- Home

- Insurance Plans

- ULIP PLANS

- Big Dreams Plan

FUTURE GENERALI BIG DREAMS PLAN

Individual, Non-Participating (without profits), Unit Linked, Life Insurance Plan

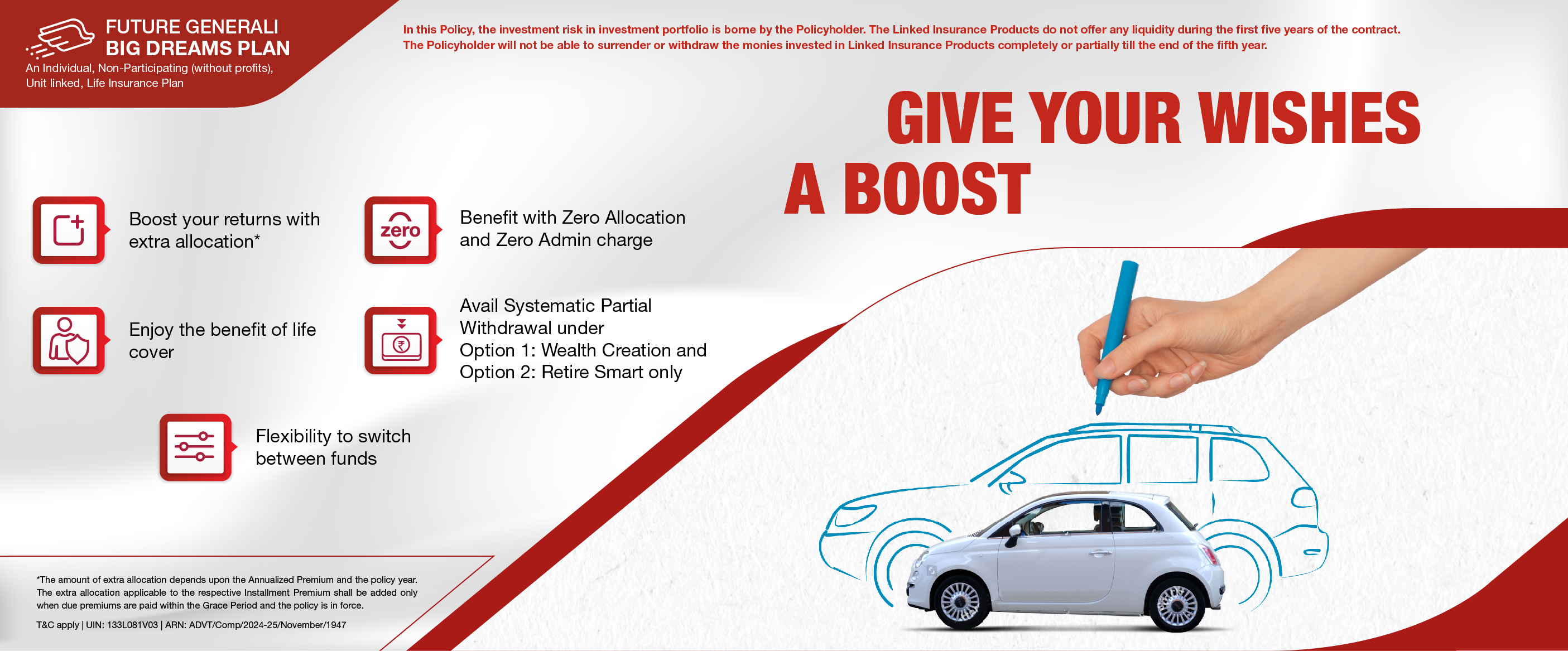

- In this policy, the investment risk in the investment portfolio is borne by the policyholder.

- The linked insurance plans do not offer any liquidity during the first five years of the contract. The policyholder will not be able to surrender/withdraw the monies invested in linked insurance plans completely or partially until the end of the fifth year.

We all want a little extra something in life. Same is true for our investments as well, so we have created a Unit Linked Insurance Plan just for that. With us, you can now dream much more.

Presenting the Future Generali Big Dreams Plan, a comprehensive Unit Linked Insurance Plan, that lets you create wealth while enjoying the benefits of an insurance plan at the same time.

So go on and secure your long-term future and dreams!

Key Benefits of Big Dreams ULIP Plan

Boost your returns

Boost your returns with extra allocation, from 1% to 7% on your each instalment premium if the due premium is paid within the Grace Period. This ensures you reach your financial goals faster.

Lower charges

Benefit with Zero Allocation and Zero Admin charge and watch your wealth grow faster.

Life Cover

Enjoy the benefit of life cover and secure your family’s future against the uncertainties of life.

3 Investment Options

Fulfil your life’s goals by choosing from 3 available options – Wealth Creation, Retire Smart and Dream Protect.

Systematic partial withdrawal

Avail Systematic Partial Withdrawal (under Option 1: Wealth Creation and Option 2: Retire Smart only) and receive money in your account monthly to help you meet specific financial requirements.

Control Asset Allocation

Get the flexibility to change your funds and always be in complete control of your wealth.

Tax Benefits

Avail tax benefits under Section 80C and Sec 10(10D) of the Income Tax Act of 1961. These benefits are subject to change as per the prevailing tax laws.

Riders

Choice of two optional rider to match your specific needs.

What are your benefits?

For Option 1: Wealth Creation and Option 2: Retire Smart:

- On policy maturity (end of policy term), you will receive your Fund Value.

For Option 3: Dream Protect:

- On policy maturity (end of policy term), you will receive your Fund Value.

- Even in case of the death of the Life Assured, you will receive your Fund Value on policy maturity (end of policy term).

