- Home

- Insurance Plans

- Guaranteed Plans

- Money Back Super Plan (NON-POS Variant) old

Money Back Super Plan (NON-POS Variant)

An Individual, Non-Linked, Non-Participating (without profits), Savings, Life Insurance Plan.

There are different things to look forward to as you enter different stages of your life. Be it your marriage, a dream vacation, your child’s birth or a comfortable retired life. And you want to ensure that these dreams are not compromised even if you are not around. What you need is adequate funds which are readily available at regular intervals and a life insurance cover to financially protect your family’s dreams and future.

We understand your needs and are committed to provide the right solutions that cater to your different life stages. Introducing the Future Generali Money Back Super Plan, a savings life insurance plan which offers guaranteed money backs at defined intervals along with the benefit of a life insurance cover. With the promise of stable returns and adequate protection coverage, you can now prepare for a comfortable life.

Why go for the Future Generali Money Back Super Plan?

- Enjoy guaranteed benefits on death, survival and maturity

- A Regular pay product with guaranteed money backs at defined intervals that can be used to take care of planned financial milestones or unplanned expenses.

- Two Plan Options

Choose from two plan options i.e. Option 1 & Option 2, based on your planned financial milestones. These options vary by Sum Assured and the amount of survival benefit payable. - Survival Benefits

Enjoy survival benefits during the policy term based on the category chosen within each option:- Platinum:Every year from the end of 6th year till the end of (Policy term minus 1) years.

- Gold:Every year from the end of 8th year till the end of (Policy term minus 1) years.

- Silver:Every year from the end of 10th year till the end of (Policy term minus 1) years.

- Guaranteed Additions

The plan offers guaranteed additions at a simple rate as a percentage of the Sum Assured for each completed policy year, starting from the end of 8th Policy year till the end of the policy term, subject to payment of all due premiums - Tax Benefits

You may be eligible for tax benefits on the premium(s) you pay and benefit proceeds, according to the provisions of Income Tax laws as amended from time to time. These benefits are subject to change as per the current tax laws. Please consult your tax advisor for more details

How can you buy the Future Generali Money Back Super Plan?

Choose the duration of cover or the policy term as per your need

Select from the two options (Option 1 & Option 2) and the available category for selected policy term that works best for you. The Option and Category chosen at inception of the policy cannot be subsequently changed during the term of the Policy.

Now that you have chosen your option and category, decide on the amount of Annualized Premium. Your Sum Assured is a multiple of Annualized Premium (excluding the applicable taxes, rider premiums, loadings for modal premium and underwriting extra premiums, if any), which depends upon the Option and Category chosen. The amount of Survival Benefit and Guaranteed Additions are a percentage of Sum Assured and will depend upon the Option and Category selected.

Fill the proposal form (application form) and complete the documentation process.

Finally pay your premium amount and head towards a financially secure future.

Note: The options vary by Sum Assured and amount of Survival Benefit to be paid.

Life Insurance Plan Summary

| Parameter | Criterion | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Under both options | ||||||||||||||||||

| Entry Age (As on last Birthday) |

Minimum | 0 Years | ||||||||||||||||

| Maximum | 60 Years | |||||||||||||||||

| Maturity Age (As on last Birthday) |

Minimum | 18 Years | ||||||||||||||||

| Maximum | 72 Years | |||||||||||||||||

| Under both options | ||||||||||||||||||

| Policy Term (PT) | 10/12/15/20 years depending upon Category as below | |||||||||||||||||

| Premium Payment Term (PPT) | Same as Policy Term | |||||||||||||||||

| Premium Payment Type | Regular Pay | |||||||||||||||||

| Category |

|

|||||||||||||||||

| Sum Assured | Minimum | Option 1 Entry Age 0 years to 50 years: ₹ 90,000/- Entry Age 51 years to 60 years: ₹ 3,00,000/- Option 2 Entry Age 0 years to 50 years: ₹ 71,250/- Entry Age 51 years to 60 years: ₹ 2,37,500/- |

||||||||||||||||

| Maximum | As per Board approved underwriting policy | |||||||||||||||||

| Sum Assured Multiple |

Where ‘Annualized Premium’ excludes the applicable taxes, rider premiums, loadings for modal premium and underwriting extra premiums, if any. |

|||||||||||||||||

| Premium Payment Frequency | Yearly, Half Yearly, Quarterly and Monthly | |||||||||||||||||

| Premium amount | Minimum |

|

||||||||||||||||

| Maximum | As per Maximum Sum Assured | |||||||||||||||||

- For minors, the date of issuance of Policy and Date of Commencement of risk shall be the same.

