The family-oriented Indian society is a prime example of collectivist culture. The most important unit of society is closely-knit families. Indian families often have few earning members feeding a relatively large number of dependents. This dependence makes Indian families increasingly vulnerable to unfortunate and unforeseen circumstances.

The fear of losing a breadwinner and the natural instinct to protect your family against devastation has made life insurance policies extremely popular in India. The Indian life insurance sector is the largest in the world with over 360 million policies in existence. The $60-billion insurance market is expected to quadruple in size to $240 billion in the next 10 years, while the life insurance sector is likely to touch $160 billion in that period.

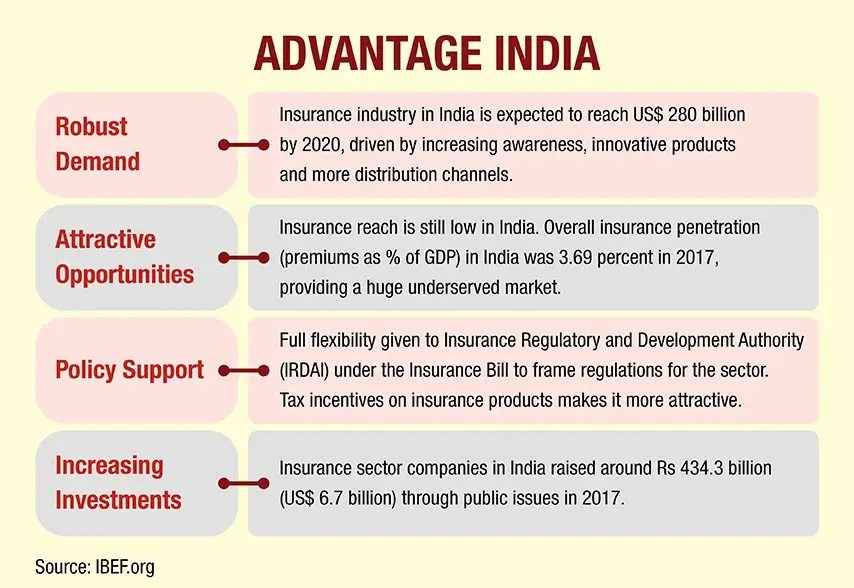

The Insurance Regulatory and Development Authority of India is an autonomous, statutory body mandated with regulating and promoting the insurance industry in the country. Over the years the regulator has taken several consumer-centric measures to protect the rights of policyholders.

Image 2Source: IBEF.org

Denial of Claims

The insurance regulator has made it clear that insurance companies cannot deny a claim just because filing is delayed. According to IRDAI guidelines an insurer cannot reject a delayed claim until the reasons for the delay are ascertained. An insurance company can reject a claim for being late only if it is sure that the claim would have been rejected even if it was reported on time. To limit claim rejections, IRDAI has barred insurers from denying claims over three years old policies, without any exceptions. Insurance companies will have to act on cases of fraud, misstatement or non-disclosure by the policyholder within the three-year deadline. After three years of commencement of the policy, it cannot be called into question.

Grievance Redressal

Insurance companies were required to provide a grievance redressal mechanism to policyholders but the procedure was ambiguous. In 2017, IRDAI notified a new set of regulations for the protection of policyholders. If a claim is rejected and the policyholder is not satisfied, he/she has to approach the grievance redressal cell of the insurance company. If the cell does not reply or resolve the problem within 15 days, the policyholder can approach the grievance redressal cell of IRDAI. A policyholder can further approach the Insurance Ombudsman or Consumer Forum/Court of Law.

Long-Term Focus

Life insurance policies are long-term instruments to provide a sense of security and protection to family members. The regulator has correlated agents’ compensation to policy tenure. Short-term policies have a lower commission than traditional products with a tenure of over 12 years. For instance, in a policy with a premium paying term of five years, the agent’s commission will be limited to 15 per cent in the first year, 7.5 per cent in the second and third year and 5 per cent after that. In contrast, in long-term policies with a premium paying term of over 12 years, the commission in the first year will be up to 35 per cent for companies over 10 years old. If the insurer has been in business for less than 10 years, it will earn a commission of up to 40 per cent.

Transparency

IRDAI has been introducing new measures on a regular basis to increase transparency in the sector which is touted to be rife with mis-selling. The new consumer protection measures notified in 2017 requires insurers to clearly state the terms and conditions for claims and coverage. Insurers also need to disclose policy exclusions upfront under three groupings — standard, policy-specific and waived under additional premium. The regulations further state that insurance companies will have to display board-approved service parameters and corresponding turnaround time on their websites.

Timelines

To make claiming life insurance hassle-free, IRDAI has defined the maximum time an insurer can take to process a claim. Within 15 days of receiving a claim, the insurer has to raise enquiries, if there are any. The insurance company has 30 days after receiving all relevant papers to pay or reject a claim. If the claim needs to be investigated, an insurer can take 90 days from the date of receiving the claim. However, the claim needs to be settled within 30 days after that. If a company fails to comply with the deadlines, it will have to pay interest at the rate of 2 per cent above the bank rate on the claim amount from the date of receipt of papers.

Conclusion

The regulator has been acting proactively to protect the rights of policyholders. The regulatory landscape is dynamic and keeps changing. Insurers will have to keep modifying their business models and products to comply with changing regulations.

References:

1.https://www.news18.com/news/business/indias-life-insurance-sector-the-biggest-in-the-world-to-grow-by-15-over-next-five-years-1337009.html

2.https://www.livemint.com/Politics/Lk8ah1PuZbV2qBbD71Kd1N/Irdai-bars-life-insurers-from-rejecting-any-claims-over-3-ye.html

Comments