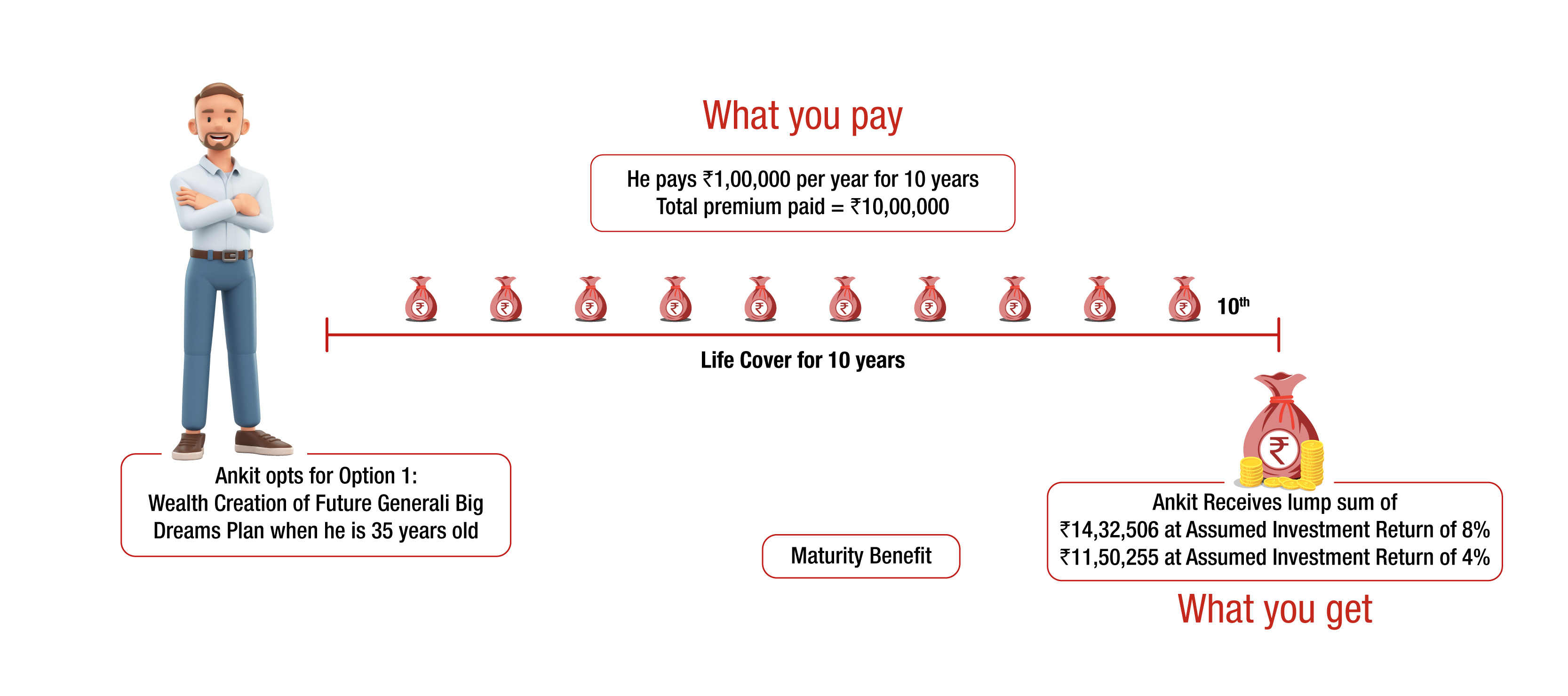

To clearly understand how maturity benefit works, let us take a look at Ankit’s story.

Ankit is 35 years old and has chosen to invest in Option 1: Wealth Creation of the Future Generali Big Dreams Plan, with a Policy Term of 10 years, an annual premium of Rs. 1,00,000 for 10 years,His Death Benefit Multiple is 10 times and a Sum Assured (cover amount) of Rs. 10,00,000.

Note: For the purpose of illustration, we have assumed 8% p.a and 4% p.a as the higher and lower values of investment returns. These rates are not guaranteed, and they are not the upper or lower limits of returns of the Funds selected in your policy, as the performance of funds depends on several factors including future investment performance. These rates in no way signify our expectations of future returns and the actual returns may be higher or lower.

In case of your unfortunate demise, the Death Benefit in this plan secures your family’s financial well-being and future. The Death Benefit varies as per the plan option you choose:

