- Home

- Insurance Plans

- combo-solutions-insurance-plans

- Assured Advantage Solution

In Future Generali Bima Advantage Plus (133L049V03), the Investment Risk in the Investment Portfolio is borne by the Policyholder.

This advertisement is designed for combination of Benefits of two individual and separate products named (1) Future Generali Assured Income Plan (UIN: 133N054V04) and (2) Future Generali Bima Advantage Plus (UIN: 133L049V03). These products are also available for sale individually without the combination offered / suggested. This benefit illustration is the arithmetic combination and chronological listing of combined benefits of individual products. The customer is advised to refer to the detailed sales brochure of respective individual products mentioned herein before concluding the sale.

THE UNIT LINKED INSURANCE PRODUCTS DO NOT OFFER ANY LIQUIDITY DURING THE FIRST FIVE YEARS OF THE CONTRACT. THE POLICYHOLDER WILL NOT BE ABLE TO SURRENDER/WITHDRAW THE MONIES INVESTED IN LINKED INSURANCE PRODUCTS COMPLETELY OR PARTIALLY TILL THE END OF THE FIFTH YEAR.

FUTURE GENERALI ASSURED ADVANTAGE SOLUTION

If you are looking to secure and potentially grow your money to achieve your financial goals along with a life cover you need to start today. Choose a solution that suits your financial abilities and helps you work towards your big plan.

Introducing Future Generali Assured Advantage Solution, a combination of two life insurance plans that gives you an assured income along with market-linked returns. You can use the guaranteed** income to maintain your family’s lifestyle. As per your life stage and risk-taking ability, you can choose from 7 investment funds and get returns on your savings based on market performance. Now you can invest in an easier, guided and more disciplined approach and confidently look forward to getting the most with the right investment choices, while being protected at the same time. Future Generali Assured Advantage Solution empowers you to successfully move towards your financial aspirations and give the best gift you can to your family.

Key Benefits of Assured Advantage Solution

Get protection^^ of capital and enjoy market linked as well as assured returns through a combination of guaranteed** and non-guaranteed life insurance plans

Get guaranteed** income for 15 years^ plus a guaranteed lump sum along with the potential market upside^^ at the end of 15th year

Maximise your returns by investing~ in any of the 7 investment fund options available

Get a life cover that safeguards your family’s financial milestones

Flexibility to take a loan## against the policy or partially withdraw# the fund, in case of a financial emergency

Get tax benefits as per the prevailing laws+

- Min. Entry Age7 years

- Max. Entry Age50 years

- Premium Payment Term15 years

- Minimum

Premium (excl.taxes)₹70,000 for Age 5 to 44 years

₹1,50,000 for Age 45 to 50 years - Premium Payment Frequency Annual

How does this solution work?

This solution is a combination of two plans:

- Future Generali Assured Income Plan - An Individual, Non-Linked, Non-Participating (Without Profits), Savings,Life Insurance Plan.

- Future Generali Bima Advantage Plus - An Individual, Unit Linked, Non-Participating (Without Profits), Life Insurance Plan.

The premium you decide to pay is distributed equally between these two plans.

Future Generali Assured Income Plan pays a regular income after the premium payment term including an additional benefit* with the last instalment and Future Generali Bima Advantage Plus pays you fund value on maturity at the end of 15th year.

^^This is a solution under which a ULIP is purchased along with a Non-Linked, Non-Participating Plan. While investment in ULIP is subject to market risks, you can get guaranteed returns under a Non-Linked, Non-Participating Plan. By taking both ULIP and Non-Linked, Non-Participating Policies at the same time, you will be able to get a guaranteed payout under the Non-Linked, Non Participating plan where the sum total of guaranteed payouts is more than the sum total of premiums paid under both the policies, subject to payment of premiums from time to time and keeping the Policy in force, as per Terms & conditions of the Policy. **Provided you have paid all due premiums on time. ^After the completion of the premium payment term. +Tax benefits are as per the Income Tax Act 1961, and are subject to the amendments made thereto from time to time. You are advised to consult your tax consultant. ~As per your risk appetite. #Under Future Generali Bima Advantage Plus, partial withdrawals can be made after the completion of a lock-in period of 5 policy years from the policy commencement date. ##Under Future Generali Assured Income Plan, you may avail a loan after your Policy acquires surrender value. Your loan amount can be up to 85% of the surrender value. For more details please refer product brochure. *Additional benefit depends upon the life assured’s age at entry.

