Why settle for less when you can get more?

Protection + Wealth Creation

We always want to get the most out of everything we buy. Why should it be any different when you choose an insurance plan? Future Generali Bima Advantage Plus is an individual, unit-linked, non participating life insurance plan that not only helps you build wealth, but also offers you the added advantage of protection. It also offers a wide choice of investment funds to match your risk appetite and a host of other flexible options for your unique needs. So, don't settle for just any ULIP. Demand more with Future Generali Bima Advantage Plus.

KEY FEATURES

- A unique combination of protection and investment that helps fulfil your medium to long term financial goals.

- Helps maximize your returns by investing in a choice of 9 investment funds to match your risk appetite.

- Flexibility to choose policy term, sum assured and other optional features like switching, re-direction & partial withdrawals.

- Premium(s) paid are eligible for tax benefit as may be available under the provisions of Section(s) 80C and 10(10D) of the Income Tax Act of 1961 as amended from time to time.

How does it Works

-

Based on your financial /savings plan, decide the amount you want to invest as premium for the desired policy term.

-

Based on your life cover requirement choose your sum assured multiple.

-

Depending on your risk appetite, you can choose to invest in any or all the nine available funds.

YOUR INVESTMENTS

Your premium, net of applicable charges, is invested in unit funds of your choice. This plan provides for nine investment funds, thereby, adding flexibility in directing your investments to any or all following unit linked funds of the company. The funds invest in a mix of cash/other liquid assets, fixed income securities and equity investments in line with the objective of the fund.

| Future Secure Fund (SFIN: ULIF001180708FUTUSECURE133) |

||||||||||||||||||

| Objective | To provide stable returns by investing in relatively low risk assets. The fund will invest exclusively in treasury bills, bank deposits, certificate of deposits, other money market instrument and short duration govt. securities.

|

|||||||||||||||||

| Future Income Fund (SFIN: ULIF002180708FUTUINCOME133) |

||||||||||||||||||

| Objective | To provide stable returns by investing in assets of relatively low to moderate level of risk. The interest credited will be a major component of the fund’s return. The fund will invest primarily in fixed income securities, such as Govt. securities of medium to long duration and Corporate Bonds and money market instruments for liquidity.

|

|||||||||||||||||

| Future Balance Fund (SFIN: ULIF003180708FUTBALANCE133) |

||||||||||||||||||

| Objective | To provide a balanced return from investing in both fixed interest securities as well as in equities so as to balance stability of return through the former and growth in capital value through the latter. The fund will also invest in money market instruments to provide liquidity. The risk profile of the fund is moderate.

|

|||||||||||||||||

| Future Apex Fund (SFIN: ULIF010231209FUTUREAPEX133) |

||||||||||||||||||

| Objective | To provide potentially high returns to unit holders by investing primarily in equities to target growth in capital value of assets. The fund will also invest to a certain extent in govt. securities, corporate bonds and money market instruments. The risk profile of the fund is high.

|

|||||||||||||||||

| Future Maximize Fund (SFIN: ULIF004180708FUMAXIMIZE133) |

||||||||||||||||||

| Objective | To provide potentially high returns to unit holders by investing primarily in equities to target growth in capital value of assets. The fund will also invest to a certain extent in govt. securities, corporate bonds and money market instruments.

|

|||||||||||||||||

| Future Opportunity Fund (SFIN: ULIF012090910FUTOPPORTU133) |

||||||||||||||||||

| Objective | To generate capital appreciation & provide long term growth opportunities by investing in a portfolio predominantly of equity & equity related instruments generally in S & P CNX Nifty stocks and to generate consistent returns by investing in debt & money market instruments. The risk profile of the fund is high.

|

|||||||||||||||||

| Future Midcap Fund (SFIN: ULIF014010518FUTMIDCAP133) |

||||||||||||||||||

| Objective | The investment objective of this fund is to generate long-term capital appreciation by investing predominantly in equity and equity related securities of mid cap companies.

