This insurance plan is designed to provide for your child's education milestones. All benefits under this plan are Guaranteed.

Harvard University. Massachusetts Institute of Technology. University of Cambridge.University of Oxford.University of California. Stanford University. All India Institute of Medical Sciences. Indian Institute of Technology. Birla Institute of Technology and Science. Indian Institute of Management.

Every parent wants their child to get an admission at one of the top universities or colleges. But very often, the high college fees can prove to be a stumbling block.

Presenting Future Generali Assured Education Plan - a plan that arms you with the necessary funds to help your child gain admission into the finest colleges. So that your child gets the ideal launching pad for a bright career. And you can be rest assured that, no matter what happens in the future, your child's education will never get compromised.

A life insurance savings plan where you pay premiums for chosen premium payment term and receive a host of benefits:

Decide the amount of money you would need for your child's future goals.

Decide the duration of Policy Term. Your and Premium Payment Term.

Choose your Plan Option.

Our advisor will help you calculate the premium amount you need to pay.

The Sum Assured, Policy term and Plan option is chosen by you at inception. Once chosen, you shall not be allowed to change any of these parameters during the term of the policy.

| Plan details | ||||

|---|---|---|---|---|

| Entry age (Age mentioned refers to age as on last birthday) | Age of the Child: 0 - 17 years Age of the Parent: 21 - 50 years (Parent will be the Life Assured under the plan) |

|||

| Maturity age of the Parent (Age mentioned refers to age as on last birthday) | Minimum: 35 years Maximum: 71 years |

|||

| Policy term | Minimum: 7 years Maximum: 21 years |

|||

| Premium payment term | Will be same as policy term | |||

| Premium Payable (Under all Options) | Minimum premium – Rs. 40,000- Yearly Rs. 20,800- Half yearly Rs. 10,600- Quarterly Rs. 3,532- Monthly Maximum Premium- No Limit as per the Board Approved Underwriting Policy |

|||

| Sum Assured (Under all Options) | Minimum:Rs. 280,368 Maximum:As per Board Approved Underwriting Policy |

|||

| Premium payment frequency | The premiums can be paid in Yearly, Half yearly,Quarterly or Monthly modes. Monthly premiums can only be paid by Electronic Clearing System (ECS). The premiums for monthly mode is 8.83% of annual premium |

|||

| Payout Options | You can choose to receive benefits based on your child’s education needs as follows: | |||

| Payout period | Option A | Option B | Option C | |

| End of Policy Term | 40% of Sum Assured | 10% of Sum Assured | 100% of Sum Assured | |

| Policy Term + 1 year | 30% of Sum Assured | 10% of Sum Assured | Nil | |

| Policy Term + 2 years | 20% of Sum Assured | 10% of Sum Assured | Nil | |

| Policy Term + 3 years | 10% of Sum Assured | 70% of Sum Assured | Nil | |

Now, you can be in complete control of your child's higher education by receiving guaranteed payouts. These payouts are designed in such a way that you are sure to use it only for payment of admission or tuition fees. Moreover, you have the flexibility to choose between three options, Option A, B or C, to receive these payouts as per your child's education milestones

Maturity Sum Assured is equal to the Sum Assured. Once chosen, the Policyholder shall not be allowed to alter the option during the Policy Term. The policy will terminate on payment of Maturity Benefit under all Plan Options

