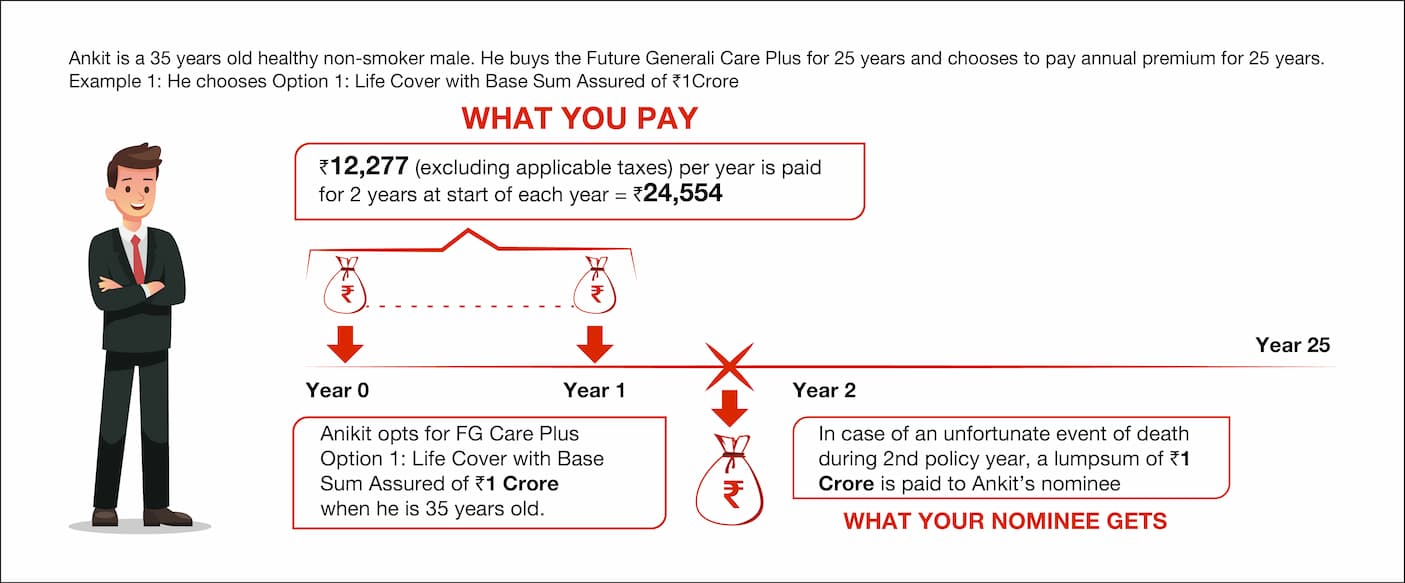

Term insurance is the most basic and cost-effective type of life insurance. It offers financial protection for the family of the life insured in return of a set amount of premium payment made for the given duration. A death benefit is provided to the insured's family in the event of the insured's death during the policy term. This plan secures your family's needs in the event of your unfortunate demise while offering high coverage at affordable premium prices. Here is one example.

Several factors make buying term life insurance worthwhile, including the following:

A term insurance policy is highly recommended for the following reasons:

How Much Does a Term Plan Cost? Calculate for FREE!

A term insurance premium calculator is a tool available online. It is specifically made to make it possible to calculate the premium amount that must be paid in order to get the coverage required. The use of term insurance premium calculator is extremely simple. If you want to get a term plan, a term insurance plan calculator can be useful. You simply need to enter the details it asks for like your date of birth, gender, amount of cover or Sum Assured, Policy Term and the years you want to pay etc.. You can adjust the parameters in the calculator basis what you think your family will require in the unfortunate event of your (life assured's) passing. Using a term insurance life calculator has a number of advantages, such as:

Time-Saving Technique - The term insurance calculator will help you save a good chunk of time. You do not need any documents to calculate premium. . The calculator will help you with the cost of term cover based on the options selected in under two minutes. Once you've chosen the cover amount, policy term, and many such criteria you can connect with our trusted financial advisor for further process.

Budgeting Becomes Simple - A person can use a term plan premium calculator to calculate how much premium s/he will need to pay according on the level of coverage they want. As a result, the person will have a clear understanding and be able to prepare their budget accordingly.

Provides a Better Idea of Coverage - If someone has a certain spending limit, the term insurance plan calculator is useful. Calculating the amount of life cover that one can buys within that spending limit is simple. The insurance buyer can also decide whether the chosen term insurance policy is sufficient to offer the family financial security in the event of an emergency. However, if the life coverage is insufficient, one can adjust the premium budget accordingly.

So, be sure to utilise the term insurance calculator sensibly. You might spend more time speculating about your premiums than it does to complete the necessary fields on the term plan calculator. It is reliable in addition to being quick and simple to use.

Tips to effectively use the calculator:

If one knows effect of various parameters on the premium for an individual of specific age, smoking status and gender, the customization can be easier. Here are some simple tips to make it easy:

Please note. your personal habits, avocation, medical history and family history can also influence the amount of premium payable.

Let’s take an example. A family of four where head of family makes the majority of the family's income. The survival of this person is important to ensure the family meets all the financial needs. If this person has purchased a term life insurance policy, in the unfortunate circumstance that S/he passes away, the term life insurance policy held can help addressing one or more of the following needs for the surviving family members:

The extent of protection depends upon the amount of cover this person has.

Hence, anyone with even one financial dependency on their income should consider purchasing term life insurance.

However, here are some examples of why one should buy term life insurance plan basis life stage or other need:

Parents - In most families, one of the parents is the sole breadwinners and provide financial assistance for their children. Hence, term life insurance is the best way to secure the financial future of the children. Upon the unfortunate demise of the life insured, the nominee receives a death benefit.

Self-Employed People - A term life insurance policy is beneficial if you fall into this category. If you are a one man show or your involvement is critical for continuity of your income stream after you, Term life insurance is a must for you. The purpose of this is to make sure your dependents' financial goals are not compromised.

Working Women - Women today work and share the financial burden equally. When she is not around, the burden falls on her partner. It is always advisable to make sure that your loved ones' financial future is protected by buying a term insurance plan. The financial support you provided can continue to be around even after you.

Young Professionals - These days many young professionals have student loans. If god forbid, something unfortunate happens to them, the burden of loan will fall on their parents. Hence, having a term insurance plan will ensure the financial burden of such loan is not passed on to the loved ones.