- Premiums mentioned above are excluding the applicable taxes, rider premiums, loadings for modal premium and underwriting extra premiums, if any.

- Age wherever mentioned is age as on last birthday.

Benefits under this plan

As per the chosen category and option you will get survival benefits during the policy term, provided all due premiums till date of survival payout are paid and upon survival on the payment due dates which will help you to meet your planned financial milestones. The different categories are:

- Platinum: Get survival benefit every year from the end of 6th year till the end of (Policy term minus 1) years.

- Gold: Get survival benefit every year from the end of 8th year till the end of (Policy term minus 1) years.

- Silver: Get Survival Benefit every year from the end of 10th year till the end of (Policy Term minus 1) years.

Survival benefits will be a percentage of Sum Assured as described below:

| Category | Survival Benefit as a % of Sum Assured | |

|---|---|---|

| Option 1 | Option 2 | |

| Platinum | 17.5% | 27.5% |

| Gold | 13.5% | 25.0% |

| Silver | 11.0% | 30.0% |

- The Policy offers simple guaranteed additions for each completed policy year, starting from the end of 8th Policy year till the end of the policy term, subject to payment of all due premiums.

- Guaranteed additions accrue as a percentage of Sum Assured at the end of applicable policy year.

- The Guaranteed Addition rates are based on the age at entry of the life assured, the option chosen, the category chosen, policy term and annualized premium (excluding the applicable taxes, rider premiums, loadings for modal premium and underwriting extra premiums, if any).

- If a policy is converted into a paid-up policy, it will not accrue any future guaranteed additions. The guaranteed additions already accrued, if any, remain attached to the policy.

On your survival till the end of the policy term, provided all due premiums have been paid, you will receive Guaranteed Maturity Benefit which is:

Sum Assured on Maturity plus accrued guaranteed additions Where Sum Assured on Maturity is equal to Sum Assured.

Policy will terminate on payment of maturity benefit.

