Wisdom is often likened to a bottle of wine; with age both get better. As we grow old, there are numerous decisions in life which we regret taking when young. Sometimes we lacked advice, and a few times we acted in a fluster. If given a chance to reorient your life, what would you want to change in your life? For many, it is poor financial planning. Although there is no magic wand that can enormously grow your wealth and keep you financially secure at once, there are a few basic golden rules and timeless financial tips which you can follow to head towards a better financially managed life. These eternal tips would be:

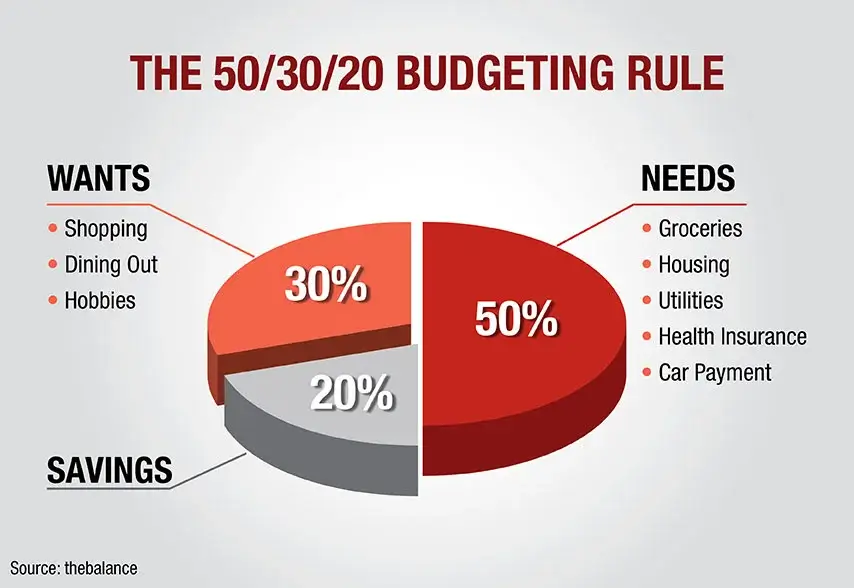

1. 50/20/30 Budget Rule

Source: thebalance

Elizabeth Warren, a member of the US Congress and former Harvard bankruptcy law professor, in 2005 popularised the 50/20/30 budget rule in her book "All Your Worth: The Ultimate Lifetime Money Plan." The primary rule is to divide your after-tax income by allocating 50% to needs and 30% go wants while earmarking 20% to savings. A clear understanding of wants and needs is beneficial. Expenditure on things like groceries, housing, utilities, health insurance, car payments, and car insurance can be grouped under 'needs'. Whereas, any expense that you can give up with only minor inconveniences must be put under 'wants'. After crossing the age of 25, most of you will assume some amount of financial responsibility. Oftentimes, it becomes difficult for young adults to manage life financially. In such a scenario, if you're not sure where to start, breaking up your salary into these basic divisions can be helpful. These percentages further assist in balancing obligations, goals and unnecessary splurges.

2. Credit Planning: Never Outgrow Your Debt

Take limited loans. One mistake Sushil made in his thirties was taking multiple loans that were beyond my repaying capacity. It not only plummeted his credit score but also took a toll on this mental health. Hence financial discipline should be given utmost priority to enjoy the benefits of various financial instruments. Also, as far as psychology in finance is concerned, paying back small debts can significantly help you tackle a bigger financial setback in the future. A study done by Northwestern University's Kellogg School of Management shows that "when facing a mountain of debt, paying off the smaller bills first greatly increased a borrower's chances of paying their debt in full". This goes against the conventional thought of school that generally recommends chipping away the most expensive debt first. As the study shows, sometimes psyching yourself up is worth it. Sushil began to follow this method, and paid off his debt in small yet significant bits. Eventually, he managed to declare himself debt-free and only wished he’d taken care not to amass such a huge amount of debt in the first place.

