- Home

- Insurance Plans

- Term Insurance Plans

- Saral Jeevan Bima

Future Generali Saral Jeevan Bima

Individual, Non-Linked, Non-Participating (without Profits), Pure Risk Premium, Life Insurance Plan

This Policy will cover death due to accident only, during the waiting period of 45 days from the Date of Commencement of Risk.

In case of death of the Life Assured other than due to accident during the waiting period, an amount equal to 100% of all premiums received excluding taxes, if any, shall be paid and the Sum Assured shall not be paid.

Preparing for the unexpected is an important step that you should take to secure your family’s future. Getting the right life insurance coverage helps to ensure that your family is able to maintain the things that are important to all of you-no matter what happens.

Future Generali Saral Jeevan Bima is designed to give you a safety net so that you can be sure of protecting your loved ones from future financial struggles. You also make their lives easier, with lesser worries, even when you are no longer around.

Now enjoy peace of mind and security with our term plan as it helps you to protect you and your loved ones for a better brighter future.

Three reasons why you should buy this plan:

- Simple protection plan

- Secure your family’s financial future

- Flexibility to choose your policy term and premium payment terms

HERE IS WHAT YOU GET IN THE PLAN:

- 1. Select your own Policy Term and Premium Payment Term

The plan gives you the flexibility to choose the period of protection and the period of premium payment (policy term of 5 to 40 years and premium payment term of 5 | 10 years | Regular Pay (equal to policy term) | Single Pay). - 2. Receive benefits as lump sum

The nominee / assignee shall receive death benefit in lump sum upon death of Life Assured during the policy term to mitigate financial losses. - 3. Lower premium rates for women

- 4. Tax benefits

You may be eligible for availing tax benefits according to the provisions of Income Tax Laws. These benefits are subject to change as per the prevailing tax laws.

EASY STEPS TO KEEP YOURSELF COVERED

Step 1 Choose the amount of insurance cover (Sum Assured) you want under this policy.

Step 2 Choose the duration of cover (Policy Term) and Premium Payment Term as per your convenience.

Step 3 Get your premium calculated and fill the proposal form (application form). Our advisor will help you with a customised quote.

Step 4 Pay your premiums as committed and stay financially protected.

Note:

-

The above mentioned benefits are subject to policy being in-force.

-

The minimum and maximum criteria of Sum Assured , Policy Term and Premium Payment Term are mentioned under the eligibility conditions below (Life Insurance Plan Summed Up).

LIFE INSURANCE PLAN SUMMED UP

| Parameter | Criterion | ||||||||

| Entry Age (as on last Birthday) |

18 years to 65 years | ||||||||

| Maturity Age (as on last Birthday) |

23 years to 70 years | ||||||||

| Policy Term and Premium Payment Term |

Premium Payment Term cannot be more than the Policy Term |

||||||||

| Sum Assured (SA) | Minimum - Rs. 5 Lacs Maximum – Rs. 25 Lacs (SA would be allowed only in multiples of ₹ 50,000) |

||||||||

| Premium Payment Frequency | Yearly, Half Yearly and Monthly (Only under ECS/NACH) | ||||||||

| Premium amount | Minimum Premium as per Premium Paying Frequency:

Maximum Premium- As per the maximum Sum Assured |

Note: Premiums mentioned above are excluding applicable taxes and extra underwriting premium, if any.

Sample Annual premium for healthy non-smoker male lives (excluding applicable taxes, extra underwriting premium and modal loading, if any).