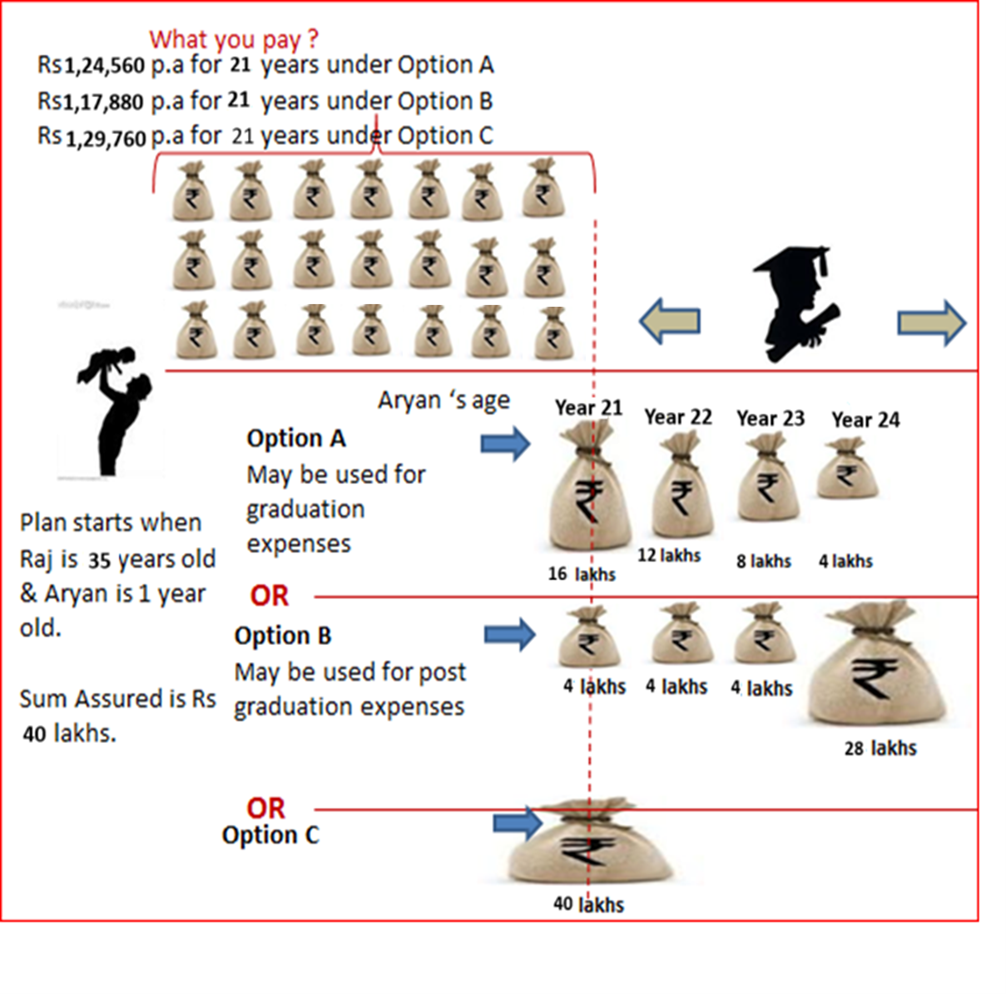

Let's understand this with an example

Raj is 35 years old and the father of a 1 year old, Aryan. As per his financial plan, he needs to get Rs 40 lakhs to fund Aryan's tuition fees through yearly payouts.

| Age of your Child | Year of Payout | Option A | Option B | Option C |

|---|---|---|---|---|

| Annual Premium | 1,24,560 p.a | 1,17,880 p.a | 1,29,760 p.a | |

| 22 years | End of 21st Year (End of Policy Term) |

40% of Sum Assured i.e. Rs. 16,00,000 |

10% of Sum Assured i.e. Rs. 4,00,000 |

100% of Sum Assured i.e. Rs. 40,00,000 |

| 23 years | Policy Term + 1 years | 30% of Sum Assured i.e. Rs. 12,00,000 |

10% of Sum Assured i.e. Rs. 2,00,000 |

Nil |

| 24 years | Policy Term + 1 years | 20% of Sum Assured i.e. Rs. 8,00,000 |

10% of Sum Assured i.e. Rs. 4,00,000 |

Nil |

| 25 years | Policy Term + 1 years | 10% of Sum Assured i.e. Rs. 4,00,000 |

70% of Sum Assured i.e. Rs. 28,00,000 |

Nil |

'With unique product benefits, funds for best colleges and universities, will be within your child's reach!'

Death Sum Assured shall be highest of the following:

On death of the life assured during the policy term, the Death Sum Assured will be payable immediately to the nominee provided the policy is in force.

