required to pay wealth tax.

What is the rate of wealth tax?

Wealth Tax was levied at the rate of 1% of the amount by which the net worth exceeds ₹ 30,00,000. No Surcharge or Education Cess was levied in case of Wealth Tax. However from Financial Year 2015-16 (i.e., Assessment Year 2016-17) wealth tax was abolished.

When was wealth tax abolished?

It was abolished in 2015 union budget by the finance minister.

Suggested Read: What is Wealth Tax? What is the rate of wealth tax in India?

3. Gift Tax

What is Gift tax? Why is gift tax charged?

India is a country of close-knitted families. Numerous occasions arise where gifts are exchanged. However, many a time gifts can also be a part of tax planning/tax evasion.

The Government introduced gift tax in April 1958 regulated by Gift Tax Act, 1958 (The GTA) with an objective to impose taxes on giving and receiving gifts under certain specific circumstances. The same was introduced with an objective to keep an eye on possible tax evasions arising out of transfer of gifts.

However, the GTA was abolished in October 1998 and made all gifts tax-free. But, Gift Tax was reintroduced in a new form and included in the Income-tax provisions in 2004.

Who is responsible for charging Gift tax in India?

The Income Tax Act, 1961 is now liable for charging Gift tax in India. The provision regarding gifts are covered under Section 56(2) of income tax act.

What terms are included in Gift?

The following terms are included in gift:

- Gifts in the form of cash

- Demand draft

- Bank cheques

- Anything having value were covered. For example – land and building, shares or debentures etc.

Provision Regarding Gift Tax

| Type of Gift Covered | Monetary Limit | Taxable Amount |

|---|---|---|

|

Any amount of money received without consideration |

More than ₹50,000 |

The entire amount received |

|

A building, land, or other immovable property without consideration. |

Value of stamp duty* more than ₹50,000 |

The property's stamp duty value |

|

Inadequate consideration for any immovable property |

Stamp duty value* exceeds consideration by more than the higher of the following amounts, namely:-

|

Stamp duty amount minus consideration Example 1: Stamp duty value = ₹2,00,000 Consideration= ₹75,000. Taxable amount is ₹1.25 lakhs (stamp duty value exceeds consideration by > ₹50,000) Example 2 Stamp duty value = ₹2,00,000 Consideration = ₹1,60,000, Taxable gift is NIL as stamp duty value does not exceed consideration by more than ₹ 50,000 |

|

Any prescribed movable property (jewellery, shares, drawings, etc.) other than immovable property without consideration |

The aggregate Fair Market Value* (FMV) is more than ₹50,000 |

The whole of the Fair Market Value of such property. Taxed on aggregate basis. Value of property received on different dates or from different person to be clubbed to arrive at amount of ₹ 50000 |

|

Property other than immovable property for a consideration |

Fair Market Value exceeds consideration by more than ₹50,000 |

Fair Market Value minus consideration. |

Exemptions from Gift Tax

As mentioned above, certain specified gifts received by any person from any person/persons attract gift tax. However, here are some exceptions to this:

| Category of Donee (Receiver of the gift) |

Category of Donor (Gift Giver) |

Occasion Covered |

|---|---|---|

|

Individual (It may be relevant to note that while gifts from defined relatives are not taxable for the donee, income derived from such gifts may in some cases be taxable by the donor- examples are clubbing provisions, deemed ownership concepts in real estate, etc.) |

Relatives include:

|

NA |

|

Individual |

Any person |

Individual’s Marriage |

|

Any person |

Any person |

As a result of a will or inheritance |

|

Any person |

Individual |

In anticipation of demise of donor or payer |

|

Any person |

Local authority – Panchayat, Municipality, Municipal Committee and District Board, Cantonment Board |

NA |

|

Any person |

Funds, foundations, universities or other educational institutions, hospitals or other medical institutions, and trusts or institutions referred to in Section 10(23C) may contribute. |

NA |

|

Any person |

Any charitable or religious trust registered under Section 12A or Section 12AA |

NA |

|

A trust, fund, institution, university, or other educational institution, or hospital or medical institution established for charitable, educational, or philanthropic purposes and approved by the prescribed authority. [Refer Section 10(23C) (iv) (v) (vi) and (via)] |

Any person |

NA |

|

Members of HUF |

HUF |

Capital assets are distributed on total or partial partition of a HUF |

|

A trust whose sole purpose is to benefit a relative of the individual |

Individual |

NA |

How much gift from parents is tax free in India?