|

|||||||||||||||||

| Future Income Plus Fund (SFIN: ULIF023211124INCOMEPLUS133) |

||||||||||||||||||

| Objective | This fund aims to provide progressive returns compared to fixed income instruments by taking a low exposure to high-risk assets like equity. The fixed income investments will be a judicious mix of government securities, corporate bonds, money market investments and other fixed income investments with minimum 25% investment in Corporate Bonds.

|

|||||||||||||||||

| Future Multi-cap Equity Fund (SFIN: ULIF024211124MULTICAPEQ133) |

||||||||||||||||||

| Objective | To generate long term capital appreciation by investing in a dynamic mix of equity and equity related instruments across market capitalization i.e. Large Cap, Mid Cap and Small Cap.

|

|||||||||||||||||

Your Benefits

Maturity Benefits:

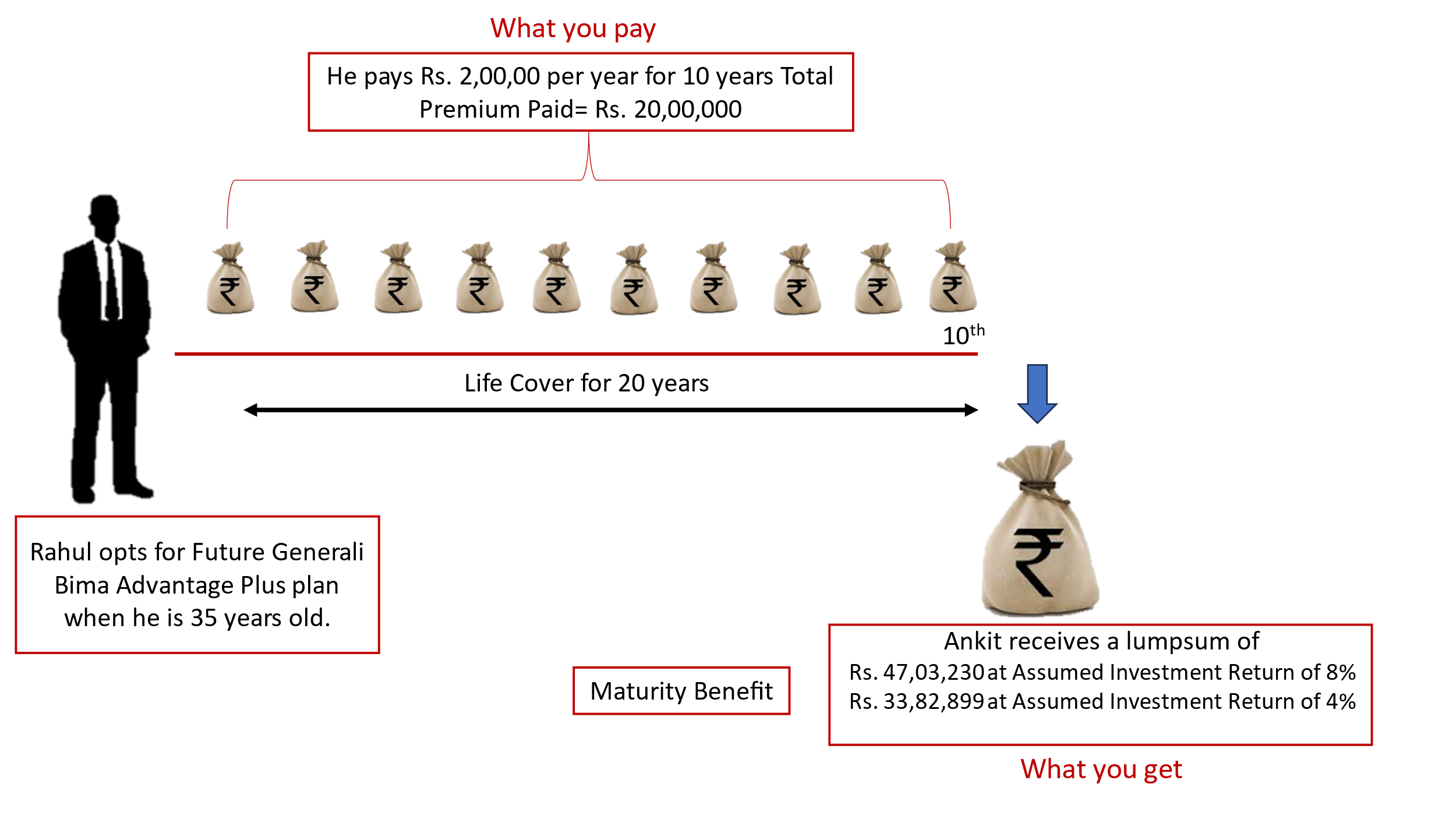

On maturity of the policy, the fund value as on the date of maturity is payable to the life assured. Top up premiums are not allowed under the product. To clearly understand how maturity benefit works, let us take a look at Rahul’s story.

Rahul is 35 years old and has chosen to invest in Future Generali Bima Advantage Plus, with a Policy Term of 20 years, an annual premium of Rs. 2,00,000 for 20 years. His Death Benefit Multiple is 10 times and a Sum Assured (cover amount) of Rs. 20,00,000.

Note: For the purpose of illustration, we have assumed 8% p.a and 4% p.a as the higher and lower values of investment returns. These rates are not guaranteed, and they are not the upper or lower limits of returns of the Funds selected in your policy, as the performance of funds depends on several factors including future investment performance. These rates in no way signify our expectations of future returns and the actual returns may be higher or lower.

Death Benefits:

In case of an unfortunate demise of the life assured during the policy term while the policy is in force,

the nominee receives the higher of

- Sum assured less deductible partial withdrawal, if any or

- Fund Value or

