Shirin has just begun her career with a marketing firm, and she plans to make a saving investment that can provide some tax benefits too. As an investment rookie, she decided to go by word of mouth and purchased a particular unit-linked insurance policy (ULIP). Although ULIPs are very popular investment instruments, she realized that the fund value of the policy was stagnant and couldn’t reap any considerable benefit over the total premium paid. Blindly following the crowd impacted the return on her investment. Had she thought through her decision to purchase the suggested ULIP by doing some careful individual research, she would have overcome the cognitive bias and made better gains.

What is cognitive bias?

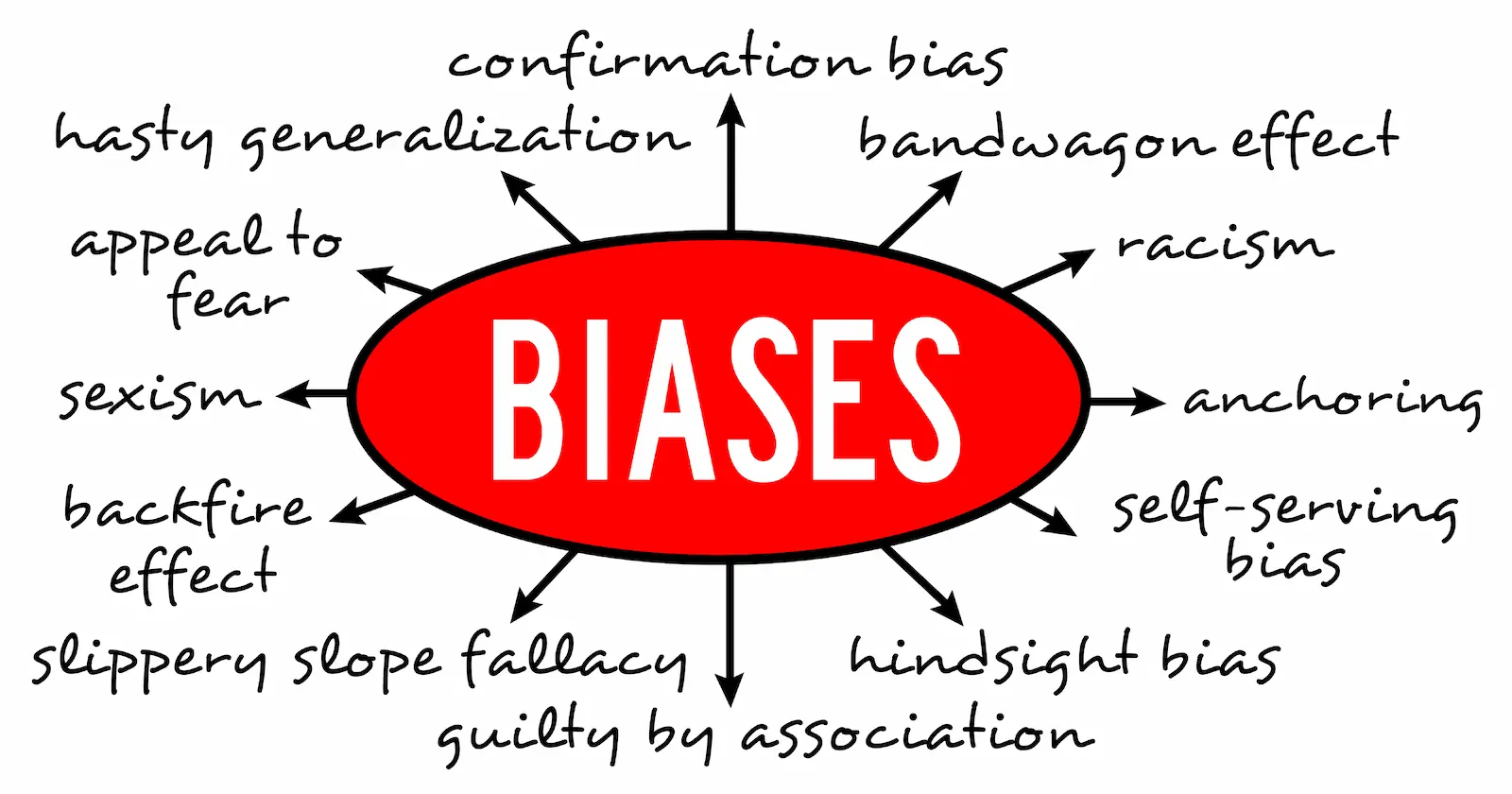

As humans, biases exist, and these biases also intrude into our investing decisions.

Most investment decisions are influenced by behavioural biases - cognitive and emotional. A cognitive bias is an unconscious bias that entails a decision arrived on the basis of a convention or thumb rule which may or may not be factual. On the other hand, an emotional bias can lead to an investment decision based on the investor’s intuitive feelings.

Investing is a risky business, but it can be rewarding when the right investment choices are made. Right investment choices are hard to come by, without prior individual research that can infuse reason and punch holes into any preconceived notions on investment. Here are a few common cognitive biases that can hurt an individual’s investment decisions:

Confirmation Bias

This bias can lead an individual to identify with only that information which confirms his/her beliefs. Potential investors feel vindicated when their beliefs get positive traction and are reflected in the information that they seek. However, failing to see information that does not subscribe to the investor’s conviction can be detrimental and can lead to making the wrong decision.

Risk-Aversion Bias

It often leads investors to play safe and avoid risks by investing in lower return instruments during uncertain times. Investors prefer a sure shot, lesser return with predictable risks to higher returns with unexpected risks.

Band-Wagon Effect

The tendency to find comfort by subscribing to something that most people also believe in, which may be perhaps, right or wrong. With this bias, the investor misses out on the independent analysis and judgement and hesitates to take the road less travelled, even if it is right. Most speculative bubbles are consequences of this bias. Instead, exhaustive research of the investment can bail the investor out of the bias and lead to profitability.

