How does it Works

- Choose the amount of insurance cover you desire under this policy.

- Choose the term of your policy i.e. decide the number of years for which you wish to pay the premium i.e. 15 years or 20 years

- Our sales representative will help you calculate your premium and provide you a customised benefit illustration.

- Get ready to enjoy triple benefits till you turn 80.

What are your Benefits?

Survival Benefit:

If you have paid all your premiums till the completion of the Premium Payment Term, you will receive 5 annual payouts equal to 10% of your Sum Assured which is called the Survival Benefit. These payouts will begin at the end of the same year in which you paid your last premium.

Maturity Benefit:

Once your policy matures, which is 5 years after your premium payment term, you will receive a lump sum payout equal to 50% of the Sum Assured plus any declared Compounded Reversionary bonuses plus any Terminal Bonus, which is called the Maturity Benefit.

Extended Life Cover:

Your insurance cover will be active till you turn 80. Once you reach 80 years of age, you will receive another lump sum payment equal to 100% of your Sum Assured which is called Extended Cover Payout

What's more, In case of your unfortunate demise after maturity but before you turn 80 years, your nominee will receive 100% of your Sum Assured.

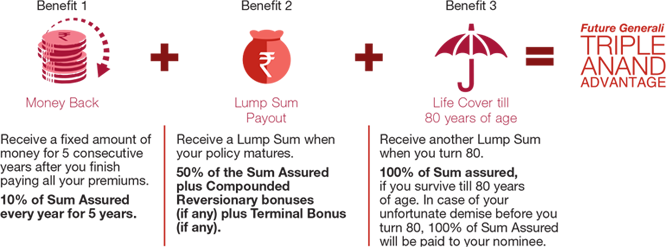

Let's understand your benefits with the help of an example:

Amit is 30 years old while buying the policy. He has opted for ![]() 10,00,000 Sum Assured for a premium payment term of 20 years. He pays

10,00,000 Sum Assured for a premium payment term of 20 years. He pays ![]() 65,250 annual premium (excluding applicable taxes) for a term of 20 years.

65,250 annual premium (excluding applicable taxes) for a term of 20 years.

As per the above example, Amit will get the following Triple Benefits:

Please Note: Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your life insurance company. These assumed rates of return 8% and 4%, are not guaranteed and they are not upper or lower limits of what you might get back as the value of your policy is dependent on a number of factors including future investment performance.

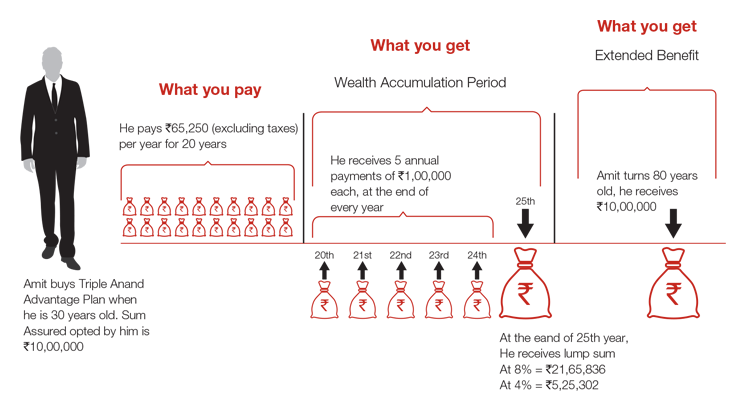

Death Benefit during the Policy Term:

Death Benefit in this plan secures your family in case of your unfortunate demise during the policy term.The Death Benefit payable shall be higher of:

- 105% of all the premiums paid(excluding taxes, rider premiums and extra premiums, if any) as on date of death; or

- Death Sum Assured + Accrued Compounded Reversionary Bonuses (if any) plus Terminal Bonus(if any)

| The Death Sum Assured will be the highest of: |

|

The above Death Benefit shall be payable irrespective of any survival benefits paid earlier

The plan terminates after paying the death benefit to the family.

Let's understand the Death Benefit with the help of the previous example. It is assumed that the death occurs in the 2nd policy year. The benefit payable to Amit's nominees will be:

Please Note: Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your life insurance company. These assumed rates of return 8% and 4%, are not guaranteed and they are not upper or lower limits of what you might get back as the value of your policy is dependent on a number of factors including future investment performance.