As long as the sum of all the gifts received during the year does not exceed the threshold of fifty thousand rupees it is fully exempt but whole of the amount becomes taxable once it crosses the threshold of fifty thousand.

Suggested Read: I received gifts during my wedding are they taxable?

4. Corporate Tax

What is corporate tax?

A corporate tax or a corporation tax is a form of direct tax which is levied on the profits of a corporation. The rate at which such profits are liable to taxation as per the provisions of Income Tax Act, 1961 is termed as the Corporate Tax Rate. The taxes are paid on a company's taxable income, which includes sales and other income (i.e., the revenue generated) minus cost of goods sold (COGS), all the direct and indirect expenses which includes general and administrative expenses, selling & distribution and marketing expense, research and development related to the business, depreciation, and any other operating & financing costs.

Who is responsible for charging corporate tax?

The Income Tax Act, 1961 is liable for charging corporate tax in India. Worldwide income of the companies registered in the country is taxed under this.

What is the rate of tax and surcharge on Corporates in India?

For the Assessment Year 2022-23 and 2023-24 the Income Tax Rate applicable in case of corporates in India is as below:

| Type of company | Corporate tax rate | Surcharge on net income greater then |

|---|---|---|

|

Domestic with annual turnover up to ₹ 400 Crore during the previous year |

25% |

7% if the total income exceeds ₹1 Crore but not exceeding ₹10 Crore. 12% if the total income exceeds ₹10 Crore. |

|

Domestic company with turnover more than ₹ 400 Crore |

30% |

7% if the total income exceeds ₹1 Crore but not exceeding ₹10 Crore. 12% if the total income exceeds ₹10 Crore. |

|

Foreign Companies |

40% |

2% if the total income exceeds ₹1 Crore but not exceeding ₹10 Crore. 5% if the total income exceeds ₹10 Crore. |

Additionally, the amount of income-tax and the applicable surcharge, shall be further increased by Health and education cess calculated at the rate of four per cent of such income-tax and surcharge.

Notifications Related to Corporate Tax

This notification has been brought by the Government in the Taxation Laws (Amendment) Ordinance 2019 that the base corporate tax for existing companies with annual turnover up to ₹400 Crore and not claiming any incentives or exemptions the tax rate was reduced from 30% to 22% and for the new manufacturing firms incorporated after 1 October 2019 and making fresh investment in Manufacturing, and started operations before 31 March 2023, the rate was cut down to 15% from 25%.

The total revenue forgone for the reduction in corporate tax rate and other relief estimated at ₹ 1,45,000 crore.

What is the rate of tax on corporates?

The base tax rate has been reduced from 30% to 22% in case the company is willing not to claim any exemption or rebate and has an annual turnover of up to ₹ 400 Crore. On this rate of 22% tax, there will be an additional 10% surcharge and 4% cess. Effectively, the rate of tax will be (22 x 1.10 x 1.04) = 25.17%.

Let us look at how much lower this is compared to the current rate.

| Existing tax with exemptions | Amount | New formula (no exemption) | Amount |

|---|---|---|---|

|

Base tax rate |

30% |

Base tax rate |

22% |

|

Surcharge on tax (Assuming income greater than ₹ 10 Crore) |

12% |

Surcharge on tax |

10% |

|

Cess on above |

4% |

Cess on above |

4% |

|

Effective tax rate |

34.95% |

Effective tax rate |

25.17% |

Effectively, by moving to the new formula, you pay 9.78% lower tax rate.

5. Perquisite Tax

What is a perquisite?

A perquisite is a non-cash benefit granted by an employer to the employee. The value of the perquisites received by an employee is included under the salary income of the employee.

Perquisites are additional benefits which are derived from a job profile at work.

For example – if an employee has a sales profile, then he/she will be required to do a lot of field work. This means the employee will need to travel a lot on a regular basis for work purposes. The expense of travel on a daily basis will cost the employee a lot of money on fuel expense, maintenance of the car, food expense, accommodation, etc. To ensure that the employee does not feel the burden of such expenses, the company or the employer normally offers perquisites in addition to the salary to compensate for such expenses.

Classification of Perquisites

For income tax purposes, Perquisites are classified into the following categories:

- Perquisites that are taxable only when the employee belongs to a specified group.

- Perquisites which are taxable in the hands of all categories of employees.

- Specified security or sweat equity shares transferred or allotted by the employer to the taxpayer.

- Employer’s contribution to the approved superannuation fund to the extent it exceeds ₹ 1,50,000.

- Tax-free Perquisites.