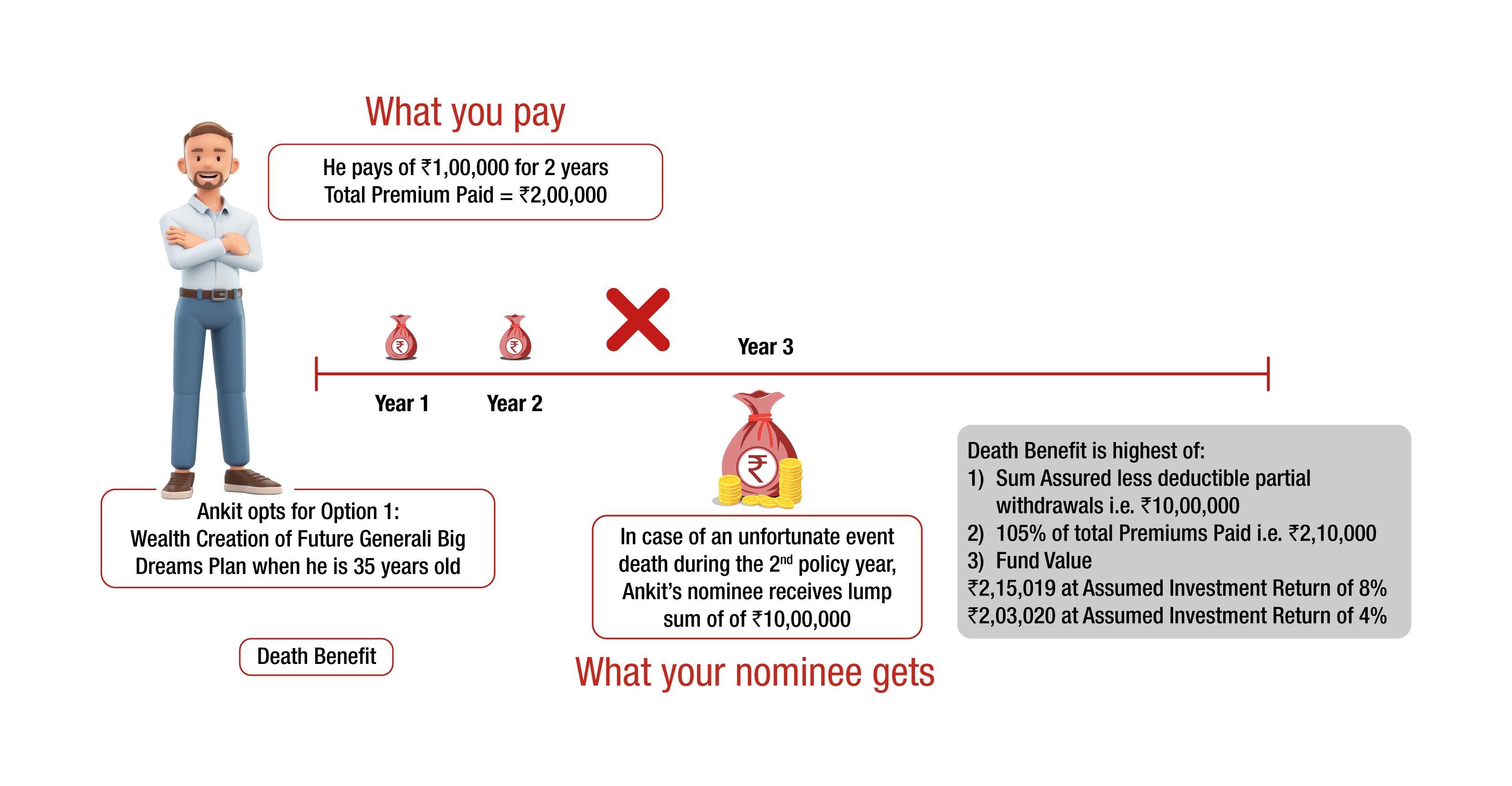

For Option 1: Wealth Creation and Option 2: Retire Smart:

The Death Benefit payable to the nominee shall be the higher of:

- Sum Assured less deductible partial withdrawals, if any, OR

- Fund Value under the policy, OR

- 105% of the total premiums paid (including top-up premiums paid, if any) till the date of death less deductible partial withdrawals, if any.

The Policy will terminate on the payment of Death Benefit.

To clearly understand how the death benefit works, let us refer to Ankit’s story.

Like we discussed, Ankit is 35 years old, and has invested in Option 1:Wealth Creation of the Future Generali Big Dreams Plan, with a Policy Term of 10 years and Death Benefit Multiple is 10 times, In case of Ankit’s unfortunate death after having paid just 2 premiums, the following illustration shows what his nominee will get:

Note: For the purpose of illustration, we have assumed 8% p.a and 4% p.a as the higher and lower values of investment returns. These rates are not guaranteed, and they are not the upper or lower limits of returns of the Funds selected in your policy, as the performance of funds depends on several factors including future investment performance. These rates in no way signify our expectations of future returns and the actual returns may be higher or lower.

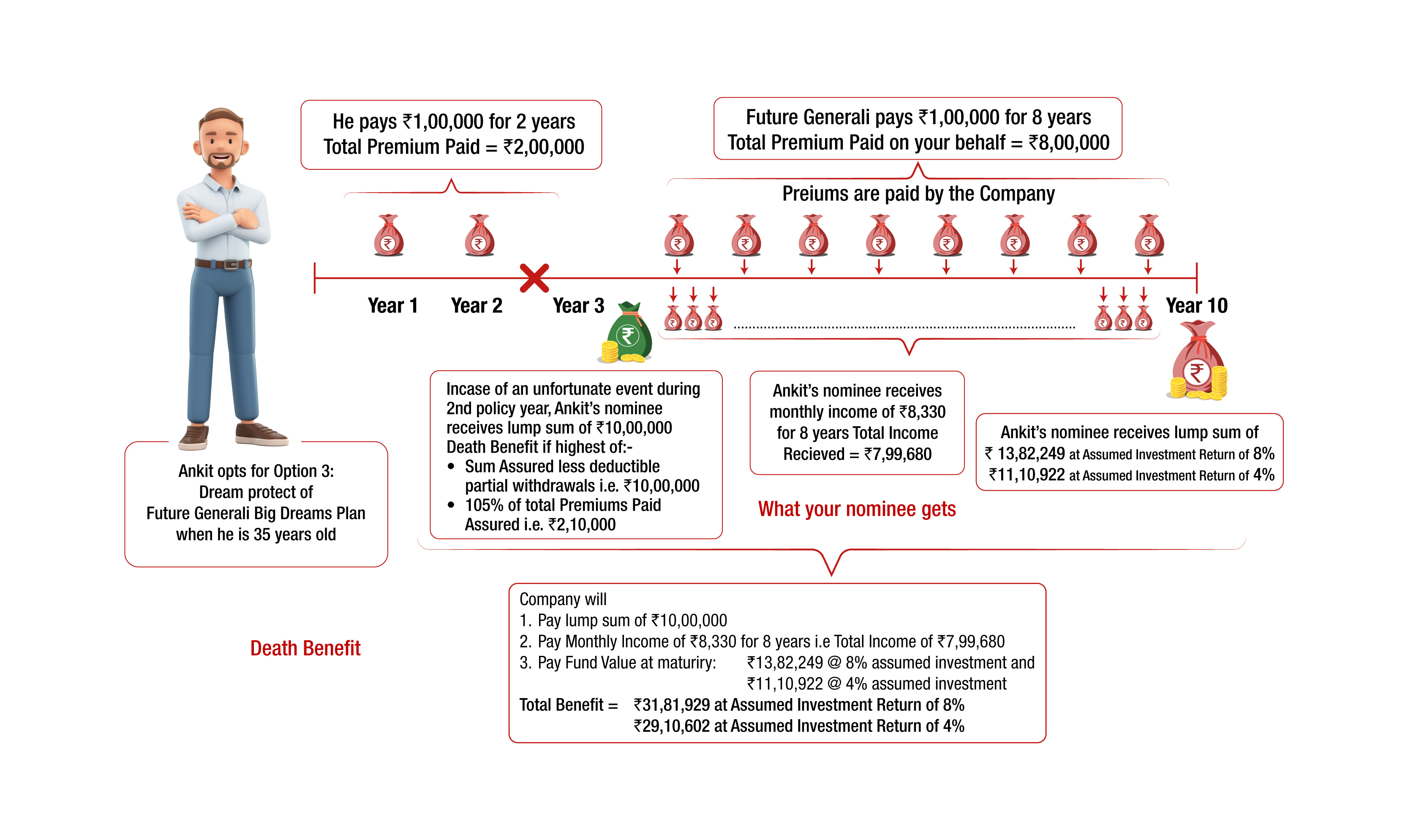

For Option3: Dream Protect

- Sum Assured less deductible partial withdrawals, if any, OR

- 105% of the total premiums paid (including top-up premiums paid, if any) till the date of death less deductible partial withdrawals, if any.

