- Home

- Insurance Plans

- ULIP PLANS

- Easy Invest Online Plan

Key Benefits of this Plan

-

1 Maturity Benefit

-

2 Death Benefit

-

3 Loyalty Additions

1Maturity Benefit

On maturity of the policy, the Fund Value (market value of the investment) is paid

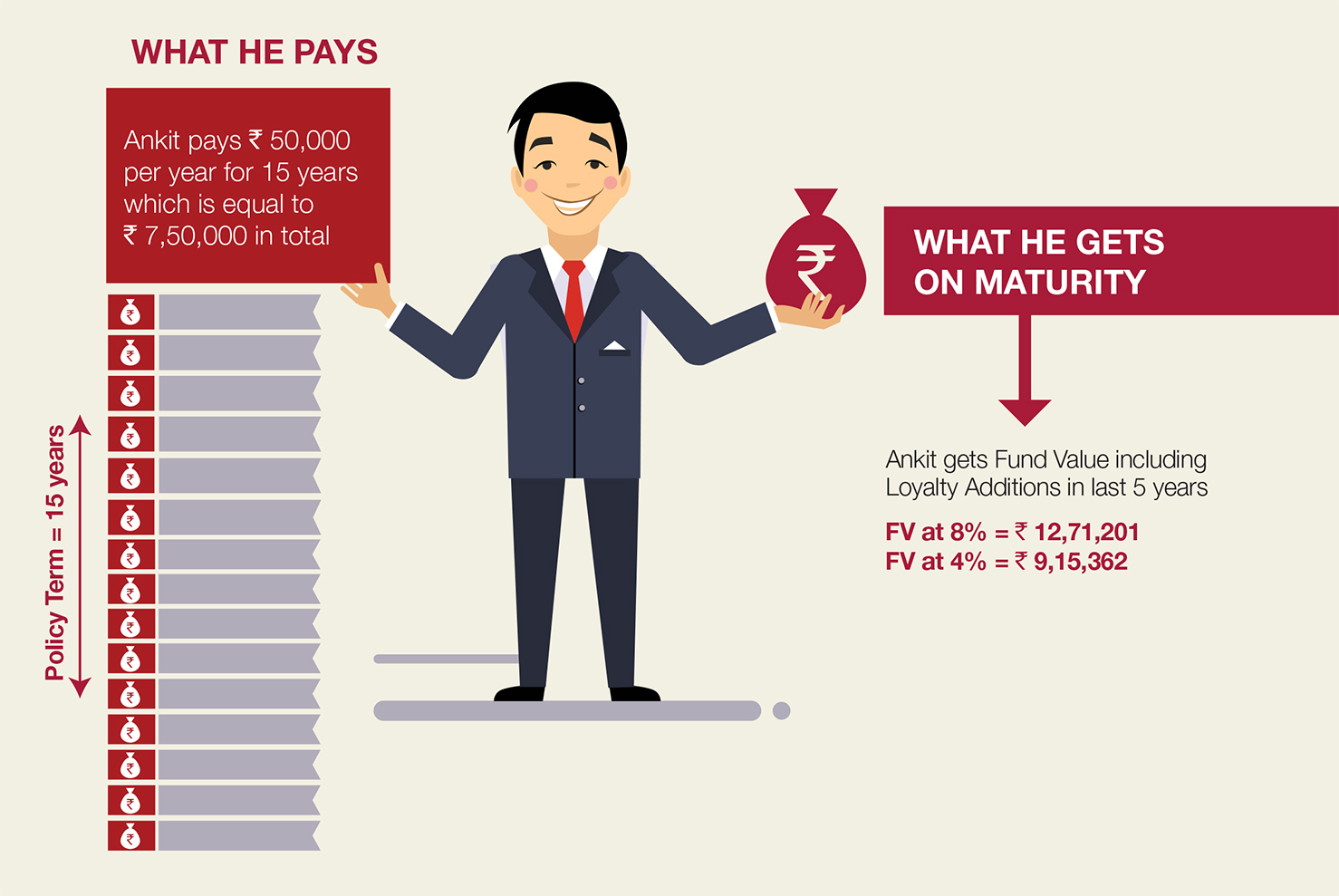

Let's understand this benefit with the help of an example:

