Take control of your future with assured income

- You are always striving to give your family and loved ones the best lifestyle you can. However, life also has its share of uncertainties and risks. In a world where so much can change, there’s finally one thing which won’t change, Your financial security.

- Our Future Generali Assured Income Plan is a life insurance plan that provides life cover and offers

Guaranteed Regular Income. The plan offers regular & limited payment options along with flexible policy terms. At the end of the term (Policy Term +1 year) regular assured income plus an additional lumpsum benefit shall be payable. This additional benefit comes along with the last income amount and ranges from 2.15 to 5.80 times of the annualised premium (depending on life assured’s entry age). - What’s more, the life assured gets a Death cover and is sure that his savings are safe and multiplying. So, go ahead and live your dreams with greater assurance and lesser uncertainty.

Unique product benefits

Guaranteed Income – You will receive guaranteed income at the end of each year from the end of Policy term + 1 year for next 8 to 15 years (depending up on the Policy Term chosen).

Additional Income – Receive additional benefit ranging from 2.15 to 5.80 times your annualised premium along with the last instalment amount of Maturity Benefit.

Death Benefit – In case of death of Life Assured during the Policy Term, depending on the Policy Term chosen by you, your nominee will start receiving income immediately and on every death anniversary thereafter. Choose your Policy Term wisely so that you can secure your family with regular flow of income for maximum number of years, in case of any unfortunate event.

Auto Cover – Your life cover continues for one year, even if you are not able pay premium due to any financial exigency.

Tax Benefit – You may be eligible for tax benefits on the premium(s) you pay and benefit proceeds, according to the provisions of Income Tax laws as amended from time to time.

Easy steps to buy Future Generali Assured Income Plan?

- The amount of Annualized Premium

- The duration of cover or the Policy Term

- The duration of premium payment or the Premium Payment Term

What are your benefits?

Maturity Benefits

If the Life Assured is alive on the Maturity Date and if all Instalment Premiums have been received in full, the Maturity Benefit shall be payable as follows:

- i. Equal annual Maturity Benefit instalments shall be payable at the end of each year from Policy Term +1 year till the end of Payout Period.

- ii. Payout Period will be equal to policy term.

- iii. Annual Maturity Benefit Instalment amount = Maturity Benefit Multiplier (as per table 1) X Annualized premium (excluding the taxes, modal loading, rider premiums, underwriting extra premiums, if any)

- iv. Additional benefit, based on the age at entry of the Life Assured shall be payable along with the last instalment.

| Premium Payment Term | Policy Term | Maturity Benefit Multiplier |

|---|---|---|

| 8 | 8 | 1.10 |

| 9 | 9 | 1.20 |

| 10 | 10 | 1.35 |

| 11 | 11 | 1.50 |

| 12 | 12 | 1.60 |

| 13 | 13 | 1.75 |

| 14 | 14 | 1.85 |

| 15 | 15 | 2.00 |

| 8 | 11 | 1.10 |

| 9 | 11 | 1.20 |

| 10 | 11 | 1.35 |

| 12 | 15 | 1.60 |

| 13 | 15 | 1.75 |

| 14 | 15 | 1.85 |

| 11 | 15 | 1.50 |

| 8 | 9 | 1.10 |

| 9 | 10 | 1.20 |

| 8 | 10 | 1.10 |

| 11 | 12 | 1.50 |

| 11 | 13 | 1.50 |

| 12 | 13 | 1.60 |

| 11 | 14 | 1.50 |

| 12 | 14 | 1.60 |

| 13 | 14 | 1.75 |

How it works?

