- Home

- Insurance Plans

- Guaranteed Plans

- New Assured Wealth Plan (POS Variant)

Future Generali New Assured Wealth Plan

(POS Variant)

An Individual, Non-Linked, Non-Participating (without profits), Savings, Life Insurance Plan.

Growth and Security now go hand-in-hand.

Financial wellness is all about how well you manage your money. With the right planning, financial milestones like your child’s education, owning a house and even retiring early, could be well within your reach. All you need is a plan that offers you both - Security of life insurance as well as Growth of your hard-earned savings.

Presenting the Future Generali New Assured Wealth Plan, a Life Insurance Plan that gives you financial security in form of lumpsum death benefit and a guaranteed lump sum amount at the end of your policy term. It also gives you Guaranteed Additions every year from 8th year, calculated at a simple percent rate of the Sum Assured. So that you don’t have to worry about the rising cost of living.

Why go for the Future Generali New Assured Wealth Plan?

- Guaranteed Additions and Increasing Death Benefit

Enjoy the added benefit of Guaranteed Additions which get accumulated, from the eighth policy year till the end of the policy term, at a simple rate as a percentage of the Sum Assured, subject to payment of all due premiums. The Death Benefit increases with the accrual of the Guaranteed Additions. - Choose your Policy Term and Premium Payment Term

Get the flexibility to select your Policy Term and Premium Payment Term, depending on your needs and fulfill your savings goals. - You can buy this plan up to the age of 53 years without any medical examination.

- Tax benefits

You may be eligible for tax benefits on the premium(s) you pay and benefit proceeds, according to the provisions of Income Tax laws. These benefits are subject to change as per the current tax laws. Please consult your tax advisor for more details

How can you buy the Future Generali New Assured Wealth Plan?

Decide on the following:

- The amount of Annualized Premium

- The duration of cover or the Policy Term

- The duration of premium payment or the Premium Payment Term

Fill the proposal form (application form) and complete the documentation process.

Finally pay your premium amount and head towards a financially secure future.

Life Insurance Plan Summary

| Parameter | Criterion | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Entry Age (As on last Birthday) |

Minimum | 0 Years | ||||||||||

| Maximum | 53 Years | |||||||||||

| Maturity Age (As on last Birthday) |

Minimum | 18 Years | ||||||||||

| Maximum | 65 Years | |||||||||||

| Policy Term | 12/16/18/20 years | |||||||||||

| Premium Payment Term(PPT) |

|

|||||||||||

| Premium Payment Type | Limited Pay | |||||||||||

| Sum Assured | Minimum | Rs. 90,000 | ||||||||||

| Maximum | As per Board Approved underwriting policy. However, Death Benefit shall not exceed the maximum as defined in the POS regulations, circulars and clarifications thereof, as prescribed by the IRDAI from time to time. The Current limit is Rs. 10,00,000 (as on 1 June 2020) | |||||||||||

| Premium Payment Frequency | Yearly, Half Yearly, Quarterly and Monthly | |||||||||||

| Premium amount | Minimum |

|

||||||||||

| Maximum | As per maximum Sum Assured | |||||||||||

Note:

- 1. For minors, the date of issuance of Policy and Date of Commencement of risk shall be the same.

- 2. Premiums mentioned above are excluding applicable taxes, rider premiums and any extra premium paid as a part of underwriting requirements, if any

- 3. Age wherever mentioned is age as on last birthday.

- The plan offers simple Guaranteed Additions for each completed policy year, starting from 8th Policy year till the end of the policy term, subject to payment of all due premiums

- Guaranteed Additions accrue as a percentage of Sum Assured

- The Guaranteed Additions accrue at the end of the policy year

- The Guaranteed Addition rates are based on the age at entry of the Life Assured, the Premium Payment Term chosen, Policy Term chosen ,Death Benefit Multiple, Annualized Premium (excluding taxes, rider premiums, loadings for modal premium and extra underwriting premiums, if any)

- If this Policy is converted to a Reduced Paid-Up Policy as per the terms and conditions it shall not accrue any future guaranteed additions from the first Premium Due Date on which the Instalment Premium was unpaid. The guaranteed additions already accrued, remains attached to the Policy.