Ankit aged 35 years has purchased a Future Generali Easy Invest Online Plan for a Policy Term of 15 years. He decided to pay Rs.50,000 as annual premium for 15 years. His Sum Assured coverage would be Rs.5,00,000. The illustration below shows his maturity benefit:

Note:

For the purpose of illustration, we have assumed 4% p.a and 8% p.a as the higher and lower values of investment returns. These rates are not guaranteed, and they are not the upper or lower limits of returns of the Funds selected in your policy, as the performance of funds depends on several factors including future investment performance. These rates in no way signify our expectations of future returns and the actual returns may be higher or lower.

2Death Benefit

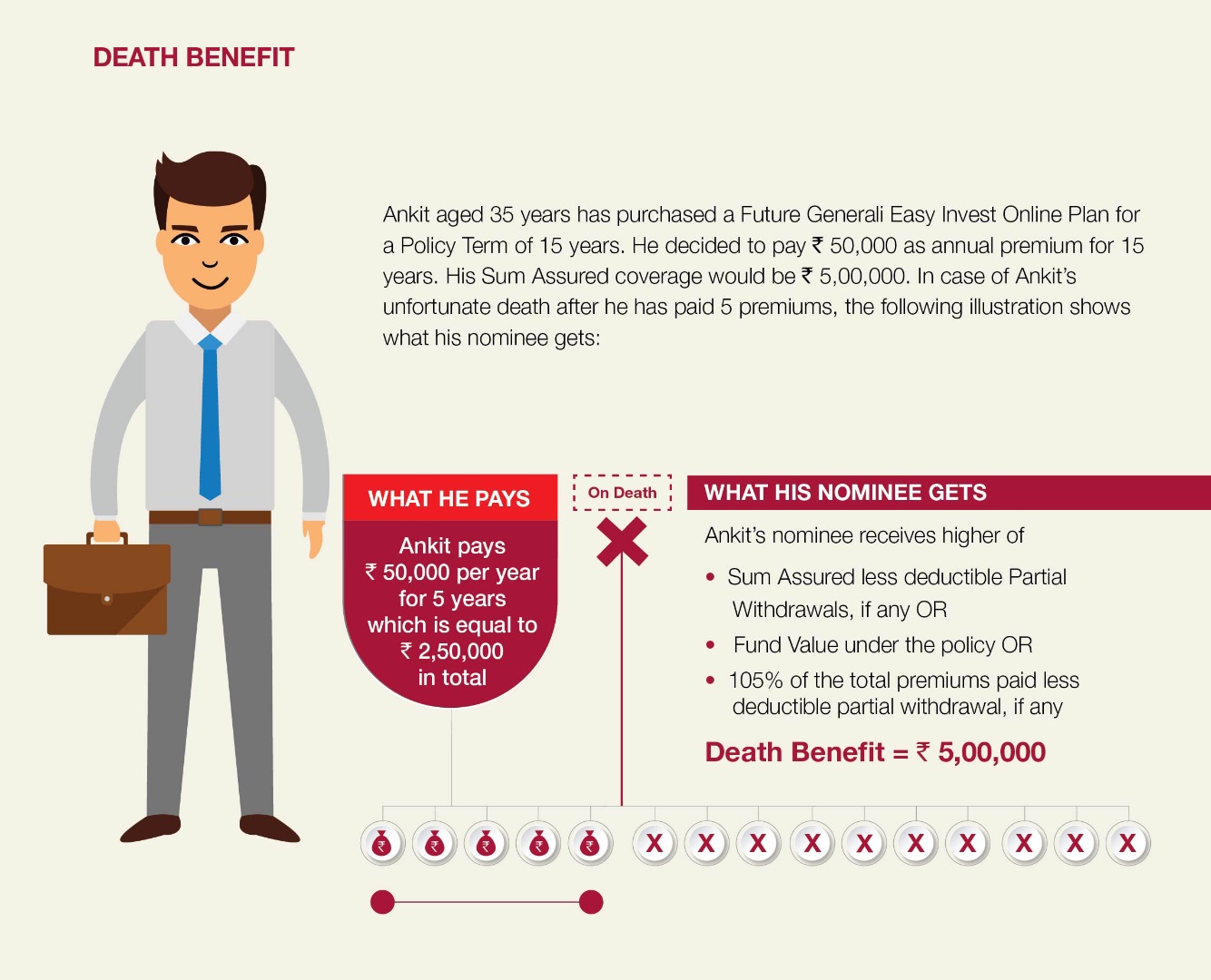

Higher of :

- Sum Assured less deductible partial withdrawals, if any, OR

- Fund Value under the policy OR

- 105% of the total premiums paid till date of death less deductible partial withdrawals, if any

Let's understand this benefit with the help of an example:

Ankit aged 35 years has purchased a Future Generali Easy Invest Online Plan for a Policy Term of 15 years. He decided to pay Rs.50,000 as annual premium for 15 years. His Sum Assured coverage would be Rs.5,00,000. In case of Ankit’s unfortunate death after he has paid 5 premiums, the following illustration shows what his nominee gets:

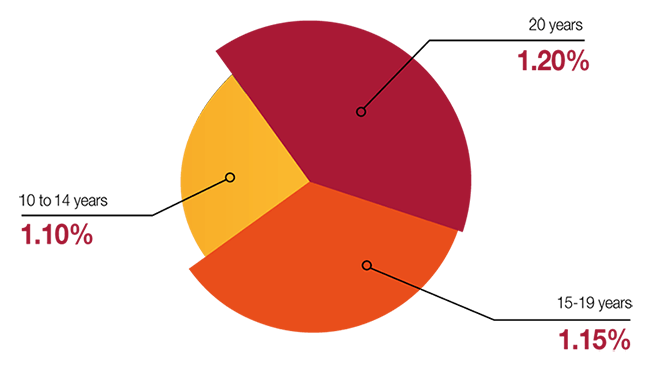

3Loyalty Additions

Staying invested throughout the Policy Term will help you get Loyalty Additions as a percentage of average fund value on the last 5 policy anniversaries. All you need to do is to ensure that you have paid all your due premiums on time and your policy is active on the date of payment of loyalty additions. Loyalty additions shall be added to the fund value on the applicable Policy Anniversary. However, The the last (Final) Loyalty addition shall be payable on date of Maturity.

