"It is easier to talk about saving money than it is to put it into practice."

You’ve probably been told that if you start saving money in your 20’s, you'll thank yourself in your 30’s and 40’s.

The best advice from successful investor Warren Buffet is:

Don't save what's left after spending; spend what's left after saving.

Saving money can help you achieve short and long-term objectives, but it's important to realise that saving alone isn't enough. To combat inflation, it is a good idea to save and invest at the same time.

Every person is concerned about how to save money from your monthly salary; the rich, the poor, and of course, the middle class. The methods and the amount we save can be different, but the objective is the same.

The general thumb rule is that one must spend 50% of a monthly salary on living expenses, 30% on lifestyle expenses, and 20% must be kept aside as savings. But if you have certain goals to fulfil in the long term or short term, then the percentage may vary. Most people have goals like buying a house or saving for retirement. Then, you must save money accordingly to fulfil your goals.

Are you wondering how to save money from your monthly salary? We have five tips to help.

- Make a Monthly Budget Plan and Track Your Finances

It's all about keeping track of where your money goes and managing your spending if you want to save money. Make a monthly budget plan and stick to it by separating your spending into key areas. To begin, keep track of the amount that is credited to your account each month. Next, make a list of your expenses and divide them into two categories: fixed and variable. You can include rent, bills, basic food, and other fixed expenses in this category. You may include purchases that don't reoccur every month in the variable category, such as eating out, vacations, and so on.

- Get Rid of Your Debts

Debt is the ultimate destroyer of all hopes of saving. You're in danger if you owe money to the bank. Pay off your debt first, and if you have credit cards, don't use them excessively. In fact, it's preferable not to use them at all.

- Savings and Investments

If you’re still wondering how to save money from your monthly salary, invest your money in a platform that allows you to save and generate higher returns, depending on your financial goals. But before even investing, make sure you have an emergency fund ready.

Investing in ULIPs is a good option if you want market-linked returns. Whereas, if you want guaranteed returns then saving in a guaranteed savings plan can be the best option to use your salary for investment. There are numerous ULIPs and Guaranteed plans offered by Future Generali India Life Insurance - you can choose the plan that might suit your requirements.

- To Avoid Penalty Costs, Pay Your EMIs on Time

Make sure you don't miss any monthly payments if you have an ongoing loan or credit card obligation. Missed or late payments result in late fees or penalties, which can eat into your paycheck and reduce your savings potential. So, to avoid late payments, consider setting up automatic monthly payments from your bank account.

- Automate Your Savings

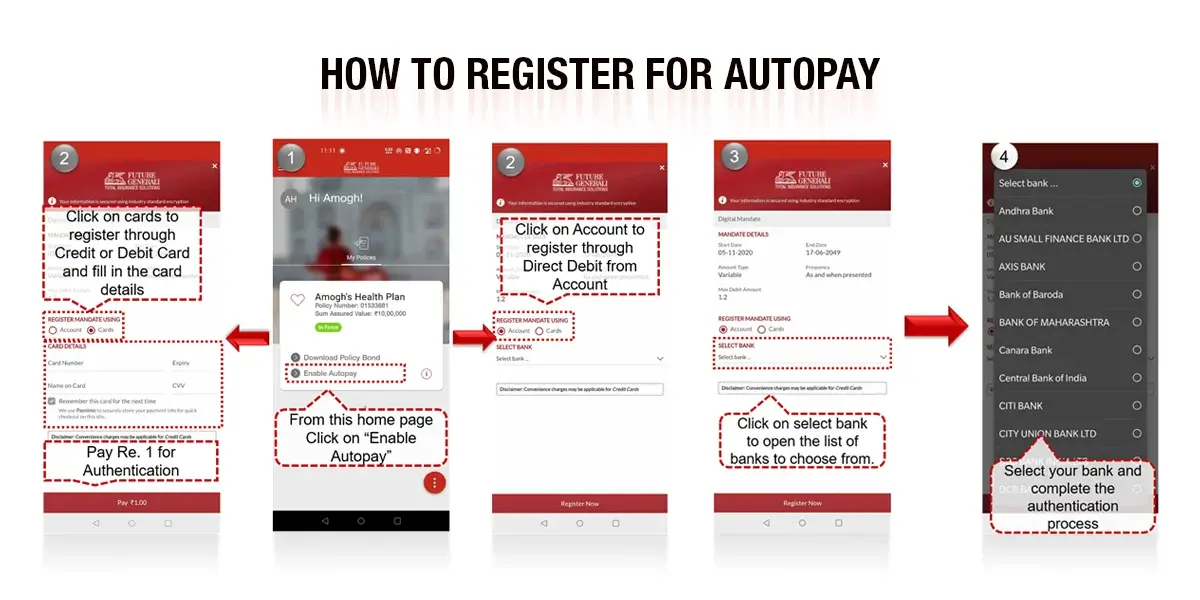

It's difficult to make a conscious effort to put aside some of your hard-earned cash for a rainy day. The easiest approach to putting away money each month is to take the choice out of your hands. Automation may help you save money without thinking about it, from periodic transfers between accounts to simple applications. You can use the Future Generali “FG Life - Customer App” to autopay all your insurance premiums for any of the insurance policies purchased from Future Generali India Life Insurance. You can follow the instructions mentioned in the below picture to set up your auto payments.

Conclusion

Budgeting, saving, and investing may appear to be difficult concepts to grasp, but they are not. It is the most effective way to safeguard your future. They say life is short and you shouldn't worry too much about the future, but it's always best to be ready for the unexpected.

So go ahead and have fun, but don't forget to put some money aside from your salary in your savings account. You will never have to worry about how to save money from your monthly salary.

For more information about savings and investment plans, connect with our trusted financial advisor.

Comments