However, the high costs of treating life-threatening illnesses are usually more than any basic plan will cover. Further, as a report by Lloyd suggests, India remains the second-most underinsured country in the world with an insurance gap of $27 billion. This effectively means, though you are shelling a few thousands annually on your insurance package, when its need may come - it won't be beneficial. In such cases, critical illness insurance should be your go-to option. Critical illness insurance provides added coverage for common medical emergencies like strokes, cancer heart-attacks and other related diseases.

Shashtri, a computer engineer, was enjoying a good life. With a decent job, two cheerful daughters and a happy marriage, he couldn't have thanked God more. He even had functional health insurance, which seemingly, gave him the confidence of being monetarily protected from any unforeseen medical situation. Just when he thought his life was promising, he was diagnosed with stomach cancer. The fact that his medical insurance didn't cover that critical-illness, further exacerbated the situation.

Like Shastri, many presume that they are medically safe after buying a standard health insurance policy. Yet, with incidences of critical illness on a high, one can never be too sure of when a medical emergency might hit. Here, we’ll examine some alarming trends which make critical illness insurance a necessity in today’s day and age.

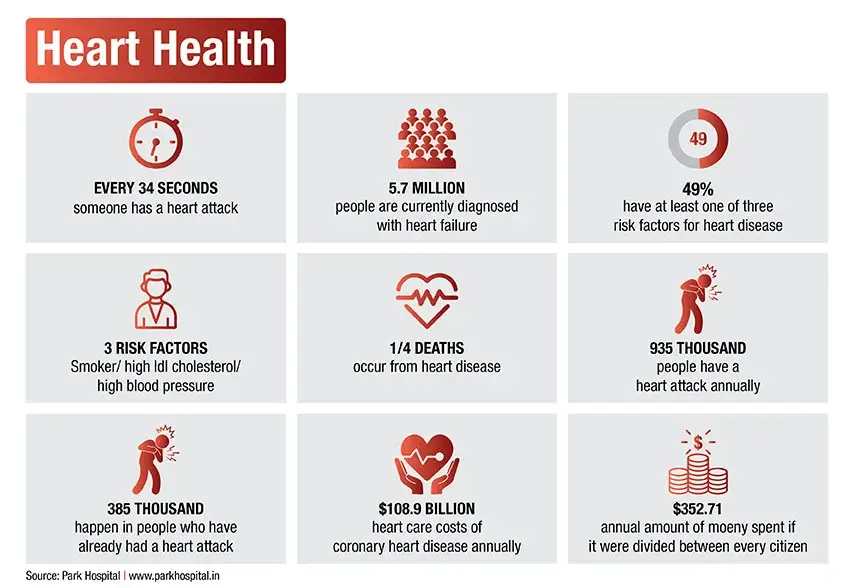

Increasing Burden of Cardiovascular Disease

Source: Park Hospital

In India, surprisingly, death from cardiac disease stands three times that of cancer. Moreover, indoor or household air pollution has been identified as a critical cause of CVDs, research papers published in the Lancet, suggests. From contributing 1/10th of total burden in the past decade, to a quarter in the present decade. Cardiovascular diseases have triggered a health alarm. More importantly, the prevalence of CVD has increased in every state of the country since 1990. Unhealthy diet, high blood pressure, obesity, high cholesterol and a higher sugar level have mainly led to ischaemic heart diseases, strokes and other critical diseases that are often not covered under the basic insurance plan. Attributed to this, and considering the changed lifestyle when compared to our elders, including a critical illness plan in your health insurance has become all the more important. Even the State-Level Disease burden study by the Global Burden of Disease (GBD) study group estimates that 28% of all deaths in India is due to cardiovascular disease, making it the largest contributor.

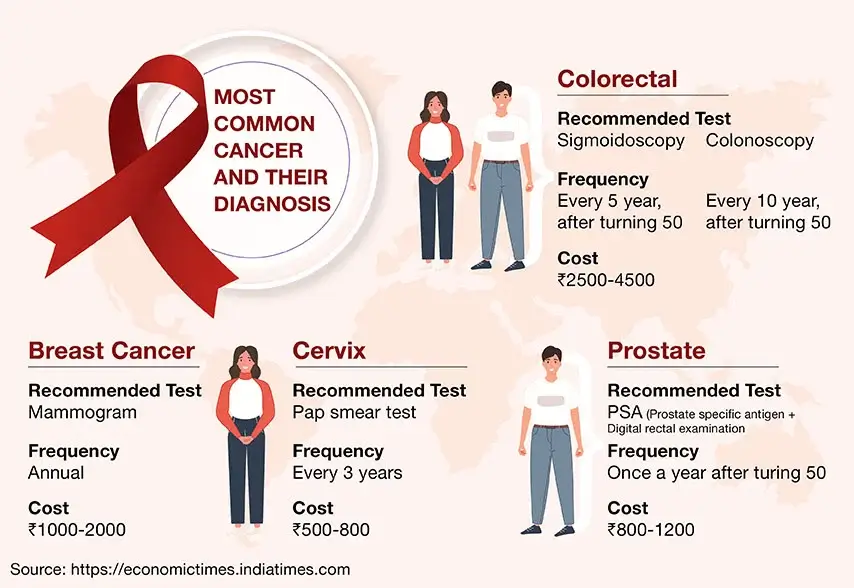

Increasing Incidences of Cancer

Most Common Cancer and Their Diagnosis

Source: https://economictimes.indiatimes.com

Over the last 26 years, the cancer burden has more than doubled in India[1]. According to the World Health Organisation (WHO) nearly 10 lakh new cases are reported in India every year. Further, the incidence is predicted to rise five-fold by 2025, and the pervasiveness is likely to increase to 19% in men and 23% in women by 2020.

In such a situation, being shielded against this disease is essential. As cancer is curable when detected early, timely scans are required, and the treatment must be appropriate. However, out-of-pocket treatment of cancer drains an individual monetarily. Owing to this, a critical insurance plan that covers cancer treatment and its related procedures adequately becomes the need of the hour.

Rising Medical Treatment Costs and a Sedentary Lifestyle

Over the last few decades, medical technology has made headway against various complex diseases. Owing to such innovations and development, it has become possible to cure diseases that were once considered fatal. However, a few treatment procedures cost so high that it becomes untenable for a middle-class person to afford the treatment. Further, the swath of government-aided hospitals has since the beginning remained narrow, with only 1.2% of GDP being the government health expenditure. In private institutions, from medicines to operations and other hospitalization charges, nothing costs less than a few lakhs. Hence, one significant way to keep yourself financially protected against medical emergencies is by buying a critical illness insurance policy that covers a range of critical illnesses comprehensively.

Although conventional health insurance will safeguard you and your family from minor health diseases and hospitalisation charges, it will not suffice against any critical illness. The trend shows that as life is progressing, the incidence of severe or critical illness is correspondingly increasing. Hence, instead of being under-insured like Shastri, it would be a wise decision to incorporate critical illness insurancein your health policy and live tension free.

References:

[1] https://www.indiatoday.in/education-today/gk-current-affairs/story/cancer-rate-india-stats-cure-treatment-1386739-2018-11-12

Comments