In addition:

- No future premiums are required to be paid by You. All future premiums under the policy shall be paid by the Company on your behalf as and when they become due. Extra Allocation applicable to the respective Installment Premium post the death of the Life Assured shall be added to the fund as and when the installment premium is paid by the company into the fund. The Policy shall continue till maturity and all the future benefits under the policy will be paid to the beneficiary as and when due. All applicable charges, except mortality charges, will continue to be deducted from the unit fund.

- We will pay a monthly income equal to 8.33% of the Annualised Premium every month to the nominee till the end of the policy term starting from the first monthly death anniversary of the Life Assured.

- We shall also pay the Maturity Benefit (Fund Value) at the end of the policy term.

The Policy will terminate on the complete payment of Maturity Benefit at the end of the Policy Term.

To clearly understand how death benefit works in this case, let us look at Ankit’s story had he chosen Option 3:Dream Protect option, with a Policy Term of 10 years and Death Benefit Multiple is 10 times, The following illustration shows what his nominee will get in case of Ankit’s unfortunate death, after paying just 2 premiums:

Note :For Deductible Partial Withdrawals applicable under Death Benefit for all plan options: Deductible partial withdrawals are partial withdrawals made in the 2 years prior to the date of death of the Life Assured.

For the purpose of illustration, we have assumed 8% p.a and 4% p.a as the higher and lower values of investment returns. These rates are not guaranteed, and they are not the upper or lower limits of returns of the Funds selected in your policy, as the performance of funds depends on several factors including future investment performance. These rates in no way signify our expectations of future returns and the actual returns may be higher or lower.

HOW TO GET THIS PLAN?

Wealth Creation- If your need is to save for a specific milestone, this option is for you. For e.g. this option is perfect if you are looking to buy a house, start your own business, pursue your education or achieve any other important life goal.

After the completion of your premium payment term, you can utilize the accumulated corpus to get monthly income using our systematic partial withdrawal feature.

Retire Smart- Say goodbye to your retirement worries with this option. Build a retirement corpus and get monthly income* any time after you have completed your premium payment term using our systematicpartial withdrawal feature.

*Enjoy tax benefit as per prevailing tax laws.

Dream Protect- Choose this option to secure the dreams of your loved ones even when you are not around. Build a corpus fund for your child’s higher education, or forthe financial security of your spouse/parents. The option will continue even in the case of your unfortunate demise,and your nominee(s) will get the following benefits:

- A lumpsum death benefit payout.

- No future premiums are required to be paid and the Company shall pay premiums on your behalf.

- Monthly income till the end of the policy term to help your family meet their regular expenses.

- Fund Value as Maturity Benefit at the end of the policy term

Now that you have chosen your option, you have a few more things to decide basis your financial goals:

- How much money do you want to invest?

- How long you want to keep investing for?

- How long do you want to remain invested for/stay protected under this plan?

- What is the frequency of premium payment?

After everything else has been decided, you need to choose your fund allocation strategy. This plan gives you two options.

- Self-invest rule: You decide your fund allocation strategy

- Auto-invest rule: Pre-defined automated fund allocation strategy

Then you may choose from the optional riders provided to get additional benefits to enhance coverage and tailor the policy to your specific needs at nominal cost. This plan gives you two options:

- Future Generali Linked Accidental Death Benefit Rider

- Future Generali Linked Accidental Total & Permanent Disability Rider

Finally, fill in the application form, pay your premiums and submit all the necessary documents.

Eligibility

- Wealth Creation

- Retire Smart

- Dream Protect

|

Min Entry Age 0 |

Max Entry Age 65 |

|

Min Maturity Age 18 |

Max Maturity Age 85 |

| Minimum Premium( in Rs) | ||

| Policy Term( in Years) | 5 to 9 | 10 & above |

|---|---|---|

| Single | 1,00,000 | 1,00,000 |

| Annual | 60,000 | 18,000 |

| Semi - Annual | 30,000 | 9,000 |

| Quarterly | 15,000 | 4500 |

| Monthly | 5,000 | 1,500 |

| Maximum Premium (in Rs.): No Limit (Subject to Board Approved Underwriting Policy) | ||

| Regular Pay | 0 to 55 years = 10 times * Annualized Premium, 56 to 65 years = 5 & 7 times * Annualized Premium |

| Limited Pay | 0 to 55 years = 10 times * Annualized Premium, 56 to 65 years = 5 & 7 times * Annualized Premium |

| Single Pay | 0 to 55 years = 1.25 times * Single Premium, 56 to 65 years = 1.10 times * Single Premium. |

|

5 to 20 years |

|

|

Premium Payment Term |

|

| Regular Pay | Equal To Policy Term |

| Limited Pay | 5 to 19 years |

| Single Pay | One Time Premium Payment |

|

Single Pay, Yearly, Half Yearly, Quarterly, Monthly |

|

Min Entry Age 18 |

Max Entry Age 65 |

|

Min Maturity Age 100 |

Max Maturity Age 100 |

| Minimum Premium( in Rs) | ||

| Policy Term( in Years) | 5 to 9 | 10 & above |

|---|---|---|

| Single | 1,00,000 | 1,00,000 |

| Annual | 60,000 | 18,000 |

| Semi - Annual | 30,000 | 9,000 |

| Monthly | 5,000 | 1,500 |

| Quarterly | 15,000 | 4500 |

| Maximum Premium (in Rs.): No Limit (Subject to Board Approved Underwriting Policy) | ||

| Regular Pay | NA |

| Limited Pay | 18 to 55 years = 10 times * Annualized Premium, 56 to 65 years = 5 & 7 times * Annualized Premium |