Let’s understand it with the help of an example for PT/PPT of 8, 11 & 15 years (Regular Pay):.

| Your Benefits | 8 Year Policy & Premium Paying Term | 11 Year Policy & Premium Paying Term | 15 Year Policy & Premium Paying Term |

| Maturity Benefits | A: 8 Annual Maturity Benefit instalments of 1.10 times your annualised premium from the end of the 9th year to the end of 16th year + B: Additional Benefit at the end of the 16th year based on age at entry shall be paid |

A: 11 Annual Maturity Benefit instalments of 1.5 times your annualised premium from the end of the 12th year to the end of 22nd year + B: Additional Benefits at the end of the 22nd year (based on age at entry shall be paid) |

A: 15 Annual Maturity Benefit instalments of 2 times your annualised premium from the end of the 16th year to the end of 30th year + B: Additional Benefits at the end of the 30th year (based on age at entry shall be paid) |

| Total Maturity Benefits | 10.6 to 11.35 times of Annualised Premium depending upon life assured's age when you purchased the policy | 19 to 19.75 times of annualised premium depending upon life assured's age when you purchased the policy | 33.7 to 34.85 times of annualised premium depending upon life assured's age when you purchased the policy. |

| Option To Receive Maturity Benefits In Monthly Instalments | Available | Available | Available |

Note:

- The annualised premium mentioned in the table above is excluding taxes, rider premium, modal premium and underwriting extra premium, if any.

- At the inception of the policy, you can opt to take your Maturity Benefit as lump sum at the Maturity Date. The lump sum Maturity Benefit is equal to the value of Maturity Benefit instalments as mentioned above, discounted at a compound interest rate of 6.85% per annum.

The Policyholder may choose to receive Maturity Benefit instalments in half yearly, quarterly or monthly frequency instead of taking it annually. In such cases, the instalments shall be payable as follows:

-

Yearly – 100% of (Annual Maturity Benefit Instalment) shall be payable on annual policy anniversary in arrears

-

Half yearly – 50.67% of (Annual Maturity Benefit Instalment) shall be payable on half yearly policy anniversary in arrears

-

Quarterly – 25.5% of (Annual Maturity Benefit Instalment) shall be payable on quarterly policy anniversary in arrears

-

Monthly – 8.54% of (Annual Maturity Benefit Instalment) shall be payable on monthly policy anniversary in arrears.

The frequency to receive Maturity Benefit Instalments need to be chosen at inception and cannot be changed during the Policy Term.

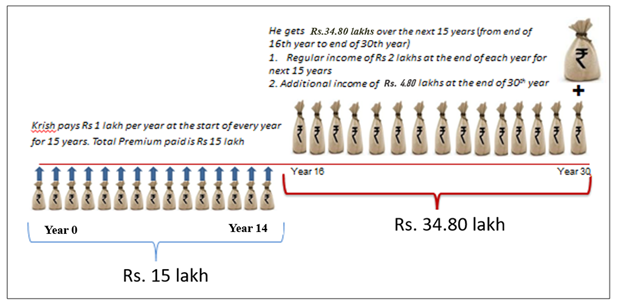

Maturity Benefit Illustrated:

For example: Krish is 30 years old and pays Rs. 1,00,000 as annual premium (excluding applicable tax) for a term of 15 years. He will receive Rs. 34,80,000 over the next 15 years. Let us explain how?

He will receive Rs 2,00,000 every year from the end of the 16th to the 30th year. Plus, in the last year i.e., the end of the 30th year, he will enjoy an additional income of Rs. 4,80,000.

Death Benefits

The Death Benefit shall be highest of the following:

-

i.Sum Assured on Death i.e. Death Benefit Multiple X Annualized Premium (excluding the taxes, rider premiums, underwriting extra premiums if any), or

-

ii.105% of total premiums paid (excluding any extra premium, any rider premium and taxes, if collected explicitly) as on date of death ,or

-

iii.Total annual instalments which is equal to: Annual Instalment amount X Policy Term

Where, Annual Instalment amount = Death Benefit payout rate (as per table 1) * Annualized premium (excluding the taxes, rider premiums, underwriting extra premiums if any)

Death Benefit payout rate table

| Policy Term | Entry Age <= 50 | Entry Age > 50 |

|---|---|---|

| 8 | 1.25 | 0.65 |

| 9 | 1.15 | 0.60 |

| 10 | 1.00 | 0.50 |

| 11 | 0.95 | 0.50 |

| 12 | 0.85 | 0.45 |

| 13 | 0.80 | 0.40 |

| 14 | 0.75 | 0.40 |

| 15 | 0.70 | 0.35 |

In case of death of the Life Assured during the policy term, provided all due premiums till date of death have been paid, the Death Benefit shall be paid in the following manner.