| Premium Payment Type | Regular Pay | Limited Pay | Limited Pay | Single Pay |

| Premium Payment Term | 25 years | 5 years | 10 years | Single Premium |

| Policy Term | 25 years | |||

| Age at entry | Base Sum Assured = Rs. 20 lacs | |||

| 30 | 6,660 | 24,900 | 13,420 | 85,840 |

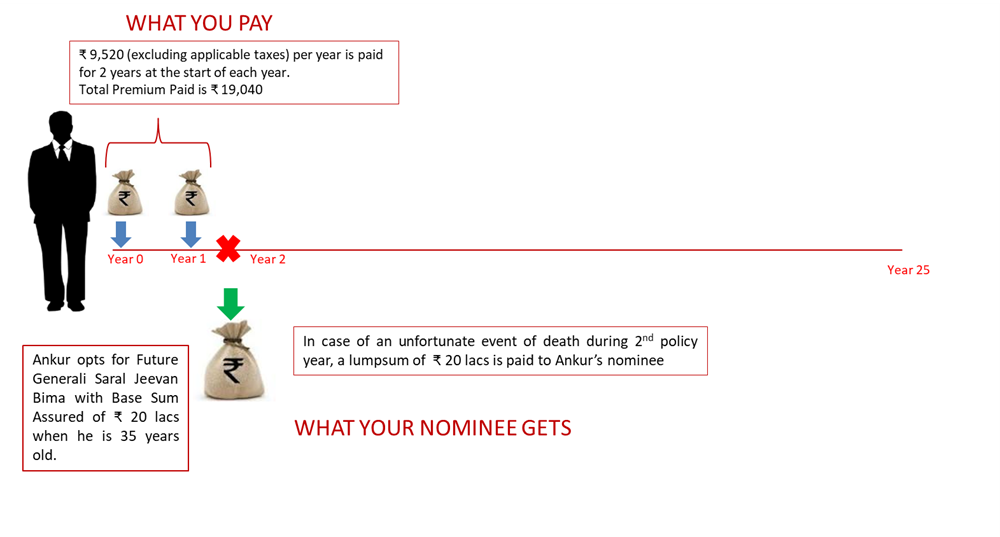

| 35 | 9,520 | 36,240 | 19,240 | 1,26,040 |

| 40 | 14,140 | 53,400 | 28,220 | 1,86,220 |

| 45 | 21,300 | 78,040 | 41,520 | 2,71,720 |

What are your benefits?

- This is a pure term plan.

- The death benefit as defined below shall be paid in lump sum to the nominee / assignee in case of Death of the Life Assured during the policy term.

- The policy shall terminate on the death of the Life Assured.

a) Death Benefit:

- On death of the Life Assured during the Waiting Period and provided the Policy is in force, the Death Benefit amount payable as a lump sum is:

- In case of Accidental Death, for regular premium or limited premium payment policy, equal to Sum Assured on Death which is the highest of:

- 10 times the Annualized Premium, or

- 105% of all premiums paid as on the date of death, or

- Absolute amount assured to be paid on death.

- In case of Accidental Death, for single premium policy, equal to Sum Assured on Death which is the higher of:

- 125% of Single Premium (excluding any extra premium, any rider premium and applicable taxes), or

- Absolute amount assured to be paid on death.

- In case of death due to other than accident, the Death Benefit is equal to 100% of all Premiums paid excluding taxes, if any.

Premiums referred above shall not include any extra amount chargeable under the policy due to underwriting decision, if any

- In case of Accidental Death, for regular premium or limited premium payment policy, equal to Sum Assured on Death which is the highest of:

- On death of the Life Assured after the expiry of Waiting Period but before the stipulated date of maturity and provided the Policy is in force, the Death Benefit amount payable as a lump sum is:

- For Regular premium or Limited premium payment policy, “Sum Assured on Death” which is the highest of:

- 10 times of Annualized Premium; or

- 105% of all the premiums paid as on the date of death; or

- Absolute amount assured to be paid on death.

- For Single premium policy, “Sum Assured on Death” which is the higher of:

- 125% of Singe Premium (excluding any extra premium, any rider premium and applicable taxes), or

- Absolute amount assured to be paid on death.

Premiums referred above shall not include any extra amount chargeable under the policy due to underwriting decision, if any

- For Regular premium or Limited premium payment policy, “Sum Assured on Death” which is the highest of:

Absolute amount assured to be paid on death shall be an amount equal to Basic Sum Assured.