Further, in our society, the young professionals will have responsibility of entire family once their parents stop working. That is another strong reason for young professionals to buy a term plan.

At young age, the premium payable for buying a term insurance will also be lower and will continue to be the same amount for entire duration of the term plan.

Married Individuals - Term insurance is like a financial safety net for your spouse, if you are not around. After marriage, the responsibility increases and the spouse is fully or partly dependent on the partner, emotionally as well as financially. While we cannot compensate an emotional loss in case of an eventuality, the financial losses can be compensated to a significant extent through a term plan.

It is advised that you select income-replacement term plans instead of term plans with lump-sum payouts. This is why:

After your demise, your partner and other family members will likely already be dealing with a lot of issues, making it difficult for them to make wise financial decisions. Additionally, people cannot suddenly learn how to manage such a huge amount of money. In such a case, they might improperly handle a lump sum payout of the term plan.

Term plan payouts generally range from 10 to 15 times the life assured's yearly salary (regardless of the method of payouts), which is sufficient to guarantee that all debts (loans on homes, cars, and so forth) are paid off and that there is enough money left over to sustain the same lifestyle, for instance, sending kids to reputable schools, etc. But doing so demands considerable expertise and mental stability. However, an income-replacement plan is designed to replace full or part of your monthly salary. You can choose an appropriate sum such as to ensure that the financial situation of your family remains the same even in your absence.

There are term plans that offer some of the pay-out in the form of a lump amount and retain the remainder for monthly payouts to replace your income. If you anticipate that many debts and obligations will need to be settled quickly after your untimely death, you may want to choose these.

Similar to this, there are term plans that offer increasing monthly income, with some annual increments. Beneficiaries can better manage the consequences of inflation thanks to this tool.

Those who are nearing retirement - You may think twice about buying a term plan at this stage in your life since the premium will look too high. However, if you do not have an active term plan, a strong reason for you to look at a term plan could be to ensure your spouse has a financially independent life after you. Also, having a term plan can ensure the burden of any liability is not passed on to the family.

Before buying a term life insurance plan of your preference, it is ideal to check if you meet the eligibility standards for the same.

The eligibility criteria for a typical term plan will be as follows:

| Features | Eligibility Criteria |

|---|---|

| Entry Age Minimum | 18 years |

| Entry Age maximum | 65 years (This will vary from one plan to the other) |

| Policy Term Minimum | 5 years (This will vary from one plan to the other) |

| Policy Term Maximum | 40 years (This will vary from one plan to the other) You can find products that offer cover up to age 70 or up to age 85 or even till age 100. |

| Who is eligible to purchase? | Young individuals, Newly Married, Parents, Senior Citizen One should be earning to be eligible to buy a term plan. |

| Can NRIs purchase? | Yes (The allowability and rules may vary from one company to another) |

| Payout Options |

Note the availability of these payout options will differ from one plan to the other. |

| Add-ons or Rider |

Note the availability of rider options will differ from one plan to the other. |

| Documents Required |

|

| Medical Test | Most term insurance policies require a medical examination. Any associated medical issues are disclosed to the company via a health risk assessment.It is advisable to disclose all material information including habits, medical history and family history at the time of buying a term plan for a seamless claim process. |

The following are some key features of term life insurance plans:

| Cost-effective | Offers high coverage at low premium. |

| Long-time Protection | With a coverage that lasts up to age 70 or 85 or even 100 years depending upon the plan chosen, you can protect your loved ones. |

| Low Entry Age | 18 years Lower the age, lower the premium |

| Mode to Buy | Avail via both offline and online modes |

| Premium Payment Frequency |

As per your comfort, you have the flexibility to choose to premium payment frequency such as:

Note: The availability of one-time payment option will vary from one plan to other. |

| Customization Option | Many term insurance policies provide you the choice to tailor the plan to meet your needs. |

| Riders/Add-on Covers |

Optional additional coverage can be opted through a number of riders such as:

Note the availability of option to choose riders varies from one plan to the other. |

| Buying Process | Online and/or Offline |

| Claim Process | Online and/or offline claim process |

| Protection of Loans and/or liabilities | Yes. You can assign your term plan against a loan or liability so that your loved ones are protected from liabilities of such a loan. |

| Physical Paperwork | Depends upon company to company and mode of purchase i.e. online or offline. |

| Payout Options | One time lump sum payout Fixed monthly payouts One time lump sum payout + Fixed Monthly Payouts One time lump sum payout + Increasing monthly payouts You can check the options available in the policy you have opted for at the time of purchase. |

| Sum Assured (Min/Max) | Note: Minimum and Maximum Sum Assured will vary from one policy to the other. |

Don’t underestimate the importance of a term plan

Term insurance plan can make sure that a family's level of lifestyle can be maintained, expenses can be covered, and goals can be achieved in case of an untoward incidence with the person insured. Term insurance plans give the following benefits in addition to protecting against risk of death of the family's breadwinner:

Simple to Understand Plans - Term insurance is well-liked since it is easy to understand. If one passes away unexpectedly, the dependents would get the amount promised under a term life insurance policy. The sole requirement is that the premium be paid on time.

Safety for Loans and Liabilities - Additionally, term insurance provides protection for your dependents from your financial commitments, such as home loans, personal loans, etc.

Higher Sum Assured at Affordable Premiums - Term life insurance offer significant life cover at a reasonable cost. This insurance plan can provide compensation in the event of an income loss for a number of years.

Tax Benefits under Section 80C - As per the provisions under Section 80C of the Income Tax Act 1961, the premium you pay to buy a term insurance plan is exempt, up to a limit of Rs 1,50,000 in a year. Tax laws are subject to change.

Tax Benefits under Section 10(10D)- As per the provisions under Section 10(10D) of Income Tax Act 1961, the death benefit of term insurance plans is completely tax-free. Tax laws are subject to changes.

Additional Coverage via Riders - To receive extra benefits, you can add riders or add-ons to your term insurance policy. With different term plans, there are a variety of rider alternatives available. However, the availability of rider varies from one plan to the other.

Multiple Premiums Payment options - Many term insurance policies come with an option to choose the premium payment period as per your wish. You have the choice of selecting single (one-time), recurring, or limited payments with a term life insurance coverage. However, this varies depending on the plan.

