- Home

- Insurance Plans

- Health Insurance Plans

- heart and health insurance plan

FUTURE GENERALI HEART & HEALTH INSURANCE PLAN

Life is about enjoying all big and small moments with those who matter to you. And, these moments are best enjoyed when you are healthy and worry free. The modern lifestyle however, exposes us to many risks arising on account of lack of exercises, irregular eating schedule, sedentary work habits and erratic sleep patterns etc. Therefore, while prevention is the best solution, preparedness is equally important.

Presenting the Future Generali Heart and Health Insurance Plan, a comprehensive health protection plan, that safeguards you and your family against financial risks arising out of any defined unforeseen medical emergency. The health insurance plan provides a fixed financial benefit that will help you cover medical costs, especially in case of critical illness which require a long term treatment, cost of second opinions, post treatment nursing and above all a loss of income during the affected period.

Key benefits of Health Insurance Plan

Comprehensive Critical

Illness Cover

The plan provides comprehensive cover against 59 Critical Illnesses and surgical procedures including Heart and Cancer related ailments.

Cover from

Early Stages

The plan covers you on diagnosis of any of the listed conditions whether it is in Minor, Moderate or Major Stage.

Inbuilt

Death Benefit

The death benefit will be available from day 1 i.e. without any waiting period.

Flexibility to Choose

Your Protection Plan

The plan provides 4 flexible options. a) Heart Cover , b) Critical Illness Cover, c) Heart Cover with Return of Premium, d) Critical Illness Cover with Return of Premium.

Fixed Benefit

Payout

The plan ensures a fixed lumpsum payout on diagnosis of critical illness or undergoing surgical procedure covered under the plan.

Online

Discount

You can avail of an online discount of 5% on buying it directly from our website https://life.futuregenerali.in

Critical Illness Benefit

| Minor Condition | 25% of Critical Illness Sum Assured up to a maximum claim benefit of two minor conditions + waiver of premium for 5 years or till end of Policy Term whichever is earlier (only on first minor condition claim) |

|---|---|

| Moderate Condition | 50% of Critical Illness Sum Assured up to a maximum claim benefit of two moderate conditions + waiver of premium for 5 years or till end of Policy Term whichever is earlier (only on first moderate condition claim) |

| Major Condition | 100% of Critical Illness Sum Assured |

The above conditions are applicable for all four options.

- Where the Critical Illness Sum Assured shall be higher of

- Sum Assured

- 105% of total premium paid (excluding applicable taxes, rider premium and underwriting extra premium):

- Total Critical Illness benefit amount payable under your policy shall never exceed 100% of the Critical Illness Sum Assured.

- In case of making a payment for any Critical Illness benefit leads to total claim benefit exceeding 100% of critical illness Sum Assured, only the residual payment shall be made to ensure total Critical Illness benefit do not exceed 100% of Critical Illness Sum Assured

- Maximum two Minor Conditions/Moderate Conditions can be claimed upto a maximum of Critical Illness Sum Assured during the entire Policy Term and any listed condition can be claimed only once.

- If more than one covered critical illness conditions are diagnosed and/or a procedure performed at the same time (within 21days of the first occurrence) from the same group of illnesses (heart related, cancer related or other critical illness related) then the benefit payout for only one critical illness condition which has a higher benefit value will be paid provided the total benefit payout does not exceed 100% of the critical illness sum assured. However, if more than one covered critical illness conditions are diagnosed and/or a procedure is performed at the same time (within 21 days of the first occurrence) but from different groups of illnesses (heart related, cancer related or other critical illness related) then benefits for both the critical illness conditions will be paid, provided the total benefit payout does not exceed 100% of the critical illness sum assured.

- For the conditions Early Stage Cancer and Carcinoma in Situ, multiple Minor Condition claims on the same organ will not be admissible.

- The Policy will terminate on payment of benefit for Major condition.

- The Policy will terminate once 100% of Critical Illness Sum Assured is exhausted.

Waiver of Premium Benefit

- Inbuilt waiver of premium shall be offered for 5 years or for the remaining policy term whichever is earlier, only once, on the occurrence of first Minor claim or first Moderate claim.

- Future Installment Premium shall not be waived for second or subsequent Minor Condition or second or subsequent Moderate Condition.

- On completion of the 5 Years for which Installment Premiums have been waived, Installment Premium shall become payable by the Policyholder on the due dates for the remaining Premium Payment Term.

- Waiver of Premium will be applicable only once during the Policy Term.