| Single Pay | NA |

|

100 – Age at entry |

|

|

Premium Payment Term |

|

| Regular Pay | NA |

| Limited Pay | 10 years to 30 years |

| Single Pay | NA |

|

Yearly, Half Yearly, Quarterly, Monthly |

|

Min Entry Age 18 |

Max Entry Age 45 |

|

Min Maturity Age 23 |

Max Maturity Age 65 |

| Minimum Premium( in Rs) | ||

| Policy Term( in Years) | 35 to 82 years | 10 & above |

|---|---|---|

| Single | 1,00,000 | 1,00,000 |

| Annual | 60,000 | 18,000 |

| Semi - Annual | 30,000 | 9,000 |

| Quarterly | 15,000 | 4500 |

| Monthly | 5,000 | 1,500 |

| Maximum Premium (in Rs.): No Limit (Subject to Board Approved Underwriting Policy) | ||

| Regular Pay | 18-45 years = 10 times * Annualized Premium |

| Limited Pay | NA |

| Single Pay | NA |

|

5 to 20 years |

|

|

Premium Payment Term |

|

| Regular Pay | Equal to Policy Term |

| Limited Pay | NA |

| Single Pay | NA |

|

Yearly, Half Yearly, Quarterly, Monthly |

Charges

Premium Allocation Charge: Nil

Policy Administration Charge: Nil

Discontinuance Charge

In case of discontinuance of the policy during the first 4 policy years, the following charges will apply.

- For Regular/Limited Pay Policy

Discontinuance during the policy year Discontinuance Charge (AP <= Rs 50, 000) Discontinuance Charge (AP >Rs 50, 000) 1 Lower of 20% x (AP or FV), subject to a maximum of Rs. 3,000 Lower of 6% x (AP or FV), subject to a maximum of Rs. 6,000 2 Lower of 15% x (AP or FV), subject to a maximum of Rs. 2,000 Lower of 4% x (AP or FV), subject to a maximum of Rs. 5,000 3 Lower of 10% x (AP or FV), subject to a maximum of Rs. 1,500 Lower of 3% x (AP or FV), subject to a maximum of Rs. 4,000 4 Lower of 5% x (AP or FV), subject to a maximum of Rs. 1,000 Lower of 2% x (AP or FV), subject to a maximum of Rs. 2,000 5 and onwards NIL Nil where,

AP = Annualised Premium under the policy

FV = Fund Value on the date of discontinuance

- For Single Pay Policy

For Single Pay Policy Discontinuance during the policy year Discontinuance Charge (SP<= Rs. 3,00,000) (SP> Rs. 3,00,000) 1 Lower of 2% x (SP or FV), subject to a maximum of Rs 3,000 Lower of 1% *(SP or FV) subject to a maximum of Rs. 6,000 2 Lower of 1.5% x (SP or FV), subject to a maximum of Rs 2,000 Lower of 0.70% *(SP or FV) subject to a maximum of Rs.5,000 3 Lower of 1% x (SP or FV), subject to a maximum of Rs 1,500 Lower of 0.50% *(SP or FV) subject to a maximum of Rs.4,000 4 Lower of 0.5% x (SP or FV), subject to a maximum of Rs 1,000 Lower of 0.35% *(SP or FV) subject to a maximum of Rs.2,000 5 and onwards NIL NIL where,

SP = Single Premium under the policy

FV = Fund Value on the date of discontinuance

Fund Management Charge

| Fund management charge (% p.a.) | |

|---|---|

| Future Income Fund (SFIN: ULIF002180708FUTUINCOME133) | 1.35% |

| Future Balance Fund (SFIN:ULIF003180708FUTBALANCE133) | 1.35% |

| Future Maximize Fund (SFIN:ULIF004180708FUMAXIMIZE133) | 1.35% |

| Future Apex fund (SFIN: ULIF010231209FUTUREAPEX133) | 1.35% |

| Future Opportunity Fund (SFIN: ULIF012090910FUTOPPORTU133) | 1.35% |

| Future Midcap Fund (SFIN:ULIF014010518FUTMIDCAP133) | 1.35% |

| Future Income Spark Fund (SFIN: ULIF022211124INCOMESPAR133) | 1.25% |

| Future Income Plus Fund (SFIN: ULIF023211124INCOMEPLUS133) | 1.35% |

| Future Multicap Equity Fund (SFIN: ULIF024211124MULTICAPEQ133) | 1.35% |

Fund Management Charges are deducted on a daily basis at 1/365th of the annual charge in determining the unit price.

Switching Charge: Nil

Partial Withdrawal Charge: Nil

Mortality Charge

- The mortality charges are determined using 1/12th of the annual mortality charge and are deducted from the unit account at the beginning of each monthly anniversary (including the policy commencement date) of a policy by cancellation of units.

- The mortality charges are levied on Sum at Risk under the policy.

- The Sum at Risk

For Option 1: Wealth Creation and Option 2: Retire Smart

Higher of (Sum assured less Deductible Partial Withdrawal or 105% of total premiums paid less Deductible Partial Withdrawal) less Fund Value under the policy.

For Option 3: Dream Protect

Higher of (Sum assured less Deductible Partial Withdrawal or 105% of total premiums paid less Deductible Partial Withdrawal) plus Discounted Value of future premium to be paid by the company and Discounted Value of Monthly Income Benefit payable, both at a discount rate of 6.85% p.a. compounded annually.

Miscellaneous charges: Nil

Revision of charges:

After obtaining appropriate approval, the Company reserves the right to revise the following charges:

- Policy administration charge up toa maximum of Rs. 500 per month.

- Miscellaneous charges up to Rs. 500 per transaction with respect to switches, partial withdrawals, Systematic Transfer Option, Systematic Partial Withdrawal, Premium Redirection, changes in Premium Payment Term or Policy Term.

However, premium allocation charge, discontinuance charge and mortality charges are guaranteed.

Little privileges just for you

Extra Allocation

Timely payment of all your due premiums within grace period ensures that an extra allocation is added to the fund along with your Instalment Premium.

Extra Allocation amount = Extra Allocation Rate applicable for the policy year X Instalment Premium paid in that year within the grace period.