Policy Term

Loyalty Additions as % of average Fund Value payable on the last 5 Policy Anniversaries

For the purpose of calculation of loyalty additions, except the last loyalty addition, the average fund value shall be simple average of fund values on the last day of previous eight calendar quarters, prior to the policy anniversary in which the loyalty additions are payable.

For the purpose of calculation of last loyalty addition, the average fund value shall be simple average of fund values on the last day of previous eight calendar quarters, prior to the date of Maturity.

Target Group

For customers looking for a tax saving systematic investment solution which helps to get market linked returns alongwith benefits of insurance

Eligibility

| Parameter | Criterion |

| Entry Age (as on last birthday) | Minimum: 0 years Maximum: 60 years |

| Maturity Age | Minimum: 18 years Maximum: 70 years |

| Premium to be paid | Minimum: Annual Mode - Monthly Mode - Maximum: No Limit |

| Policy Term | 10 to 20 years |

| Premium Payment Term | Same as Policy Term |

| Sum Assured | Sum Assured = 10 x Annual Premium |

| Premium Payment Frequency | Annual/Monthly. Monthly premiums can only be paid by Auto Pay System. Auto Pay methods of payment are available in all premium modes. |

FUND OPTIONS

Depending on your ability to expose yourself to risks associated with the markets, choose to invest your premiums in any of the following 6 funds. Your premium, net of applicable charges, is invested in funds of your choice. The funds in turn, are segregated into liquid investments, fixed income securities and equity investments in line with their risk profile.