Differences between Allowances and Perquisite

The following are some of the major differences between allowances and perquisite:

| Allowances | Perquisites |

|---|---|

|

A fixed amount of money given periodically in addition to the salary is called allowance |

Small benefits or perks offered by the employers in addition to the normal salary at free of cost |

|

It is taxable on due/accrued basis whether it is paid in addition to the salary or in lieu thereon |

It is taxable in the hand of employees |

|

Examples: transportation allowance, phone allowance etc. |

Examples: Rent-free accommodation, free electricity etc. |

Method of Calculating Perquisite Tax

Generally, taxability of perquisite is determined as an average of income tax that is calculated based on these following:

- Rate of tax for the given fiscal year

- Income charged under ‘salaries’

- Value of perquisites for the amount of tax paid by the employer

Let’s understand this with the help of an example:

Suppose the income charged under ‘Salaries’ of a regular employee is ₹ 8 lakh inclusive of ₹ 90,000 that is paid by the employer as non-monetary perquisites. As per the ITA, the perquisite tax will be:

- Income that is charged under ‘Salaries’ = ₹ 8 lakh

- Tax on salary inclusive of education and health cess @4% = ₹ 75,400

- Average tax rate = ₹ 75400 ÷ 8,00,000 x 100 = 9.4%

- Tax paid on ₹ 90000 = 9.24% x 90,000 = ₹ 8,316

- The amount to be deposited every month = ₹ 8,316 ÷ 12 = ₹ 693

Hence, ₹ 693 will be deducted by the employers as TDS on employee’s salary.

How can I avoid perquisite tax?

An insurance premium paid by an employer on an accident policy taken out for the employee is a tax-free perquisite. Also, employer’s contribution to the superannuation fund of the employee provided such contribution does not exceed ₹ 1,50,000 per employee per year can be treated as a tax-free perquisite.

What is another word for perquisite?

Perquisite is generally interchanged with many other words such as:

- Bonus

- Perk

- Plus

- Freebie

- Incentive

- Advantage

- Consideration

- Privilege, etc.

6. Securities Transaction Tax

What is Securities Transaction Tax?

Securities transaction tax (STT) is a form of Direct Tax which is payable (payable in India) by a person on the value of securities which he transacted through a recognised stock exchange.

It is charged at the time of purchase as well as at the time of sales. Hence, securities transaction tax is a direct tax.

Securities on which securities transaction tax is payable are:

- Shares, Stock, scrips, bonds, debentures, Debenture stock, marketable securities.

- Derivatives

- Government securities that are equity nature

- Equity oriented mutual fund

- STT levied on securities that are traded on the stock exchange.

However, securities transaction tax is not applicable on “Off – Market transactions”.

Is security transaction refundable?

NO, security transaction tax (STT) is not refundable. Neither STT is claimed as a part of the acquisition cost, nor will it reduce the capital gain tax liability.

Types of Indirect Taxes

Moving further, let us now understand each type of indirect taxes in detail.

1. GST- Goods and Services Tax

India is a federal country wherein both the Central as well as State Governments have been empowered to levy and collect tax to perform their different set of functions and responsibilities.

Goods & Services Tax (GST) was implemented in India with effect from 01st July 2017 and is a destination based consumption tax i.e., tax is levied wherein consumption takes place. The same is levied at each and every stage of value addition. Like other set of indirect taxes, the burden gets transferred at each and every stage and the final onus falls on the ultimate consumer.

The GST was implemented with an ideology of “One Nation One Tax” and also mainly to remove the cascading effect (tax on tax) which was widespread under the previous tax regime.

Taxes Included with the Introduction of GST

GST is one of the biggest indirect tax reform since Independence of India as it has subsumed various other erstwhile indirect taxes.

With the introduction of GST, following taxes got included:

- Central Excise Duty

- Service Tax

- Additional Duties of Customs

- Surcharges

- State Value Added Tax

- Central Sales Tax

- Purchase Tax

- Luxury Tax

- Entertainment Tax etc.

However, there are still few of the erstwhile taxes which are still prevalent and has not been subsumed even after the introduction of GST law. Some of them includes:

- Basic Customs Duty

- Taxes on Petroleum products

- Excise duty on liquor

- Toll tax/road tax

- Stamp duties

- Property tax, etc.

Levy and Collection of GST

India has adopted a dual structure GST model, i.e. the taxation is administered and looked after by both Union and state governments.

- Transactions made within the same state (intra-state), would be subjected to Central GST (CGST) by the Central Government and State GST (SGST) by the State governments.

