Retirement is not the end of the road. It is the beginning of the open highway!

The human life cycle has three financial stages.

- The first stage is childhood, when you earn nothing. This is when you build a foundation for the next stage, complete your education, and acquire new skills.

- The second stage is the youth and adulthood stage, when your energy is at its peak, and your career kicks off. The focus is on generating wealth and saving enough for the last stage.

- The final stage is old age or retired life, where you have a lot of wisdom but you don't work to earn a living, and hence you no longer have a source of earned income.

For most people, the only source of money at the final stage is passive income generated from the wealth and assets collected during the earlier stages of life. However, apart from wealth and assets, life insurance plays a vital role in ensuring a peaceful retired life.

The goal should be to retire as early as possible with as much income and wealth-generating assets, that can take care of your financial needs for rest of your life, without any compromises.

Just like a term insurance policies support the family of the insured after their demise or Health insurance protects the insured against health-related and medical expenses, Pension plans and annuities can support you with a regular income for golden years post retirement.

What is a pension plan? or What is a retirement plan?

Pension Plan or Retirement Plan offered by a life insurance company is something that helps you build a fund through your earning years to ensure that you have a steady source of income after you retire.

So, when you plan for your retirement at an early stage in life - it is critical to explore the best pension plan in India.

You can also find Life Insurance plans that pay income for long term or even lifetime and hence may serve as a pseudo retirement plan.

Why is retirement planning important?

In today's ultra-stressful lifestyle, we hardly have time to plan for the future or even think about retirement.

Having said that, let's pause for a moment, take a look at our lifestyle, understand the current and possible future expenses, and then check the readiness.

If you are prepared great. If not, it’s time to action so as to relieve ourselves of retirement worries.

The following are a few reasons why retirement planning is important:

- A retirement plan is a disciplined, affordable, and secure way to save for retirement.

- When you already have a retirement plan in place, you know that you will have a fixed and stable monthly income to take care of your needs post-retirement. When your future is taken care of, it leads to reduced anxiety and better mental health.

- Financial independence is one of the major reasons why retirement planning is important. A retirement plan will enable you to make decisions even after retirement, without worrying about depending on anyone else for finances.

How to plan for retirement?

Planned retirement involves a number of steps, such as:

Step 1: Decide When You Want to Retire

Most people in India retire at 60 years of age, but it may vary from person to person. Note that years to retirement is also the time you have to plan for retirement.

For example, if you are 35 years old and you plan to retire at 55, then your years to retirement are = 55 – 35 = 20 years. This means you have only 20 years left to plan your retirement.

Step 2: Estimate Your Life Expectancy

Life expectancy is an important factor to consider when determining your retirement age. It is the approximate number of years you are expected to live based on your age, medical condition, family history, and other demographic factors.

Step 3: Calculate Your Retirement Fund

Retirement Fund is the amount you require post retirement to meet your expenses and continue with the same lifestyle and maybe pursue your other personal goals.

- For this, first ascertain your annual expenses at present.

- Then factor in inflation to calculate how much your present expenses will amount to at the time of retirement. This is referred to as the future value of money. This is the amount you will need every year to meet your post-retirement expenses.

For example, Mr. X is 32 years old. He wants to retire at the age of 60. Currently, he spends ₹ 75,000 every month for household and other expenses. In addition he spends ₹ 5 lakhs in a year for medical and travel expenses.

Pre and post retirement - he assumes household inflation is 7% per year; travel and medical expenses will increase by 10%; and his retirement fund will earn 6% per year after it is built post retirement.

To maintain his current standard of living, how much will he need when he retires assuming he wants to meet expenses from the earning from retirement fund?

Answer - Approximately 22 Crores to meet expenses at age 60.

Can this be achieved?

Absolutely. A trusted financial expert can help you determine your financial goal. To connect with a financial expert, fill in your details!

Step 4: Calculate the Future Value of Your Current Savings

Saving a certain amount of money each year alongside paying all your expenses is crucial to building a retirement fund.

The best way to save for retirement is to designate a portion of your savings. You should keep this part of your savings sacred and shouldn't disturb it unless it's extremely critical.

In order to calculate this, you have to assume an expected rate of return on your investment. This is the rate at which your savings or investments will grow till you retire.

For example, if you can save Rs 100,000 per year for retirement and invest that amount in a financial instrument, which gives you a 7% rate of return annually. When you reach retirement age, say in 30 years, you will have a corpus of approximately Rs. 1 Crore.

