Double taxation is a situation where an income is subject to tax twice. This can occur in one of two ways - economic or juridical. Economic double taxation occurs if an income or a part of it is taxed twice in the same country, in the hands of two individuals. Alternatively, juridical double taxation occurs if income earned outside India is taxed two times in the hands of the same individual, once abroad and once in their home country. This unique situation puts an undue burden on the taxpayer when their income is taxed twice.

Types of Double Taxation

There are mainly two types of double taxation:

- Corporate Double Taxation - This refers to the taxation on corporate profits through corporate taxation and dividend taxation (imposed on dividend pay-outs).

- International Double Taxation - This refers to the taxation of foreign income in both the country where the income is derived and the country where the investor resides.

What is DTAA (Double Taxation Avoidance Agreement)?

Many times, if you live abroad and have an income source in India, you will be taxed in both your country and the place you reside. Thus, India has implemented the DTAA (Double Tax Avoidance Agreement) policy.

It is a tax treaty that India signs with another country in order to avoid double taxation. Using this treaty, an individual can avoid being taxed twice. DTAAs can either be comprehensive agreements, which cover all types of income, or specific agreements, which target only certain types of income.

For instance, there is a DTTA (Double Taxation Avoidance Agreement) between India and Singapore under which income is taxed based on the residential status of the individual. This streamlines the flow of taxation and ensures that the individual is not taxed twice for the income earned outside India. Currently, India has DTAAs in place with more than 80 countries.

Many people believe that the DTAA will allow them to avoid paying taxes altogether, but that is not true. Since the DTAA allows for a rebate, not a total deduction, NRIs can decrease their tax implications when they earn income in India.

How is Relief Against Double Taxation Provided under the Income Tax Act?

There are many cases in which residents have paid income tax to another country on their foreign income but are also required to pay tax in India on that same income. Relief from double tax is available in such cases.

The Income Tax Act 1961 contains two Sections (Section 90 and Section 91) that provide relief from double taxation.

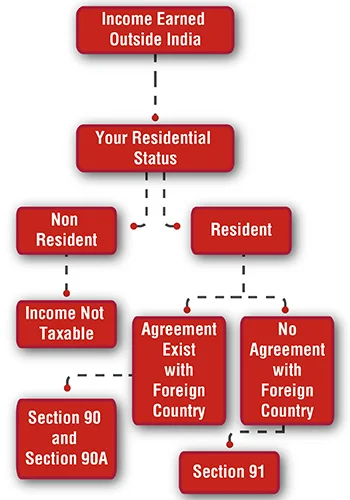

The following diagram illustrates the application of Sections 90 and 91:

Source:https://taxguru.in/income-tax/relief-case-double-taxation.html

Source:https://taxguru.in/income-tax/relief-case-double-taxation.html1. Bilateral Relief Covered Under Section 90

Double Taxation Avoidance Agreements grant relief in two ways under Bilateral relief covered under Section 90. The relief is offered in two ways.

A. Exemption Method

The exemption method ensures that you will not be taxed twice. That is, if an income earned outside India has been taxed in the relevant foreign country, it is not subject to tax in India.

B. Tax Credit Method

According to this method, the individual or the corporation can claim a tax credit (deduction) for the taxes paid outside India. This tax credit can be utilized to set-off the tax payable in India, thereby reducing the assessee’s overall tax liability.

Double Taxation Relief Example - Tax Credit Method

According to the DTAA between India and Germany, interest is taxed at 10%, whereas under Income Tax Act 1961, it is based on slab rates for individuals and HUFs, and flat rates (generally 30%) for other assessees (firms, companies, etc). In this case, one can follow DTAA and pay tax at 10% only.

Despite the fact that there are few things an individual taxpayer can do to avoid double taxation, the Income Tax Act itself contains provisions for individuals whose income is likely to be taxed twice. Double Taxation Avoidance Agreements (DTAAs) are the basis for this relief measure.