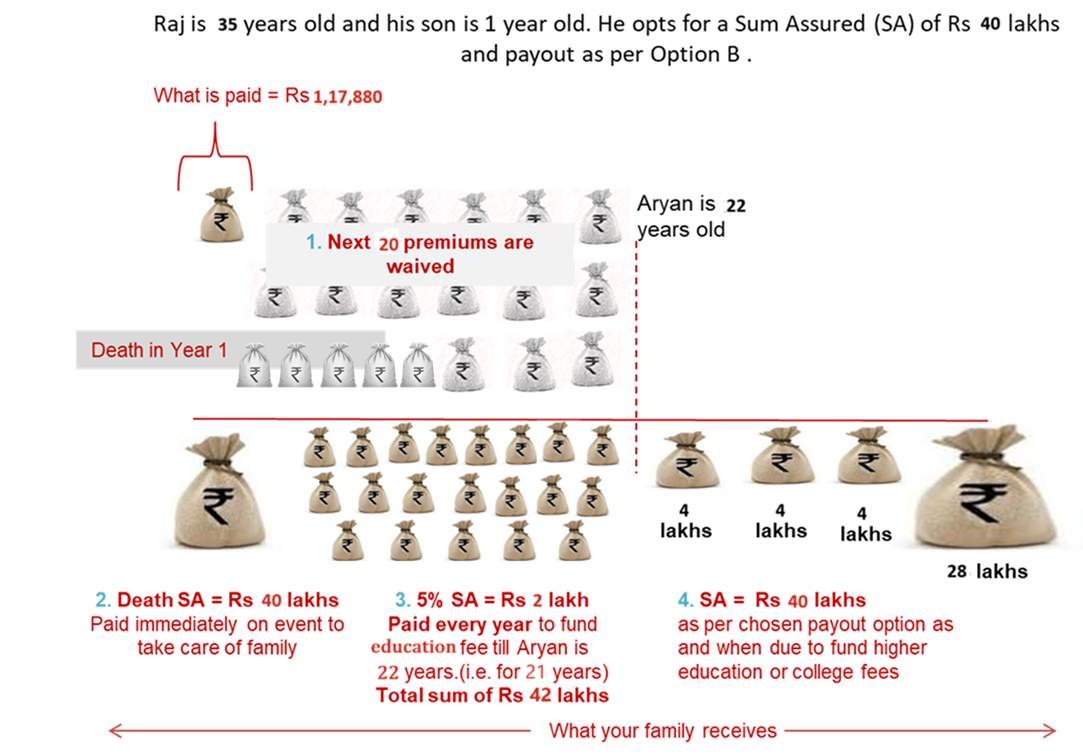

Let's understand this benefit with an example

Raj has purchased Future Generali Assured Education Plan and he opted for Option B. He meets with an accident which causes his untimely death within one year after purchasing the policy. The benefits paid out to Raj's family will be as under:

Your child's education will be taken care of just the way you planned it, come what may!

Uninterrupted protection for your child's education

Our plan ensures your child's education would not suffer in case you are not around. In such an unfortunate event, we will make sure your child gets the following guaranteed benefits to help achieve all the education milestones you have planned for:

We will:

| Your Benefits | |

|---|---|

| Maturity Benefit | 100% of sum assured is paid in the manner as opted by you at inception |

| Death Benefit | Death Sum Assured is paid immediately to the nominee on death of the life assured. We will also pay, 1. 5% of the Sum Assured on death and on every death anniversary of the Life assured during the Policy Term, subject to minimum of one payment of 5% of Sum Assured on death. 2. Maturity Benefit in the manner as opted by you at inception. |

If you disagree with the terms and conditions of the policy, you can return the policy within 30 days of receipt of the Policy Document (whether received electronically or otherwise). To cancel the policy, you can send us a request for cancellation along with the reason for cancellation. We will cancel this policy if you have not made any claims and refund the Instalment Premium received after deducting proportionate risk premium for the period of cover, stamp duty charges and expenses incurred by us on the medical examination, if any.

You get a grace period of 30 days for Annual, Half-yearly and Quarterly Premium Payment Frequency and 15 days for Monthly Premium Payment Frequency from the due date, to pay your missed premium. During these days, risk on your life and your nominee will be entitled to receive all the benefits subject to deduction of due premiums.

You can change your premium payment frequency subject to minimum eligibility criteria. Such change shall be applicable from the policy anniversary.

The premiums for various modes as up to percentage of annual premium are given below:

| Half-yearly Premium | 52.0% of annual premium |

|---|---|

| Quarterly Premium | 26.5% of annual premium |

| Monthly Premium | 8.83% of annual premium |

There shall be no charge made for the change of premium payment frequency.

The company will offer waiver of modal premium loadings for Annualized Premium of Rs. 1 crore and above.

No riders are available under this product.

You may avail a loan once the policy has acquired a Surrender Value. The maximum amount of loan that can be availed is up to 85% of the Surrender Value. The minimum amount of policy loan that can be taken is Rs. 10,000. For more details, please refer to the Policy Document. The interest rate applicable for the Financial Year will be declared at the start of the Financial Year, basis current market interest rate on 10-year Government Securities (G-Sec) as on 31st March every year + 2% rounded to nearest 1%. The current interest rate applicable on loans is 9% per annum compounded half- yearly for the Financial Year 2024-25. Please contact Us or Our nearest branch for information on the latest interest rate on loans.