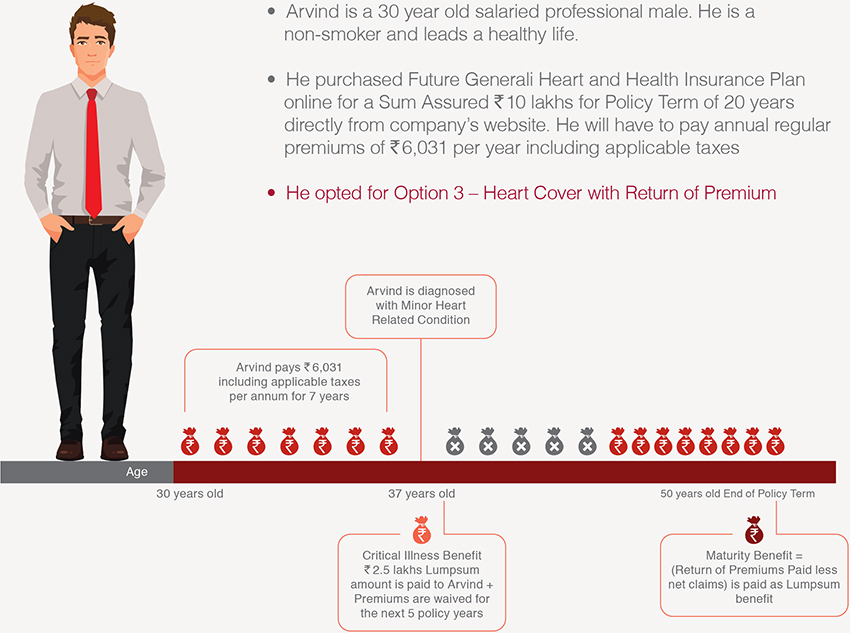

Maturity Benefit

- This benefit is available only with Option 3 - Heart Cover with Return of Premium Option and Option 4 - Critical Illness Cover with Return of Premium Option, as chosen by the Policyholder.

- If Life Assured is alive on the Maturity Date and if all Installment Premiums have been received in full, Guaranteed Maturity Sum Assured shall be paid at the end of Policy Term.

Where, Guaranteed Maturity Sum Assured is equal to- Nil - For Option 1 and 2

- Sum of all Instalment Premiums paid (excluding taxes, rider premium, modal loadings and extra underwriting premiums) less any critical illness benefits paid.

Any Premiums waived shall also be considered along with premiums paid by the Policyholder for calculation of the Maturity Benefit

Death Benefit

Death Benefit will be Higher of

- 25% of Sum Assured

- 10 times Annualised Premium (excluding applicable taxes, rider premium, modal loadings and underwriting extra premiums, if any)

- 105% of all the premiums paid (excluding applicable taxes, rider premium and underwriting extra premiums, if any) as on date of death

- Guaranteed Maturity sum assured , if any

Any Premiums waived shall also be considered along with premiums paid by the Policyholder for calculation of the death Benefit. The policy will terminate once death benefit is paid.