Maturity Benefits - Since a term insurance policy is a “pure-risk” cover, it does not come with any survival or maturity benefits. However, if you want maturity benefits, then a Term with Return of Premium plan (TROP) is suggested.

In order to cater to the varying demands of consumers, insurance companies offer a variety of term insurance plans that customers can choose from. So before jumping into signing a proposal form for term insurance policy, it is important you understand the varying forms of term insurance plans you can choose from.

Decreasing Term Insurance Plans - These plans provide a death benefit that decreases in amount with time. For example, a ten year decreasing term policy with Sum Assured of 1 Lakh may offer a benefit of Rs. 1,00,000 for death in the first year, 90,000 for death in the second year, 80,000 for death in the third year and so on to pay Rs. 10,000 for death in the last (tenth) policy year. The premium for such policies is payable for limited duration, which could typically be half or two third the policy term.

Increasing Term Insurance Plans - As the name suggests, the plan provides a death benefit, which increases along with the term of the policy. The sum may increase by a specified amount or by a percentage at stated intervals over the policy term. Alternatively the face amount may increase according to a rise in the cost of living index. Premium generally increases as the amount of coverage increases.

TROP - Term with Return of Premiums Plans - Yet another type of policy (quite popular in India) has been that of term insurance with return of premiums. The plan leaves the policyholder with the satisfaction that he / she has not lost anything in case he/she survives the term. Obviously, the premium paid for such policies would be much higher than that applicable for an equivalent term assurance without return of premiums.

Group Term Insurance Plan - It is specially designed for businesses, companies, societies, associations etc. and provides term life insurance cover for all the members of the group. These policies provide the same set of benefits that an individual term plan offers. Most of these plans are offline as each policy is generally customised to suit the needs of the group taking the policy.

