Before diving deep into numbers and knowing what will be the cost of a 50 Lakh term insurance plan; let us understand what exactly a term insurance plan is.

A term insurance policy is the purest and most cost-effective type of life insurance policy. This policy is designed in such a way that it only pays out benefits on the death of the life insured during the policy term. This plan is an essential step for taking care of your family’s future needs and requirements in your absences. Before we move further, let us understand the following:

Who should buy term insurance plans?

The answer may vary from person to person, but what's common is any individual, between 18 to 55 years2, having a financially dependency on their income, should seriously consider purchasing a Rs. 50 lakh term insurance plan.

Death is undoubtedly a tragic event. Practically, losing the sole breadwinner, the family head, or the father will probably bring financial instability. Hence, buying a term insurance plan is a smart choice for individuals who want to protect their families in their absence.

Term insurance plans can benefit various people with varied kinds of income, such as:

- Parents

- Newlyweds

- Young professionals – salaried or self-employed

- Taxpayers

- Retired individuals

- Individuals nearing retirement

Moreover, anyone wanting to keep their family under an umbrella of financial security can purchase a Rs. 50 lakh term insurance plan.

--

Since you have decided to buy a policy for 50 lakhs, this amount must be sufficient to ensure that you have the following covered:

- Is the amount enough to cover your immediate loans and liabilities?

- Is the amount enough to cover your children’s primary and higher education?

- Is the amount enough to cover your household expenses like the monthly bill of groceries, maidservants, driver, petrol, and so on?

50 lakhs - the decided sum assured of your term plan must cover the above costs. If it is doing so, you can relax – you are adequately covered. It is as simple as that! If not, you will need to recalculate and decide on a sum assured amount that covers the above costs.

The important thing to remember – Do not bite more than you can chew! Purchase a term insurance plan with a sum assured amount for which you can pay premiums. Assuming that you need a term insurance plan with a sum assured of Rs 1 crore, but the premiums are a huge burden on your finances, then buy a plan with a sum assured that you can easily afford.

--

With the various aspects of a term insurance plan covered, it is time to learn how much a Rs. 50 lakh term insurance plan would cost.

Before purchasing, analyze how much the Rs. 50 lakh term insurance plan will cost you periodically to ensure higher returns.