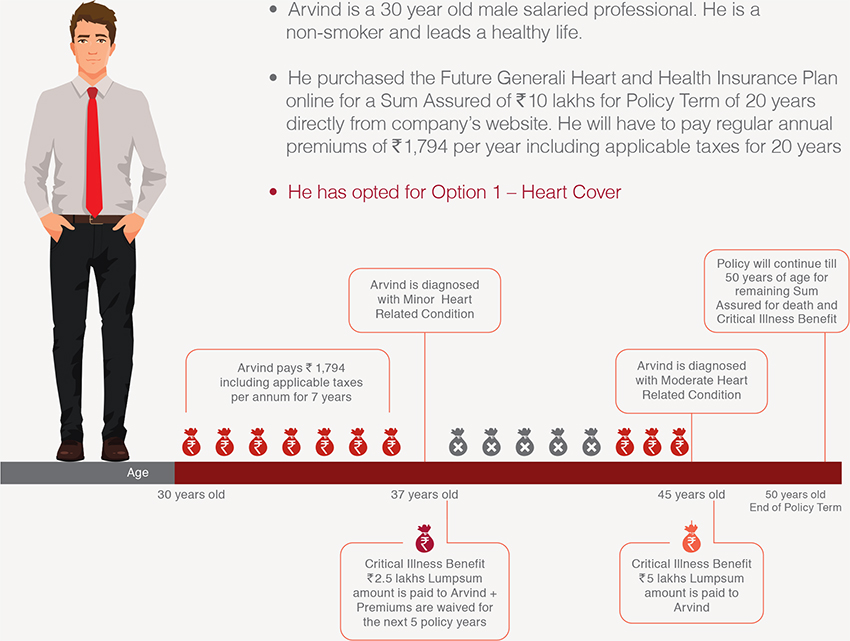

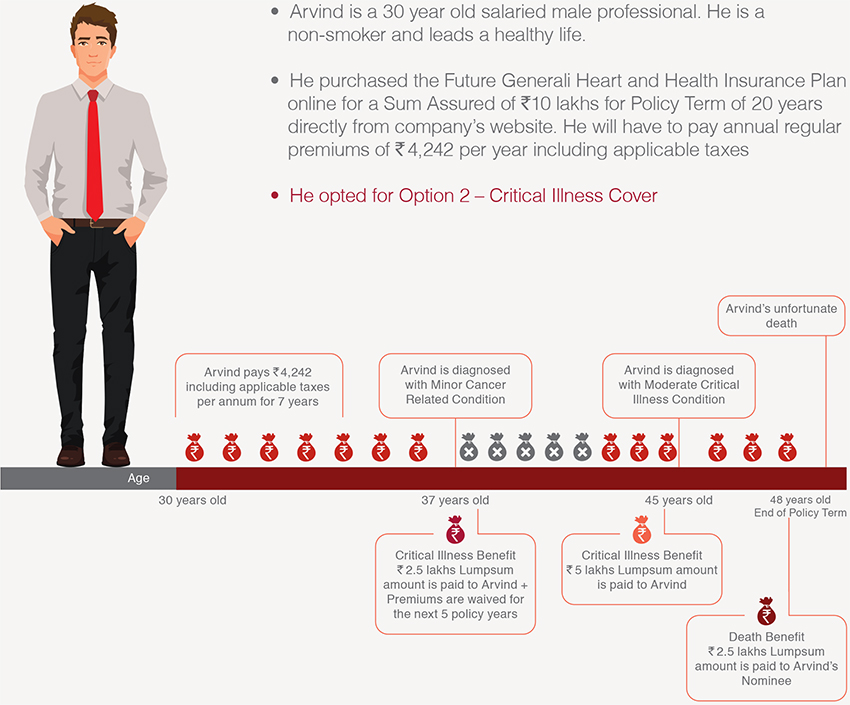

How our health Plan works?

with Waiver of Premium

Waiver of Premium and Death Benefit

Waiver of Premium and Maturity Benefit

4 Quick steps to buy Health Insurance

Choose the amount of health cover (Sum Assured) from the following options

Cover Amount

| ₹ 5 Lakhs | ₹ 10 Lakhs | ₹ 20 Lakhs |

| ₹ 30 Lakhs | ₹ 40 Lakhs | ₹ 50 Lakhs |

Policy Term/ Premium Payment Term

| 10 years | 15 years | 20 years |

| 25 years | 30 years | 75 minus age at entry |

For Option 3 and 4, Policy Term offered is 10 years for age 51 to 65 years

Choose your coverage option

Option 1 - Heart Cover

Option 2 - Critical Illness Cover

Option 3 - Heart Cover with Return of Premium

Option 4 - Critical Illness Cover with Return of Premium

Fill a form by answering some health questions

Pay your premium

Important details on Health Insurance Plan

| Entry Age and Maturity Age (as on last birthday) | |||

|---|---|---|---|

| Product options | Minimum entry age (in years) | Maximum entry age (in years) | Maximum maturity age (in years) |

| Heart Cover | 18 | 65 | 75 |

| Critical Illness Cover | 18 | 65 | 75 |

| Heart Cover with Return of Premium | 18 | 65 | 75 |

| Critical Illness Cover with Return of Premium | 18 | 65 | 75 |

| Minimum | ₹ 5 Lakhs |

| Maximum | ₹ 50 Lakhs |

| Cover Amount Options | ₹ 5 Lakhs | ₹ 10 Lakhs | ₹ 20 Lakhs | ₹ 30 Lakhs | ₹ 40 Lakhs | ₹ 50 Lakhs |

| Monthly | Quarterly |

| Half Yearly | Annually |

Little privileges just for you

Free Look Period

In case you disagree with any of the terms and conditions of the policy, you can return the policy to the company within 15 days (30 days if policy is sold through direct marketing mode) of its receipt for cancellation, stating your objections. Future Generali India Life Insurance Co. Ltd will refund the policy premium after the deduction of stamp duty charges, medical expenses, if any and proportional risk premium for period of cover, if any.