- For transactions made between two different states (inter-state) and import related cases, an Integrated GST (IGST) is levied by the Central Government.

- This IGST would in turn be shared by the Central Government with the respective State Governments.

GST Registration Requirements

A person would be required to get registered in the State/Union Territory (other than special category states) from where he makes taxable supplies of goods or services or both if his aggregate turnover exceeds ₹ 20 lakhs. However, if a person is exclusively engaged in the supply of goods only, the threshold limit for obtaining registration is ₹40 lakhs.

In case of special category states (which includes Sikkim, Arunachal Pradesh, Himachal Pradesh, Uttarakhand, Assam & Meghalaya), the person making taxable supplies has to obtain registration if the aggregate turnover exceed ₹10 lakhs (₹20 lakhs in case of exclusive supply of goods only)

Aggregate turnover has been defined under GST Act in a very broad angle to include taxable, exempt & exports turnover on PAN basis. However, taxable supplies made under reverse charge mechanism (RCM) wherein taxes are paid by recipient are excluded in the calculation of aggregate turnover.

However, there are few categories of persons which shall be compulsorily required to get registered under GST irrespective of their turnover. Some of them are as follows:

- Non-resident taxable person making taxable supply

- Input Service Distributors (ISD)

- Persons who are required to deduct TDS under GST

- Person who supply goods or services or both through E-commerce operator who is required to collect TCS (Tax collected at Source)

Further, there are few set of persons who are not liable to obtain registration. The same includes:

- Person engaged exclusively in the business of goods or services or both that are not liable to GST or are wholly exempt from GST.

- An Agriculturist only to the extent of supply of produce generated out of cultivation of land.

GST: Tax Rate Structure

The GST has a four-tier tax structure containing a NIL rate, a lower rate, standard rate and a higher rate.

In case of NIL rated tax, the goods or services are subjected to NIL rate of GST. Predominantly this category of tax rate includes products which are of essential nature. For example food grains, milk, eggs, curd, meat etc.

In case of lower rate of tax the GST is charged at the rate of 5% on the supply of Goods or Services or both. This, along with the zero rate of tax helps in preventing inflation on other essential items.

Standard rates under GST includes two rates i.e., 12% and 18%. Processed foods are generally taxed at 12%. However products like hair oil, toothpaste, etc., are charged at the rate 18%.

A higher rate of 28% is levied on white goods (luxury items) such as Washing Machine, Air Conditioners, Climate control system, aerated drinks etc.

GST rate refers to the percentage rate of tax imposed on the sale of goods or services under the CGST, SGST and IGST Acts. A business registered under the GST law must issue invoices with GST amounts charged on the value of supply.

In addition to above rates a special rate of 3% has been decided for Gold and a rate of 0.25% has been finalised for precious and semi-precious stones.

Lastly, products like Motor Vehicle and tobacco products would be subjected to cess also.

Input Tax Credit (ITC)

Input Tax Credit means the credit of taxes paid on purchase of goods or services or both which are used in the course of furtherance of business. The said ITC can be used to make payment of output GST on supply of goods or services or both in the prescribed manner.

Input tax credit under GST may be claimed by a person in GST only on fulfilment of the below conditions:

- The recipient must be in the possession of tax invoice

- The goods must be actually received by the recipient

- The tax charged in respect of such supply is paid to the Government either by cash or by utilizing input tax credit

- The return should be filed

Blocked ITC:

As per Section 17(5), for few of the cases, the input tax credit shall not be available. Some of them are as follows:

- Membership of a club, health and fitness centre

- Work Contract services when supplied for construction of an immovable property except when it is an input service for further supply of works contract service

- Taxes paid under composition scheme

- Goods lost, stolen, destroyed, written off, etc.

Returns under GST

Every registered person shall be liable to furnish electronically, details of all outward supplies made during a tax period on or before 10th day of the succeeding month in FORM GSTR-1 (currently, the due date is 11th day of succeeding month as notified

Further, with effect from 01st January 2021, Quarterly Returns Monthly Payments (QRMP) scheme has been implemented which allows taxpayers with an aggregate turnover up to ₹ 5 crore to file return on quarterly basis and make payment of tax on monthly basis.

In addition to GSTR-1, the monthly taxpayer would be required to file a summary return along with payment of tax in FORM GSTR-3B by 20th of the succeeding month.

2. VAT – Value Added Tax

Value Added Tax (VAT) is an indirect tax introduced with effect from 1st April, 2005. It is a tax levied on sale of goods whenever there is any value addition in the supply chain right from production to its sale.