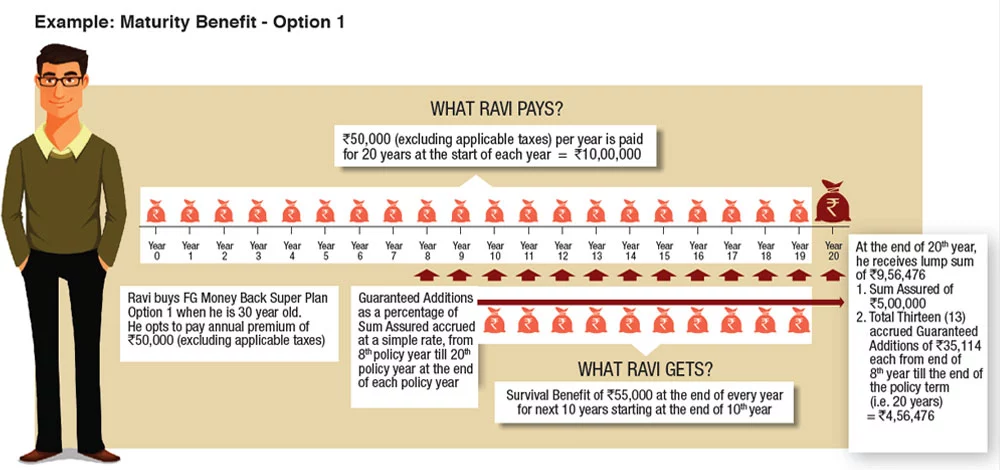

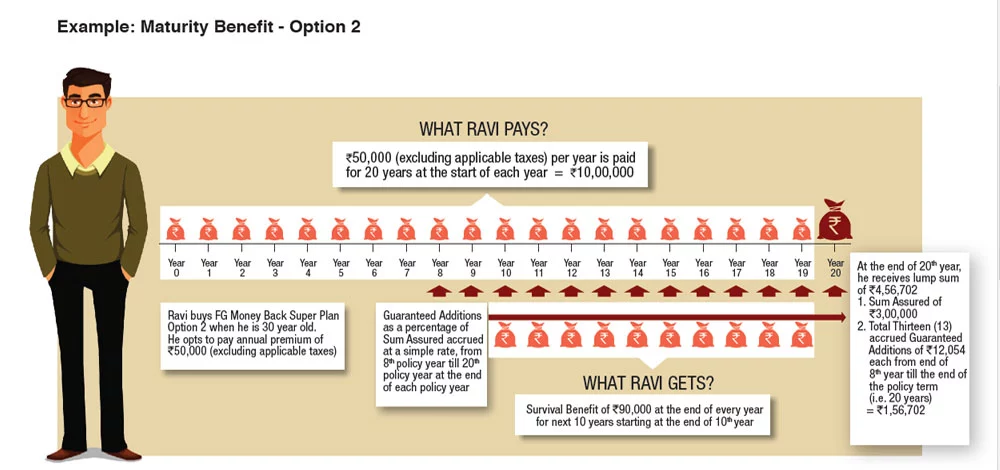

To clearly understand how the maturity benefit works, let us take a look at Ravi’s story.

Ravi is 30 years old healthy man and has purchased the Future Generali Money Back Super Plan –

-

Option 1

He has opted for Silver category with an annualized premium (excluding the applicable taxes, rider premiums, loadings for modal premium and underwriting extra premiums, if any) of ₹ 50,000. His policy term and premium payment term is 20 years and his Sum Assured is ₹ 5,00,000.He will get survival benefit of ₹ 55,000 every year starting from end of 10th policy year till end of 19th policy year plus guaranteed addition of ₹ 35,114 every year will also get accrued in his policy for each completed policy year, starting from end of 8th policy year till end of 20th policy year. The accrued guaranteed additions will be paid along with Sum Assured on Maturity on the policy maturity date as explained below:

Keeping other conditions same, in case Ravi opts for Option 2, his Sum Assured will be ₹ 3,00,000. He will get survival benefit of ₹ 90,000 every year starting from end of 10th policy year till end of 19th policy year plus guaranteed addition of ₹ 12,054 every year will also get accrued in his policy for each completed policy year, starting from end of 8th policy year till end of 20th policy year. The accrued guaranteed additions will be paid along with Sum Assured on Maturity on the policy maturity date as explained below:

The Policy will terminate on payment of Maturity Benefit.

-

Let’s understand the benefits under all options and categories for a 30 year old healthy individual who opts for a 15 year Policy Term and pays an annual premium of ₹ 50,000 per year.

Option Category Sum Assured Survival Benefit Period Benefits Payable 1 Platinum ₹ 3,00,000 end of year 6 to end of year 14 Total Benefit of ₹ 9,54,072

(Total Survival Benefit of ₹ 4,72,500 Plus

Total Maturity Benefit of ₹ 4,81,572)1 Gold ₹ 4,00,000 end of year 8 to end of year 14 Total Benefit of ₹ 9,86,950

(Total Survival Benefit of ₹ 3,78,000 Plus

Total Maturity Benefit of ₹ 6,08,950)1 Silver ₹ 5,00,000 end of year 10 to end of year 14 Total Benefit of ₹ 10,21,500

(Total Survival Benefit of ₹ 2,75,000 Plus

Total Maturity Benefit of ₹ 7,46,500)2 Platinum ₹ 2,37,500 end of year 6 to end of year 14 Total Benefit of ₹ 8,97,779

(Total Survival Benefit of ₹ 5,87,817 Plus

Total Maturity Benefit of ₹ 3,09,962)2 Gold ₹ 3,00,000 end of year 8 to end of year 14 Total Benefit of ₹ 9,36,931

(Total Survival Benefit of ₹ 5,25,000 Plus

Total Maturity Benefit of ₹ 4,11,931)2 Silver ₹ 3,00,000 end of year 10 to end of year 14 Total Benefit of ₹ 9,70,145

(Total Survival Benefit of ₹ 4,50,000 Plus

Total Maturity Benefit of ₹ 5,20,145)

In case of unfortunate demise of the life assured, the death benefit in this plan secures life assured’s family’s financial wellbeing and future. If the policy is in-force and due premium till the date of death have been paid, the death benefit under all Options and all Categories shall be higher of:-

- 105% of total premiums paid as on date of death (excluding the applicable taxes, rider premiums and underwriting extra premiums, if any) or

- Sum Assured on Death i.e. 10 times of annualized premium (excluding the applicable taxes, rider premiums and underwriting extra premiums, if any) plus Accrued Guaranteed Additions, if any.