- For Regular/ Limited Pay Policy

Extra Allocation Rate applicable on Each installment Premium Policy Year Annualised Premium less Than Rs. 60,000 Annualised Premium Rs. 60,000 and above 1 to 5 NIL 1.0% 6 to 8 NIL 3.0% 9 to 10 NIL 4.0% 11 to 15 NIL 5.0% 16 to 30 NIL 7.0% Note: The extra allocation applicable to the respective Instalment Premium shall be added only when due premiums are paid within the Grace Period and the policy is in force.

- For Single Pay Policy

Policy Year Extra Allocation Rate applicable on Single Premium 1 1% 2 to 20 NIL

Switching

At any time, the policyholder may instruct us in writing to switch some or all the units from one unit linked fund to another, except switches to and from the Discontinuance Fund. The company will give effect to this switch by cancelling units in the old fund(s) and allocating units to the new fund(s) at the applicable unit price. The amount to be switched should be at least Rs. 5,000. The switch request shall be processed as per the IRDAI guidelines.

- Unlimited free switches are allowed in the plan.

- Fund Switching will not be allowed when Auto Invest Rule is active.

- For Option 3. Dream Protect, fund switching shall not be allowed after the death of the Life Assured.

Premium Redirection

At any time after completion of one year, the policyholder may instruct us in writing,before the next premium due date,to redirect all future premiums in an alternative proportion to the various unit funds available. Redirection will not affect the premiums paid prior to the request. A maximum of two premium redirections are allowed in a policy year.

- For Option 3. Dream Protect, premium redirection shall not be allowed after death of the Life Assured.

- Premium Redirection is not applicable under a single pay policy.

- No charge shall be deducted for premium re-direction.

Partial Withdrawal

At any time after the completion of the lock-in period of 5 years from the policy commencement date, the policyholder may instruct us in writing to withdraw fund value partially from the policy. Unlimited free partial withdrawals that can be done in this plan. The minimum fund value after the partial withdrawal shall be at least 105% of the Total Premiums Paid (including top-up premiums paid, if any) during the premium payment term and one annualized premium after the premium payment term for Regular and Limited pay policies and at least Rs. 10,000 for Single pay policies.

- The amount that can be withdrawn should be minimum Rs. 5,000.

- The amount that can be withdrawn should be in multiple of thousands (‘000).

- Partial withdrawals, which would result in the termination of a contract, are not allowed.

- Partial withdrawal will not be allowed if the age of the insured at the time of partial withdrawal is less than 18 years.

- For Option 3: Dream Protect, partial withdrawal will not be allowed after the death of the Life Assured.

Systematic Transfer Option(STO)

Systematic Transfer Option (STO) is a feature which allows auto switching of units from one segregated fund to another segregated fund. You have the option to weekly transfer the Fund Value available under one specific Fund to another fund by making a written request to the Company. Once this feature is used, the Fund Value available under one specific fund will be transferred to another fund on a weekly basis for 48 weeks. The policyholder can submit STO request anytime during the policy term. The policyholder cannot make another STO request until the current STO instruction has been completed or has been cancelled.

The fund from which the units will be transferred is called the ‘Selected Fund’ and the fund to which the units will be deposited is called the ‘Target Fund’. At any point in time, a STO request is only applicable between anyone Selected Fund and anyone Target Fund. The remaining 7 funds will not be affected or participate in the STO.

Once a STO request is placed, units from the Selected Fund will be transferred to the Target Fund through 48 automatic switches on the 7th, 14th, 21st and 28th of each calendar month for a 12-month period. Under every automated switch in a given STO, 1/Xth of units from the Selected Fund will be transferred to theTarget Fund, Where X = no of automatic switches which are left to be done in the given STO request i.e. X will be 48 for the first automated switch, it will be 47 for the second automated switch and it will be 1 for the 48th automated switch.

Premiums by Policyholder can come in any of the 9 segregated funds. Future premium redirection can be done in any of the 9 segregated funds.

However, during the period in which STO is invoked, no switching can take place in any of the 9 segregated funds.

The policyholder has the option to stop the STO by providing a written request to the Company. Once the STO is stopped, the policyholder can switch units between segregated funds as needed.

A policyholder can make further STO requests after the completion of a previous STO request. STO will apply to both future premiums as well as existing premiums in the Selected Fund. The NAV applicable for STO will be the NAV of the Selected Fund and target fund on the day when the STO takes effect.

STO will not be activated when Auto Invest Rule is active

For Option 3: Dream Protect, STO request will not be allowed after the death of the Life Assured.

STO will stop if:

- The fund value of the Selected Fund becomes zero; or

- The policyholder has submitted a request to stop the STO.

There are no charges for STO.

Systematic Partial Withdrawal

This feature allows the policyholder to withdraw a monthly amount from the policy during the policy term. This feature is only available under Option 1: Wealth Creation and Option 2: Retire Smart. At any time during the policy term after the end of the lock-in period, the policyholder may request us to make systematic partial withdrawals from the fund under the policy. The policyholder shall be required to specify the withdrawal start date, amount of withdrawal and the number of withdrawals to be done in the request. The monthly amount withdrawn from the fund shall be paid at the end of each calendar month following the withdrawal start date.

The conditions for systematic partial withdrawal are:

- The withdrawal start date must be after the completion of the premium payment term.

- The withdrawal start date cannot be before the Life Assured has attained 18 years of age.

- The number of withdrawals should be such that all withdrawals occur prior to the maturity date.

- The monthly withdrawal amount should be atleast Rs. 5,000 and should be in multiples of ‘000.

- Only one request of systematic partial withdrawal shall be taken at one point in time.

Systematic Partial Withdrawal will stop if any of the following is triggered:

- The policyholder submits a request to stop systematic partial withdrawal

- Systematic Partial Withdrawal leads to the fund value after the withdrawal falling below one annualized premium for regular or limited pay policies and Rs. 10,000 for single pay policies on date of withdrawal.

- Termination of policy due to death, maturity, surrender or discontinuance.

No charges shall be deducted for Systematic Partial Withdrawal.

Fund Allocation Strategy

The plan offers two fund allocation strategies which can be chosen at the start of the policy or at any time during the policy term. The policyholder can request to change the fund allocation strategy anytime during the policy term.