Every state and union territory has its own different VAT laws. The threshold limit for registration and the list of goods which are exempt also changes from state to state.

VAT has 2 components: Output VAT and Input VAT.

The excess of Output VAT over Input VAT becomes the output liability i.e., VAT Payable.

Output VAT – It is the VAT charged to the customer on sales made by the seller. The seller has to register himself to make the sales over the prescribed threshold limit. Once the seller gets registered, he has to charge Output VAT on all taxable sales of that particular period

Input VAT – It is the VAT paid on the purchases made by a dealer. The registered dealer can claim the credit on the input VAT as per the prescribed rules and make the balance excess payment of Output VAT (if any) under cash.

With the implementation of Goods & Services Tax (GST) in India with effect from 01st July 2017 various indirect taxes has been subsumed which includes VAT also.

3. Central Sales Tax

Central sales tax is imposed on sale or purchase of goods during the course of inter-state trade or commerce. Mere transfer of goods to a branch or another unit of the same entity may not attract CST. In other words, CST is applicable only in the case when there is a sale or purchase transaction.

CST is payable in the state where the goods are sold. The tax collected in retained by the state in which tax is collected. CST is administrated by sales tax authorities of each state.

With the implementation of Goods & Services Tax (GST) in India with effect from 01st July 2017 various indirect taxes has been subsumed which includes CST also.

4. Custom Duty

What is Custom Duty?

Custom duty is a type of indirect tax and is applicable to all goods imported and a few goods exported out of the country. Custom duty tax is covered under Custom Tariff Act, 1975. Simply it is applicable to import and export of goods from out of country.

Customs duty refers to the tax imposed on the export and import of goods out of country. It is applicable for safeguarding of domestic industry, regulate export, protect from revenue from resources etc.

The prima facie objective of imposing custom duty is to protect the domestic industry from competition arising from foreign industry by application on custom duty tax that will help increase the value of imported goods.

Types of Custom Duty

- Basic Custom Duty

- Surcharge

- Additional duty of customs

- Special Additional duties

- Other levies like Countervailing duty, Anti-dumping duty, Safeguard duty and so on. Also, cess duty is charged on certain goods.

How to Make Online Custom Duty Payment

The following steps should be followed to make online payment of custom duty:

- Login to E-Payment Portal of ICEGATE

- Enter the import and export code in login Credentials

- Click on e-payment button then you would be able to check all challan which is under your name or firm name

- Then choose challan we wish to pay and select the payment method and then you are redirected to payment gateway

- Once the payment is done you redirected to ICEGATE portal

Then click on print and save it.

Recent Changes in Custom Duty Act Announced in Union Budget 2021

In the union budget 2021, recent changes in relation to the revision of rates have been introduced. Some of the changes are as below:

- Custom duty on copper scrap have been reduced from 5% to 2.5%.

- Special additional excise duty has been reduced on petrol and high speed diesel oil.

- Custom duty on solar inverter has been increased from 5% to 20% and on solar lanterns from 5% to 15%.

- Basic duty (a type of custom duty) applicable on gold and silver have been reduced.

- These revise rates are applicable from 2nd Feb 2021 onwards

5. Octroi Duty

What is Octroi Duty?

Octroi duty is a type of indirect tax that was applied by local or state government on certain category of goods entering a town or city.

As on 1 July 2017 with the introduction of GST ,the octroi has been abolished .

Octroi is an amount you must pay when you cross the city or Sate border.The government charges this tax on certain goods for sales and personal use.Octroi was not charged in all parts of India.

Applicability of Octroi Duty

Octroi Duty is applicable on certain goods that are below:-

- Gold items

- Silver items

- Product made from wood

- Food grains

- Imported glass

- Silk product

- Car and other vehicle

- Leather goods

The government has charged around 3 to 5%for the goods that cross city or state border on certain goods.

When is Octroi Duty charged?

When the transporter vehicle will reach a state border, a supervisor will inspect the good and based on that calculate the total amount of tax they have to pay. The packing and moving company will pay tax at the time of transport and after that we have to return the tax at the time of full payment to company.

What is the difference between Octroi and Custom duty?

Octroi Duty is applicable for goods that are transported from one state to another. Whereas custom duty is applicable on import and export of goods.

6. Toll Tax

What is Toll Tax?

Toll Tax is a type of Indirect Tax. Hence, it is not charged on individual income.