- 105% of total premiums paid (including top-up premiums paid, if any) till date of death less deductible partial withdrawals, if any.

Deductible partial withdrawals are

- Partial withdrawals made in 2 years immediately prior to the date of death,

In this Policy, Sum Assured is defined as 'Death Benefit Multiple * Annualized Premium (excluding taxes,

rider premiums and underwriting extra premium on riders, if any)'.

Death Benefit Multiple Options available under this product:

| Entry Age (years) | Minimum Multiple Factor | Maximum Multiple Factor |

|---|---|---|

| 7 years to 44 years | 10 | 25 |

| 45 years to 54 years | 7 | 15 |

| 55 years to 65 years | 5 | 7 |

Note:

- On death of the life assured, the policy will be terminated by paying the death benefit.

- Risk will commence immediately for minor lives.

Surrender Benefits

Policy can be surrendered any time during the Policy Term. The Surrender Value will be Fund Value less Discontinuance Charge, if any, as mentioned below:

(1) Discontinuance of policy during the lock-in period: If policy is surrendered before the completion of lock in period of 5 policy years from the policy commencement date, the surrender value equal to fund value less applicable discontinuance charge will be kept in a Discontinued Policy Fund of the company. No subsequent charges except Fund management charge of 0.50% per annum for the Discontinued Policy Fund will be deducted. The Discontinued Policy Fund would earn a minimum guaranteed interest as prescribed by IRDAI from time to time. Currently the minimum guaranteed interest rate is at 4% p.a The surrender value so accumulated will be paid after the lock in period of 5 years. In case of death of the life assured during the lock in period, the proceeds will be payable to the nominee / legal heirs as applicable.

(2) Discontinuance of policy after the lock-in-period:If the policy is surrendered after the lock-in period, then the Surrender Value is the Fund Value at the prevailing NAV without deduction of the Discontinuance Charges. It becomes payable immediately.