Step 5: Create an Ideal Portfolio with the Help of a Financial Planner

Your standard allocation to each asset class should be determined by your age and the amount of risk you are willing to take. Investment portfolios should be diversified across a variety of asset classes.

Step 6: Start Saving/Investing Early to Retire Peacefully

Start planning your retirement as soon as possible. As you have several years in your pocket, you can take advantage of the power of compounding.

For example, if you want to create a corpus of Rs. 1 Crore for retirement, assuming the rate of return is 7%, here is the amount of annual saving you need to achieve the target fund depending upon number of years to retirement when you start:

| Years to Retirement | Saving required at the start of each year |

|---|---|

|

10 years |

₹ 6,76,425 |

|

15 years |

₹ 3,71,912 |

|

20 years |

₹ 2,27,971 |

|

25 years |

₹ 1,47,762 |

|

30 years |

₹ 98,938 |

Avoid delaying retirement planning at all costs. In the worst case, you might have to rely on your children or family if you do not have enough funds by retirement. Therefore, begin early - start now.

Step 7: Keep Track of Your Plan and Review it Regularly

You should monitor your retirement plan regularly (at least once a year) to make sure you are on track to meet your goals. The retirement plan must reflect any changes in income, expenses, retirement age, etc. Additionally, in a changing market, ensure that your retirement plan meets your investment objectives.

Pension plans offered by Life Insurance companies are often considered to be a reliable way to retirement planning.

How do pension plans work?

Pension plans are primarily designed to provide a steady income after retirement, as well as a fallback option if your savings fall short during emergencies. But how do pension plans work in India? Let's take a closer look:

To receive a certain amount of fund by retirement, you must pay premium(s). Your premiums are invested depending upon the plan chosen. You may get to choose a fund of your choice if you have chosen a ULIP pension. Once the pension plan reaches maturity, you will be able to receive the vesting benefits, which can be utilised in the following two ways:

- Buy an annuity plan using the entire maturity value of your pension plan

- You can withdraw a portion of your pension benefits and invest the remaining amount in an annuity plan.

If you choose a Life Insurance saving plan to create the retirement fund, you can get a third option, which is to decide at retirement about where to invest the maturity value to generate a regular income. You may also choose from the life insurance plans that pay you a regular income for life and this could be the fourth option.

Let’s Look at some examples:

Using Life Insurance Pension Plan and an Annuity for Retirement Planning

Mohit had purchased a Pension Plan from Future Generali India Life Insurance in December 2011, when he was 50 years old. His policy matures and the maturity value (or vesting value) is Rs. 15,00,000.

It is mandatory to use the maturity proceeds of pension plan to buy an annuity after commutation (withdrawal of part of the proceeds).

Scenario-1: Mohit uses entire maturity value of his pension plan to buy an annuity

Mohit purchases Future Generali Saral Pension plan – Option 1: Life annuity with Return of 100% of Purchase price (ROP) using the maturity proceeds of Rs. 15 Lakh + applicable taxes

He will receive an annuity of Rs.75,262 every year as long as he survives.

Upon Mohit’s death, his nominees will receive Rs. 15 Lakh (Purchase Price, excluding Taxes).

Scenario-2: Mohit withdraws 1/3rd of the maturity proceeds of his Future Generali Saral Pension plan and uses the balance to buy an annuity

Mohit withdraws Rs. 5 Lakh immediately

Mohit purchases Future Generali Saral Pension – Option 1: Life annuity with Return of 100% of Purchase price (ROP) using the balance maturity proceeds of Rs. 10 Lakh + applicable taxes

He will receive an annuity of Rs.50,175 every year as long as he survives.

Upon Mohit’s death, his nominees will receive Rs. 10 Lakh (Purchase Price, excluding Taxes).

Lets look at a scenario when Life Insurance Saving Plans are used for retirement planning as an alternative:

Using Life Insurance Saving Plan for Retirement Planning

Scenario-1: Amit uses a life insurance saving plan to create fund for post-retirement years.

He has not decided how the income should be generated post retirement.

Amit had purchased a Future Generali New Assured Wealth Plan when he was 40 years old. His policy matures when he is 60 years old, and the maturity value is Rs. 15,00,000.

Amit is free to decide where to invest this 15 Lakh to generate an income. He can buy an Annuity from a Life Insurance Company or income plans offered by other financial institutions including post office.

