Under the Section 80CCC and Section 80CCD (1B) of the Income Tax Act 1961; you are eligible for availing tax deductions of up to Rs. 1,50,000 + 50,000 in a financial year. That said, tax deductions accrued against retirement savings have two components:

#1. Using Life Insurance Saving Plan for Retirement Planning – Save Taxes under Section 80C and 10(10D)

You have the investment instruments such as retirement plans and/or annuity plans offered by reputable life insurance companies. These tax-saving instruments can help you create a retirement corpus while availing tax benefits of up to Rs. 1,50,000 under Section 80C for the premiums paid towards life insurance savings plan and tax-free maturity proceeds under 10(10D).

Let’s take an example:

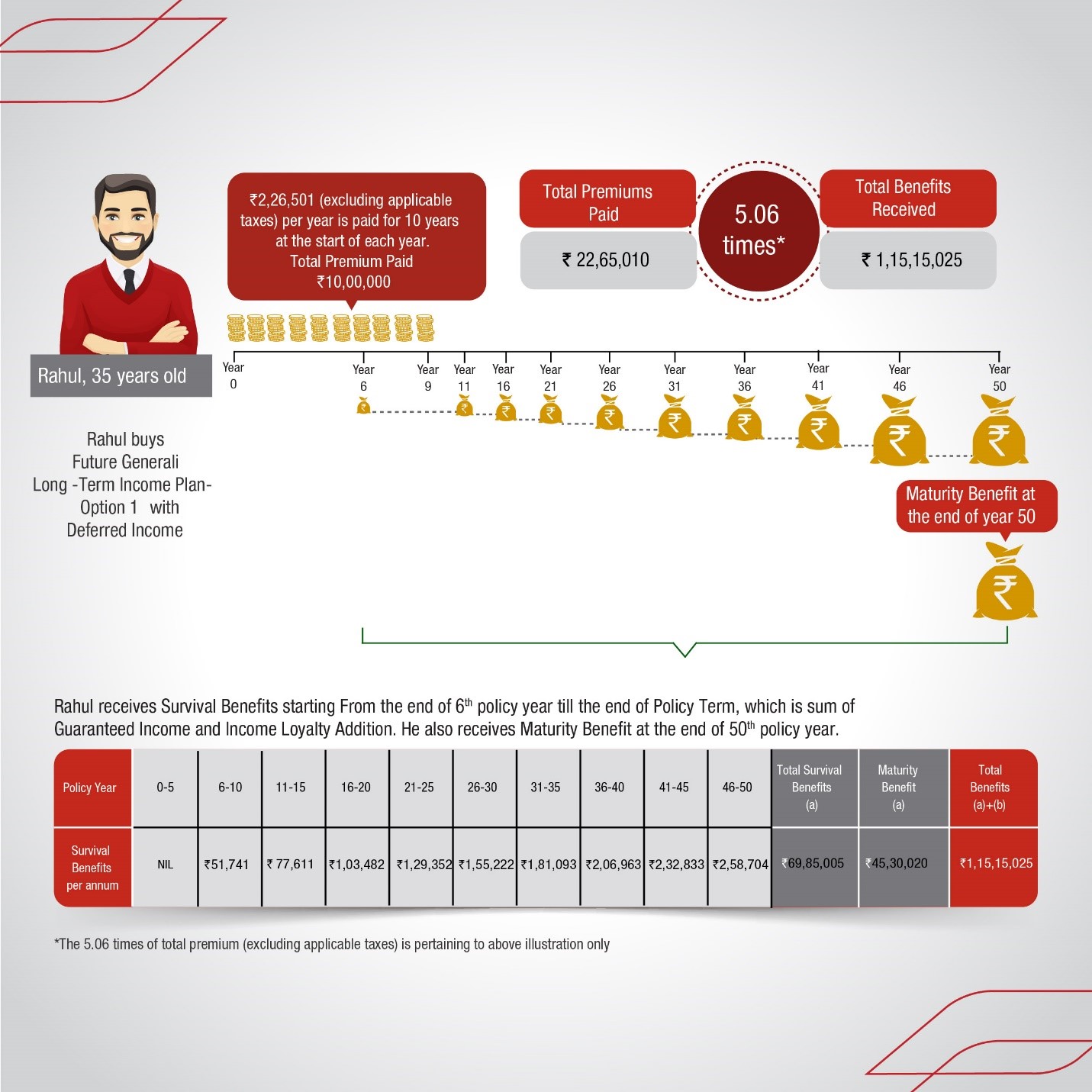

Rahul is a 35-year-old healthy man old non-smoker man who is a resident individual. He falls under the highest tax slab rate of 31.20% (including cess excluding surcharge) having income less than ₹ 50 lakhs. He has opted for old tax regime.

He has purchased the Future Generali Long Term Income Plan. He has opted for annual premium of ₹ 2,26,501 for a Premium Payment Term of 10 years and Policy Term of 50 years. He has opted for Option 1 with Deferred Income Option. His Sum Assured is ₹ 22,65,010.