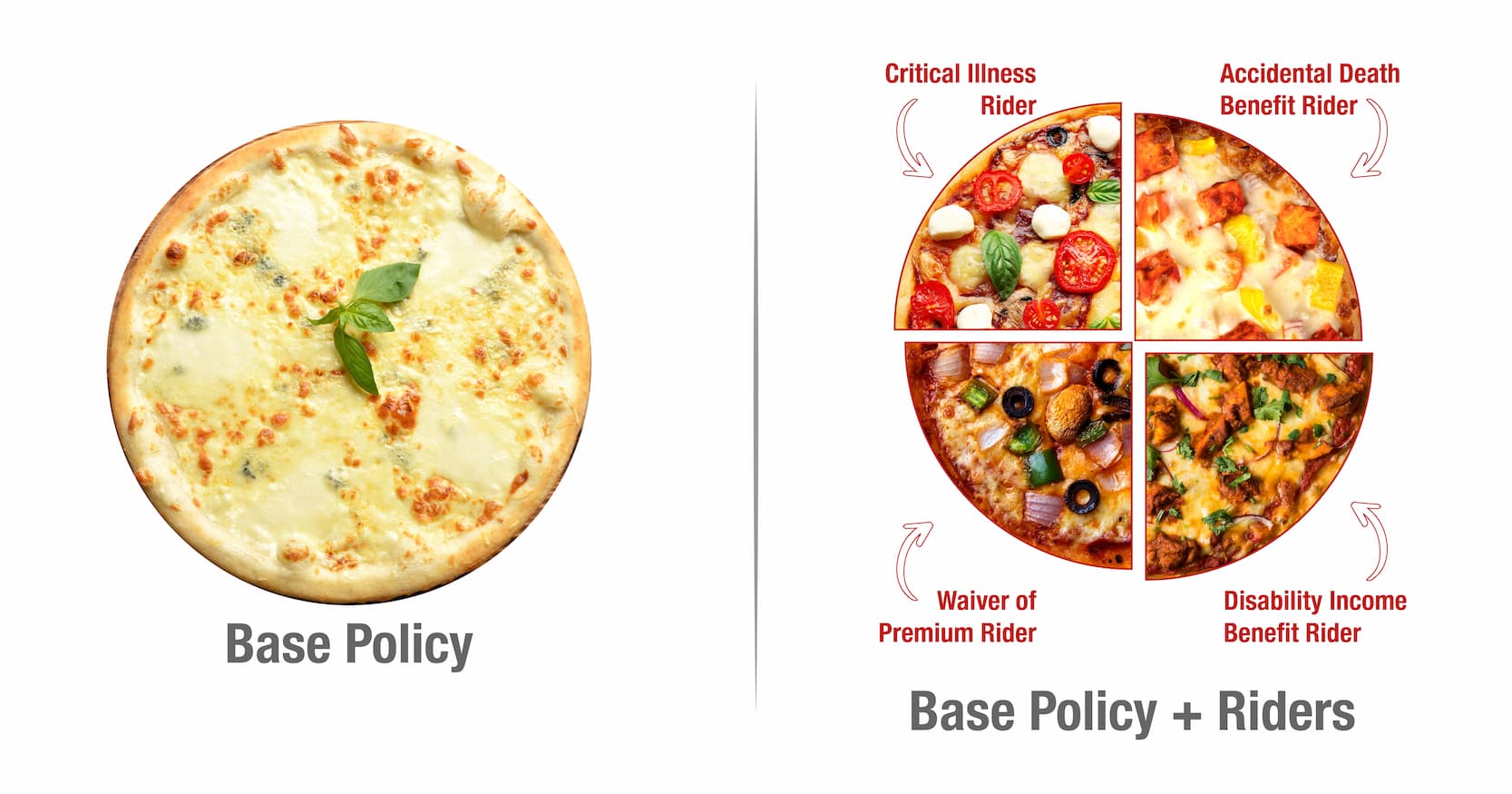

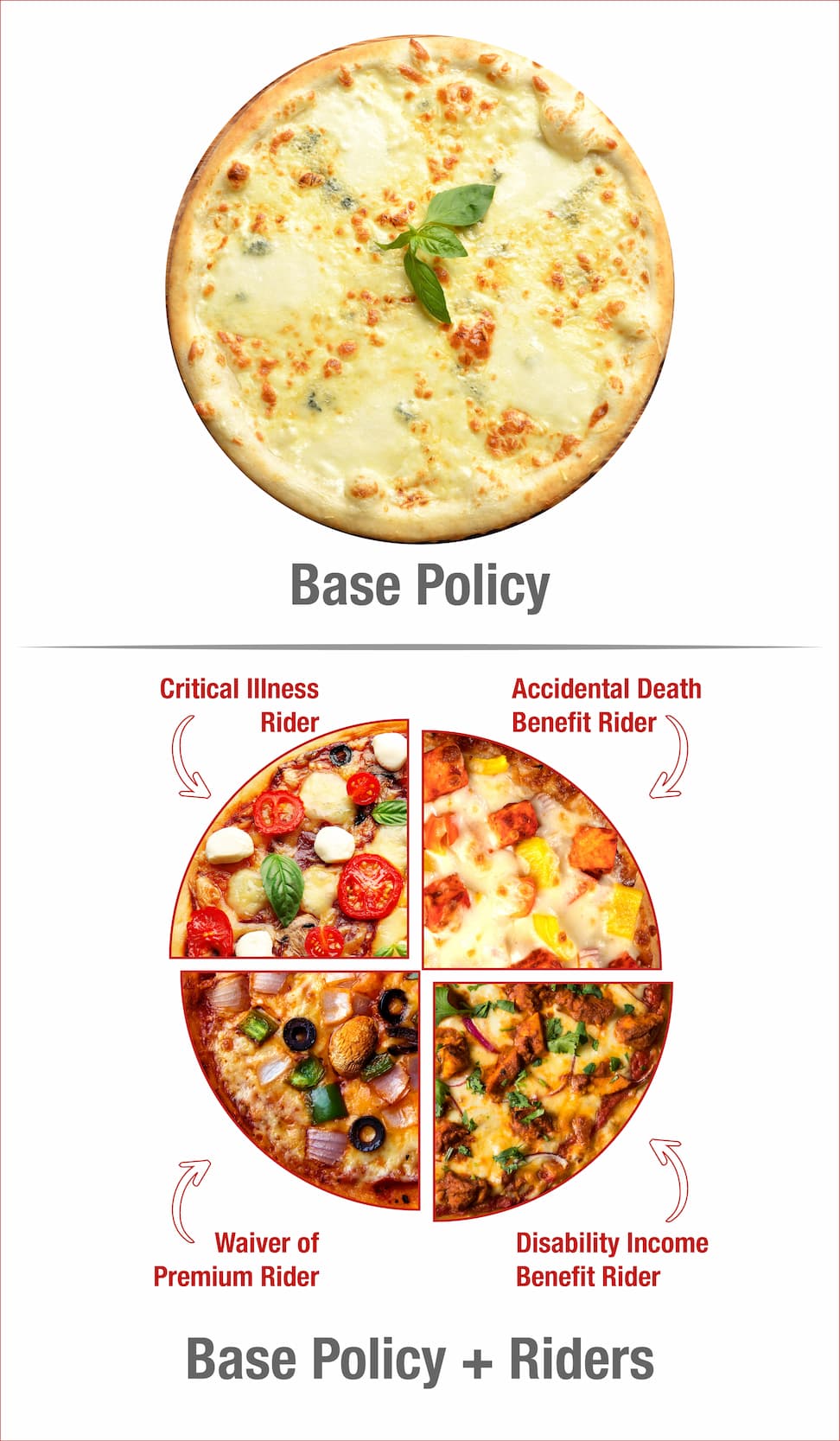

In addition to the base term insurance policy, riders offer additional coverage to the life assured. Riders are optional. You can compare riders to different toppings on a pizza. Base policies are like pizza bases, and riders are like the different toppings available to customise the pizza according to an individual’s preferences. Using riders, you can combine different needs into a single plan.

As an addition to a standard life insurance contract, riders can provide disability cover, accident cover, critical illness cover etc. The life assured can purchase these riders by opting for them as allowed under the desired plan and paying an additional premium.

Here are the most common types of riders in insurance offered by several of life insurance companies:

| Types of Riders | Description | Typical Key Features | Typical Eligibility Conditions |

|---|---|---|---|

| Accidental Death Rider | This rider covers death because of an accident. If the life assured dies as a result of an accident while the rider is in effect, additional rider benefit is paid. |

|

The criteria varies from one policy to the other. |

| Permanent and/or Partial Disability Rider |

This rider covers Partial or Permanent disability brought on by an accident that are equal to the amount assured under. People who are partially disabled are eligible to a partial sum promised if covered under the rider. |

Partial disability covers the loss of one arm, one leg, one eye whereas permanent disability will cover loss of two limbs, where limbs for the purpose could be an arm or a legs or an eye. |

The criteria varies from one policy to the other. |

| Accelerated Death Benefit Rider OR Terminal illness rider | In case the life assured is detected with a terminal illness, s/he receives a partial advance amount of their sum assured. |

|

The entry and maturity age of this rider/benefit is usually similar to base plan. The criteria varies from one policy to the other. |

| Critical Illness rider | Critical Illness rider benefit is paid when the life assured is diagnosed with any critical illnesses mentioned in the policy such as kidney failure, heart attack, cancer, stroke, etc. |

|

The criteria varies from one policy to the other. |

| Waiver of Premium Rider | In the event of the life assured contracting any of the covered critical illnesses or permanent total disability (as mentioned in the rider document) the future premium payments waived off and the policy continues. |

|

The criteria varies from one policy to the other. |

To select a suitable term insurance plan, one should look into the following factors:

Assess Life Goals and Financial Dependencies - Choosing term life insurance involves assessing your life goals first. Age and financial situation are important factors to consider when choosing a life insurance plan. In turn, it influences the duration of the policy and, therefore, the amount of life cover that is appropriate.

Evaluate Current Lifestyle - You should determine the type and the amount of coverage of term insurance you require based on your lifestyle. Your way of life involves a certain standard of living and financial practices. If you are aware of your lifestyle needs, protecting your family will be simpler.

Check for current liabilities - While selecting a term life insurance plan, liabilities and loans are also significant aspects to take into account. Sometimes people owe significant loans. If the policy term is not long enough to cover the loan repayment time or if the loan amount is more than the coverage level, your dependents may face financial hardship in case of an eventuality before such loan is paid off.

Option to add riders to the Base Plan - In addition to their standard term life insurance plan, many term insurance policies offer the ability to choose additional coverage that would help under specific or severe circumstances. A plan's scope of coverage can be enhanced by adding such optional riders. When you buy a rider, you can add it to your base insurance by paying an extra premium. However, the option to avail a rider varies from one policy to the other.