For policyholders opting for high Sum Assured, a large Sum Assured discount is available as given below:

| Sum Assured (Rs.) / Premium Payment Term | Discount on premium Per Rs 1000 sum Assured | |||

|---|---|---|---|---|

| 7 to 10 | 11 to 12 | 13 to 15 | 16 to 21 | |

| Less than 4 lacs | Nil | Nil | Nil | Nil |

| 4 lacs to less than 8 lacs | 2.00 | 1.00 | 0.00 | 0.00 |

| 8 lacs to less than 12 lacs | 4.50 | 3.00 | 1.50 | 1.00 |

| 12 lacs and above | 5.00 | 4.00 | 2.00 | 2.00 |

If any due premium for first policy year has not been paid within the grace period, the policy shall lapse and shall have no value

All risk cover ceases while the policy is in lapsed status.

You have the option to revive the plan within 5 years from the date of the first unpaid due premium.

If the plan is not revived by the end of the revival period, the policy will terminate and no benefits are payable.

If due premiums for atleast one (1) full policy year has been paid and subsequent premiums have not been paid within the grace period, then the policy will be converted to a paid-up policy and the Sum Assured and Death Sum Assured will be reduced in the same proportion as the ratio of number of premiums paid to the total number of premiums payable under the policy.

Paid Up Sum Assured = ( No of premiums paid / Total No of premiums payable) * Sum Assured.

Maturity Paid-Up Sum Assured shall be payable as per the Option chosen.

Death Benefit paid is

Reduced Paid Up Death Sum Assured immedietly to the nominee on death of the life assured.

5% of the Paid Up Sum Assured on Death (i.e. on claim settlement) and on every death anniversary of the Life assured during the Policy Term subject to minimum of one payment of 5% of Paid Up Sum Assured on death.

Maturity Paid-Up Sum Assured shall be payable

You can revive your paid up policy within a period of five years from the due date of the first unpaid premium

You can surrender your paid up policy anytime.

If the Paid up Sum assured is less than rupees two thousand five hundred, the Policy may be terminated after expiry of revival period by paying the surrender value.

You purchased this plan to ensure your child's education milestones remain uninterrupted. This objective will be achieved only if you continue the plan up to maturity. However, should you be in need of money in case of an emergency, you have the option to surrender the policy before its maturity. If you do, you will be paid a Surrender Value. The policy acquires a Surrender Value after completion of first policy year provided one full year premium has been received.

On surrender, the higher of the Special Surrender Value (SSV) and the Guaranteed Surrender Value (GSV) will be paid.

Nomination shall be in accordance with Section 39 of the Insurance Act, 1938 as amended from time to time.

Assignment shall be in accordance with Section 38 of the Insurance Act, 1938 as amended from time to time.

In case of death of Life Assured due to suicide within 12 months from the date of commencement of risk under the policy or from the date of revival of the policy, as applicable, the nominee or beneficiary of the policyholder shall be entitled to at least 80% of the total premiums paid till the date of death or the surrender value available as on the date of death whichever is higher, provided the policy is in force.

For further information, Section 45 of the Insurance Laws (Amendment) Act, 2015 may be referred.

In case you have any grievances on the solicitation process or on the Product sold or any of the Policy servicing matters, you may approach the Company in one of the following ways:

We will provide a resolution at the earliest. For further details please access the link: https://life.futuregenerali.in/customer-service/grievance-redressal-procedure

Future Generali India Life Insurance Company Limited offers an extensive range of life insurance products, and a distribution network that ensures we are close to you wherever you go.

At the heart of our ambition is the promise to be a lifetime partner to our customers. And with the help of technology, we are making the shift from not only offering protection to our customers but also providing personalized services to them.

It starts with our extensive agent base which is at the core of this transformation. Through our distribution network, we ensure that there is always a caring touch while servicing the individual needs of our customers. With this philosophy, we aim to make simplicity, innovation, empathy and care synonymous with our brand - Future Generali India Life Insurance Company Limited.

This Product is not available for online sale.

Tax benefits are subject to change in law from time to time. You are advised to consult your tax consultant

For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the policy document or consult your advisor or visit our website (life.futuregenerali.in) before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. You are advised to consult your tax consultant. Future Group's and Generali Group's liability is restricted to the extent of their shareholding in Future Generali India Life Insurance Company Limited.

Future Generali India Life Insurance Co. Ltd. (IRDAI Regn. No. 133) CIN:U66010MH2006PLC165288

Regd. and Corporate Office address: Future Generali India Life Insurance Co. Ltd, Unit 801 and 802, 8th floor,

Tower C, Embassy 247 Park, L.B.S. Marg, Vikhroli (W), Mumbai - 400083

Email - care@futuregenerali.in

Call us at - 1800-102-2355

Website: life.futuregenerali.in

UIN: 133N057V03