Where,

“Annualized Premium” shall be the premium amount payable in a year chosen by the policyholder, excluding the taxes, rider premiums, underwriting extra premiums and loadings for modal premiums, if any

And

"Total Premiums Paid" means total of all the premiums received, excluding any extra premium, any rider premium and taxes

Note:- In case of death of Life Assured under an in-force policy wherein all the premiums due till the date of death have been paid and where the mode of payment of premium is other than yearly, balance premium(s), if any, falling due from the date of death and before the next policy anniversary shall be deducted from the claim amount.

Let us understand this benefit with the help of example:

Ankur is a 35 year old healthy non-smoker male. He buys the Future Generali Saral Jeevan Bima with Base Sum Assured of Rs. 20 lacs for a policy term of 25 years and chooses to pay annual premium regularly for 25 years.

b) Maturity Benefit:

There are no maturity benefits under this plan.

LITTLE PRIVILEGES JUST FOR YOU

Free Look Period

The Policyholder has a free look period of 30 days from the date of receipt of the policy document, (whether received electronically or otherwise) to review the terms and conditions of the policy and where the policyholder disagrees to any of those terms and conditions of the policy, or otherwise and has not made any claim,, the policy holder has the option to return the policy to the Company for cancellation, stating the reasons for the objection, then the policyholder shall be entitled to a refund of the premium paid subject only to the deduction of a proportionate risk premium for the period of cover and expenses incurred by the Company on medical examination of the proposer and stamp duty charges.

If the policy is opted through Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:-

- For existing e-Insurance Account: Computation of the said Free Look Period shall commence from the date of delivery of the e-mail confirming the credit of the Insurance policy by the IR.

- For New e-Insurance Account: If an application for e-Insurance Account accompanies the proposal for insurance, the date of receipt of the 'welcome kit' from the IR with the credentials to log on to the eInsurance Account (eIA) or the delivery date of the email confirming the grant of access to the eIA or the delivery date of the email confirming the credit of the Insurance policy by the IR to the eIA, whichever is later shall be reckoned for the purpose of computation of the Free Look Period.

Grace period

You get a grace period of 30 days where the mode of payment of Premium is yearly or half yearly and 15 days in case of monthly, is allowed for the payment of each renewal Premium. If the premium is not paid before the expiry of the days of grace, the Policy lapses.

If the death of the Life Assured occurs within the grace period but before the payment of the premium then due, the policy will still be valid and the benefits shall be paid after deductions of the said unpaid premium as also the balance premium(s), if any, falling due from the date of death and before the next policy anniversary.

Flexibility to make changes

- Premium payment mode can be changed among Annual/ Half-yearly /Monthly modes.

- The premiums for various modes as percentage of annual premium are given below:

- Half-yearly Premium - 52% of annual premium

- Monthly Premium - 8.83% of annual premium

Riders

There are no riders available in this policy.

Loan

There are no loans available under this policy.

TERMS AND CONDITIONS

Premium Rate Guarantee

Premium rates are guaranteed for the entire policy term.

Exclusions

Suicide Exclusion

- Under Regular/Limited Premium Policy

This Policy shall be void if the Life Assured commits suicide at any time within 12 months from the Date of Commencement of Risk, provided the policy is inforce or within 12 months from the date of revival and the Company will not entertain any claim except for 80% of the premiums paid (excluding any extra amount if charged under the Policy due to underwriting decisions, taxes and rider premiums, if any) till the date of death.

This clause shall not be applicable for a lapsed Policy as nothing is payable under such policies.

- Under Single Premium Policy

This Policy shall be void if the Life Assured commits suicide at any time within 12 months from the Date of Commencement of Risk and the Company will not entertain any claim except for 90% of the Single Premium paid (excluding any extra amount if charged under the policy due to underwriting decisions, taxes and rider premiums, if any.

Waiting Period

There is a 45 days Waiting Period from the date of commencement of risk. During the waiting period, the policy will cover death due to accident only. In case of death of life assured other than due to accident during the waiting period, an amount equal to 100% of all premiums received excluding applicable taxes, if any, shall be paid and the Death Sum Assured shall not be paid.

In case of Revival of policy, the Waiting Period shall not be applicable.