| Fund Name | Investment Strategy | Investment Objectives | Portfolio Allocation | Risk Profile |

| Future Income Fund (SFIN: ULIF002180708 FUTUINCOME133) |

Investments in assets of low risk | To provide stable returns by investing in assets of relatively low to moderate level of risk. The interest credited will be a major component of the fund’s return. The fund will invest primarily in fixed interest securities, such as Government Securities of medium to long duration, Corporate Bonds and Money Market Instruments for liquidity. | - Money Market

Instruments: 0%-50% - Fixed Income investments: 50%-100% - Equity Instruments: NIL |

Low Risk |

| Future Balance

Fund (SFIN:ULIF003180708 FUTBALANCE133) |

Balance of high return and risk balanced by stability provided by fixed interest instruments | To provide a balanced return from investing in both Fixed Interest Securities as well as in Equities so as to balance stability of return through the former and growth in capital value through the latter. This Fund will also invest in Money Market Instruments to provide liquidity. | - Money Market

Instruments: 0%-30% - Fixed Income Instruments: 40%-70% - Equity Instruments: 30%-60% |

Moderate Risk |

| Future Maximize

Fund

(SFIN:ULIF00418

0708 FUMAXI MIZE133) |

Investment in a spread of equities. Diversification by sector, industry and risk | To provide potentially high returns to Unitholders by investing primarily in equities to target growth in capital value of assets. This Fund will also invest to a certain extent in Government Securities, Corporate Bonds and Money Market Instruments. | - Money Market

Instruments: 0%-40% - Fixed Income Instruments: 10%-50% - Equity Instruments: 50%-90% |

High Risk |

| Future Apex Fund (SFIN: ULIF010231209 FTUREAPEX133) |

Investment in a spread of equities. Diversification by sector, industry and risk. | To provide potentially high returns to Unitholders by investing primarily in equities to target growth in capital value of assets. The Fund will also invest to a certain extent in Government Securities, Corporate Bonds and Money Market Instruments. | - Money Market

Instruments: 0%-50% - Fixed Income Instruments: 0%-40% - Equity Instruments: 50%-100% |

High Risk |

| Future

Opportunity

Fund (SFIN: ULIF012090910 FUTOPPORT U133) |

Investment in a spread of equities. Diversification by sector, industry and risk. | To generate capital appreciation and provide long term growth opportunities by investing in a portfolio predominately of Equity and Equity related Instruments generally in S&P CNX Nifty stocks and to generate consistent returns by investing in Debt and Money Market Instruments. | - Money Market

Instruments: 0%-20% - Fixed Income Instruments: 0%-15% - Equity Instruments: 80%-100% |

High Risk |

| Future Midcap Fund (SFIN: ULIF014010518 FUTMIDCAP133) |

Investment in mix of mid cap and large cap companies across sectors | To generate long-term capital appreciation by investing predominantly in equity and equity related securities of mid cap companies by investing in mix of mid cap and large cap companies across sectors. | - Money market instruments: 0% – 20%

- Equity Instruments: 80% – 100% (Out of the equity investment, atleast 50% shall be in midcap stocks) |

High Risk |

Default Fund (in case of closure)

A fund can be closed with prior approval from IRDAI.

In case the existing fund is closed the default fund is Future Income Fund (SFIN: LIF002180708FUTUINCOME133)

In case any existing fund is closed, the Company shall seek prior instructions from the Policyholder for switching units from the existing closed fund to the any other available fund under the policy. On such closure of fund, if the Company does not receive choice of fund from the Policyholder, the Company shall transfer units of Policyholder from the fund which is intended to be closed, to Future Income Fund.

Modification of Fund

A fund can be modified with prior approval from IRDAI.

In case any existing fund is modified, the Company shall seek prior instructions from the Policyholder for switching units from the existing modified fund to the any other available fund under the policy. On such modification of fund, if the Company does not receive choice of fund from the Policyholder, the Company shall continue to invest in such modified fund.

Company will also seek instructions for future premium redirections in case of closure/modification of the existing fund.