If he pays all the due premiums and survives throughout the policy term, he is entitled to receive total benefits (Survival Benefit + Maturity Benefit) of ₹ 1,15,15,025 as explained below:

Long Term Income Plan - Option 1

Long Term Income Plan - Option 1Tax Benefits Received by Rahul under Section 80C

Hence, he will receive a tax benefit of ₹ 46,800 (1,50,000 Gross deductible amount from taxable income u/s 80C max) for annual premium of ₹ 2,26,501 p.a., under Section 80C of the Income Tax Act.

The calculation goes like this:

- Amount Invested in Section 80C = ₹ 1,50,000

- Tax Savings = 45,000

- Cess on Tax Savings @4% = 1,800

- Total Tax Savings in a Year= 46,800

- Therefore, Total Tax Savings in 10 years (PPT) = ₹ 46,800 x 10 = ₹ 4,68,000

Tax Benefits Received by Rahul under Section 10(10D) on Maturity

Entire maturity receipts will also be tax exempt u/s 10(10D) hence Tax savings on the same will be:- (1,15,15,025* 31.20%) = 35,92,688

#2. Using Life Insurance Pension Plan and an Annuity for Retirement Planning – under Section 80C

Mohit is a resident individual. He falls under the highest tax slab rate of 31.20% (including cess excluding surcharge) having income less than ₹ 50 lakhs. He has opted for old tax regime.

Mohit had purchased a Pension Plan from Future Generali India Life Insurance in December 2011, when he was 50 years old. His policy matures and the maturity value (or vesting value) is Rs. 15,00,000.

It is mandatory to use the maturity proceeds of pension plan to buy an annuity after commutation (withdrawal of part of the proceeds).

Scenario-1: Mohit uses entire maturity value of his pension plan to buy an annuity

Mohit purchases Future Generali Saral Pension plan – Option 1: Life annuity with Return of 100% of Purchase price (ROP) using the maturity proceeds of Rs. 15 Lakh + applicable taxes

He will receive an annuity of Rs. 75,262 every year as long as he survives.

Upon Mohit’s death, his nominees will receive Rs. 15 Lakh (Purchase Price, excluding Taxes).

Scenario-2: Mohit withdraws 1/3rd of the maturity proceeds of his Future Generali Saral Pension plan and uses the balance to buy an annuity

Mohit withdraws Rs. 5 Lakh immediately

Mohit purchases Future Generali Saral Pension – Option 1: Life annuity with Return of 100% of Purchase price (ROP) using the balance maturity proceeds of Rs. 10 Lakh + applicable taxes

He will receive an annuity of Rs.50,175 every year as long as he survives.

Upon Mohit’s death, his nominees will receive Rs. 10 Lakh (Purchase Price, excluding Taxes).

Uncommuted pension received will be taxable in the hands of the assesse under Salary head as per provision of Income Tax Act.

For Commuted Pension :

- If it is received my employee of State Government/Central Government/ Statutory Corporation then it is completely exempt.

- If it is received my any other employee there are 2 cases :

- If Gratuity was received by such employee

Amount of Exemption : (Amount on Commuted Pension * 100 / % of Uncommuted Pension) * 1/3 - If Gratuity was not received by such employee

Amount of Exemption : (Amount on Commuted Pension * 100 / % of Uncommuted Pension) * 1/2

- If Gratuity was received by such employee

Conclusion

Planning for retirement is a crucial step towards ensuring a peaceful life and is the best gift you can give yourself at any stage. Depending on someone for your retirement may be a risky proposition. Retirement planning only requires allocating appropriate amount of money out of the total earnings you earn in your adult stage to secure your old age. Your contribution will be lower if you start early.

Future Generali India Life Insurance is your trustworthy retirement partner with various plans available to suit your specific needs.

Disclaimer for:

Future Generali Long Term Income Plan (UIN: 133N090V01) - Individual, Non-Linked, Non-Participating (without profits), Savings, Life Insurance Plan

- Survival Benefit - Starting the end of the 6th policy year he will receive a Yearly guaranteed income of ₹ 51,741. He will also receive Income loyalty addition that will enhance your guaranteed income every year starting from 11th policy year.

- Maturity Benefit - Upon survival up to the end of policy term he will receive ₹ 45,30,020 which includes Maturity loyalty addition.

- Guarantee is subject to payment of all due premiums

Future Generali New Assured Wealth Plan (133N085V01) - An Individual, Non-Linked, Non Participating (without profits), Savings, Life Insurance Plan

Future Generali Saral Pension (133N089V01) – A Single Premium, Non-participating, Individual, Immediate Annuity Plan

The tax benefit calculation assumes he is eligible to claim full premium paid by him under Section 80C i.e., he does not have any other investment/instrument to claim under Section 80C that exceeds the total deduction beyond ₹ 1.50 lakhs.

For more details on risk factors, terms and conditions please read sales brochure before concluding a sale.

Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. You are advised to consult your tax consultant.

The information provided herein is generic in nature and solely for educational purposes. Before investing in any financial product, readers are advised to exercise caution and to seek independent professional advice. The use of this information does not imply any liability on the part of Future Generali India Life Insurance Company Ltd.

Comments