- Sample annual Guaranteed Addition rates are provided below:

| Option | Age at Entry | Premium Payment Term | Policy Term | Annualized Premium | Guaranteed Addition Rate |

|---|---|---|---|---|---|

| 1 | 30 | 10 | 20 | 50,000 | 8.75% |

| 1 | 40 | 10 | 20 | 50,000 | 8.45% |

You will receive a Guaranteed Maturity Benefit, on survival till the end of the Policy Term subject to all your premiums due being paid.

Maturity Sum Assured Plus Accrued Guaranteed Additions, shall be paid where Maturity Sum Assured is equal to Sum Assured

Sum Assured under this product is equal to the total Annualized Premium payable under the policy (excluding the taxes, rider premiums, underwriting extra premiums and loadings for modal premiums, if any)

The policy terminates on the payment of the Maturity Benefit.

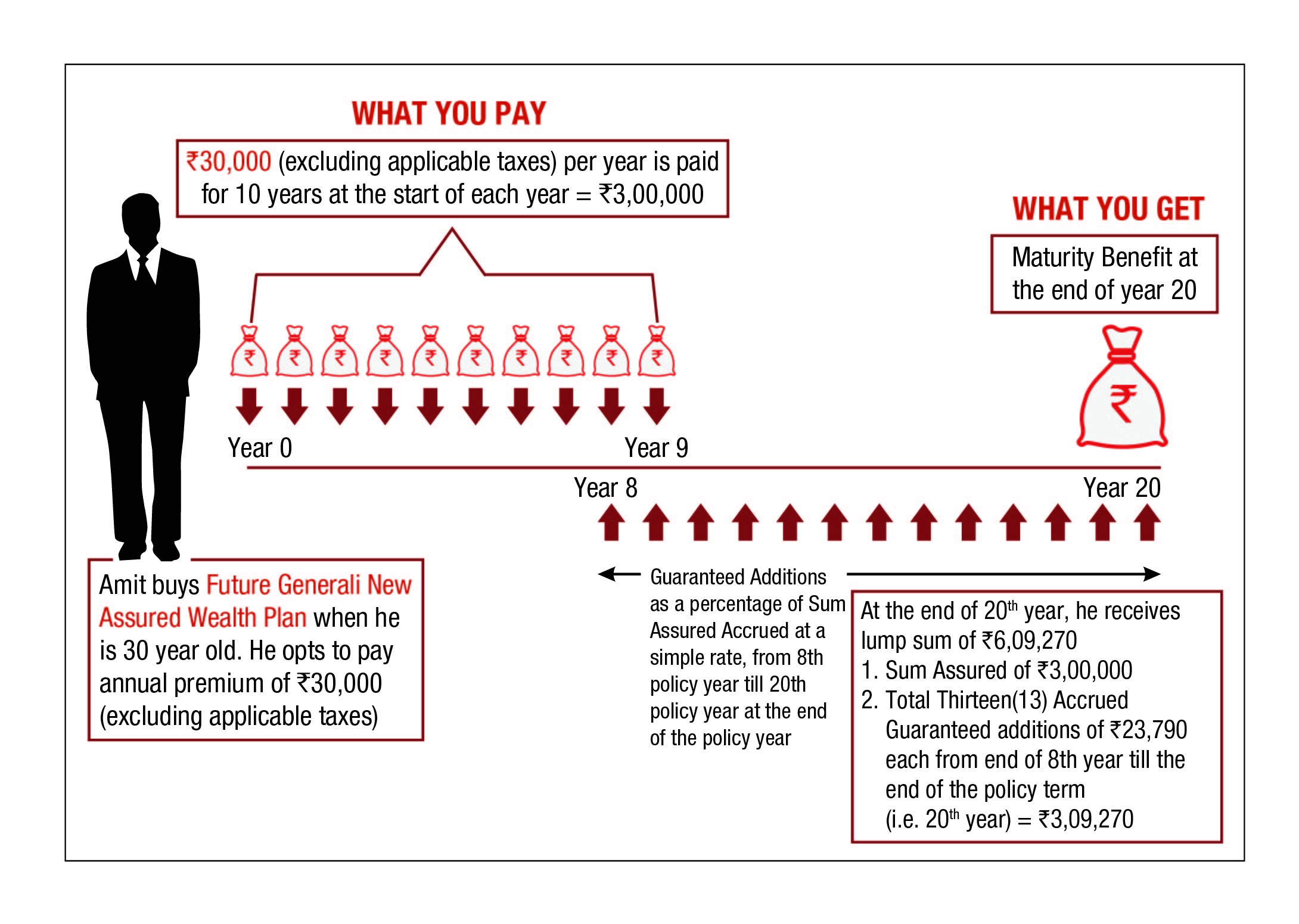

To clearly understand how the maturity benefit works, let us take a look at Amit’s story.

Amit is 30 years old healthy man and has purchased the Future Generali New Assured Wealth Plan. He has opted for an Annualized Premium (excluding the taxes, rider premiums, underwriting extra premiums and loadings for modal premiums, if any) of Rs. 30,000 for a Policy Term of 20 years and Premium Payment Term of 10 years. His Sum Assured is Rs. 3, 00,000.

Guaranteed Additions will accrue at a simple rate of 7.93% of Sum Assured from the 8th Policy year till the end of Policy term at the end of each policy year.

In case of unfortunate demise of the life assured, the Death Benefit in this plan secures Life Assured’s family’s financial well-being and future. The Death Benefit varies as per the plan option you choose:

In case of unfortunate demise of the life assured during the Policy Term, the life assured’s nominee/beneficiary shall receive Death Sum Assured plus Accrued Guaranteed Additions, if any. This is applicable if the policy is in-force and due premium till date of death have been paid.

The Death Sum Assured shall be the highest of the following:

- Death Benefit Multiple * Annualized premium (excluding the taxes, rider premiums and underwriting extra premiums, if any), or

- 105% of Total Premiums Paid (excluding any extra premium, any rider premium and taxes, if collected explicitly) as on date of death.

- Waiting Period:There is a 90 day waiting period from the date of acceptance of risk, within which, if death occurs (other than due to accident), the nominee will receive 100% of the premiums paid till the date of death excluding taxes. During this period, the Death Sum Assured will not be payable.