3. Building an Emergency Fund

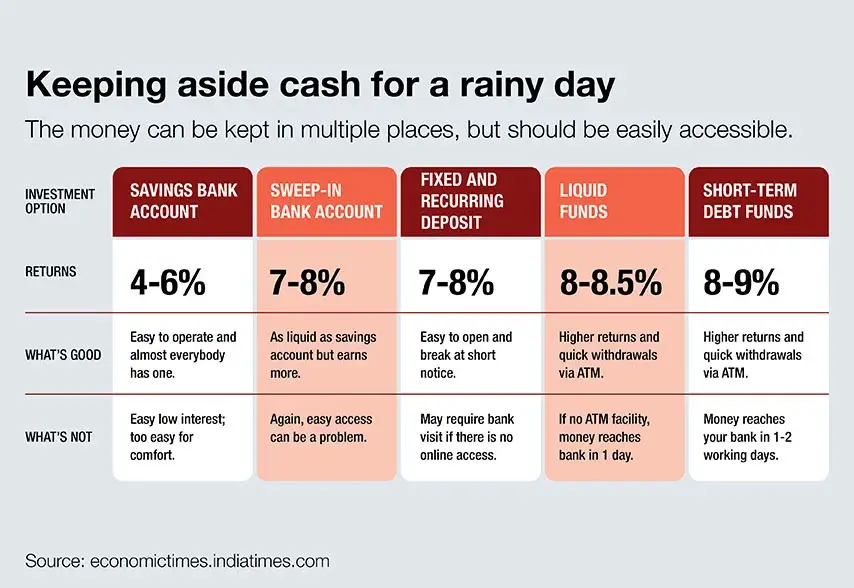

An emergency fund is an amount of money that one keeps aside as a contingency or back-up plan. It's not used for your everyday-expenses but for unexpected and unplanned scenarios. Having such a fund to meet unforeseen financial shortfalls allows an individual to have a peace of mind. The fund can have diverse benefits if used well. It can decrease the debt burden, in case of a financial mishap. It covers various tiny things that go unnoticed in our financial outline - say urgent house repairs, medical consultant fees etc. More often than not the emergencies people encounter in life are of a medical nature. Purchasing critical illness insurance, which gives you a lump sum amount on diagnosis of a critical illness is key to managing such medical emergencies. Your emergency fund effectively increases your capacity to handle stressful events and also increases your risk-appetite that in most cases, leads to better financial planning and extra profits.

Source: economictimes.indiatimes.com

4.Contribute to a Retirement Plan from Early in Life

If at-present your monthly expenses are Rs 40,000, and you retire in 25 years from now, you will need Rs 1.5 lakh every month, assuming that the annual inflation rate is 5%. Hence, contributing to a retirement corpus becomes indispensable. Recently, India has been tagged as the worst country to retire in. This is mostly because of ill-planning our retirement life. We underestimate the benefits associated with 'compounding'. A monthly investment of 10,000 if started early, can give a figure of 12,128,765/- compounded annually at an interest rate of 7% spread over 30 years. However, if you delay the same even by five years (i.e tenure becomes 25 years ), the final amount reduces to Rs. 8,121,176/-. As a result, it is advised that one must start investing early to live a comfortable retired life.

5. Maximise Your Employment Benefits

Often there are corporate privileges, such as mediclaim, meal passes, bonus movie tickets etc. that due to our limited knowledge or sheer inaction, are underutilized. Try to make use of these benefits if you have them. They have the potential to save you a significant sum of money annually. Ask your employer what all benefits you are provided.

Managing money in today’s scenario has become an important aspect of our lives. Even if your salary is a tad lower when compared to your peers, you can ensure that you can make up for the same with sound financial planning. If you are at a stage where wading through the uncharted waters of financial management is difficult, follow these financial tips and tailor your financial plan as you move forward

Comments