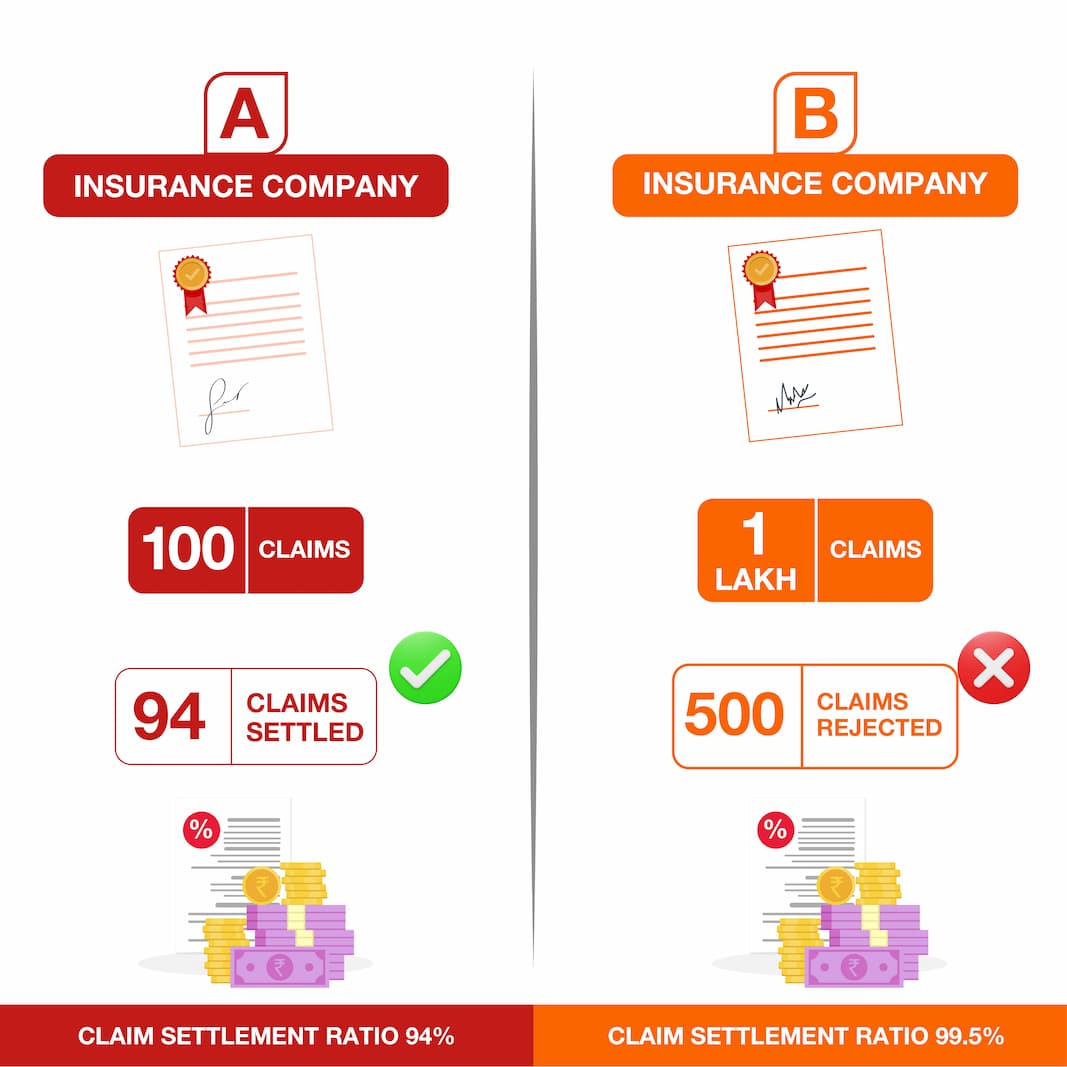

Check Claim Settlement Ratio (CSR) of the insurer - One of the elements to be taken into account is the claim settlement ratio of the life insurance provider. But when purchasing a life insurance policy, people frequently solely consider the Claim Settlement Ratio, which may not be the best route to take.

For example:

Source Video - Understand Claim Settlement Ratio

Insurance Regulatory and Development Authority of India (IRDAI) India releases the claim settlement ratio every year.

It is a myth that if the claim settlement ratio is higher, then the claim settlement process will surely be faster and easier.

The insurance regulator, Insurance Regulatory and Development Authority of India (IRDAI) does not allow any insurance company to reject a claim without any solid reason. Considering only the claim settlement ratio of the company does not help.

Also, there are processes to appeal to the Claims Review Committee of the Company in case the claimant is not satisfied with the claims decision made by the Company and further to the Insurance Ombudsman if the decision of Claims Review Committee is also not satisfactory.

Company Reliability - The Company’s reputation and financial stability are crucial for gaining the trust of customers. This is particularly accurate for the life insurance industry. Before making a choice, it is essential to research a company's reputation.

Solvency Ratio - In the event of a claim, an insurance firm with a high solvency ratio will be able to pay out. Every life insurer is required by the IRDAI to maintain a solvency ratio of 150% or above.

Ease of buying - Each and every one of us desires convenience. Customers now search for insurance plans that can be viewed as well as purchased online when buying insurance. The day when one policy document was created on paper is long gone. These days, policies are provided electronically and delivered to your email address, where they may be accessed from any location at any time.

Customer Service - When buying life insurance, be sure to study the insurance company's customer service division as well. After all, the effectiveness of the customer service will determine how quickly or slowly your issue is treated once you have purchased the policy and may have a problem.

Here are some crucial factors to take into account while determining the term insurance coverage:

Current Income and Expenses - Finding the current yearly income and total expenses is the first step in figuring out how much term insurance is needed. Experts in the field recommend that a term cover be 10 to 15 times your annual income. For instance, it would be wise to choose a Rs. 1 crore cover if your yearly income is 10 lakhs.

Current and Future Liabilities and Assets - It is crucial to take the loans and liabilities by the insurance buyers into account when calculating the term life insurance plan's sum assured value. Examples of these loans are home loans, personal loans, auto loans, etc. Additionally, /monthly commitments towards assets including savings such as fixed deposits, ULIPs, gold, and capital markets, among other things should also be considered. It is always important to include recurring and planned savings while defining the coverage amount of the term life plan.