The Policy will terminate on payment of Death Benefit

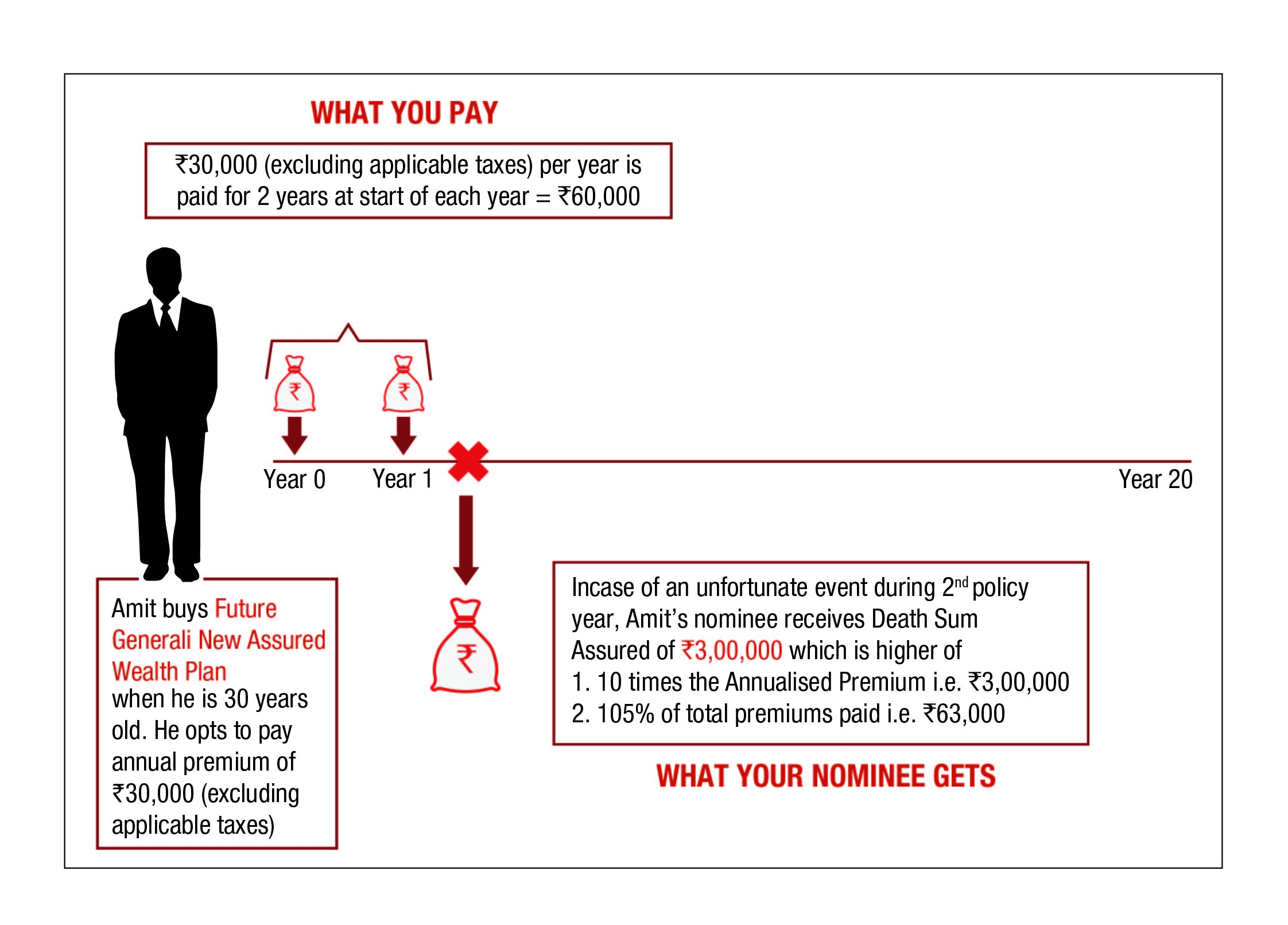

To clearly understand how death benefit works in this case, let us look at Amit’s story

Amit is 30 years old healthy man and has purchased the Future Generali New Assured Wealth Plan. He has opted for an Annualized Premium(excluding the taxes, rider premiums, underwriting extra premiums and loadings for modal premiums, if any) of Rs. 30,000 for a Policy Term of 20 years and Premium Payment Term of 10 years. His Sum Assured is Rs.3, 00, 000.

It is assumed that Amit’s death occurs during 2nd policy year. The benefit payable to Amit's nominee(s) will be:

LITTLE PRIVILEGES JUST FOR YOU

Free Look Period

If you disagree with the terms and condition of the Policy, you can return the Policy within 30 days of receipt of the Policy Document(Whether received electronically or otherwise ). To cancel the Policy, you can send us a written request for cancellation which is dated and signed by you, along with the reason for cancellation. We will cancel this Policy if you have not made any claims and refund the Instalment Premium received after deducting proportionate risk Premium for the period on cover, stamp duty charges and expenses incurred by Us on the medical examination of the Life Assured (if any).

Note:

- For existing e-Insurance Account: Computation of the said Free Look Period will commence from the date of delivery of the e-mail confirming the credit of the Insurance policy by the IR.

- For New e-Insurance Account: If an application for e-Insurance Account accompanies the proposal for insurance, the date of receipt of the ‘welcome kit’ from the IR with the credentials to log on to the eInsurance Account (eIA) or the delivery date of the email confirming the grant of access to the eIA or the delivery date of the email confirming the credit of the Insurance policy by the IR to the eIA, whichever is later shall be reckoned for the purpose of computation of the Free Look Period.

Grace Period

You get a grace period of 30 days for Yearly, Half yearly and Quarterly Premium Payment Frequency and 15 days for Monthly Premium Payment Frequency from the due date, to pay your missed premium. During these days, you will continue to be covered and be entitled to receive all the benefits subject to deduction of due premiums.

Change in Premium Payment Frequency

You can change your premium payment frequency subject to minimum eligibility criteria. Such change shall be applicable on the Policy Anniversary.