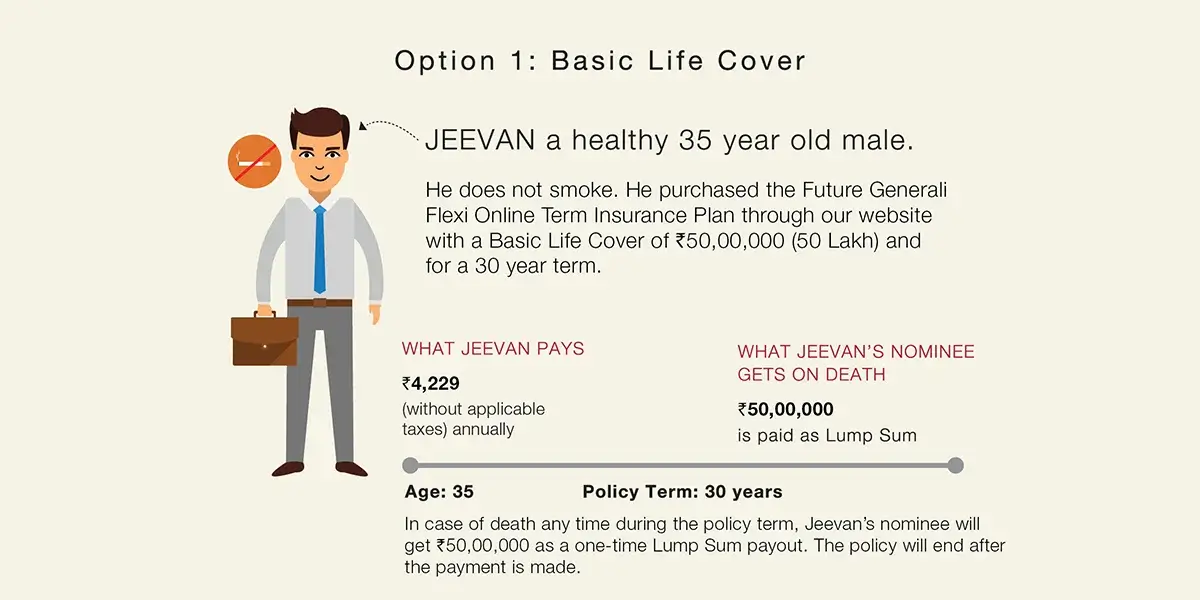

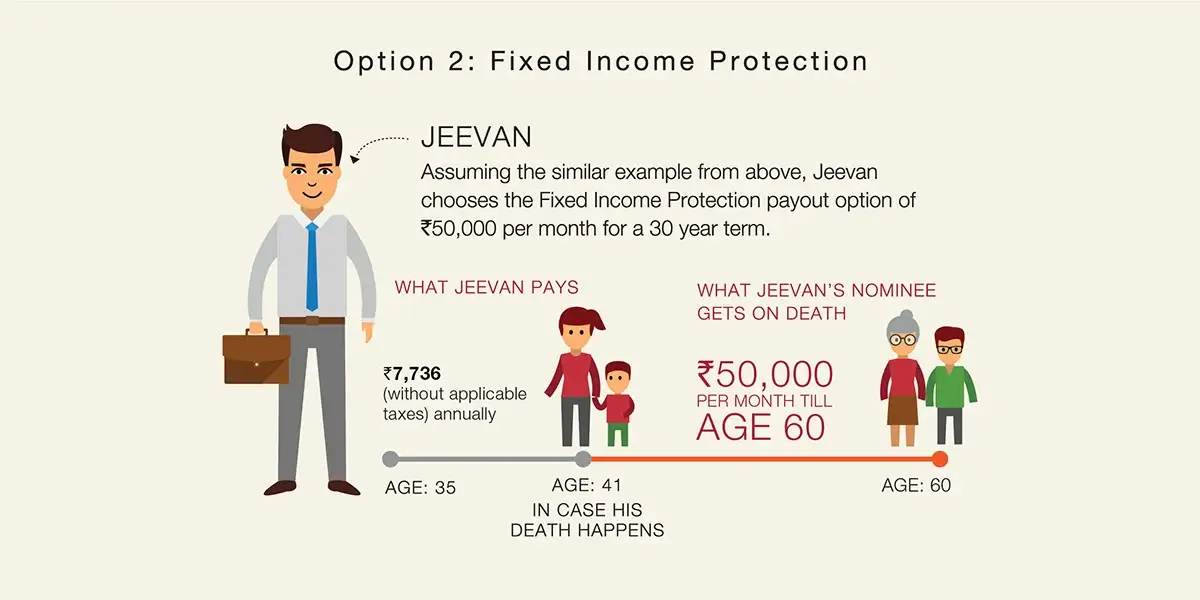

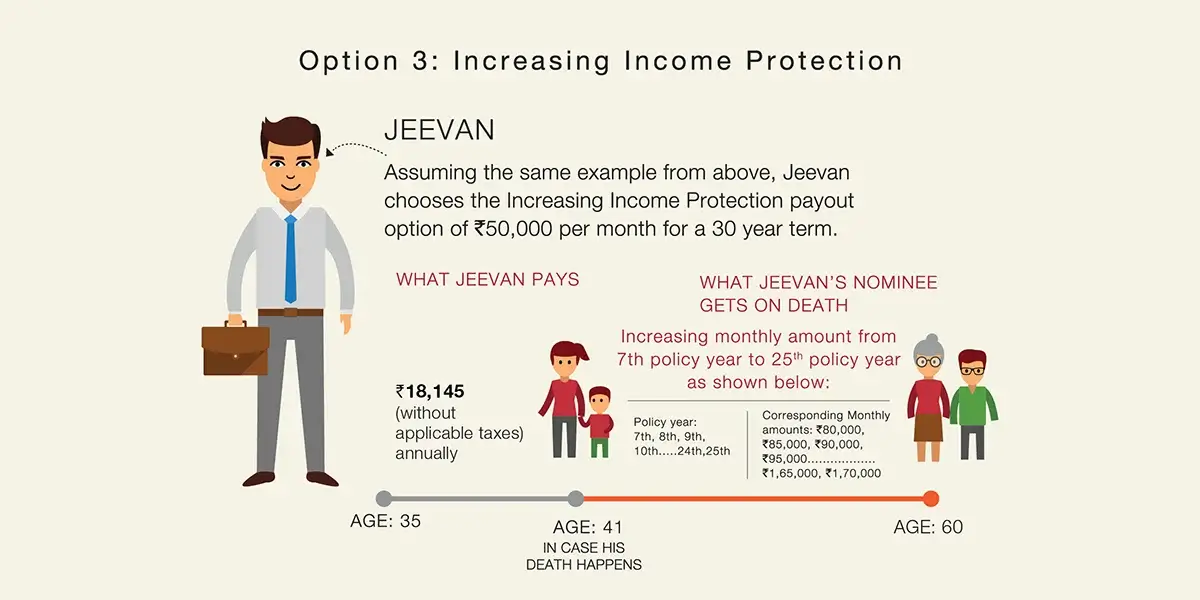

Let us understand it with an example.

For more details refer the product brochure.

For more details refer the product brochure.

For more details refer the product brochure.

How to apply for a Rs. 50 lakh term insurance plan?

To apply for a Rs 50 lakh term insurance plan through Future Generali India Life Insurance, follow the steps below:

- Visit the Future Generali Life Insurance website to generate a quotation.

- Fill the application form and pay the premium online.

- Submit all documents required online to complete the process.

Conclusion

One of the topmost priorities for any individual is to provide for his/her family’s well-being, regardless of its presence. The Rs. 50 lakh term insurance plan from Future Generali India Life Insurance may just be the plan suited for your family’s needs in the future, without taking a toll on your pocket in the present.

Click on the link - Life Insurance Made Simple to learn more about life insurance, explore other related products, and read more about insurance and financial planning today.

Comments