Future Financial Goal for Family and Self - The term insurance buyers should consider “how much coverage they require” over “how much of the premium they can afford to pay” for the policy to guarantee the financial future of their loved ones and family while keeping the long- and short-term financial goals of life in mind.

Make Use of Human Life Value Calculator - Human life value calculators are provided by a number of insurance companies. It aids policy buyers in developing an understanding of the amount of sum assured they need for a term policy. Based on the straightforward time value of money formula, the human life value calculator determines the sum assured amount. To determine the sum insured amount that one needs to opt for, a person only has to provide a few details, such as his/her current age, expenses, income, and expected inflation rate. Hence, it is highly recommended to use the human life value calculator to determine the appropriate coverage amount for you.

Here’s how term insurance policies work:

Death Benefit/ Life Cover:

In the case of the unfortunate event of the life assured's demise, the sum assured or the death benefit is paid to the nominee of the life assured and policy gets terminated.

Maturity Benefit:

Since a term insurance plan is a "pure-risk" cover it does not offer maturity benefit if the life assured survives till the end of the policy term. However, only in the case of "term insurance with return of premium plan" - at the end of the policy term, if the life insured survives s/he is paid the promised maturity benefit, which is the total premiums paid excluding taxes, extra premium, rider premium etc.

The right term life insurance plan will depend on your needs. But before buying the right term insurance plan you should consider these factors:

1. Cost of Premiums -

2. Eligibility Criteria

As discussed, the eligibility for a term life insurance plan may vary from insurer to insurer. However, the standard minimum entry age is 18 years while the minimum age limit to opt for a term insurance plan is typically 65 years.

3. Availability of Cover Amount -

| Age | Cover Amount |

|---|---|

| If you are between 25 to 35 years | It should be approximately 20X of your annual income |

| If you are between 36-45 years | It should be approximately 15X of your annual income |

| If you are between 46-55 years | It should be approximately 10X of your annual income |

4. Types of Term Insurance Payouts

As the policyholder, you can decide on the payout option of the death payout to your nominee depending on the type of option chosen by you at the time of purchase. You can opt for a lump sum, lump sum monthly income, or income replacement or monthly income, as allowed in the policy you choose based on your requirements.

For example- Sum assured= 1 crore Payout= Rs.1 crore as a lump-sum payment to the beneficiary of the policy.

For example- Sum assured= Rs.1crore, Lump Sum Payout= Rs.50 lakhs at the time the claim is made to the nominee and Rs. 53,690 every month to the Nominee for next 120 months as a death benefit. The total amount payable can increase since the payouts are made in instalments instead of a lump sum.

For example- Sum assured= Rs.1 Crore Payout= Rs. 1,07,380 per month (about Rs. 12.88 lakhs yearly) for 120 months.

The amount shown above can change from policy to policy.

Life insurance premium rates are computed through an underwriting process that employs the use of various statistical and mathematical calculations around the insured person. Some of the major parameters while calculating premium rates are:

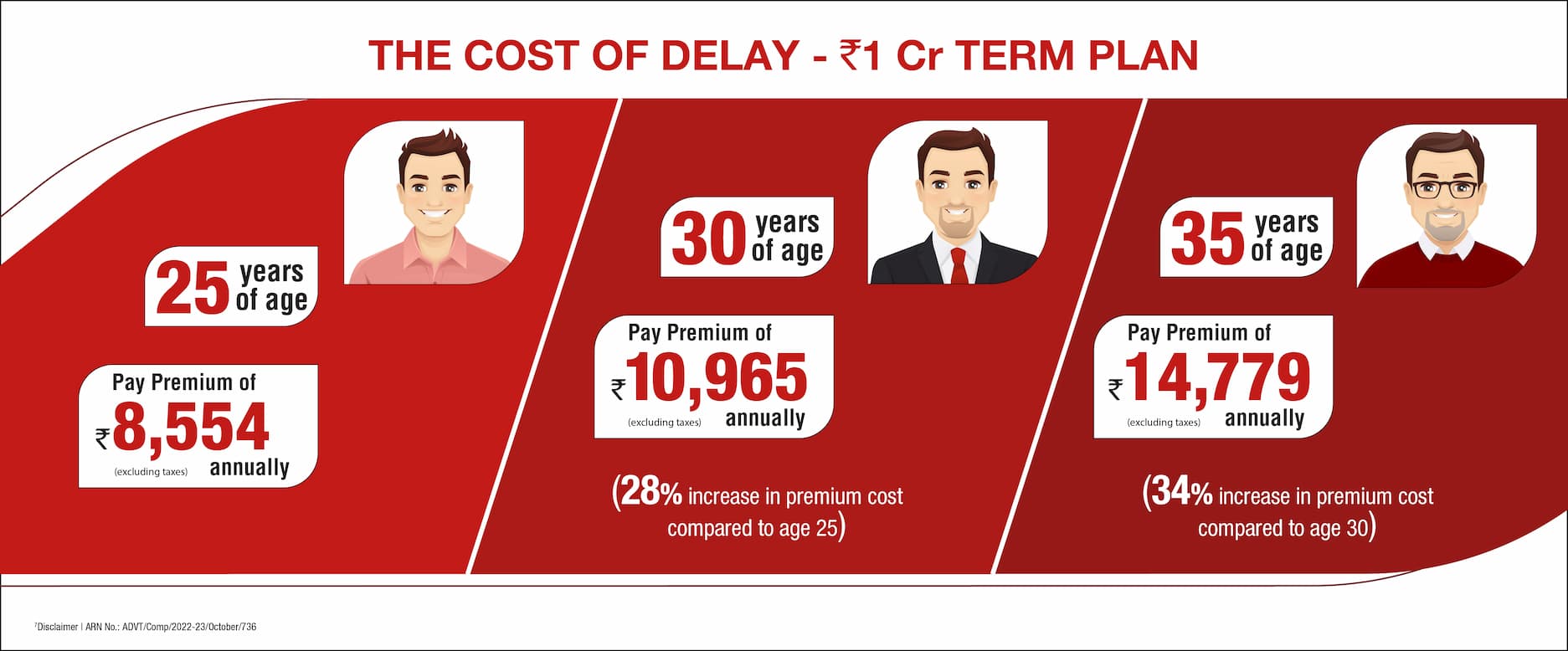

Age - Younger individuals are at lower risk of death or getting life-threatening diseases. Therefore, younger people are offered lower premium charges than an older person.