- Equal Death Benefit instalments shall be payable with the first instalment being paid at the time of claim settlement and the remaining Death Benefit instalments payable on each of the following death anniversary of the Life Assured.

How it works?

Let’s understand it with the help of an example for PT/PPT of 8, 11 & 15 years (Regular Pay):.

| Your Benefits | 8 Year Term | 11 Year Term | 15 Year Term |

| Death Benefits | 8 Annual Death Benefit instalments of 1.25 times your Annualised premium. The first Death Benefit instalment will be paid to the nominee at the time of settlement of claim and the remaining 7 Death Benefit instalments will be paid on each of the following death anniversary of the Life Assured | 11 Annual Death Benefit instalments of 0.95 times your Annualized premium. The first Death Benefit instalment will be paid to the nominee at the time of settlement of claim and the remaining 10 Death Benefit instalments will be paid on each of the following death anniversary of the Life Assured | 15 Annual Death Benefit instalments of 0.70 times your Annualised premium. The first Death Benefit instalment will be paid to the nominee at the time of settlement of claim and the remaining 14 Death Benefit instalments will be paid on each of the following death anniversary of the Life Assured |

Please Note:

- The death benefit mentioned above will be payable if your policy is inforce. The annualised premium mentioned in the table above is excluding taxes, rider premium and underwriting extra premium, if any.

The Policyholder may choose to receive Death Benefit instalments in half-yearly, quarterly or monthly frequency instead of taking it annually. In such cases, the Death Benefit instalments shall be payable as follows:

-

Yearly – 100% of (Annual Death Benefit Instalment) shall be payable on annual policy anniversary in arrears

-

Half yearly – 50.67% of (Annual Death Benefit Instalment) shall be payable on half yearly policy anniversary in arrears

-

Quarterly – 25.5% of (Annual Death Benefit Instalment) shall be payable on quarterly policy anniversary in arrears

-

Monthly – 8.54% of (Annual Death Benefit Instalment) shall be payable on monthly policy anniversary in arrears.

The frequency to receive Death Benefit Instalments need to be chosen at inception and cannot be changed during the Policy Term.

Lumpsum Death Benefit, if death occurs during the Policy Term:

The nominee has the option to take a lump sum death benefit as the discounted value of outstanding Death Benefit instalments. The outstanding Death Benefit instalments will be discounted at a compound interest rate of 6.85% per annum

Lumpsum Death Benefit, if death occurs during the Payout Period:

In the event of death during the payout period, regular Maturity Benefit instalments as per the maturity benefit will be paid to the nominee. The nominee has the option to take a lump sum death benefit as a discounted value of outstanding Maturity Benefit instalments. The outstanding Maturity Benefit instalments will be discounted at a compound interest rate of 6.85% per annum. The value of lump sum payment to nominee is at least equal to Sum Assured on Maturity less Maturity Benefit instalments already paid

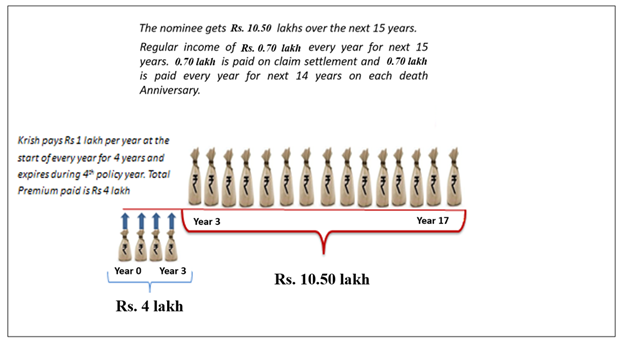

Death Benefit Illustrated

For example: Krish is 30 years old and has purchased the plan for a duration of 15 years with an annual premium of Rs. 1,00,000. He pays the premium for 4 years and unfortunately expires during the 4th policy year. In this case, the nominee will receive Rs. 70,000 as the first payout when the death claim is settled and thereafter for 14 years on Krish’s death anniversary.