Vesting of the Policy in Case of Policies Issued to Minor Lives: The policy vests on the life assured on the policy anniversary coinciding with or immediately following the 18th birthday of the life assured. Upon such vesting, the Policy will be deemed to be a contract between the Life Assured (also the policyholder there forth) as the owner of the policy and the Company. The erstwhile policyholder or his estate shall cease to have any right or interest therein. In case of death of the Policyholder while the Life Assured is a minor, the surviving parent/ legal guardian may be appointed as a new Policyholder. In case the policy is in Paid-Up status or upon non- payment of future premiums, provisions of discontinuance of the policy and paid-up clause shall apply.

Eligibility

| Age at Entry(as on last birthday) | 7 to 65 years | ||||||||

| Age at Maturity (as on last birthday) | 18 to 95 years | ||||||||

| Policy Term | 10 to 30 years | ||||||||

| Premium Paying Term | Same as Policy Term | ||||||||

| Sum Assured | Minimum Sum Assured

Maximum Sum Assured (as a multiple of Annual Premium)

|

||||||||

| Annual Premium | Minimum: Yearly - Rs 20,000/- , Half-Yearly – Rs 10,000/- , Quarterly – Rs 5,000/-, Monthly – 2,000/- Maximum: No Limit |

||||||||

| Premium Payment Mode | Yearly, Half Yearly, Quarterly and Monthly |

CHARGES UNDER YOUR POLICY

| Charges | Description of Charges | |||||||||||||||||||||

| Premium Allocation Charge | The premium allocation charge will be deducted from the premium amount at the time of premium payment and the remaining premium will be used to purchase units in various investment funds according to the specified fund allocation. Year 1st: 9% Year 2nd: 5% Year 3rdonwards: 3% |

|||||||||||||||||||||

| Policy Administration Charge | The maximum Policy Administration Charge will not exceed 500/- per month. These charges are determined using 1/12th of the annual charges given above and are deducted from the unit account monthly at the beginning of each monthly anniversary of the policy by cancellation of units for equivalent amount. Year 1: Nil Year 2 onwards: 1.6% p.a. |

|||||||||||||||||||||

| Fund Management Charge | Fund Management Charges are deducted on a daily basis at 1/365th of the annual charge in determining the unit price. The company may change the fund management charges from time to time with appropriate approval.

|

|||||||||||||||||||||

| Mortality Charge | This shall be levied at the beginning of each policy month from the fund. Following are sample mortality charges per Rs. 1,000/- sum at risk.

Mortality Charges are deducted on sum at risk which is calculated as excess of (Higher of (Sum assured less deductible partial withdrawal), 105% of premiums paid less Deductible Partial Withdrawal) over Fund Value. |

|||||||||||||||||||||

| Discontinuance Charge | In case of discontinuance/ surrender of the policy during the first 4 policy years, the following charges will apply:

|

|||||||||||||||||||||

| Switching Charges |

|

|||||||||||||||||||||

| Partial Withdrawal Charge | Beyond the free withdrawals allowed in a policy year, a charge of Rs 200 will be levied per withdrawal in each policy year. |

|||||||||||||||||||||

| Miscellaneous Charge | This charge is levied for any alterations within the insurance contract, such as premium redirection and decrease in sum assured. The charge is expressed as a flat amount levied by cancellation of units. This charge is levied only at the time of alteration and is equal to Rs.250 per alteration |

|||||||||||||||||||||

| Note :Applicable tax & cess is applicable on the above charges as per prevailing tax rules. One month notice period will be given to the policyholder in case of an increase in charges. The increase, if any will apply from the policy anniversary coinciding with or following the increase.Any change in amount or rate of charges as stated above will be subject to appropriate approval. |

||||||||||||||||||||||

Riders

No riders are available under this product.

Free Look Period

Policyholder has the right option to cancel the policy within 30 days of receipt of the Policy Document (whether received electronically or otherwise) if the policyholder disagrees with any of the policy terms and conditions, or otherwise and has not made any claim, by giving a written request for cancellation of the policy to the company, stating the reasons for such objections.

