4.4 minutes Read

Do you face the following issues or challenges?

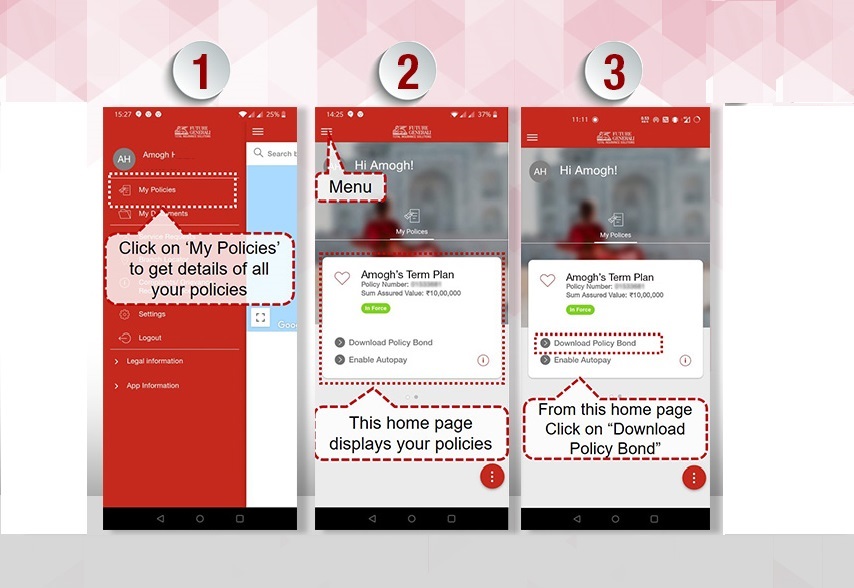

You can link multiple policies on the FG life app so that they are available digitally. Moreover, all these details can be availed even in the offline mode.

All the policy-related information is handy and can be used in case of emergencies. You can access all your policy details round the clock through the FG Life app.

No more hassle of remembering your premium due dates. Once you log in to FG Life app and link your policy with all the required information, you will be reminded by the app whenever your policy is due for renewal.

Along with an array of insurance services available on the app, you can instantly avail your tax certificate also known as a premium paid certificate within a few clicks.

The app has around 30 different types of forms right from the forms required at the initial stage like the nomination form to the last stage like the claim form.

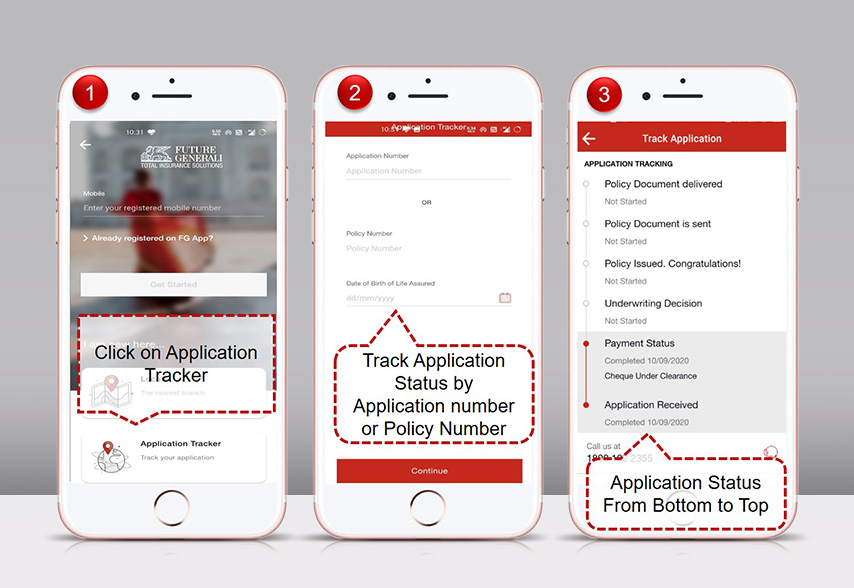

Tracking the application of the purchased policy has never been easy as it is with the FG Life app. By just adding the policy number or the application number, you can track the status of your application in just 3 clicks! It is that easy!

No need to run from one place to the other and waste time in long queues. You can now fulfill all your underwriting requirements directly through the FG Life app! Moreover, after fulfilling all the underwriting requirements, you can track the underwriting decision of the policy if it is issued or not. It does not end here, once the policy is issued, you can also track if the documents are sent to you or not.

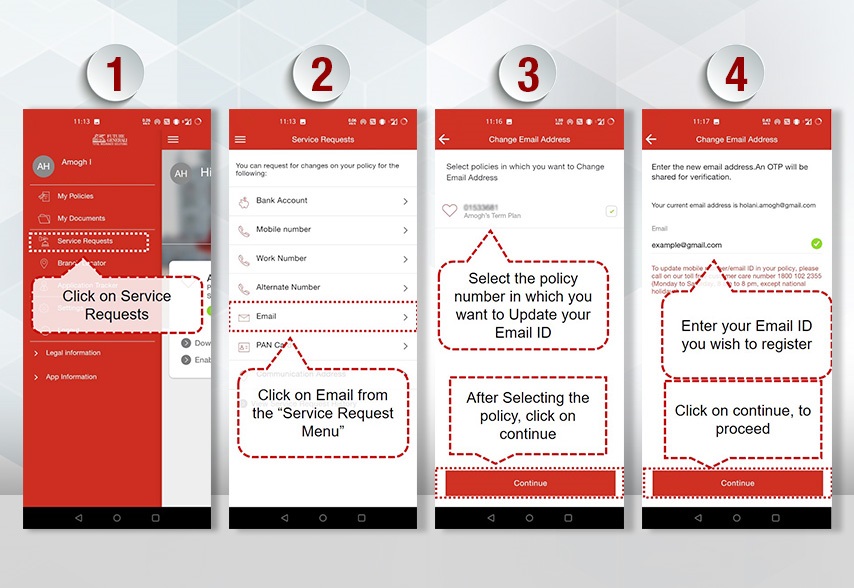

On the FG Life App you can also change the contact number, email ID, update bank details, change in signature, change the communication address, update PAN card details, and many such services can be availed at the 'Service Requests' section of the app.

Many times we forget to pay premiums and realize at the end moment. You can now instantly pay your premiums using the FG Life App at anytime, anywhere. Moreover, you can also enable the ‘Autopay’ feature on the app. Through this feature, the money will automatically be deducted from the default credit card or bank account whenever the renewal is due.

Locations with presence in major cities across India

Lives covered since inception

Worth of Asset Under Management

Individual claims settlement ratio for FY 2020-2021

Figures as on 31st March 2021