The premiums for various modes as upto a percentage of annual premium are given below:

- Half-yearly premium – 52.0% of annual premium

- Quarterly premium - 26.5% of annual premium

- Monthly premium - 8.83% of annual premium

There shall be no charge made for the change of premium payment mode.The company will offer waiver of modal premium loadings for Annualized Premium of Rs. 1 crore and above

Rider

No riders are available under this product.

Loan

You may avail a loan once the policy has acquired a Surrender Value. The maximum amount of loan that can be availed is up to 85% of the Surrender Value. The minimum amount of policy loan that can be taken is Rs. 10,000. For more details, please refer to the policy document. The interest rate applicable for the Financial Year will be declared at the start of the Financial Year, basis current market interest rate on 10-year Government Securities (G-Sec) as on 31st March every year + 2% rounded to nearest 1%. The current interest rate for the Financial Year 2024-25 applicable on loans is 9% per annum compounded half-yearly. Please contact Us or Our nearest branch for information on latest interest rate on loans.

TERMS AND CONDITIONS

Non Payment of Due Premium

Lapse:

If due premiums for the first one (1) policy years have not been paid in full within the grace period, the policy shall lapse and will have no value.

All risk cover ceases while the policy is in lapsed status.

The policyholder has the option to revive the policy within Five years from the due date of first unpaid premium.

In case the Policy is not revived during the revival period no benefit shall be payable at the end of revival period and the policy stands terminated.

Paid-Up Value:

If due premiums for the first one (1) or more policy years have been paid in full and any subsequent premium is not paid within the grace period, the policy will be converted into a paid-up policy.

Death Sum Assured and Maturity Sum Assured will be reduced in proportion to the number of premiums paid to the total number of premiums payable under the policy. The reduced benefit shall be payable in the same manner as for an in-force policy.

If a policy is converted into a paid-up policy, it will not accrue any future Guaranteed Additions under both options. The Guaranteed Additions already accrued, if any, remains attached to the policy. A paid-up policy will not accrue any future Guaranteed Additions after death of the Life Assured under option 2.

You can revive a Paid-Up Policy within a period of five years from the due date of first unpaid premium. A paid-up policy cannot be revived once the policy term is over.

You can also surrender your Paid-Up policy anytime during the Policy Term.

If the Paid up Sum assured (exclusive of attached bonuses and the guaranteed additions) is less than rupees two thousand five hundred, the Policy may be terminated after expiry of revival period by paying the surrender value.

Revival

- You have the option to revive a lapsed/paid-up policy within 5 years from the date of the first unpaid due premium.

- The revival will be considered on the receipt of the application from the policyholder along with the proof of continued insurability of life assured and on the payment of all overdue premiums with interest. The revival will be effected as per the Board approved underwriting policy.

- The Company, however, reserves the right to accept on original terms, or on modified terms or decline the revival of a discontinued policy. The revival of the discontinued policy shall take effect only after the same is approved by the Company and is specifically communicated to the policyholder.

- On revival, the simple rate of 9% p.a. shall be charged by the company.The interest rate applicable for the Financial Year will be declared at the start of the Financial Year, basis current market interest rate on 10-year Government Securities (G-Sec) as on 31st March every year + 2% rounded to nearest 1%. However, the company may decide to increase the interest charged on revival from time to time with a prior approval from IRDAI.

- On revival, all the Guaranteed Additions due while the policy was in Lapse/Paid up status, will be added back to the policy.

- A policy cannot be revived once the policy term is over.

Surrender Value

We encourage you to continue your policy as planned, however, you have the option to surrender the same for immediate cash requirement, in case of an emergency, any time after completion of first policy year provided one full year premium has been received.

- The amount payable on surrender will be (a) The Guaranteed Surrender Value (GSV) or (b) Special Surrender Value (SSV), whichever is higher.

- The policy terminates on surrender and no further benefits are payable under the policy.

Guaranteed Surrender Value (GSV):

The GSV will be equal to the GSV factor for premium multiplied by the total premium paid (excluding taxes, rider premiums, underwriting extra premiums, if any) plus the GSV factor for Guaranteed Additions multiplied by accrued Guaranteed Additions.