Scenario-2: Amit chooses a life insurance income plan that pays income for lifetime.

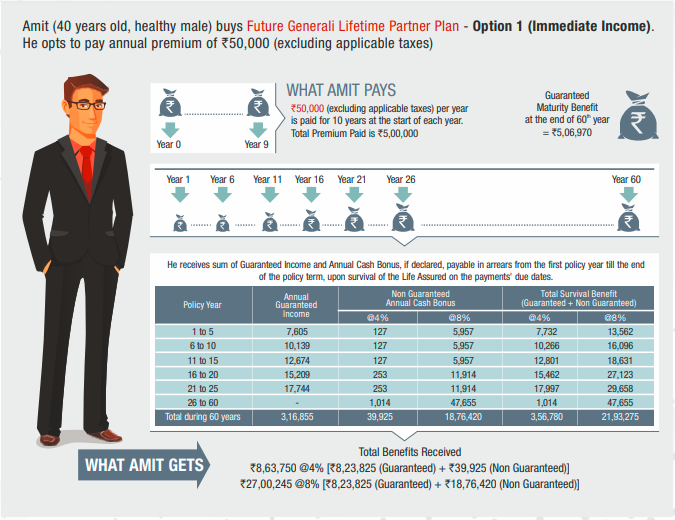

Amit is a healthy 40-year old male and has purchased the Future Generali Lifetime Partner Plan – Option 1: Immediate Income. He has opted for an Annual Premium of Rs. 50,000 per year (excluding applicable taxes) for a Premium Payment Term of 10 years and Annual Survival Benefit frequency. His Policy Term is 60 years and his Sum Assured is Rs. 2,53,485.

What Amit Pays? Premium Amount x Premium Paying Term = 50,000 x 10 = Rs. 5,00,000 plus applicable taxes

What Benefits Does Amit Get?

Amit starts getting a regular income right from year-1. The income is mix of Guaranteed Income and a cash bonus, as declared by the Company from time to time. The income keeps increasing as shown in the illustration below:

Future Generali Lifetime Partner Plan - Option 1 (Immediate Income)

Future Generali Lifetime Partner Plan - Option 1 (Immediate Income)As per the current Bonus Rate (applicable as on 1 April 2022), the total survival benefit receivable by Amit will be Rs. 12,801, which is Guaranteed Income of Rs. 7,605 + Cash Bonus of Rs. 5,196.

By this way, Amit successfully secured his retirement. Just like Amit, if you are looking for lifelong support, the Future Generali Lifetime Partner Plan is an excellent choice.

How much do I need to save for retirement?

To determine the amount you need to save for retirement, the following factors should be considered:

- Day-to-day Expenses – Your retirement fund should be adequate to generate an income that you will need to maintain your lifestyle even after retirement.

- Events and Milestones During Retirement – Even after retirement, there may be financial responsibilities, such as taking care of the dependent partner’s expenses, child’s weddings, and more. Including these costs in a retirement plan is crucial.

- Post-retirement Dreams – After retirement, you may have dreams you wish to fulfil, such as travelling, starting your own business, etc. In order to calculate the fund you would require after retirement, you need to include these costs.

- Unforeseen Costs – When planning for retirement, be sure to set aside some money for any unexpected costs, such as medical expenses or financial emergencies.

- Inflation – Prices will rise for goods and services and you will have to pay more to consume the same items at a later date.

For example, currently, at the age of 45 - your expenses amount to ₹ 6 lakh a year. In order to maintain the same lifestyle after retirement at the age of 60, you would need ₹14.38 lakh every year (taking 6% yearly inflation into account). It is therefore important to factor in inflation when calculating the amount you would need for retirement.

What are the benefits of pension plans?

Among the benefits you can get from pension plans are the following:

- Continuity of Income – With a pension plan, you can obtain a fixed and steady income following retirement (deferred pension plan) or directly after investing (immediate annuity plan). As a result, you are financially independent after retirement.

- Flexibility to Choose Vesting Age – Participant's vesting age, or the point at which they will begin receiving a pension, is known as the vesting age. Pension plans in India typically have a minimum vesting age of 40-50 years and a maximum age of 70 years. Depending on your chosen age range, you can begin earning a monthly pension at any time between the minimum and maximum limit.

- Death Benefit – A pension plan may also provide a death benefit for the financial security of your family in the event of your death. In the event of your untimely death, the nominee will receive the death benefit or sum assured.