Target Group

For customers who are looking for guaranteed income and tax saving life insurance plan which provides guaranteed returns over 11/ 15 year payout period in the form of monthly/annual stream of income.

Little privileges just for you

Grace Period:

You get a grace period of 30 days for Annual, Half-yearly and Quarterly Premium Payment Frequency and 15 days for Monthly Premium Payment Frequency, from the premium due date to pay your missed premium. During these days, risk on your life you will continue to be covered and your nominee will be entitled to receive all the benefits subject to deduction of due premium.

Change in Premium Payment Frequency:

You can change your premium payment frequency subject to minimum eligibility criteria. Such change shall be applicable from the next Policy Anniversary.

Auto Cover

After payment of at least 1 year premiums, if you are not able to pay premium within the grace period, you will get an auto cover of one year.

If death occurs during the Auto Cover period, the Death Benefit payable will be as for an in-force policy after deducting unpaid due premium.

If due premium remains unpaid during the Auto Cover period, the policy will be converted to a paid-up policy.

Auto Cover will be available only once during the Policy Term and will not be available if the policy has been converted to a paid-up policy.

Free Look Period:

If you disagree with the terms and conditions of the Policy, you can return the Policy within 30 days of receipt of the Policy Document (whether received electronically or otherwise). To cancel the Policy, you can send us a request for cancellation along with the reason for cancellation. We will cancel this Policy if you have not made any claims and refund the Instalment Premium received after deducting proportionate risk Premium for the period on cover, stamp duty charges and expenses incurred by us on the medical examination of the Life Assured (if any).

If the policy is opted through Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:-

-

- For existing e-Insurance Account: Computation of the said Free Look Period will commence from the date of delivery of the email confirming the credit of the Insurance Policy by the IR.

-

- For New e-Insurance Account: If an application for e-Insurance Account accompanies the proposal for insurance, the date of receipt of the ‘welcome kit’ from the IR with the credentials to log on to the e-Insurance Account(e IA) or the delivery date of the email confirming the grant of access to the eIA or the delivery date of the email confirming the credit of the Insurance Policy by the IR to the eIA, whichever is later shall be reckoned for the purpose of computation of the Free Look Period.

Riders :

No riders are availabel under this product.

Loan :

You may avail a loan once the policy has acquired a Surrender Value. The maximum amount of loan that can be availed is up to 85% of the Surrender Value. The minimum amount of policy loan that can be taken is Rs. 10,000. For more details, please refer to the policy document. The interest rate applicable for the Financial Year will be declared at the start of the Financial Year, basis current market interest rate on 10-year Government Securities (G-Sec) as on 31st March every year + 2% rounded to nearest 1%. The current interest rate applicable on loans is 9% per annum compounded half-yearly for the Financial Year 2024-25. Please contact Us or Our nearest branch for information on latest interest rate on loans.

Vesting of the Policy in case of policies issued to minor lives

The policy vests on the life assured on the policy anniversary coinciding with or immediately following the 18th birthday of the life assured. In case of death of Policyholder, while the Life Assured is a minor, the surviving parent/ legal guardian may be appointed as a new Policyholder. In case the policy is in paid-up status or upon non-payment of future premiums.

Nomination and Assignment :

Nomination, in accordance with Section 39 of the Insurance Act, 1938 as amended from time to time, is permitted under this policy.

Assignment, in accordance with Section 38 of the Insurance Act, 1938 as amended from time to time is permitted under this policy.

Policy purchased under MWP ( Married Women’s Property) Act cannot be assigned.

EXCLUSIONS

Suicide: In case of death of Life Assured due to suicide within 12 months from the date of commencement of risk under the policy or from the date of revival of the policy, as applicable, the nominee or beneficiary of the policyholder shall be entitled to at least 80% of the total premiums paid till the date of death or the surrender value available as on the date of death whichever is higher, provided the policy is in force.

Grievance Redressal Processes

In case you have any grievances on the solicitation process or on the Product sold or any of the Policy servicing matters, you may approach the Company in one of the following ways:

- (a) Calling the Customer helpline number 1800-102-2355 for assistance and guidance.