Too Tax may be referred to as the tax paid to use the expressway or highway in India. The proceeds collected in the form of toll tax is used for maintenance and construction of road and ensuring better connectivity between roads.

Toll tax collection happens at a Toll Booth or toll plaza that is allotted by NHAI to private parties /contractors. These are directly collected from the persons crossing the Toll Booth.

Toll Tax Collection

Toll tax collection very from vehicle to vehicle according to their size and the carriage weight of the vehicle. The size of the vehicle also determines the PCU (Passenger Car Unit) upon which the toll tax is calculated.

Vehicle/Persons Exempt from Paying Toll Tax

Some vehicles are exempted from paying toll tax at toll plazas across India. They are as follows:

- Ambulance

- Funeral Van

- Central and state forces in uniform

- Ministry of defence

- President of India

- Prime minister

- Other government vehicles

- Other vehicles that are approved by NHAI, etc.

7. Education Cess

What is an education cess?

Cess may be defined as a form of tax which is charged on the tax liability of a taxpayer. In other words, it may be defined as a tax on tax.

The government imposes an education cess on the basic tax liability in order to raise additional income to fund primary, secondary, and higher education. Corporations, like individuals, are obligated to pay this cess every year at rates specified during yearly budgets.

Rate of Education Cess

The cess, levied at 4 percent of the tax payable, is imposed as an additional surcharge on taxpayers for funding select government welfare programmes, specifically primary and secondary education, and health infrastructure.

NOTE: If the total income is less than 5 lakhs then rebate under 87A is available and no education cess will be levied.

The education cess and secondary and higher education cess for last 5 years is as follows:

| Financial Year | Rate (Education Cess + Secondary and Higher Education Cess)/Health and Education Cess |

|---|---|

|

16-17 |

3% |

|

17-18 |

3% |

|

18-19 |

4% |

|

19-20 |

4% |

|

20-21 |

4% |

Example:

An individual has a total income of ₹ 7 lakhs. Let’s calculate the amount of tax to be paid.

| Particulars | Amount |

|---|---|

|

Income from other sources |

₹ 7 lakhs |

|

Total taxable income |

₹ 7 lakhs |

|

Tax on taxable income |

₹ 52,500 |

|

Add- Education cess@4% |

₹ 2100 |

|

Total tax payable |

₹54,600 |

8. Entertainment Tax

What is entertainment tax?

Entertainment Tax is a type of Indirect Tax.

Commercial shows, movie tickets, sporting events, music festivals, amusement parks, exhibitions, theatre shows, and other private festivals are all subject to an entertainment tax imposed by the State Government.

Earlier, entertainment Tax rate used to differ from state to state as it falls under the ambit of State Government.

However, Beginning July 1, 2017, the Entertainment Tax was subsumed under the Goods and Services Tax Law. (GST). Therefore, state-specific rates are no more applicable. Uniform GST rates are applicable in all the states on the basis of nature of services rendered.

Features of Entertainment Tax

The state governments are in charge of collecting the entertainment tax from customer.

Earlier, the entertainment tax in the country varies by state because it was governed by state governments.

All laws and principles that apply to the entertainment tax in India are listed in Article 246 of the Indian constitution.

Applicability of Entertainment Tax

- Exhibition

- Sports related Activities

- Amusement parks

- Arcade

- Celebrity stage show’s

- Theatre & Cinema

- Video game and related activities etc

Applicable Tax Rates

With the introduction of GST, Entertainment Tax was subsumed under the Goods and Services Tax Law.

The tax rates in GST have been defined according to the nature of activities. The tax rate applicable on activities related to Entertainment is as follows:

| Entertainment | GST Rate |

|---|---|

|

Drama Circus Theatre Indian Classical dance inclusive of folk dance |

18% |

|

Race Casino Cinema Movie Festivals Amusement Parks Sport events |

28% |

9. Professional Tax

What is Professional tax?

Professional tax is a form of Direct Tax which is levied by the State Governments in India.

It is a tax levied on all types of professions, trades, and employment and is based on the income generated by the profession, trade, or job. It is imposed on employees, self-employed individuals, freelancers, professionals etc. The tax collected in the form of Professional tax is used for the betterment of Profession.

Can deduction for professional tax be claimed?

Professional tax is a deductible amount for the purposes of the Income Tax Act of 1961 and can be deducted from taxable income. The deduction will be allowed in the year in which the tax is actually paid by the employee. In other words, professional tax due but not paid will not be allowed as deduction for the purpose of Income Tax.