The policy will terminate on payment of Death Benefit.

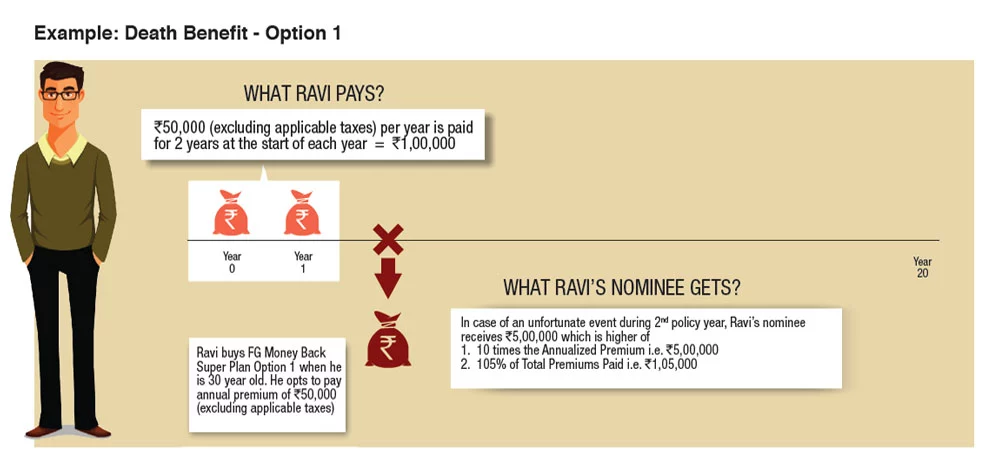

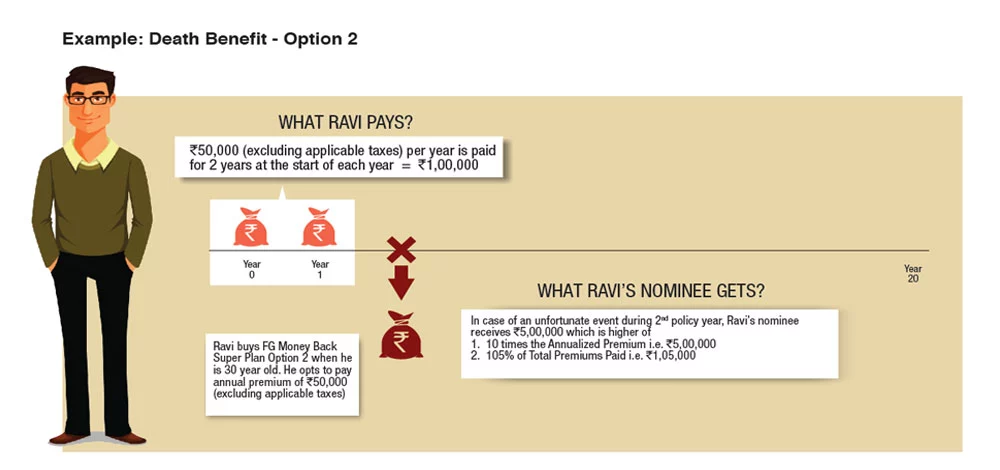

To clearly understand how death benefit works in this case, let continue with Ravi’s story

Ravi is 30 years old healthy man and has purchased the Future Generali Money Back Super Plan – Option 1. He has opted for Silver category with an annualized premium (excluding the applicable taxes, rider premiums, loadings for modal premium and underwriting extra premiums, if any) of ₹ 50,000. His policy term and premium payment term is 20 years and his Sum Assured is ₹ 5,00,000.

It is assumed that Ravi’s death occurs at the end of 2nd policy year. The benefit payable under Option 1 to Ravi's nominee(s) will be:

Similarly in case Ravi opts for Option 2, his Sum Assured will be ₹ 3,00,000. It is assumed that Ravi’s death occurs at the end of 2nd policy year. The benefit payable under Option 2 to Ravi's nominee(s) will be:

The Policy will terminate on payment of Death Benefit.