- Self-Invest Rule: Under this option, the policyholder can select the apportionment of his/her premiums into the funds as per his/her choice among the nine available funds.

- Auto Invest Rule: Under this option,

- The premium shall be invested in only two segregated funds. Out of these two, the Future Income Fund (SFIN: ULIF002180708FUTUINCOME133) is a mandatory fund for investment. For the second fund the policyholder can choose between the Future Apex Fund (SFIN: ULIF010231209FUTUREAPEX133) and the Future Midcap Fund (SFIN: ULIF014010518FUTMIDCAP133). Fund Switching, Premium Redirection and Systematic Transfer Option (STO) shall not be allowed when Auto Invest Rule is active.

- Further, the policyholder must choose between the two Auto Invest rules based on whether he/she wants his/her investments to be based on the age of the policyholder or he/she wants his/her investments to be based on the outstanding years to maturity of the policy. These are called:

- Age-linked Auto Invest rule

- Milestone-Linked Auto Invest rule

- In both these Auto Invest rules, all future premiums will be allocated to the Future Income Fund and the Second Fund (as per the choice of the policyholder) in the proportion as defined below.

- Further in these auto-invest rules, at the end of each Policy Anniversary, the company shall automatically rebalance the Fund Value of the policy into the segregated funds and proportions as per below.

-

- Age-Linked Auto invest rule: The future premiums will be invested in the Future Income Fund and the Second Fund (as per the choice of the policyholder) based on the ‘current age of the policyholder’

Funds Fund Allocation and Premium Allocation Percentage Future Apex Fund or Future Midcap Fund as chosen by the policyholder [100- Current Age of the Policyholder (Age as on his/her last birthday)] % Future Income Fund [Current Age of the Policyholder (Age as on his/her last birthday)] % - Milestone-Linked Auto invest rule: The future premiums will be invested in the Future Income Fund and the Second Fund (as per the choice of the policyholder) based on the ‘outstanding years to maturity of the policy’

Outstanding years to maturity of the policy (as on last policy anniversary) Fund Allocation and Premium Allocation Percentage to Future Apex Fund or Future Midcap Fund as chosen by the policyholder Fund Allocation and Premium Allocation Percentage to Future Income Fund 16 and more 100% 0% 11 to 15 80% 20% 9 to 10 60% 40% 6 to 8 40% 60% 1 to 5 20% 80%

- Age-Linked Auto invest rule: The future premiums will be invested in the Future Income Fund and the Second Fund (as per the choice of the policyholder) based on the ‘current age of the policyholder’

Free Look

You may return this Policy within 30 days of receipt of the Policy Document (whether received electronically or otherwise), if You disagree with any of the terms and conditions by giving Us a request for cancellation of this Policy which states the reasons for Your objections.

On cancellation of the Policy after such request , You shall receive the Fund Value as on the date of cancellation of the Policy plus non-allocated Premium, if any plus charges levied by cancellation of Units minus (Stamp duty + medical expenses, if any, + proportionate risk premium for the period on cover) minus Extra Allocation added to the Policy.

If the Policy is opted through Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:

- For existing e-Insurance Account: Computation of the said Free Look Period will commence from the date of delivery of the email confirming the credit of the Insurance Policy by the IR.

- For New e-Insurance Account: If an application for e-Insurance Account is accompanied by the proposal for insurance, the date of receipt of the ‘welcome kit’ from the IR with the credentials to log on to the eInsurance Account(eIA) or the delivery date of the email confirming the grant of access to the eIA or the delivery date of the email confirming the credit of the Insurance Policy by the IR to the eIA, whichever is later shall be reckoned for the purpose of computation of the Free Look Period.

Grace Period

Grace period means the time granted by the insurer from the due date of payment of premium, without any penalty or late fee, during which time the policy is considered to be in-force with the risk cover without any interruption, as per the terms & conditions of the policy. The grace period for payment of the premium for all types of life insurance policies shall be fifteen days, where the policyholder pays the premium on a monthly basis and 30 days in all other cases.Grace Period is not applicable under the single pay policy.

Change in Premium Payment Mode:

- Under the Regular/Limited pay options, premium payment mode can be changed among Yearly/Half-Yearly/Quarterly/Monthly modes.

- The alteration of premium mode will be allowed subject to minimum instalment premium.

- Any change in premium payment mode should not lead to any change in Annualized Premium under the policy.

- The change shall be applicable from the next Policy Anniversary.

- No charges shall be deducted for the same.

- Change in premium payment mode shall be in accordance with their Board approved underwriting policy.

Change in Premium Payment Term and Policy Term:

- Under Option 1: Wealth Creation and Option 2: Retire Smart, the Premium Payment Term and Policy Term can be increased anytime during the Policy Term subject to eligibility conditions of respective options.

- The change in Premium Payment Term shall not be allowed after the completion of the Premium Payment Term.

- This option will be available only to policies which are in in-force status.

- This option will not be available to the nominee after the death of the Life Assured in the Option 3: Dream Protect Option.

- No charge will be deducted for change in premium payment term and policy term.

- Change in premium payment mode shall be in accordance with their Board approved underwriting policy.

Decrease in Premium:

- Anytime after payment of premium for first five completed policy years, the policyholder has an option to decrease the premium up to 50% of the original Annualized Premium.

- The decrease in premium is subject to the following conditions. Decrease in premium:

- Shall be restricted up to 50% of the original Annualized Premium as paid during the inception of the policy

- Is subject to minimum premium conditions as defined under the plan

- Shall not be allowed when the policy is in discontinuance status i.e. decrease in premium is allowed only when all due premiums have been paid

- Shall be applicable only on policy anniversary

- Once reduced, the premiums cannot be subsequently increased.

- The decrease in premium will lead to reduction in Sum Assured as defined under the plan. The revised Sum Assured applicable shall be based on reduced premium.

- Extra allocation rate shall be accordingly based on revised reduced premium.