- Flexible Premium Payment Terms – With retirement plans and pensions, you can also choose how long you want to pay premiums. Based on your financial goals, you can choose your premium payment term.

- Tax Benefits – You may be eligible for tax benefits on the premium(s) you pay and benefit proceeds, according to the provisions of Income Tax laws. These benefits are subject to change as per the current tax laws. Please consult your tax advisor for more details.

6 Tips for Choosing the Right Retirement Plan

Do something today that your future self will thank you for.

- Sean Patrick Flanery

Retirement planning is one of those things that you must start today so that your future self will thank you for! The few who ignore it may regret it later in life. Moreover, with rising life expectancy and housing & healthcare costs, retirement planning should be a priority.

So, here are some tips to help you select suitable retirement account plans:

- The Inflation Rate Should Be Lower than the Return on Investment (ROI)

Retirement planning may be viewed as a long-term monetary objective if the inflation rate is less than the ROI. Many consumers face the significant challenge of safeguarding the invested amount from capital loss caused by changing inflation rates while investing for the long term. It is because inflation can occasionally harm the value of your corpus and long-term investments. As a result, it is critical to remember that the overall ROI should ideally be higher than the inflation rate.

- Look for Plans that Provide Regular Income

Upon retirement, you will no longer receive a regular income. This is when annuity plans come into play. It is a good idea to invest in retirement plans or annuity plans as they provide regular income after retirement or from the time you choose. Additionally, retirement plans provide financial security to your loved ones after your death.

You may also consider other Life Insurance plans that pay an income for long term or even whole of life.

- Reduce Risks while Ensuring a Guaranteed Return

A person can take certain risks to diversify their wealth. Nevertheless, as you get older and closer to retirement, you should strive to reduce your risk and search for instruments that give you fully or at least partly guaranteed returns. Thereby, you can be sure that the benefits you receive will have higher probability to last for your entire lifetime.

- Period of Vesting

Vesting age is the age from which you start getting income from your investment/retirement plan. Thus, if you wish to start receiving income from your retirement plan at the age of 55, choose a plan with a 55-year vesting age. If you plan to retire late, you may choose a plan with a higher vesting age.

- A Suitable Annuity Option

You should select an annuity option that is the best for you. For example, you can choose a life annuity that pays a guaranteed amount of annuity as long as you live but nothing is payable to your survivors after you OR you can choose a life annuity with return of purchase price, that pays a guaranteed amount of annuity as long as you live and returns the fund back to your nominees after you. The later would have a little lower annuity rate.

You also have an option to secure your spouse by choosing joint life annuity option, which pays as long as at least one of you and your spouse is surviving.

- Commitment

No one’s ever achieved financial fitness with a January resolution that’s abandoned by February. – Suze Orman

It can be tough to choose a retirement plan, and even harder to stick to it. However, if you want to accomplish your goal, you must stick to the plan you bought. Do not break the plan before it is mature. Watch it grow until it eventually pays you out the money you need to retire.

Conclusion

Planning for retirement is a crucial step towards ensuring a peaceful life and is the best gift you can give yourself at any stage. Depending on someone for your retirement may be a risky proposition. Retirement planning only requires allocating appropriate amount of money out of the total earnings you earn in your adult stage to secure your old age. Your contribution will be lower if you start early.

Future Generali India Life Insurance is your trustworthy retirement partner with various plans available to suit your specific needs.

—

Disclaimer for

- Future Generali Lifetime Partner Plan (133N086V01): An Individual, Non-Linked, Participating (with-profits), Savings, Life Insurance Plan

Please Note: Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your life insurance company. These assumed rates of return 8% and 4%, are not guaranteed and they are not upper or lower limits of what you might get back as the value of your policy is dependent on a number of factors including future investment performance.

- Annual Cash Bonus: At the end of each financial year, the Company may declare a cash bonus expressed as a percentage of the Sum Assured. The Annual cash bonuses shall be determined separately for each option.

- Terminal Bonus: The Company may declare a terminal bonus which may be payable on death or on maturity of the plan.

- Future Generali New Assured Wealth Plan (133N085V01) - An Individual, Non-Linked, Non Participating (without profits), Savings, Life Insurance Plan

- Future Generali Saral Pension (133N089V01) – A Single Premium, Non-participating, Individual, Immediate Annuity Plan

Comments