Gender - As per various studies, women tend to live few years longer than men. So, many insurers charge a lower premium to women because they have a higher probability of surviving few more years compared to men.

Family’s Medical History - An Individual whose family has a history of ailments such as diabetes or heart attack etc. has a higher probability of contacting or diagnosing diseases which can have a hereditary effect. Thus, if there is a family history, it can increase premium amounts.

Smoking and Drinking Habits - The premium rates for smokers and alcohol users may be more in comparison to non-smokers.

Policy Duration - If the policy term is longer, then you will end up paying a high amount of premiums as the insurer will have to cover your life for higher risk. And, a small policy tenure will have a low rate of premium as compared to a longer one.

Occupation - Individuals working in a high risk industries such as shipping, transport, gas, mining, oil, etc. are at higher risk of accidents or other occupational hazards. Thus, in such cases, the premium rates may be higher basis the exact nature of duties, for example working in a mine vs handling a desk job in a mining company.

The amount of premium payable for term insurance and the duration for which it is payable are important parameters that govern the purchase decision. The policyholder should always make the selection as per their preference, requirements and future goals. Many term plans offer different premium payment options such as regular pay, limited pay, and single pay.

Individuals opting form Regular or Limited Pay option are recommended to setup auto payment methods such as NACH or standing instructions to ensure that a premium is not inadvertently missed.

Term insurance plans also referred to as protection plans. Such policies usually have a time period assigned to them, also known as the “policy term” of the plan. In case the life assured dies during this policy term, the nominees listed under the insurance policy receives the sum assured of the policy.

In exchange for this guarantee, a specific sum of money called “premiums” is payable at defined dates.

The sum assured of the policy is the coverage the policyholder agrees to at the time of purchasing the policy. It should be noted that pure term policies do not have a maturity value. This means that in case the plan completes its term and the life assured is still alive, no benefit will be paid to the nominee Due to the same, term plans are usually the cheapest form of life insurance policies available to customers.

With our lives becoming highly uncertain, unfortunately, we can’t guarantee that we'll be around our loved ones to provide for them forever. Yet, we can help them by planning for their future with term insurance. Term insurance provides financial security in the event of uncertainty and gives the peace of mind knowing that our loved ones will be supported, no matter what happens.

It is all the way more important if you are the sole bread earner of the family or living in a nuclear family. No matter how much you have saved over the years, sudden eventualities, tend to affect your family financially, apart from the enormous emotional loss. So, put simply, while emotional losses cannot be compensated, term insurance is the ultimate way to compensate for the financial losses or hardship for the family and show your family how much you care for them.

The following are the key features of the term insurance policy:

In the case of the unfortunate event of the life assured's demise, the Sum Assured or the death benefit is paid to the nominee of the life assured and policy gets terminated.

However, many life insurance companies provide various options in death benefit payout such as:

In exchange for the life cover offered by the life insurance company, a specific sum of money called “premiums” is paid by the policyholder at fixed intervals to the insurance company.

The policyholder can choose to pay the premium on yearly, half-yearly, quarterly, or monthly basis.

As the name suggests - add-on is an additional coverage added to your base policy. Add-ons also called as riders are very useful when an unexpected event takes place with life assured. At very minimal premiums, they expand your coverage. A single plan can include additional benefits like critical illness rider, waiver of premium rider, income on disability rider, accidental death rider, and so on. However, the availability to choose a rider varies from one plan to the other.

Term insurance riders are extra additions that can be added to an existing term insurance plan at reasonable premium rates. These riders provide the policyholder with more coverage, which increases the policy's value. There are numerous types of riders available, some of them are as follows:

The majority of the riders are reasonably priced. There is no cap on how many riders you can add to your base term insurance policy, but the total premium for all of them combined cannot exceed 30% of your base premium. In case of health riders, the rider cost can be up to 100% of your base premium for term plans.

The benefits of purchasing a rider are as follows:

Yes, you are allowed to purchase multiple-term plans in order to achieve your goals in life. Purchasing more than one term insurance plan is undoubtedly advantageous in terms of the variety of death benefit payment options, affordable premiums, riders, coverage, straightforward claim settlement, and tax exemption under ITA Section 10(10D). However, one must evaluate in case there is any advantage of premium applicable by combining the Sum Assureds under one policy if the intent is to buy two policies simultaneously.

Here are the documents required to submit when buying a term plan online:

In addition to these, if the insurance company requires any other documents they will ask for it.The list of documents required can vary from company to company.

Determine your objectives, needs, the number of dependents you have, your outstanding loans, etc., before choosing the appropriate term insurance plan. You will be in a better position to narrow down the options once you have an idea of the benefit amount you will need to maintain future liabilities. It's crucial that you choose one that provides the death benefit matching your needs at a premium that is both reasonable and within your budget.

Experts recommend that a term cover should be 10 to 15 times your annual income. For instance, it would be wise to choose a Rs. 1 crore cover if your yearly income is 10 lakhs. However, here are some factors that you should consider:

The life assured does not receive any benefit or returns in case s/he survives the policy term, unless the policy has a return of premium benefit included.

All term insurance plans offer coverage against COVID death claims. The only exclusion that typically term plans will have is death because of suicide within one year from the date of commencement of the policy or date or reinstatement of lapsed policy, whichever is later.

Smoking may increase your risk of developing cancer or heart disease or lung diseases, among other diseases. Smokers therefore have a greater mortality risk than the non-smoking individuals. Hence, term insurance companies charge smokers a higher premium to help cover their higher mortality risk.

It is crucial that you provide the insurance with the necessary information. You are required to identify yourself as a tobacco user, even if you only smoked a few cigarettes for the insurance company to assess the risk on your life basis the facts. If it is later discovered that the information was hidden, the insurer has the ability to declare the policy null and void and without any benefits.

There is no particular date that is best suited to buy a term policy. You should get a term insurance as soon as possible. People in their 40s typically pay greater premiums than those in their 30s or 20s. No matter of your age, whether you are in your twenties, thirty, or beyond, purchasing insurance commensurate to your income levels is a smart move.

The term insurance generally provides coverage for any type of death, including those that are natural, accidental, or caused by illness.