Riders

- Future Generali Linked Accidental Death Benefit Rider (UIN: 133A053V01):

This rider provides 100% of Rider Sum Assured as an additional coverage in case of death due to accident of Life Assured during the rider term and such unforeseen event shall occur within a period of 180 days of the accident. - Future Generali Linked Accidental Total & Permanent Disability Rider (UIN: 133A055V01) :

This rider provides 100% of Rider Sum Assured as an additional protection in case of total or permanent disability due to accident of Life Assured, to such an extent that the Life Assured cannot perform 3 out of 6 daily life activities without continuous assistance from another person during the rider term. The Life Assured has to deemed disable by a suitable medical practitioner (appointed by the company) and the disability should persist continuously for a period of 180 days.

For further information on these riders including risk factors, exclusions, terms and conditions etc., please refer the rider/s brochures available on the website at www.futuregenerali.in or contact us at Email – care@futuregenerali.in , Customer Care Number – 1800-102-2355.

Loan

No loan is allowed under this product.

Tax benefits

- Tax benefits under section 80C of the Income Tax Act, 1961, may be available to an individual for the premiums paid subject to the conditions/limits specified therein.

- Benefits received under a life insurance policy may be exempted under section 10 (10D) of the Income Tax Act, 1961, subject to the conditions specified therein. Where the amount paid to the policyholder is not exempt under the provisions of section 10(10D), the said amount will be subject to tax deduction at source in accordance with provisions of section 194DA of the Act.

- For further details, please consult your tax advisor. Tax benefits are subject to change from time to time.

Exclusions

Suicide

In case of death of Life Assured due to suicide within 12 months from the date of commencement of the policy or from the date of revival of the policy, as applicable, the nominee or the beneficiary of the policyholder shall be entitled to the fund value, as available on the date of intimation of death.

Further, any charges other than Fund Management Charges (FMC) and Guarantee Charges recovered subsequent to the date of death shall be added back to the fund value as on the date of intimation of death.

Grievance Redressal Processes

- (a) Calling the Customer helpline number 1800-102-2355 for assistance and guidance

- (b) Emailing at care@futuregenerali.in

- (c) You may also visit us at the nearest Branch Office. Branch locator - https://life.futuregenerali.in/branch-locator/

- (d) Senior citizens may write to us at the following ID: senior.citizens@futuregenerali.in for priority assistance

- (e) You may write to us at:

Customer Services Department

Future Generali India Insurance Co. Ltd,

Unit 801 and 802, 8th floor, Tower C,

Embassy 247 Park, L.B.S Marg, Vikhroli (W)

Mumbai – 400083

We will provide a resolution at the earliest. For further details please access the link: https://life.futuregenerali.in/customer-service/grievance-redressal-procedure

Target Group

For customers looking for a tax saving systematic investment solution which helps to get market linked returns along with benefits of insurance

DISCLAIMERS

Future Generali Big Dream Plan (UIN: 133L081V03)

- Unit Linked Insurance plans are different from traditional insurance plans and are subject to risk factors.

- The Premium paid in Unit Linked Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of the fund and factors influencing the capital market. The policyholder/insured is solely responsible for his/her decisions.

- Future Generali India Life Insurance Company Limited is only the name of the Insurance Company and Future Generali Big Dreams Plan is only the name of the Unit Linked Life Insurance contract and does not in any way indicate the quality of the contract, its prospects or returns

- Please know the associated risks and the applicable charges from your insurance agent or the intermediary or policy document of the Company.

- The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their prospects and returns. Past performance is not indicative of future performance, which may be different. The investments in the Units are subject to market and other risks and there can be no assurance that the objectivities of any of the funds will be achieved. The funds do not offer guaranteed or assured return.

- Tax benefits are subject to change in law from time to time. You are advised to consult your tax consultant.

- The linked insurance plans do not offer any liquidity during the first five years of the contract. The policyholder will not be able to surrender/withdraw the monies invested in linked insurance plans completely or partially till the end of the fifth year.

- Please refer product brochure for details of the various funds offered along with the details and objective of the fund, the definition of all applicable charges and maximum limit to increase the charges.

This Product is not available for online sale.Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@futuregenerali.in For further details please access the link: https://life.futuregenerali.in/customer-service/grievance-redressal-procedure.

Faq's

Future Generali Big Dreams Plan is an Individual, Non-Participating (without profits), Unit Linked, Life insurance plan.

- Choose the option as per your requirement:-

- Option 1: Wealth Creation :- Provides normal Death Benefit which is higher of Sum Assured and Fund Value in case of death

- Option 2: Retire Smart :- Provides Whole-life cover

- Option 3: Dream Protect :- Provides Death Benefit and Regular Income. In case of death of Life Assured, all future premiums are funded by the company.

- Pay the premium till the end of premium payment term

- Receive benefits as per the options chosen

No, the Plan option needs to be chosen at the outset of the Policy.

Once chosen, the Policyholder shall not be allowed to change the option during the policy term

Individuals, Residents and Non Resident Indians, PIO & Foreigners (subject to Underwriting) can be covered under Future Generali Big Dreams Plan

View All

Why Future Generali India Life Insurance

1369

Self & Partner Branches

96.08%

Individual claims settlement ratio for FY 2023-2024

1.4 Million

Lives covered since inception

Rs. 87.84 Billion

Worth of Asset Under Management

Data as on 31st March 2025

Media Coverage

- Deepening digital engagement, investing in purpose-led branding our priorities in 2025AdGully - May, 2025

- Future Generali India Life CFO says company at an inflection point, targets 3x growth in next two three yearsET CFO - May, 2025

- Plan Your Long-Term Goals with Financial Literacy and Avoid the Loan TrapYourStory Hindi - May, 2025

- Which Life Insurance policy Should You Buy?Outlook Money - May, 2025

- FGILI expands insurance footprint in Sikkim with grassroots push, eyes 'Insurance for All' BY 2047'Sikkim Herald - May, 2025

- Empathy isn’t a buzzword but bedrock of company cultureHR Katha - April, 2025

- How Future Generali India Life Insurance is leveraging AI to usher in a future ready insurance ecosystemAdGully - April, 2025

- Measuring and Enhancing Productivity in Financial InstitutionsPeople Matters - April, 2025

- Life Insurance for All: Securing India’s Social and Economic FutureET BFSI - April, 2025

- MWPA: Ensure That Your Life Insurance Payout Reaches The Intended RecipientsOutlook Money - April, 2025

Reach us

Customer care number

1800 102 2355