Professional Tax Rate

Article 276 of the Constitution which empowers the State Government to charge and collect professional tax. As per the article the maximum cap of charging professional tax is Rs 2,500 beyond which professional tax cannot be charged on any person.

Here’s a list of professional tax rates charged by some of the major states of India:

Professional Tax Rates in Karnataka

| Particulars | Amount |

|---|---|

|

Monthly Salary/Wage up to ₹ 15,000 |

NIL |

|

Monthly Salary/Wage more than ₹15,000 |

₹200 per month |

Professional Tax Rates in Andhra Pradesh

| Particulars | Amount |

|---|---|

|

Monthly Salary/Wage up to ₹15,000 |

NIL |

|

Monthly Salary/Wage more than ₹15,000 but less than ₹20,000 |

₹150 per month |

|

Monthly Salary/Wage more than ₹20,000 |

₹200 per month |

Professional Tax Rates in Telangana

| Particulars | Amount |

|---|---|

|

Monthly Salary/Wage up to ₹15,000 |

NIL |

|

Monthly Salary/Wage more than ₹15,000 but less than ₹20,000 |

₹150 per month |

|

Monthly Salary/Wage more than ₹20,000 |

₹200 per month |

Individuals Who Have to Pay Professional Tax

An employer is responsible for deducting and paying professional tax to the state government in the case of employees.

A person carrying on a trade or profession who is also an employer (corporations, partnership businesses, sole proprietorships, etc.) is required to pay professional tax on his trade or profession.

Individuals who operate a freelancing business without employing others are also obliged to register.

Individuals Who Do Not Have to Pay Professional Tax

The following individuals are exempted to pay Professional Tax:

- Members of the forces as specified in the Army Act of 1950, the Air Force Act of 1950, and the Navy Act of 1957, including members of auxiliary forces or reservists, serving in the state.

- Workers in the textile sector who are Badli.

- A person who is physically disabled for the rest of his or her life (including blindness).

- Under the Mahila Pradhan Kshetriya Bachat Yojana or Director of Small Savings, women are solely employed as agents.

- Someone who are the parents or guardians of people who have a mental illness.

- Individuals over the age of 65.

Applicability of Professional Tax across India

The states which impose professional tax in India are as follows:

- Andhra Pradesh

- Assam

- Bihar

- Gujarat

- Jharkhand

- Karnataka

- Kerala

- Madhya Pradesh

- Maharashtra

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Odisha

- Puducherry

- Punjab

- Sikkim

- Tamil Nadu

- Telangana

- Tripura

- West Bengal

The states which currently do not impose professional tax in India are as follows:

- Andaman and Nicobar Islands

- Arunachal Pradesh

- Chandigarh

- Chhattisgarh

- Dadra and Nagar Haveli

- Daman and Diu

- Delhi

- Goa

- Haryana

- Himachal Pradesh

- Jammu and Kashmir

- Ladakh

- Lakshadweep

- Rajasthan

- Uttar Pradesh

- Uttarakhand

Suggested Read: Professional Tax (P Tax) - Tax Rates, Applicability & Exemptions.

10. Property Tax

What is Property Tax?

Property tax is the annual amount paid by the owner / owners of the property to the local government or municipality in the area. Real estate can include tangible assets, homes, office buildings, and assets that he or she rents to others.

The amount collected by property tax will be used for the maintenance of local infrastructure such as road and school maintenance and road repair. Property taxes vary by location, city or town in the city.

Types of Property Tax

Property in India has been divided into four types:

- Personal Property: Portable man-made property such as vehicles, buses, and cranes

- Land: Land in its most basic form, devoid of any kind of structure.

- Land improvements and upgrades: include man-made structures on land that can't be moved, such as buildings.

- Intangible property: Property that isn't physical.

Calculation of Property Tax

The following is the formula for calculating the property tax:

Property Tax = base value × built-up area × age factor × type of building × category of use × floor factor

Property taxes in India vary by state and are based on the location of the property in issue. Different civic corporations calculate tax in different ways, but the general overview of such computations is the same.

Methods of Calculating Property Tax

Property tax is calculated in three different ways, such as:

- Capital Value System (CVS) - In the city of Mumbai, this valuation system is used.The property tax is determined as a percentage of the market value of the property. The government determines the market value of a property based on the location of the property.

- Unit Area Value System (UAS) - Many municipalities such as Patna, Bangalore, Delhi, Hyderabad and Kolkata follow this method.The unit area value system or UAS tax assessment is calculated based on the unit price of the city of land. This price is based on the expected return on the property by location, usage and land price. Multiply this value by the building area of the asset to derive a tax assessment.