LITTLE PRIVILEGES JUST FOR YOU

Free Look Period

If you disagree with the terms and condition of the Policy, you can return the Policy within 15 days of receipt of the Policy Document (30 days if you have purchased this Policy through Distance Marketing Mode or in case of electronic policies). To cancel the Policy, you can send us a request for cancellation along with the reason for cancellation. We will cancel this Policy and refund the Instalment Premium received after deducting proportionate risk Premium for the period on cover, stamp duty charges and expenses incurred by us on the medical examination of the Life Assured (if any).

Note: Distance Marketing means insurance solicitation/lead generation by way of telephone calling/ Short Messaging Service (SMS)/other electronic modes like e-mail, internet & Interactive Television (DTH)/direct mail/ newspaper and magazine inserts or any other means of communication other than that in person.

Grace Period

You get a grace period of 30 days for Yearly, Half yearly and Quarterly Premium Payment Frequency and 15 days for Monthly Premium Payment Frequency from the due date, to pay your missed premium. During these days, risk on your life will continue to be covered and your nominee will be entitled to receive all the benefits subject to deduction of due premiums.

Change in Premium Payment Frequency

You can change your premium payment frequency subject to minimum eligibility criteria. Such change shall be applicable from the Policy Anniversary.

The premiums for various modes as a percentage of annual premium are given below:

- Half-yearly Premium – 52.0% of annual premium

- Quarterly Premium - 26.5% of annual premium

- Monthly Premium - 8.83% of annual premium

There shall be no charge made for the change of premium payment frequency.

Rider

No riders are available under this product.

Loan

You may avail a loan once the policy has acquired a Surrender Value. The maximum amount of loan that can be availed is up to 85% of the Surrender Value. The minimum amount of policy loan that can be taken is ₹ 10,000. For more details, please refer to the policy document. The interest rate applicable for the Financial Year will be declared at the start of the Financial Year, basis current market interest rate on 10-year Government Securities (G-Sec) +2% rounded to nearest 1%. The current interest rate applicable on loans is 9% per annum compounded half-yearly for the Financial Year 2023-24. Please contact us or Our nearest branch for information on latest interest rate on loans.

TERMS AND CONDITIONS

Non Payment of Due Premium

Lapse:

If due premiums for the first two (2) policy years have not been paid in full within the grace period, the policy shall lapse and will have no value.

All risk cover ceases while the policy is in lapsed status.

The policyholder has the option to revive the policy within five years from the due date of first unpaid premium.

In case the Policy is not revived during the revival period, no benefit shall be payable at the end of revival period and the policy stands terminated.

Paid-Up Value:

If due premiums for the first two (2) or more policy years have been paid in full and any subsequent premium is not paid within the grace period, the policy will be converted into a paid-up policy.

If a policy is converted into a paid-up policy, it will not accrue any future guaranteed additions under both options. The guaranteed additions already accrued, if any, remain attached to the policy.

If policy is converted into a paid-up policy, future survival benefit payments shall stop and no further survival benefits shall be payable.

- Paid-Up Death Benefit:

Paid-Up Sum Assured on Death = (Number of Premiums Paid / Total number of premiums payable) * Sum Assured on Death

On death of the life assured during the policy term while the policy is in paid-up status, a reduced death benefit equal to the Paid-up Sum Assured on Death plus Accrued Guaranteed Additions, if any shall be payable. - Paid-Up Survival Benefit: Nil

If a policy is converted into a paid-up policy, future survival benefit payments shall stop and no further survival benefits shall be payable. - Paid-Up Maturity Benefit:

Paid-Up Sum Assured on Maturity = (Number of premiums paid / Total number of premiums payable) * (Sum of total survival benefits payable under the policy plus Sum Assured on Maturity) minus Total survival benefits already paid.

On survival of the life assured at the end of the policy term while the policy is in a paid-up status, Paid-up Sum Assured on Maturity plus Accrued Guaranteed Additions, if any shall be paid at the end of the policy term.

You can revive a paid-up policy within a period of five years from the due date of first unpaid premium. A paid-up policy cannot be revived once the Policy Term is over.

You can also surrender your paid-up policy anytime during the Policy Term.

