Equipping your child with the best educational opportunities is always a priority. It enables them to pursue their interests and become independent and informed individuals. However, it comes at a price, quite literally. The cost of education in India is on a steep rising curve. Studying at premier institutes for an MBA or engineering degrees brings expenses in no less than Rs 15 lakhs. Management institutes like IIM-A increased the fees from Rs. 18.5 lakh in 2017 to Rs. 19.5 lakh in 2018.

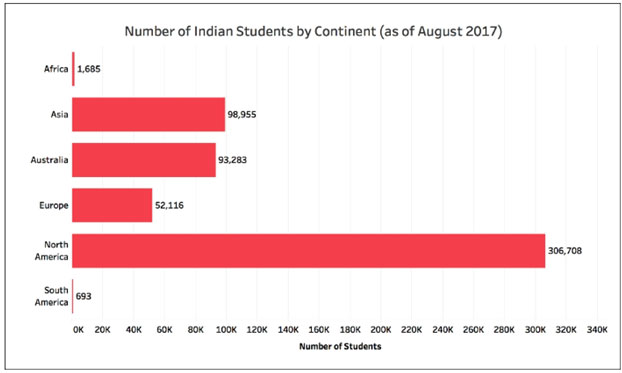

An increasing number of children are now also opting to study abroad, in order to access the best education and networking opportunities to get ahead in their career in such competitive times. Here’s a chart showing how many students from India are studying overseas.

Studying abroad is a great stepping stone, but it is an expensive affair. For a two-year course of Masters in Finance at the University of Melbourne, Australia you will need to shell out around AUD$ 40,000. The student will also have to bear the cost of living expenses -accommodation, food, clothes, airfare etc. Add to that visa expenses of about AUD $18,000. Similarly, a decent postgraduate degree in the UK will come at around GBP 25000, with visa, living, accommodation, food, airfare expenditure on top of that.

The point is that higher education involves gigantic sums of money, and these expenses are only going to rise. Thus it can never be too early for you to start planning how you are going to provide for your child’s education. The right investment strategy has the potential to serve as a financial cushion for your kid, considering not many things are under your control.

Education planning can be an overwhelming task - whenever kids are involved, you want the best for them, and don’t want anything to go wrong. So, it is important to have a sense of how you can best provide your kids with resources that will help them achieve their dreams.

Early bird catches the worm

This old adage fits well with the savings and investments for education. You should start saving as early as when your child is born - you will be able to save more amount with ease, and benefit from its compounding returns. To be able to build a financial corpus that suffices for your kids’ needs, planning needs to begin much earlier than say, your 40s. Otherwise, you may end up falling short on the amount. Not to mention, lack of adequate funds and savings can also jeopardise your other financial goals, or lead you to fiddle with your retirement savings. Ask anyone - it is always a bad idea to dig into your retirement savings to fund other pursuits.

The action plan for investment in your child’s education

What you need is a plan that arms you with the necessary funds to help your child gain admission into a premium institute to receive a quality education. Since you cannot predict with absolute certainty what a degree would cost ten years from now, your best bet is to invest in a plan like theFuture Generali Assured Education Plan

.It is Guaranteed Income Plan, and designed in a way that you are sure to use it only for payment of admission or tuition fees. You can choose to receive the payouts as per three different options, again designed to give payouts when your child hits particular education milestones.

This way, you can save systematically and regularly until your child is 17 or 18 years old. When s/he reached that age, her/his education will be secure under the plan. It is a seamless instrument for you to assure education even in the unfortunate case of your demise, disability and the like by availing additional riders like Accidental Death Rider, Disability rider etc under the plan.

It is important that you are saving for your child's education in keeping with the economic trends and your child’s ambitions. Your wise and timely investments can facilitate a launching pad for your kid’s bright career. At the same time, with a plan like Future Generali Assured Education Plan you can rest assured that even in the face of eventualities, your child’s education will never get compromised. And remember, the 18-year clock starts ticking the moment your child is born.

Comments