The only exclusion is suicide within one year form the date of commencement of policy or date of reinstatement of a lapsed policy, whichever is later.

The policy you select will determine everything at inception. With term insurance, the initial price, the amount of coverage, and other factors are fixed for the duration of the policy. If your policy lapses, the insurance company can do a re-assessment of risk and may change premium amount and/or terms of coverage upon any adverse findings.

The base premium of a term plan is covered under section 80C of Income Tax Act, 1961. If you have opted for a health-related rider such as critical illness coverage with term insurance plans from the life insurance company, you can avail of tax benefits under section 80D of the Income Tax Act, 1961 on the premium payable for such a rider. Please note, tax laws are subject to change.

Yes, under Section 10(10D) of the Income tax act the term insurance claim amount also called as the death benefit payout is tax-free for individual life policies. However, it should be noted that tax laws may change.

Term life insurance plans provides much needed financial protection to the family in case the insured dies unexpectedly, thus peace of mind.

It also provides tax exemptions and deductions in addition to the death benefit amount to the family of the deceased life assured. For example, Section 80C of the Income Tax Act allows the policyholder to claim tax deductions of up to Rs 1.50 lakhs on policy premiums. Additionally, Section 10(10D) of the Income Tax Act offers tax-free death benefit payout to your loved ones.

Term insurance is designed to help you secure your family in case of an unfortunate incidence. For wealth creation, you should choose savings plans that allow wealth creation along with insurance cover.

You will find options for wealth building like guaranteed plans, ULIPs, traditional plans that pay bonuses etc.

Yes. The policyholder is given the choice to choose the frequency of payment while buying the policy. There may be times when you want to alter the frequency of premium payments, in such times you can reach out to your life insurance company to process the same. The change of frequency is typically allowed and effective from annual policy anniversary.

Ideally, it is advised that you purchase a term insurance policy only till the time you have even a single dependency on your income that requires replacement in your absence. Thus, the maturity age of 60 to 70 is recommended.

There are term insurance policies that allow cover for longer duration like up to age 80 or 85 or even 100 years of age. You can take a call basis your preference. However, keep in mind, longer the term, higher the premium.

| Policy Term (years) | Annual Premium excluding GST Rs. | Increase in premium compared to premium applicable for Policy Term 25 years |

|---|---|---|

| 25 | 12,277 | 0.0% |

| 30 | 13,503 | 10.0% |

| 35 | 14,779 | 20.4% |

| 40 | 16,236 | 32.2% |

| 45 | 17,787 | 44.9% |

| 50 | 19,296 | 57.2% |

As can be seen, if the term chosen is 50 years as compared to 25 years, the premium increases by over 57%.

As long as you make your premium payments on schedule, they will usually continue to honor your policy. However, it is advisable to notify your insurance company in writing if you decide to move out of India.

Yes. You have complete freedom to change the name of your nominee after purchasing a term insurance policy any number of times till the end of policy term. For example, after getting married, you might want to include your spouse or kids on the list of nominees.

Even if you are protected by the group insurance plan offered by your employer, it is a good idea to obtain an individual term plan. Group term insurance coverage amounts are typically not very high and may not meet the desired level of protection you desire for your family. You can look out for an individual term plan, which may be one of the unique plans tailored to meet your specific needs. Your promised sum and the manner in which your nominees will be paid are both up to you. Individual policies provide continuous coverage, unlike group plans provided by the employer, which will not cover the risk upon separation. You and your family may face a serious financial risk if you decide to leave the group. Whether or not you decide to change jobs at any time, you may always benefit from improved coverage with both an individual and a group policy.

To pay your missed premium, you get a grace period of 30 days for yearly, half-yearly and quarterly premium payment frequency and 15 days for monthly premium payment frequency from the due date. During these days, you will continue to be covered and be entitled to receive all the benefits subject to the deduction of due premiums till the following policy anniversary. If any instalment premium remains unpaid at the end of the grace period, the policy shall lapse and the protection of life insurance cover will cease.

The first step to ensure a smooth and hassle free claim settlement is providing all material information accurately to the insurance company at the time of application/proposal and subsequently at the time of any medical examination or filing out a medical questionnaire etc. According to Section 45 of the Insurance Act, a life insurance company cannot reject or deny a claim three years after the issuance of a policy in order to protect the interests of policyholders. However, it is crucial that they the nominee(s) be aware of the claim process in general so that your loved ones do not experience any pain at the hands of the insurance company. Make sure the individual you designate for your policy has complete awareness of it when naming a nominee or beneficiary.

The two escalation levels are Claims Review Committee of the Insurance Company and then Insurance Ombudsman in case the nominee is not happy with the claims decision.

Yes. A 15-day free-look period applies to term insurance policies also after the day you receive the policy document. During this time, you can cancel the policy and receive a refund of your premium if you do not agree of any of the terms and conditions. There may be some deductions involved like stamp duty, cost of medical examination, if any, proportionate cost of risk cover till date of such cancellation request etc.

For electronic policies, the freelook period is 30 days.

If payments are paid during the grace period, there is no interest applied to the payment. Should you miss the grace period also, you can be liable to pay an interest as defined in your policy document.

The answer is no, you cannot change the insurer of your term insurance policy while the policy is still in effect. You may buy a term policy with another insurer and terminate the existing one in case you are not happy and decide to switch at any cost.

The cost of term insurance is impacted by a variety of factors, including the applicant's age, gender, weight, health, and lifestyle choices like smoking and drinking, family history and so on.

Surrender value is simply the sum of money that an insured policyholder is entitled to in the event that they want to terminate their life insurance policy prior to its scheduled expiry and provided that the Company has some money that belongs to the policyholder.

In term plans, surrender value is typically payable in case of single premium term plans and limited pay term plans subject to conditions defined in the policy terms and conditions. The final surrender value that is paid to the insured may be less than the total premiums paid. There is no surrender value available for regular pay term plans.

Term plans with return of premium (TROP) will have a surrender value.

The risk cover starts from the date of issuance of policy. According to the terms and conditions of the policy, the death benefit will be paid out upon death after the date of commencement that is recorded in the policy document.

However, it is important to note that in case of death because of suicide within one year from the date of issuance of policy or date of reinstatement of the policy, whichever is later, only 80% of premiums is refunded.

ARN No.: Comp-September-2022_880.