Revival

- You have the option to revive a lapsed/paid-up policy within five consecutive years from the date of the first unpaid premium.

- Revival of a policy cannot be done once the policy term is over.

- The revival will be considered on the receipt of the application from the policyholder along with the proof of continued insurability of life assured and on payment of all overdue premiums with interest, if any. We, however, reserve the right to accept at original terms, accept with modified terms or decline the revival this Policy.

- The revival will be effected as per the Board approved underwriting policy.

- On revival, all the Guaranteed Additions due while the policy was in Lapse/Paid-up status, will be added back to the policy. Survival Benefits due but not paid while the policy was in paid-up status shall be paid to you as a lumpsum.

- On revival, the interest rate of 9% p.a. compounded yearly shall be charged by the company. However, the company may decide to increase the interest charged on revival from time to time with a prior approval from IRDAI.

Surrender Value

We encourage you to continue your policy as planned, however, you have the option to surrender the same for immediate cash requirement, in case of an emergency, any time after the payment of all due premiums for at least first two (2) full policy years

- The amount payable on surrender will be (a) Guaranteed Surrender Value (GSV) or (b) Special Surrender Value (SSV), whichever is higher.

- The policy terminates on surrender and no further benefits are payable under the policy.

Guaranteed Surrender Value (GSV):

Guaranteed Surrender Value = [GSV factor for Premium * Total Premiums paid (excluding the applicable taxes, rider premiums and underwriting extra premiums, if any)]

plus

[GSV factor for Guaranteed Additions * Accrued Guaranteed Additions]

minus

[Total Survival Benefits already paid]

Special Surrender Value (SSV):

The Special Surrender Value shall be based on the Company’s expectation of future financial and demographic conditions. This shall be reviewed by the company from time to time with prior approval from IRDAI.

Special Surrender Value = SSV Factor*[Paid-up Sum Assured on Maturity + Accrued Guaranteed Additions]

Vesting of the Policy in Case of Policies Issued to Minor Lives

In case of minor lives, the ownership of the policy shall automatically vest on the Life Assured on attainment of majority (i.e. when the Life Assured attains age 18 years).

Nomination and Assignment

Nomination shall be in accordance with Section 39 of Insurance Act, 1938 as amended from time to time.

Assignment shall be in accordance with Section 38 of Insurance Act, 1938 as amended from time to time.

Exclusions

Suicide exclusion:

In case of death due to suicide within 12 months from the risk commencement date under the policy or from the date of revival of the policy, as applicable, the nominee or beneficiary of the policyholder shall be entitled to 80% of the total premiums paid till the date of death or the surrender value available as on the date of death whichever is higher, provided the policy is in force.

Prohibition on rebates:

Section 41 of the Insurance Act 1938 as amended from time to time states:

- No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer.

- Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakh rupees.

Fraud and Misstatement:

Section 45 of the Insurance Act 1938 as amended from time to time states:

- No Policy of Life Insurance shall be called in question on any ground whatsoever after the expiry of 3 years from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later.

- A policy of Life Insurance may be called in question at any time within 3 years from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later, on the ground of fraud.

For further information, Section 45 of the Insurance laws (Amendment) Act, 2015 may be referred.

Why choose us?

Future Generali India Life Insurance Company Limited offers an extensive range of life insurance products, and a distribution network which ensures that we are close to you wherever you go.

At the heart of our ambition is the promise to be a life-time partner to our customers. And with the help of technology we are making the shift from not only offering protection to our customers but also providing personalized services to them.

It starts with our extensive agent base who is at the core of this transformation. Through our distribution network we ensure that there is always a caring touch while servicing the individual needs of our customers. With this philosophy, we aim to make simplicity, innovation, empathy and care synonymous with our brand - Future Generali India Life Insurance Company Limited.

Disclaimer

Future Generali Money Back Super Plan (UIN : 133N088V03)

POS variant of ‘Future Generali Money Back Super Plan’ is also available which can be applied without any medical examination up to a limited Sum Assured, with waiting period for non-accidental death. Please refer to the POS variant sales literature for more details.

This Product is not available for online sale.

For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the policy document or consult your advisor before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. You are advised to consult your tax consultant. Future Group’s and Generali Group’s liability is restricted to the extent of their shareholding in Future Generali India Life Insurance Company Limited.