- (b) Emailing at care@futuregenerali.in

- (c) You may also visit us at the nearest Branch Office. Branch locator - https://life.futuregenerali.in/branch-locator/

- (d) Senior citizens may write to us at the following id: senior.citizens@futuregenerali.in for priority assistance

- (e) You may write to us at: Customer Services Department Future Generali India Insurance Co. Ltd, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S Marg, Vikhroli ( W ) Mumbai – 400083

We will provide a resolution at the earliest. For further details please access the link: https://life.futuregenerali.in/customer-service/grievance-redressal-procedure

Eligibility

| Plan Summary | |||||||||||||||||||

| Parameters | Criterion | ||||||||||||||||||

| Entry Age (As on last birthday) |

|

||||||||||||||||||

| Maturity Age | 18 to 80 years | ||||||||||||||||||

| Policy Term | 8 years or 15 years | ||||||||||||||||||

| Premium Payment Term |

|

||||||||||||||||||

| Premium(minimum) | Annual Mode:- Rs 40,000 Half-yearly Mode:- Rs 20,800 Quarterly Mode:- Rs 10,600 Monthly Mode:- Rs 3,532 |

||||||||||||||||||

| Sum Assured on Death | Minimum Sum Assured on Death: Rs.2,00,000 Maximum Sum Assured on Death: As per Board Approved underwriting Policy |

||||||||||||||||||

| Premium Payment Frequency | Annually/ Half-Yearly/Quarterly/Monthly | ||||||||||||||||||

| Payout Period | Equal to Policy Term | ||||||||||||||||||

| Additional Benefits | Depending on the entry age an additional lumpsum benefit ranging from 2.15 to 5.80 times of the annualised premium shall be payable along with the last instalment amount of Maturity Benefit. | ||||||||||||||||||

DISCLAIMERS

Future Generali Assured Income Plan (UIN: 133N054V05)

This Product is not available for online sale.

For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the policy document and consult your advisor, or, visit our website (life.futuregenerali.in) before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. You are advised to consult your tax consultant. Future Group's and Generali Group's liability is restricted to the extent of their shareholding in Future Generali India Life Insurance Company Limited.

Future Generali India Life Insurance Co. Ltd. (IRDAI Regn. No. 133)

Regd. and Corporate Office address: Unit 801 and 802, 8th floor, Tower C,

Embassy 247 Park, L.B.S. Marg, Vikhroli (W), Mumbai - 400 083.at

Email - care@futuregenerali.in

Call us at - 1800-102-2355 800 102 23

Website: life.futuregenerali.in

UIN: 133N054V05

Free Look Period:

If you disagree with the terms and conditions of the Policy, you can return the Policy within 30 days of receipt of the Policy Document (whether received electronically or otherwise). To cancel the Policy, you can send us a request for cancellation along with the reason for cancellation. We will cancel this Policy if you have not made any claims and refund the Instalment Premium received after deducting proportionate risk Premium for the period on cover, stamp duty charges and expenses incurred by us on the medical examination of the Life Assured (if any).

Note: Distance Marketing means insurance solicitation by way of telephone calling/ short messaging service (SMS)/other electronic modes like e-mail, internet & interactive television (DTH)/direct mail/ newspaper & magazine inserts or any other means of communication other than in person.

Life Insurance Made Simple

-

Decoding Your Policy’s Fine Print

The fine print in a policy can come in the way of making an informed purchase. We’ve simplified the fine print into big print.

-

Ensure Your Claims Are Always Settled

Read the terms and conditions carefully. Ensure that your current health, occupation or lifestyle habits do not exclude you from getting the policy benefits.

-

Protecting Your Policy – Do’s & Don’ts

Do's and don’ts to protect your life insurance policy from unauthorised elements posing as company representatives.

-

Are You Financially Prepared For Your Future?

Find out how prepared you are to meet your financial goals, with our FutureReady calculator.

-

12 Questions to Ask Before You Buy

Buying a life insurance policy without asking your advisor the right questions is as good as crossing a road blindfolded.