In case of death after the Policy Term but before reaching age 80 years, Sum Assured is paid to your Nominee

| Your Benefits | 15 Year PPT | 20 Year PPT |

| Regular Payouts | 10% of Sum Assured every year from end of 15th year till end of 19th policy year. | 10% of Sum Assured every year from end of 20th year till end of 24th year |

| Lump Sum Payout | 50% of Sum Assured + Compounded Reversionary bonuses1 (if any) + Terminal Bonus2(if any) at end of 20th year | 50% of Sum Assured + Compounded Reversionary bonuses1 (if any) + Terminal Bonus (if any) at end of 25th year |

| Extended Cover Benefit | 100% of Sum Assured on turning 80 years or 100% of Sum Assured paid to nominee in case of death before 80 years |

|

| 1. Compounded Reversionary Bonus: At the end of each financial year the Company may declare a bonus expressed as a percentage of the Sum Assured and all previous bonuses declared. The bonus of each year is added to the Sum Assured and the next year's bonus is calculated on the enhanced amount. |

| 2. Terminal Bonus: The Company may declare a discretionary terminal bonus which is payable on death or maturity of the plan. |

Target Group

For the customers who are looking for tax saving life insurance plan that offers triple benefits of Money backs, Lumpsum benefit alongwith potential upside through bonuses and cover till 80 years of age, all in one plan

Plan Summary

| Parameter | Criterion |

| Entry Age (as on last Birthday) | 7 to 50 years Please note, we will undertake the risk on your policy from the policy commencement date. |

| Maturity Age | 27 years – 75 years |

| Policy Term | Premium Payment Term + 5 years |

| Premium Payment Term | 15 or 20 years |

| Minimum Sum Assured | |

| Premium Payment Frequency | Annual, Semi-Annual and Monthly. |

| Premium | Minimum: Maximum: No limit |

DISCLAIMERS

Future Generali Triple Anand Advantage Plan [UIN: 133N055V02]

- Tax benefits are subject to change as per tax laws.

- For more details on the risk factors and the terms and conditions please read the sales brochure and/ or sample policy document on our website carefully, and/ or consult your advisor before concluding the sale.

- Insurance is the subject matter of solicitation.

Free Look Period

In case you disagree with any of the terms and conditions of the policy, you can return the policy to the company within 15 days (30 days if the policy is sold through the Distance Marketing Mode) of its receipt for cancellation, stating your objections. Future Generali will refund the policy premium after the deduction of proportionate risk premium for the period of cover, stamp duty charges, cost of medical examination, if any.

Note: Distance Marketing means insurance solicitation by way of telephone calling/ Short Messaging Service (SMS)/other electronic modes like e-mail, internet & Interactive Television (DTH)/direct mail/ newspaper and magazine inserts or any other means of communication other than that in person.

- For existing e-Insurance Account: Computation of the said Free Look Period will commence from the date of delivery of the e mail confirming the credit of the Insurance Policy by the IR.

- For New e-Insurance Account: If an application for e-Insurance Account accompanies the proposal for insurance, the date of receipt of the ‘welcome kit’ from the IR with the credentials to log on to the e-Insurance Account(e IA) or the delivery date of the email confirming the grant of access to the eIA or the delivery date of the email confirming the credit of the Insurance Policy by the IR to the eIA, whichever is later shall be reckoned for the purpose of computation of the Free Look Period.

Grace Period

You get a Grace Period of 30 days if you have opted for annual or half-yearly premium payment or 15 days if you have opted for monthly premium payment from the premium due date to pay your missed premium. During these days, you will continue to be covered and be entitled to receive all the benefits subject to deduction of due premiums.

Flexibility to Make Changes

We allow you to make change in the mode of payment on the basis of valid reasons submitted by you and subject to underwriting policy of the Company.

Loan

You may avail of a loan once the policy has acquired Surrender Value. The maximum amount of loan that can be availed is up to 85% of the Surrender Value. For more details, please refer to the policy document.

Life Insurance Made Simple

-

Decoding Your Policy’s Fine Print

The fine print in a policy can come in the way of making an informed purchase. We’ve simplified the fine print into big print.

-

Ensure Your Claims Are Always Settled

Read the terms and conditions carefully. Ensure that your current health, occupation or lifestyle habits do not exclude you from getting the policy benefits.

-

Protecting Your Policy – Do’s & Don’ts

Do's and don’ts to protect your life insurance policy from unauthorised elements posing as company representatives.

-

Are You Financially Prepared For Your Future?

Find out how prepared you are to meet your financial goals, with our FutureReady calculator.

-

12 Questions to Ask Before You Buy

Buying a life insurance policy without asking your advisor the right questions is as good as crossing a road blindfolded.