If the Policy is opted through Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:-

- For existing e-Insurance Account: Computation of the said Free Look Period will commence from the date of delivery of the e mail confirming the credit of the Insurance Policy by the IR.

- For New e-Insurance Account: If an application for e-Insurance Account accompanies the proposal for insurance, the date of receipt of the ‘welcome kit’ from the IR with the credentials to log on to the eInsurance Account(e IA) or the delivery date of the email confirming the grant of access to the eIA or the delivery date of the email confirming the credit of the Insurance Policy by the IR to the eIA, whichever is later shall be reckoned for the purpose of computation of the Free Look Period.

Tax Benefits

The Premium(s) paid by you are eligible for tax benefit as may be available under the provisions of Section(s) 80C, 80D and 10 (10D) as applicable. For further details, consult your tax advisor. Tax benefits are subject to change from time to time.

Grace Period

You get a grace period of 30 days for annual, half yearly and quarterly mode and 15 days for monthly mode from the premium due date to pay your missed premium. During this grace period, you will continue to be insured and be entitled to receive the benefits. If a valid claim arises under the policy during the Grace Period, but before the payment of due premium, the claim will be honoured. In such cases, the due premium will be deducted from the benefit payable.

Change in Premium Payment Frequency

We allow you to make change in the mode of premium payment under the policy which shall be applicable from the next policy anniversary.

Exclusions and Limitations

The following exclusions are available in this plan.

1) Suicide Exclusion :

In case of death due to suicide within 12 months from the date of commencement of risk under the policy or from the date of revival of the policy, as applicable, the nominee or beneficiary of the policyholder shall be entitled to 80% of the total premiums paid till the date of death or the surrender value available as on the date of death whichever is higher, provided the policy is in force.

2) Pre-Existing Disease :

Pre-existing Disease means any condition, ailment, injury or disease:

- a) That is/are diagnosed by a physician within 48 months prior to the effective date of the policy issued or its reinstatement by the insurer or

- b) For which medical advice or treatment was recommended by, or received from, a physician within 48 months prior to effective date of the policy or its reinstatement.

No Critical Illness benefits shall be payable for any condition(s) which is a direct or indirect result of any pre-existing conditions unless Life Insured has disclosed the same at the time of proposal or date of reinstatement whichever is later and the Company has accepted the same.

Reinstatement means the revival of policy post expiry of grace period.

Waiting Period -

No Critical Illness benefits shall be payable under this Policy for any covered disease/illness/disorder diagnosed or manifested within the 180 days following the effective date of the Policy or reinstatement date (whichever is later) and the policy will terminate. In such case, Company will refund the premiums from risk commencement date of the policy or from the date of revival as applicable. This will be subject to Section 45 of the Insurance Act, 1938, as amended from time to time.

Waiting period in case of reinstatement shall not be applicable if policy is revived within 90 days of last premium due date and a continuous waiting period of 180 days has been served.

Survival Period -

No Critical Illness benefit shall be payable under this Policy for any covered disease/illness/disorder if Insured person has survived for less than or equal to 21 days.

Survival period is not applicable for Cancer related conditions i.e. Early Stage Cancer, Carcinoma in Situ and Major Stage Cancer.

No critical illness benefit will be payable in respect of any listed condition arising directly or indirectly from, though, in consequence of or aggravated by any of the following:

- Unreasonable failure to seek or follow medical advice or treatment or the Life Insured has delayed medical treatment in order to circumvent the waiting period or other conditions and restriction applying to this policy.

- Self-inflicted injuries, suicide, insanity, and immorality, and deliberate participation of the life insured in an illegal or criminal act.

- Use of intoxicating drugs / alcohol / solvent, taking of drugs except under the direction of a qualified medical practitioner.

- Radioactive contamination due to nuclear accident.

- War – whether declared or not, civil commotion, breach of law with criminal intent, invasion, hostilities (whether war is declared or not), rebellion, revolution, military or usurped power or wilful participation in acts of violence.

- Illness or Injury cause by engaging in hazardous sports / pastimes, i.e. taking part in (or practicing for) boxing, caving, climbing, horse racing, jet skiing, martial arts, mountaineering, off pastel, skiing, pot holing, power boat racing, underwater diving, yacht racing or any race, trial or timed motor sport, bungee jumping, hand gliding etc. or Any injury, sickness or disease received as a result of aviation (including parachuting or skydiving), gliding or any form of aerial flight other than as a fare-paying passenger on regular routes and on a scheduled timetable unless agreed by special endorsement.

- Existence of any Sexually Transmitted Disease (STD) and its related complications

For exclusions under each of the listed critical illnesses, please read the sales brochure carefully.