Charges

PREMIUM ALLOCATION CHARGE

The Premium Allocation Charge as a percentage of Annualised Premium is as per the table below:

Premium Allocation Charges are deducted from premiums paid and the premiums, net of premium allocation charges, are used to purchase units in any of the six underlying funds.

POLICY ADMINISTRATION CHARGE

The Policy Administration Charges expressed as a percentage of premium is 0.1% of Annualised Premium per month subject to a minimum of ![]() 50 p.m. and maximum of

50 p.m. and maximum of ![]() 500 p.m.

500 p.m.

The Policy Administration Charges given above are deducted from the unit account on monthly basis at the beginning of each monthly anniversary (including the policy commencement date) of a policy by cancellation of units.

DISCONTINUANCE CHARGE

In case of discontinuance of the policy during first 4 policy years, the following charges will apply

| Discontinuance during the policy year | Discontinuance charge For Annual Premium <=50,000 | Discontinuance charge For Annual Premium >50,000 |

| 1 | Lower of 20% x (AP or FV), subject to a maximum of Rs 3,000 | Lower of 6% x (AP or FV), subject to a maximum of Rs. 6,000 |

| 2 | Lower of 15% x (AP or FV), subject to a maximum of Rs 2,000 | Lower of 4% x (AP or FV), subject to a maximum of Rs. 5,000 |

| 3 | Lower of 10% x (AP or FV), subject to a maximum of Rs 1,500 | Lower of 3% x (AP or FV), subject to a maximum of Rs. 4,000 |

| 4 | Lower of 5% x (AP or FV), subject to a maximum of Rs 1,000 | Lower of 2% x (AP or FV), subject to a maximum of Rs. 2,000 |

| 5 and onwards | Nil | Nil |

Where, AP = Annualised Premium under the policy

FV = Fund Value on the date of discontinuance

FUND MANAGEMENT CHARGE

| FUND MANAGEMENT CHARGE (% per annum) | |

| Future Income Fund | 1.35% |

| Future Balance Fund | 1.35% |

| Future Apex Fund | 1.35% |

| Future Opportunity Fund | 1.35% |

| Future Maximize Fund | 1.35% |

| Future Midcap Fund | 1.35% |

Fund Management Charges are deducted on a daily basis at 1/365th of the annual charge in determining the unit price.

SWITCHING CHARGE

- Twelve free switches are allowed each policy year. Subsequent switches in that policy year will attract a charge of

100 per switch. Unused free switches cannot be carried forward.

100 per switch. Unused free switches cannot be carried forward. - This charge will be levied at the time of effecting switch and will be deducted from the unit account by cancellation of units.

- This charge is also subject to increase in future upto

250 per switch, subject to prior approval of IRDAI.

250 per switch, subject to prior approval of IRDAI.

PARTIAL WITHDRAWAL CHARGE

Four free Partial Withdrawals are allowed each policy year. Subsequent Partial Withdrawal in a policy year shall attract a charge of ![]() 200 per withdrawal.

200 per withdrawal.

MORTALITY CHARGE

- The Mortality Charges are determined using 1/12th of the Annual Mortality Charge and are deducted from the unit account monthly at the beginning of each monthly anniversary (including the policy commencement date) of a policy by cancellation of units.

- The Mortality Charges are levied on Sum at Risk. The Sum at Risk at any point of time is the higher of (Sum Assured less Deductible Partial Withdrawal, 105% of premiums paid less Deductible Partial Withdrawal) less Fund Value under the policy.

- For female lives, a 3 year age set back shall be used except for female lives aged 0 to 9 years. For example, Mortality Charge for a 30 year old female shall be that of a 27 year old male. However, Mortality Charge for 9 year old female shall be that of a 9 year old male.

MISCELLANEOUS CHARGE

This charge is levied for any alterations within the insurance contract, such as change in premium mode and premium redirection. The charge is expressed as a flat amount levied by cancellation of units and is equal to ![]() 250 per alteration.

250 per alteration.