On cancelation of the policy after such request, the Fund Value as on the date of cancellation of the Policy plus non-allocated premium, if any plus charges levied by cancellation of units minus (Stamp duty + medical expenses, if any, + proportionate risk premium for the period on cover) minus extra allocation, if any added to the Policy will be payable to the Policyholder.

If the Policy is opted through an Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:

- For existing e-Insurance Account: Computation of the said Free Look Period will commence from the date of the delivery of the e-mail confirming the credit of the Insurance Policy by the IR.

- For New e-Insurance Account: If an application for e-Insurance Account accompanies the proposal for insurance, the date of receipt of the ‘welcome kit’ from the IR with the credentials to log on to the eInsurance Account(e IA) or the delivery date of the email confirming the grant of access to the eIA or the delivery date of the email confirming the credit of the Insurance Policy by the IR to the eIA, whichever is later shall be reckoned for the purpose of computation of the Free Look Period.

Grace Period

Grace period means the time granted by the insurer from the due date of payment of premium, without any penalty or late fee, during which time the policy is considered to be in-force with the risk cover without any interruption, as per the terms & conditions of the policy. The grace period for payment of the premium for all types of life insurance policies shall be fifteen days, where the policyholder pays the premium on a monthly basis and 30 days in all other cases.

The policy will remain in force during the grace period.

Lock-in Period

It is a period of five consecutive completed years from the date of commencement of the policy, during which period the proceeds of the policies cannot be paid by the insurer to the policyholder or to the insured as the case may be, except in the case of death or upon the happening of any other contingency covered under the policy.

Revival Period

Means the period of three consecutive complete years from the Date of first unpaid premium .

VARIABILITY OF THE CHARGES

- The Premium Allocation Charge & Mortality Charge under the base plan are guaranteed throughout the policy term.

- The policy administration charge can be increased by not more than 5% per annum subject to appropriate approval and will not exceed Rs. 500 per month.

- The switching charges are subject to increase up to Rs.250500 per switch, subject to appropriate approval

- The Discontinuance charges are guaranteed.

- The company may change the Fund Management charges from time to time subject to appropriate approval. As per prevailing Regulations, the fund management charges will not exceed 1.35% p.a.

- The partial withdrawal charges may increase up to Rs 500 per withdrawal with prior appropriate approval.

- Charges deducted are subject to applicable tax as per prevailing tax laws.

A month’s notice will be given to the policyholder in case of an increase of charges whenever charges can be increased. The increase, if any, will apply from the policy anniversary coinciding with or following the increase. Any change in amount or rate of charges as stated above will be subject to appropriate approval.

RISK OF INVESTMENT IN THE UNITS OF THE PLAN

- Unit Linked Life Insurance products are different from the traditional insurance products and are subject to risk factors, as in the former, the investment risks in the investment portfolio is borne by the policyholder.

- ‘Future Generali India Life Insurance Company’ is only the name of the life insurance company and ‘Future Generali Bima Advantage Plus’ is only the name of the unit linked life insurance contract and does not in anyway indicate the quality of the contract, or its future prospects of return.

- Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document of the insurer.

- The various funds offered under this contract are the names of the funds and do not in any way reflect their quality, their future prospects and returns.

- The premium paid in unit linked life insurance policies are subject to investment risks associated with the capital markets and the NAV’s of the units may go up and down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions.

- Past performance of the funds is no indication of future performance which may be different. The investments in the Units are subject to market and other risks and there can be no assurance that the objectivities of any of the funds will be achieved. The funds do not offer guaranteed or assured return.

- Tax benefits are subject to change in law from time to time. You are advised to consult your tax consultant.

- The linked insurance plans do not offer any liquidity during the first five years of the contract.

The policyholder will not be able to surrender/withdraw the monies invested in linked insurance plans completely or partially till the end of the fifth year.