2. Double Taxation Relief - Unilateral relief Covered Under Section 91

Section 91 of the Income Tax Act, 1961 provides for unilateral relief against double taxation. According to the provisions of this section, an individual can be relieved of being taxed twice by the government, irrespective of whether there is a DTAA between India and the foreign country in question or not. However, there are certain conditions that have to be satisfied in order for an individual to be eligible for unilateral relief. These conditions are:

- The individual or corporation should have been a resident of India in the previous year.

- The income should have been accrued to the taxpayer and received by them outside India in the previous year.

- The income should have been taxed both in India and in the country with which there is no DTAA.

- The individual or corporation should have paid tax in that foreign country.

Thus, by utilising the provisions of DTAAs and the relief measures offered under the Income Tax Act, individuals earning income from other countries can minimise their tax liabilities and avoid the burden of double taxation.

Incomes on Which DTAA Allows Tax Rebate

NRIs can take advantage of the Double Tax Avoidance Agreement or DTAA to deduct double taxes paid on income earned from the following sources:

- The salary received in India

- Fixed deposits in India

- Capital gains earned on asset transfers in India

- House property situated in India

- Services offered in India

- Indian savings bank account

In the event that income from these sources is taxed in the country you currently reside in, then you can take advantage of the DTAA benefits to avoid paying taxes in India.

Benefits available under DTAAs

There are lots of benefits associated with DTAA for taxpayers. The basic benefit includes not having to pay double taxes on the same income. Apart from this,

- According to these treaties, each country determines its own resident status in accordance with its domestic laws. When a person qualifies for tax residency in both countries, the treaty may provide a tiebreaker. As an example, a PIO could qualify as an Indian tax resident if his/her stay in India exceeds a specific threshold. Additionally, they may be considered US tax residents by virtue of their citizenship. In this case, the tiebreak rule under the India-USA DTAA comes into play, and it may occur that the person qualifies as a tax resident of the United States.

- Those who are tax residents of countries with which India has DTAAs can claim tax exemptions under these agreements and their tax liability in India will be limited to the extent of taxing rights permitted by the DTAAs. Even if the scope of taxation under the Indian income tax law is wider, such individuals may benefit from the treaty by virtue of section 90 of the Indian Income-tax Act, 1961, subject to certain procedural requirements, such as submission of Tax Residency Certificates (TRC) of the other country.

- However, if a person qualifies as a tax resident of India both under the Indian law and the relevant treaty, then India will have residual powers of taxation, subject to the limited rights granted to the other country under the treaty.

- Foreign Tax Credit (FTC) in India - Once an NRI or PIO qualifies as an Indian tax resident, he/she will be eligible to claim credit of taxes paid in other foreign countries in his/her income tax return filed in India, subject to certain conditions and procedural compliances prescribed in rule 128 of the Income Tax Rules. FTC is allowed in the year when the corresponding income is taxed in India. Form 67 along with documents supporting payment or deduction of tax in other countries will be required to be submitted by the individual.

To claim FTC, one needs to provide a certificate or statement that specifies the nature of income and the amount of tax deducted from or paid by the assessee. You can obtain one of the following:

- From the tax authority of the country or the specified territory outside India; or

- From the person responsible for deduction of such tax; or

- signed by the assessee (along with an acknowledgement of online payment or bank counterfoil of challan for payment of tax where the payment has been made by the assessee or proof of deduction where the tax has been deducted).

It may be noted that FTC is allowed only in respect of taxes paid in other countries in accordance with the applicable DTAA and any excess foreign tax will be ignored. Also, FTC will be limited to the extent of taxes payable in India.

- Lower Withholding Tax (Tax Deduction at Source or TDS) - Lower withholding tax is a plus for taxpayers as they can pay lower TDS on their interest, royalty or dividend incomes in India, while some agreements provide for tax credits in the source or country of operations so that taxpayers don’t pay the same tax twice. In some cases, such as agreements with Mauritius, Cyprus, Singapore, Egypt etc. capital gains tax is exempted which can be a boon to taxpayers as they can use the DTAA agreement to minimise taxes

The overall process of FTC in India has been streamlined pursuant to introduction of the rules with effect from April 2017 and taxpayers can avail benefit of such credit to avoid the burden of double taxation to the extent legally possible.