Non Payment of due premiums (applicable in case of Regular Premium or Limited Premium policies)

- If any due premium(s) have not been paid within the grace period, the policy shall lapse. All risk cover ceases while the policy is in the lapsed status and all benefits cease to exist.

- The policyholder has the option to revive the policy within 5 years from the due date of the first unpaid premium subject to policy term not over.

- If the policy is not revived during the revival period, the policy stands terminated. In case of Regular Premium policies, nothing shall be payable. However, in case of Limited Premium Payment policies, if premium payment is discontinued after payment of at least first two years premiums, the amount as payable in case of policy cancellation shall be paid and the policy shall terminate. In case of Limited Premium Payment policies, if premium payment is discontinued before payment of at least first two years premiums, nothing shall be payable and the policy shall terminate.

Revival

- Revival Period means the period of five consecutive years from the due date of first unpaid premium during which period the policyholder is entitled to revive the policy which was discontinued due to the non-payment of premium.

- If the Policy has lapsed due to non-payment of due premium within the days of grace, it may be revived during the lifetime of the Life Assured, but within the Revival Period and before the Date of Maturity, as the case may be, on payment of all the arrears of premium(s) together and the revival interest rate shall be determined by the company from time to time based on current market interest rate on 10-year Government securities (G-Sec) as on 31st March every year + 2% rounded to nearest 1%. The interest rate applicable for the financial year will be declared at start of the financial year. The simple interest rate charged is 9% p.a. for FY 2024-25. 10-year G-Sec rates are as declared by FIMMDA (Fixed Income Money Market and Derivatives Association of India). However, the company may decide to increase the interest charged on revival from time to time with prior approval from IRDAI. The company may offer revival campaigns wherein full interest or capped to a certain amount/percentage can be waived. This shall be applicable to all policies eligible for revival during the revival campaign period. Any change in the basis of determination of interest rate shall be done only after prior approval of the Authority.

- In addition to the arrears of premium with interest, proof of continued insurability may be required for revival of the discontinued policy. The Company, however, reserves the right to accept at original terms, accept with modified terms or decline the revival of a discontinued policy. The revival of the discontinued policy shall take effect only after the same is approved by the Company and is specifically communicated to the Policyholder.

- If a lapsed policy is not revived within the revival period but before the Date of Maturity, the policy will automatically terminate. In case of Regular Premium policies, nothing shall be payable. However, in case of Limited Premium Payment policies, the amount as payable in case of policy cancellation shall be refunded and the policy will terminate.

- The revival will be effected as per Board approved underwriting policy.

- The company may decide to increase the interest charged on revival from time to time with prior approval from IRDAI.

Paid Up

There is no Paid Up benefit available under this product.

Surrender Value

There is no surrender value available under this product. However, the policy cancellation value is applicable as per the provisions given below.

Policy Cancellation Value

Policy Cancellation Value shall be payable:

- upon the Policyholder applying for the same before the stipulated date of maturity in case of Single premium Policy; or

- upon the Policyholder applying for the same before the stipulated date of maturity or at the end of revival period if the Policy is not revived, in case of Limited Premium Payment Policies.

-

The amount payable shall be as follows:

- Single Premium Policies:

The Policy Cancellation Value acquires immediately after receipt of Single Premium and is calculated as follows:

= 70% x Single Premium x (Unexpired Term / Original Policy Term) Single Premium shall be inclusive of extra premium but excludes taxes, if any. Where unexpired policy term is computed rounded down in months and original policy term is computed in months. - Limited Premium Payment Term: 5 years or 10 years:

The Policy Cancellation Value is required if at least two (2) consecutive full years’ premiums are paid and is calculated as follows:

= 70% x Total Premiums Paid x (Unexpired Term / Original Policy Term) Total Premiums Paid shall be inclusive of extra premium but excludes taxes, if any. Where unexpired policy term is computed rounded down in months and original policy term is computed in months and Unexpired policy term is calculated from the date on which policy status was last in force.

- Single Premium Policies:

- No policy cancellation value shall be payable in respect of regular premium policies.

Nomination and Assignment

Nomination shall be in accordance with Section 39 of Insurance Act, 1938 as amended from time to time.