Narrative Fallacy2

This bias causes the investor to make an investment decision that’s driven by a good, successful and relatable story. If the investor can relate to the success story of the investment, he/she will prefer the story to be overshadowed by facts and rationality of the investment choice. This irrational decision can lead to poor outcomes.

Recency Bias

It is an inclination towards endorsing the latest available information without weighing its pros and cons. For instance, mutual fund investment is the latest investment trend in India and mutual funds are touted as superior investment products over insurance plans. However, the point missed by the investor is that insurance policies like ULIPs too, rely on market-based performance, just like mutual funds, in addition to providing life cover during emergencies. Most insurance products like the ones under the Future Generali India Life Insurance cover various needs of an individual’s life like buying a vehicle, child’s education, health and pensions, in the form of life insurance with guaranteed benefits and accumulation of life-long savings. Thus, it is important to carefully observe the long-term trends of a product before investing in it, rather than blindly following the recent trends.

Anchoring Bias

This is a belief in the first piece of information that you encounter, and a tendency to use this information as an ‘anchor’ or a reference point for all subsequent data that may further lead to distorted investment decisions. A simple example of this bias would be the stock prices. Most people base their investment decision on the basis of the current stock prices, instead of studying the trading history of the stock. The fact of the matter is that the stock prices change and having a range of well-researched investment choices is essential when the stocks perform below par.

Overcoming Cognitive Biases

Overcoming these biases is a challenge, but it can help make sound investment decisions. It is important for the investor to keep in mind that his/her investment decision will not just impact him/her, but also others related to the investor. This shall inculcate practical mindfulness in the investor to undertake some exhaustive research and rational analysis in reaching the decision. At times, a quick peek into the investor’s past for similar situations, or a reliable outsider perspective on investment also brings clarity in arriving at the right investment decision. Decision-making is a never-ending process in life and approaching the investment opportunities with a pragmatic perspective can put the investor on an upward growth trajectory.

Comments