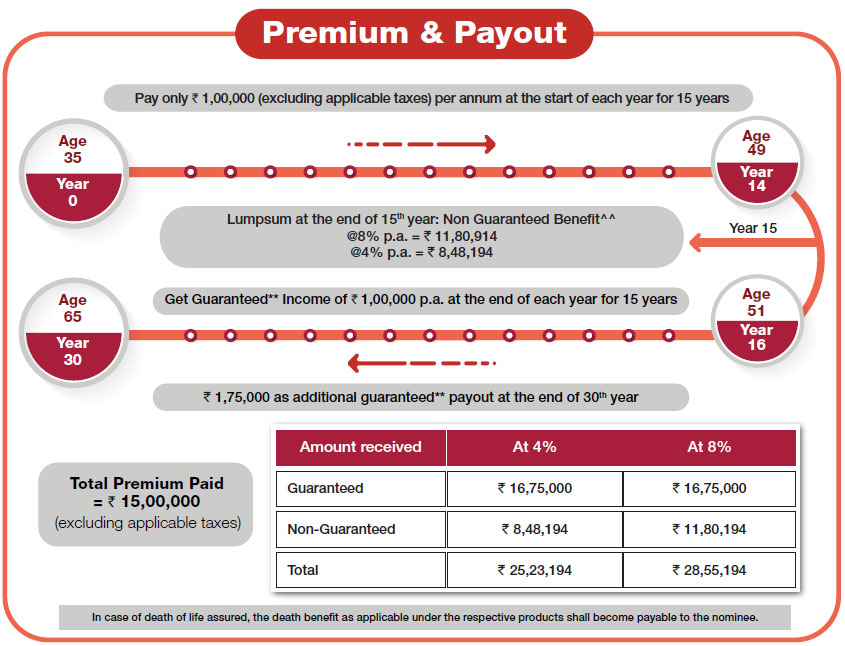

Let’s understand the working of this solution using an example

Suresh Kumar

Suresh KumarAge 35

Advantage Solution

Return

ReturnMarket

Conservative

Conservative- Guaranteed** Income

- Guaranteed** Maturity Benefit

- Market Linked Return

@8% p.a. = ₹ 11,80,914

@4% p.a. = ₹ 8,48,194

= ₹15,00,000 (Excluding applicable taxes)

- Amount received

- At 4%

- At 8%

- Guaranteed

- ₹ 16,75,000

- ₹ 16,75,000

- Non-Guaranteed

- ₹ 8,48,194

- ₹ 11,80,194

- Total

- ₹ 25,23,194

- ₹ 28,55,194

In case of death of life assured, the death benefit as applicable under the respective products shall become payable to the nominee.

The premium mentioned above is for a normal standard male excluding taxes/ loading/rider premium. Fund opted: Future Opportunity Fund (100% allocation). **Provided all due premiums are paid on time. ^^Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your life insurance company. If your policy offers guaranteed benefits then these will be clearly marked "guaranteed" in the illustration table. If your policy offers variable benefits then the illustration will show two different rates of assumed future investment returns, of 8% p.a. and 4% p.a. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance.

DISCLAIMERS

Future Generali Assured Income Plan (UIN: 133N054V04) is an individual, non-linked, non-participating (without profits), savings, life insurance plan. Future Generali Bima Advantage Plus (UIN: 133L049V03) is an individual, unit linked, non-participating (without profits), life insurance plan. For above illustration, we have combined the premiums payable and benefits that you may receive under each plan of this solution. To know the details of individual products please go through the "Benefit Illustration" of each product. This is not a product brochure. Please read product brochures of Future Generali Assured Income Plan and Future Generali Bima Advantage Plus to fully understand the charges, features, benefits, exclusion, risk factors, product terms and conditions. The individual products under this solution have certain product features which offer options beyond the ones assumed in the benefit illustration shown here. The customer can apply for above mentioned plans individually and opt for product features or options beyond the ones provided in the illustration shown here. Maturity benefits are available only if all the premiums are paid as per the premium payment term and the policy is in-force till the completion of entire policy term. Future Generali Assured Advantage Solution is only the name of the combination solution and does not in any way indicate the quality of the contract, its prospects or returns. Please know the associated risks and the applicable charges from your insurance agent or the intermediary or policy document of the Company. Unit Linked Insurance plans are different from traditional insurance plans and are subject to risk factors.The Premium paid in Unit Linked Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of the fund and factors influencing the capital market. The policyholder/insured is solely responsible for his/her decisions. Future Generali India Life Insurance Company Limited is only the name of the life Insurance Company and Future Generali Bima Advantage Plus is only the name of the Unit Linked Life Insurance contract and does not in any way indicate the quality of the contract, its prospects or returns. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their prospects and returns. Past performance is not indicative of future performance, which may be different. It is suggested that you undergo suitability test before making a purchase. Future Group's and Generali Group's liability is restricted to the extent of their shareholding in Future Generali India Life Insurance Company Limited. Future Generali India Life Insurance Co. Ltd. (IRDAI Regn. No. 133) (CIN: U66010MH2006PLC165288). Regd. & Corporate Office Address: Future Generali India Life Insurance Co. Ltd, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S. Marg, Vikhroli (W), Mumbai - 400083 | Email: care@futuregenerali.in | Call us at 1800 102 2355 | Website: life.futuregenerali.in | ARN: ADVT/Comp/2021-22/April/009