Grievance Redressal Processes

In case you have any grievances on the solicitation process or on the Product sold or any of the Policy servicing matters, you may approach the Company in one of the following ways:

- Calling the Customer helpline number 1800-102-2355 for assistance and guidance

- Emailing @ care@futuregenerali.in

- You may also visit us at the nearest Branch Office. Branch locator - https://life.futuregenerali.in/branch-locator/

- Senior citizens may write to us at the following id: senior.citizens@futuregenerali.in for priority assistance

- You may write to us at: Customer Services Department Future Generali India Insurance Co. Ltd, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S Marg, Vikhroli ( W ) Mumbai – 400083

We will provide a resolution at the earliest. For further details please access the link: https://life.futuregenerali.in/customer-service/grievance-redressal-procedure

EXCLUSIONS

No benefit will be payable in respect of any condition arising directly or indirectly through or in consequence of the following exclusions and restrictions -

Suicide Exclusion: In case of death of Life Assured due to suicide within 12 months from the date of commencement of the policy or from the date of revival of the policy, as applicable, the nominee or the beneficiary of the policyholder shall be entitled to fund value, as available on the date of intimation of death.

Further, any charges other than Fund Management Charges (FMC) and Guarantee Charges recovered subsequent to the date of death shall be added back to the fund value as on the date of intimation of death.

DISCLAIMERS

Future Generali Bima Advantage Plus (UIN: 133L049V04)

- Unit Linked Life Insurance Products are different from the traditional insurance products as in the former, the investment risk in the investment portfolio is borne by the policyholder.

- ‘Future Generali India Life Insurance Company’ is only the name of the life insurance company and ‘Future Generali Bima Advantage Plus’ is only the name of the Unit Linked Life Insurance contract and does not in any way indicate the quality of the contract, or its future prospects of return.

- Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document of the insurer.

- The various funds offered under this contract are the names of the funds and do not in any way reflect their quality, or its future prospects of return.

- The premium paid in unit linked life insurance Policies are subject to investment risks associated with the capital markets and the NAVs of the units may go up and down based on the performance of the fund and the factors influencing the capital market and the insured is responsible for his/ her decision.

- Past performance of the funds is no indication of future performance which may be different.The investments in the Units are subject to market and other risks and there can be no assurance that the objectivities of any of the funds will be achieved. The funds do not offer guaranteed or assured return.

- All premiums/ benefits payable under this plan are subject to applicable laws and taxes including Goods & Services Tax, as they exist from time to time.

- Tax benefits are subject to change as per tax laws.

- For more details on the risk factors and the terms and conditions please read the Product Brochure and/ or sample policy document on our website carefully, and/ or consult your advisor before concluding the sale.

- The linked insurance plans do not offer any liquidity during the first five years of the contract.

- The policyholder will not be able to surrender/withdraw the monies invested in linked insurance plans completely or partially till the end of the fifth year.

- For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the policy document and consult your advisor, or, visit our website (life.futuregenerali.in) before concluding a sale.

Future Generali India Life Insurance Co. Ltd. (IRDAI Regn. No. 133)

Regd. and Corporate Office address: Unit 801 and 802, 8 th floor, Tower C, Embassy 247 Park,

L.B.S. Marg, Vikhroli (W), Mumbai – 400 083.

Email - care@futuregenerali.in

Call us at - 1800-102-2355 800 102 23

Website: life.futuregenerali.in

UIN: 133L049V04

Life Insurance Made Simple

-

Decoding Your Policy’s Fine Print

The fine print in a policy can come in the way of making an informed purchase. We’ve simplified the fine print into big print.

-

Ensure Your Claims Are Always Settled

Read the terms and conditions carefully. Ensure that your current health, occupation or lifestyle habits do not exclude you from getting the policy benefits.

-

Protecting Your Policy – Do’s & Don’ts

Do's and don’ts to protect your life insurance policy from unauthorised elements posing as company representatives.

-

Are You Financially Prepared For Your Future?

Find out how prepared you are to meet your financial goals, with our FutureReady calculator.

-

12 Questions to Ask Before You Buy

Buying a life insurance policy without asking your advisor the right questions is as good as crossing a road blindfolded.