- Annual Rental Value System or Ratable Value System (RVS) - Chennai and Hyderabad follow this tax calculation method.Taxes are calculated based on the rental value obtained from the property for one year. However, it is a rent assessment determined by the municipality and is based on the location, size and condition of the property. The proximity of the property to attractions and other related facilities is also taken into account during the evaluation.

Interest Payment on House Property

Interest rates vary from state to state, some state charge interest rates ranging from 5% to 20%. While other may not charge interest at all, depending on individual policies.

Due Date of Property Tax

Due date of property tax varies from state to state. Some examples are as follows:

| City | Due Date |

|---|---|

|

Chandigarh |

31st July |

|

Kolkata |

30th June |

|

Bangalore |

31st March |

|

Delhi |

30th June |

What are the benefits of paying tax?

In general benefits of paying tax to the citizens of India are as follows:

- Payment of Interest - The Central government spends the lion's share of its total expenditure towards payment of interest every year. When the government takes a loan, it has to pay interest on such credit.

- Defense Allocation – The tax paid by the citizens also helps pay for the country's defense and security-related expenditure.

- Government and Welfare Schemes - Government spending is kind of split between for all intents and purposes several schemes, generally such as healthcare, education, fairly social security, and others.

- Subsidies - All goods or services provided below cost to certain sections of the population are subsidies (e.g., fertilizers, train tickets, LPG, metro rail fares).

- Pension - In order to demonstrate its responsibility as an employer, the government provides pensions to its retired employees. Pensions are another major expense. After retirement, former government employees and former military personnel receive a pension.

- Transfer to the States and Union Territories - The central government gives a certain percentage of the taxes paid by the citizens in the form of grants and transfers to the union territories and states for emergency management and development.

The benefits of paying taxes at an individual level are as follows:

- Simple Loan Approval - Most banks are likely to ask your income tax return as a part of your loan application process to verify your income and its source. Filing your income return on regular basis puts you in the positive position with the potential lenders. So, whenever you apply for a loan this makes you a creditworthy person.

- Visa Processing Benefits - While processing your visa application, it is likely that you will be asked to provide your income tax returns by the respective embassy / consulate. Usually it is expected that you will be asked to provide past 3 years tax filing papers.

- Claim Tax Refund - One of the most significant advantage of filing the income tax return is that, if you’re eligible to receive tax refunds, this is the only way to know it right. In cases such as regular TDS (tax deducted at source) deductions or advance tax payment, you might just find yourself eligible for a tax refund from the government depending upon your tax eligibility.

- Carry Losses Forward - Within a financial year, you may have suffered damages such as speculation loss, capital loss or business loss. Your income tax returns are the only way for you to carry them forward to subsequent years and thereby balance them against your future income.

- Proof of Address and Income - Lastly, apart from all these benefits, the receipt of your income tax returns is a comprehensive document that serves the purpose of providing legitimate address and income proof.

Penalties for Not Paying Taxes

Penalty for Late Filling of Income Tax Returns

The penalty charged for late filling of Income Tax Returns is as follows:

- Not filling ITR on due dates make liable for a penalty of maximum of ₹ 5000

- Small taxpayer whose total income is not more than ₹ 5 lakh as a maximum penalty of ₹ 1000

- Not filling of ITR on or before due dates cause to pay an interest of 1% for every month, or a part of a month on the amount of tax remaining unpaid.

- Carry forward of losses is not allowed if you have not file return within due dates.

- If ITR is not filed within due dates there is a delay in refund (the excess taxes you have paid).

Penalty for Late Filling of GST Returns

The penalty charged for late filling of GST Returns is as follows:

- For NIL GSTR-3B return ₹ 20 per day (CGST+SGST) and maximum late fees is ₹ 500(CGST+SGST).

- For Other than NIL GSTR 3B return ₹ 50 per day (CGST+SGST) and maximum late fees is:

- If Annual Aggregate Turnover in the preceding year is less than ₹5 crore then maximum penalty is ₹2,000 (CGST+SGST).

- If Annual Aggregate Turnover in the preceding year is ₹5 crore less than ₹5 crore then maximum penalty is ₹5,000 (CGST+SGST).

- If Annual Aggregate Turnover in the preceding year is above ₹5 crore then maximum penalty is ₹10,000 (CGST+SGST)

- If the tax paid after due date of filing of return, then 18% per annum interest is liable for the amount.

Comments