Special Surrender Value (SSV):

The Special Surrender Value shall be based on the company’s expectation of future financial and demographic conditions. and may be reviewed in accordance with applicable IRDAI regulations on this behalf

Special Surrender Value = [{Number of Premiums Paid / Total number of premiums payable} * Sum Assured plus Accrued Guaranteed Additions)] x Special Surrender Value Factor

Vesting of the Policy in Case of Policies Issued to Minor Lives

The policy vests on the life assured on the policy anniversary coinciding with or immediately following the 18th birthday of the life assured. In case of death of Policyholder, while the Life Assured is a minor, the surviving parent/ legal guardian may be appointed as a new Policyholder. In case the policy is in paid-up status or upon non-payment of future premiums, Paid Up or Lapse provisions as mentioned above shall apply.

Nomination and Assignment

Nomination shall be in accordance with Section 39 of Insurance Act, 1938 as amended from time to time.

Assignment shall be in accordance with Section 38 of Insurance Act, 1938 as amended from time to time.

Exclusions

Suicide Exclusion :

In Case of death of Life Assured due to suicide within 12 months from the risk commencement date under the policy or from the date of revival of the policy, as applicable, the nominee or beneficiary of the policyholder shall be entitled to at least 80% of the total premiums paid till the date of death or the surrender value available as on the date of death whichever is higher, provided the policy is in force.

Grievance Redressal Processes

- (a) Calling the Customer helpline number 1800-102-2355 for assistance and guidance

- (b) Emailing at care@futuregenerali.in

- (c) You may also visit us at the nearest Branch Office. Branch locator - https://life.futuregenerali.in/branch-locator/

- (d) Senior citizens may write to us at the following ID: senior.citizens@futuregenerali.in for priority assistance

- (e) You may write to us at:

Customer Services Department

Future Generali India Insurance Co. Ltd,

Unit 801 and 802, 8th floor, Tower C,

Embassy 247 Park, L.B.S Marg, Vikhroli (W)

Mumbai – 400083

We will provide a resolution at the earliest. For further details please access the link: https://life.futuregenerali.in/customer-service/grievance-redressal-procedure

Prohibition on rebates:

Section 41 of the Insurance Act 1938 as amended from time to time states:

- No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer.

- Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakh rupees.

Fraud, misrepresentation or non-disclosure:

Section 45 of the Insurance Act 1938 as amended from time to time states:

- No Policy of Life Insurance shall be called in question on any ground whatsoever after the expiry of 3 years from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later.

- A policy of Life Insurance may be called in question at any time within 3 years from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later, on the ground of fraud.

For further information, Section 45 of the Insurance laws (Amendment) Act, 2015 may be referred.

Why choose us?

Future Generali India Life Insurance Company Limited offers an extensive range of life insurance products, and a distribution network which ensures that we are close to you wherever you go.

At the heart of our ambition is the promise to be a life-time partner to our customers. And with the help of technology we are making the shift from not only offering protection to our customers but also providing personalized services to them.

It starts with our extensive agent base who is at the core of this transformation. Through our distribution network we ensure that there is always a caring touch while servicing the individual needs of our customers. With this philosophy, we aim to make simplicity, innovation, empathy and care synonymous with our brand - Future Generali India Life Insurance Company Limited.

Disclaimer

Future Generali New Assured Wealth Plan (UIN: 133N085V03)

POS Life variant of ‘Future Generali New Assured Wealth Plan’ is also available where only Option-1 of this product can be applied without any medical examination up to limited Sum Assured, with waiting period for non-accidental death. Please click here to know more.

This Product is not available for online sale.Life Coverage is included in this Product

For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the policy document and consult your advisor, or, visit our website (life.futuregenerali.in) before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. You are advised to consult your tax consultant. Future Group’s and Generali Group’s liability is restricted to the extent of their shareholding in Future Generali India Life Insurance Company Limited. If you have any request, grievance, complaint or feedback, you may reach out to us at care@futuregenerali.in For further details please access the link: https://life.futuregenerali.in/customer-service/grievance-redressal-procedure