- One month Notice Period will be given to the Policyholder in case of an increase in charges. The increase, if any will apply from the Policy Anniversary coinciding with or following the increase.

- Any change in amount or rate of charges as stated above will be subject to IRDAI approval. All charges are subject to Service Tax, if any, as prescribed by the Government from time to time.

Decrease in Premium

Anytime after payment of premium for first five completed policy years, the policyholder has an option to decrease the premium up to 50% of the original Annualized Premium.

The decrease in premium is subject to the following conditions. Decrease in premium:

- Shall be restricted up to 50% of the original Annualized Premium as paid during the inception of the policy

- Is subject to minimum premium conditions

- Shall not be allowed when the policy is in discontinuance status i.e. decrease in premium is allowed only when all due premiums have been paid

- Shall be applicable only on policy anniversary

- Once reduced, the premiums cannot be subsequently increased.

- The decrease in premium will lead to reduction in Sum Assured as defined under the plan. The revised Sum Assured applicable shall be based on reduced premium.

- Premium Allocation Charges and Policy Administration Charges shall be accordingly based on revised reduced premium.

Exclusions

SUICIDE

In case of death due to suicide within 12 months from the date of commencement of the policy or from the date of revival of the policy, as applicable, the nominee or the beneficiary of the policyholder shall be entitled to the fund value, as available on the date of intimation of death.

Further, any charges other than Fund Management Charges (FMC) recovered subsequent to the date of death shall be added back to the fund value as available on the date of intimation of death.

Disclaimers

- Unit Linked Insurance Products are different from the traditional insurance products and are subject to the risk factors.

- The Premium paid in Unit Linked Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the Policyholder/Insured is responsible for his/her decisions.

- Future Generali India Life Insurance Company Limited is only the name of the life Insurance Company and Future Generali Easy Invest Online Plan is only the name of the Unit Linked Life Insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns.

- Please know the associated risks and the applicable charges, from your Insurance Agent or the intermediary or policy document of the Company.

- The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. Past performance is not indicative of future performance, which may be different.

Future Generali Easy Invest Online Plan (UIN: 133L061V03)

FREE LOOK CANCELLATION:

You have a period of 15 days (30 days if the policy is purchased through Distance Marketing Mode) from the date of receipt of the Policy document to review the terms and conditions of the Policy. If you are not satisfied with or disagree with any of the terms and conditions, you have the option to Cancel/withdraw and return the Policy along with a letter (dated and signed) stating your intention to cancel the Policy and reasons for the objections/Cancellation, within this period. Cancellation of Policy and refund of premium is allowed under this provision, whereby the amount payable on such cancellation will be equal to the total premium paid less a proportionate cost of insurance for the period of cover and expenses towards Policy stamp duty and medical examination, if any.

If the Policy is opted through Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:

For existing e-Insurance Account: Computation of the said Free Look Period will commence from the date of delivery of the email confirming the credit of the Insurance Policy by the IR.

For New e-Insurance Account: If an application for e-Insurance Account is accompanied by the proposal for insurance, the date of receipt of the welcome kit from the IR with the credentials to log on to the eInsurance Account (eIA) or the delivery date of the email confirming the grant of access to the eIA or the delivery date of the email confirming the credit of the Insurance Policy by the IR to the eIA, whichever is later shall be reckoned for the purpose of computation of the Free Look Period.

Life Insurance Made Simple

-

Decoding Your Policy’s Fine Print

The fine print in a policy can come in the way of making an informed purchase. We’ve simplified the fine print into big print.

-

Ensure Your Claims Are Always Settled

Read the terms and conditions carefully. Ensure that your current health, occupation or lifestyle habits do not exclude you from getting the policy benefits.

-

Protecting Your Policy – Do’s & Don’ts

Do's and don’ts to protect your life insurance policy from unauthorised elements posing as company representatives.

-

Are You Financially Prepared For Your Future?

Find out how prepared you are to meet your financial goals, with our FutureReady calculator.

-

12 Questions to Ask Before You Buy

Buying a life insurance policy without asking your advisor the right questions is as good as crossing a road blindfolded.