How to Use Benefits Under DTAA (DTAA methods)

To claim benefits under DTAA, you can use the following methods:

- Exemption: With this method, tax relief may be claimed in either country (country where you reside or India).

- Tax Credit: Under this method, tax relief can be claimed only in the country where you live.

DTAA Rates

The double taxation avoidance agreement carried out by India with other countries fixes a specified rate according to which TDS must be deducted on the income paid to residents of that country. Which means if you are earning an income in India, the TDA will be charged according to rates set under DTAA with that country.

The rates and rules of DTAA vary from country to country depending on the particular signature between both parties. TDS rates on interests earned for most countries is either 10% or 15%, though rates range from 7.50% to 15%. List of DTAA rates for particular countries is given in the next section.

Double Taxation Avoidance Agreement Country List

A total of 85 countries currently have DTAA agreements with India. The following countries have a Double Taxation Avoidance Agreement with India. TDS rates on interests are listed below. (Listed alphabetically)

| Country | TDS Rate |

|---|---|

|

Armenia |

10% |

|

Australia |

15% |

|

Austria |

10% |

|

Bangladesh |

10% |

|

Belarus |

10% |

|

Belgium |

15% |

|

Botswana |

10% |

|

Brazil |

15% |

|

Bulgaria |

15% |

|

Canada |

15% |

|

China |

15% |

|

Cyprus |

10% |

|

Czech Republic |

10% |

|

Denmark |

15% |

|

Egypt |

10% |

|

Estonia |

10% |

|

Ethiopia |

10% |

|

Finland |

10% |

|

France |

10% |

|

Georgia |

10% |

|

Germany |

10% |

|

Greece |

As per agreement |

|

Hashemite kingdom of Jordan |

10% |

|

Hungary |

10% |

|

Iceland |

10% |

|

Indonesia |

10% |

|

Ireland |

10% |

|

Israel |

10% |

|

Italy |

15% |

|

Japan |

10% |

|

Kazakhstan |

10% |

|

Kenya |

15% |

|

South Korea |

15% |

|

Kuwait |

10% |

|

Kyrgyz Republic |

10% |

|

Libya |

As per agreement |

|

Lithuania |

10% |

|

Luxembourg |

10% |

|

Malaysia |

10% |

|

Malta |

10% |

|

Mauritius |

7.50-10% |

|

Mongolia |

15% |

|

Montenegro |

10% |

|

Morocco |

10% |

|

Mozambique |

10% |

|

Myanmar |

10% |

|

Namibia |

10% |

|

Nepal |

15% |

|

Netherlands |

10% |

|

New Zealand |

10% |

|

Norway |

15% |

|

Oman |

10% |

|

Philippines |

15% |

|

Poland |

15% |

|

Portuguese Republic |

10% |

|

Qatar |

10% |

|

Romania |

15% |

|

Russia |

10% |

|

Saudi Arabia |

10% |

|

Serbia |

10% |

|

Singapore |

15% |

|

Slovenia |

10% |

|

South Africa |

10% |

|

Spain |

15% |

|

Sri Lanka |

10% |

|

Sudan |

10% |

|

Sweden |

10% |

|

Swiss Confederation |

10% |

|

Syrian Arab Republic |

7.50% |

|

Tajikistan |

10% |

|

Tanzania |

12.50% |

|

Thailand |

25% |

|

Trinidad and Tobago |

10% |

|

Turkey |

15% |

|

Turkmenistan |

10% |

|

UAE |

12.50% |

|

UAR (Egypt) |

10% |

|

Uganda |

10% |

|

UK |

15% |

|

Ukraine |

10% |

DTAA is an effective financial agreement that is beneficial to both the taxpayer as well as the respective tax collection authorities in various countries.

Comments

u