Assignment shall be in accordance with Section 38 of Insurance Act, 1938 as amended from time to time.

Prohibition on rebates

Section 41 of the Insurance Act 1938 as amended from time to time states

- No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer.

- Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakh rupees.

Grievance Redressal Processes

In case you have any grievances on the solicitation process or on the Product sold or any of the Policy servicing matters, you may approach the Company in one of the following ways:

- Calling the Customer helpline number 1800-102-2355 for assistance and guidance

- Emailing @ care@futuregenerali.in

- You may also visit us at the nearest Branch Office. Branch locator - https://life.futuregenerali.in/branch-locator/

- Senior citizens may write to us at the following id: senior.citizens@futuregenerali.in for priority assistance

-

You may write to us at: Customer Services Department Future Generali India Insurance Co. Ltd,

Unit 801 and 802, 8th floor, Tower C,

Embassy 247 Park, L.B.S Marg, Vikhroli ( W ) ,

Mumbai - 400083

We will provide a resolution at the earliest. For further details please access the link: https://life.futuregenerali.in/customer-service/grievance-redressal-procedure

Fraud and Misstatement

Section 45 of the Insurance Act 1938 as amended from time to time states

- No Policy of Life Insurance shall be called in question on any ground whatsoever after the expiry of 3 years from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later.

- A policy of Life Insurance may be called in question at any time within 3 years from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later, on the ground of fraud.

For further information, Section 45 of the Insurance laws (Amendment) Act, 2015 may be referred.

Why choose us?

Future Generali India Life Insurance Company Limited offers an extensive range of life insurance products, and a distribution network which ensures that we are close to you wherever you go.

At the heart of our ambition is the promise to be a lifetime partner to our customers. And with the help of technology we are making the shift from not only offering protection to our customers but also providing personalized services to them.

It starts with our extensive agent base who is at the core of this transformation. Through our distribution network we ensure that there is always a caring touch while servicing the individual needs of our customers. With this philosophy, we aim to make simplicity, innovation, empathy and care synonymous with our brand - Future Generali India Life Insurance Company Limited.

Disclaimer

This Product is not available for online sale.

Life Coverage is included in this Product.

For detailed information on this product including risk factors, terms and conditions etc., please refer to the policy document and consult your advisor or visit our website (life.futuregenerali.in) before concluding a sale. We advise you to visit our website/speak to one of our advisors to know about range of products offered by us. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. You are advised to consult your tax consultant. Future Group’s and Generali Group’s liability is restricted to the extent of their shareholding in Future Generali India Life Insurance Company Limited

Future Generali India Life Insurance Co. Ltd. (IRDAI Regn. No. 133) CIN:U66010MH2006PLC165288 Regd. and Corporate Office address: Future Generali India Life Insurance Co. Ltd, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S. Marg, Vikhroli (W), Mumbai – 400083.

Email - care@futuregenerali.in

Call us at - 1800-102-2355 800 102 23

Website: life.futuregenerali.in

UIN: 133N087V01

Why Future Generali India Life Insurance

1369

Self & Partner Branches

96.08%

Individual claims settlement ratio for FY 2023-2024

14 Lakh

Total no. of unique lives covered since inception

₹ 8,784 Crores

Worth of Asset Under Management

Data as on 31st March 2024

Media Coverage

- Future Generali India Life offers cover for heart, cancer ailments with return of premium Times of India - Feb 9, 2018

- Heart and Health Insurance Plan: New Future Generali India plan covers 59 critical illnessesIndia Financial Express - Feb 8, 2018

- FGILI launches new heart & health insurance plan Web India 123 - Feb 8, 2018

- Heart and Health Insurance Plan: New Future Generali India plan covers 59 critical illnessesCNBC - Feb 8, 2018

- Future Generali India Life Insurance bolsters its health solutions, launches new Heart & Health Insurance PlanWeb Newswire - Feb 8, 2018

- FGILI launches new heart & health insurance planUNI India - Feb 8, 2018

Reach us

Customer care number

1800 102 2355

Email us at

care@futuregenerali.in