Target Group

For the customers who want fixed benefit critical illness policy that covers Heart, Cancer or other major organ related critical illnesses, to financially protect themselves and their family from the medical and non-medical expenses.

DISCLAIMERS

Future Generali Heart & Health Insurance Plan (UIN: 133N069V03)

Future Group’s and Generali Group’s liability is restricted to the extent of their shareholding in Future Generali India Life Insurance Company Limited

Tax benefits are as per Income Tax Act 1961 and are subject to any amendment made thereto from time to time You are advised to consult your tax consultant

Faq's

Future Generali Heart & Health Insurance Plan is an Individual / Non - Linked / Non - Participating / Fixed Benefit Health plan which pays lump sum to the life assured on diagnosis or undergoing the surgical procedure of the listed Minor, Moderate or Major stage Critical Illness as per options chosen.

- This is a regular premium payment Individual / Non - Linked / Non – Participating/ Health plan

- As per your requirement, choose the option:-

- Option 1 - Heart Cover

- Option 2 - Critical Illness Cover

- Option 3 - Heart Cover with Return of Premium

- Option 4 - Critical Illness Cover with Return of Premium

- Pay the premium till the end of policy term

- Receive lump sum on diagnosis or undergoing the surgical procedure of the listed Minor, Moderate or Major stage critical illness

- On diagnosis/undergoing the surgical procedure of the Minor or Moderate critical illness, premiums will be waived off for the period of 5 policy years or till the end of the policy term, whichever is earlier. (Only once during the policy term)

- Death benefit in case life assured dies during the policy term

- Maturity Benefit if life assured survives till the end of policy term (Available only with option 3 and 4)

Life is about enjoying all big and small moments with those who matter to you. And, these moments are best enjoyed when you are healthy and worry free. The modern lifestyle however, exposes us to many risks arising on account of lack of exercises, irregular eating schedule, sedentary work habits and erratic sleep patterns etc. Therefore, while prevention is the best solution, preparedness is equally important.

Presenting the Future Generali Heart and Health Insurance Plan, a comprehensive health protection plan, that safeguards you and your family against financial risks arising out of any defined unforeseen medical emergency. The plan provides a fixed financial benefit that will help you cover medical costs, especially in case of critical illness which require a long term treatment, cost of second opinions, post treatment nursing and above all a loss of income during the affected period.’

- Provides Comprehensive Health Cover - Get cover against 59 Critical Illnesses and surgical procedures including Heart and Cancer related ailments. You have an option to opt for a separate Heart Cover as well that will provide cover against 18 Heart Related illnesses and surgical procedures.

- Flexibility to Choose your cover – you can choose from the available 4 options basis your needs

- Lumpsum Payout on diagnosis/undergoing surgical procedure of the listed illnesses

- Inbuilt Death Benefit – Has death cover from day 1 with all the options

- Multiple Claim Benefit – Claim upto 2Minor or 2 Moderate conditions provided you have not exhausted your Sum Assured

- Waiver of Premium Benefit - If you are diagnosed with any of the defined minor or moderate conditions, your premiums will be waived for the following 5 years. This means that the plan continues without you having to pay premiums for 5 years

- Provides option to get your premiums back on maturity

- Buy for Self and Family - You can also buy this plan for Your Spouse, Children and Parents. You will have to buy individual policy for each family member.

- 5% Discount on premium rates on buying directly from our website

- Tax Benefit under both section 80C and 80D

View All

Why Future Generali India Life Insurance

1357

Self & Partner Branches

95.04%

Individual claims settlement ratio for FY 2022-2023

1.5 Million

Lives covered since inception

₹70.74 Billion

Worth of Asset Under Management

Data as on 31st March 2023

Media Coverage

- Future Generali India Life offers cover for heart, cancer ailments with return of premiumTimes of India - Feb 9, 2018

- Heart and Health Insurance Plan: New Future Generali India plan covers 59 critical illnessesIndia Financial Express - Feb 8, 2018

- FGILI launches new heart & health insurance plan Web India 123 - Feb 8, 2018

- Heart and Health Insurance Plan: New Future Generali India plan covers 59 critical illnessesCNBC - Feb 8, 2018

- Future Generali India Life Insurance bolsters its health solutions, launches new Heart & Health Insurance PlanWeb Newswire - Feb 8, 2018

- FGILI launches new heart & health insurance planUNI India - Feb 8, 2018

Reach us

Customer care number

1800 102 2355

Email us at

care@futuregenerali.in