The tax system in India is progressive, meaning that as taxpayers' income increases, they end up paying higher taxes. Whereas, the taxpayers who fall into the low to medium tax brackets can save a significant amount of money.

Tax slabs help determine the total taxable income during a fiscal year. However, before you start calculating your taxes, you need to know the income on which tax will be calculated. This is because earned income is not the same as taxable income.

Suggested Read: Steps to Calculate Your Taxable Income and Tax Liability

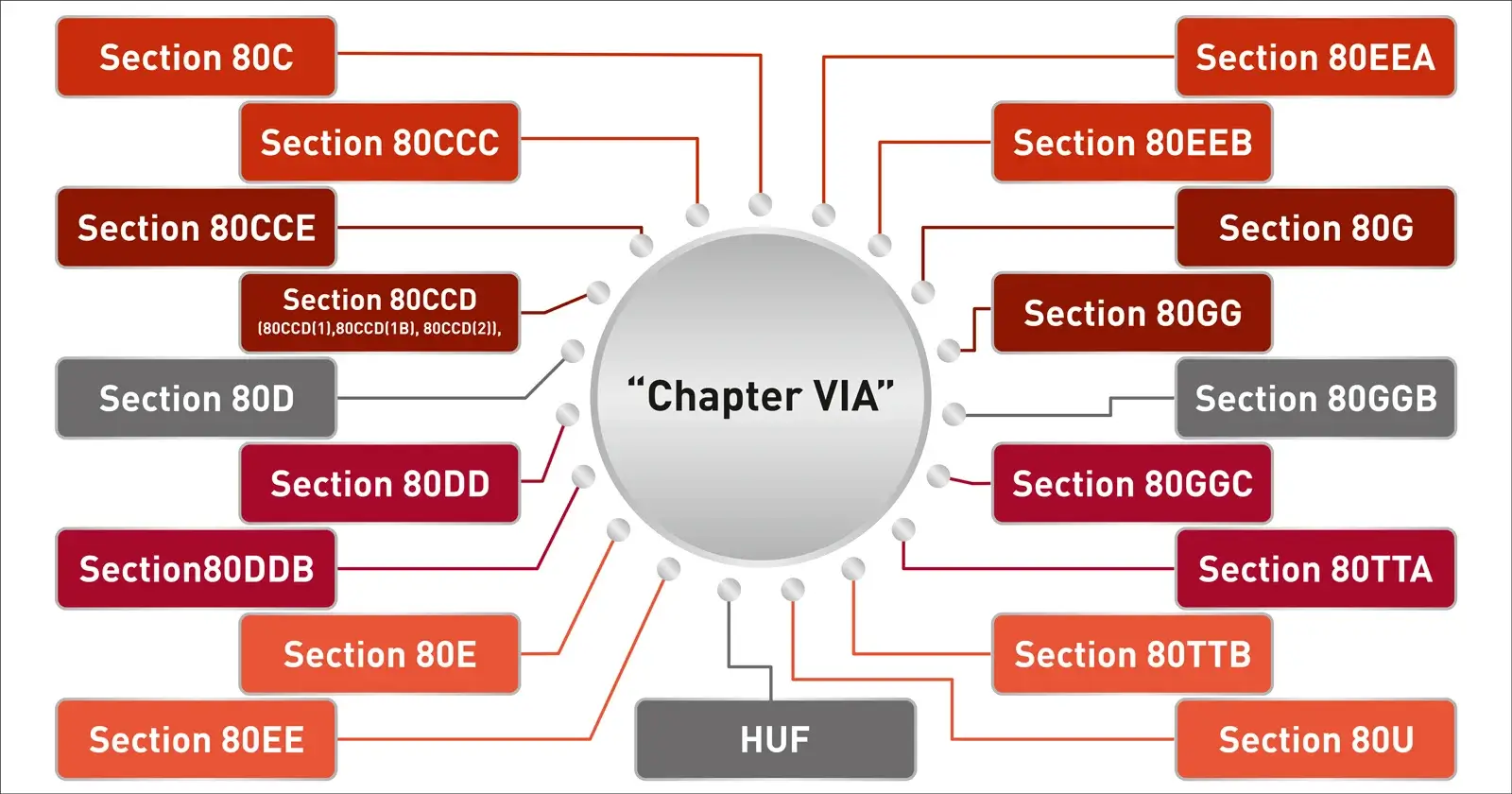

Chapter VI A has various sub sections that you can use to claim deductions so as to reduce your taxable income.

What is Chapter VIA of Income Tax Act?

As per Chapter VIA of the Income Tax Act, a taxpayer can claim deductions from income on the basis of various tax-saving investments, permitted expenditures, donations, etc. The deductions under Chapter VIA are designed to benefit the taxpayer so that the tax burden is reduced.

For instance, deductions can be claimed under Sections 80C, 80CCC, 80CCD, 80CCE, 80D to 80U of the Income Tax Act.

Under deductions from Chapter VIA, you can not only save and invest money - but also save on taxes.

Below you will find all the information you need to know about Chapter VIA.

Conditions for Availing Deductions under Chapter VIA

The following conditions must be met to qualify for deductions under Chapter VIA:

- Under Chapter VIA, a taxpayer's deductions cannot exceed their gross total income. For example, the taxpayer earns Rs. 3, 00,000 in Gross Total Income. The total deductions under Chapter VIA amount to Rs. 3, 50,000. Due to this, the amount of deductions allowed to the taxpayer will now be Rs. 3, 00,000 because the deductions (Rs. 3, 50,000) cannot exceed the Gross Total Income (Rs. 3,00,000).

- Under section 111A and section 112 deductions under Chapter VIA will not be allowed for long-term capital gains and short-term capital gains.

Deductions under Chapter VIA

The Sections which gives benefit of lowering the taxes to Individual and HUF taxpayers are listed below:

Deduction under Section 80C

| Eligible Taxpayer |

Individual and HUF |

|---|---|

| Investments and Conditions |

To take advantage of Section 80C, the taxpayer must invest and make certain payments as follows: 1. Life Insurance Premium 2. Contribution to Public Provident Fund (PPF) 3. Contribution to Recognized Employee Provident Fund (EPF) 4. Investment in National Pension Scheme (NPS) 5. Investment in National Savings Certificate (NSC) 6. Investment in Equity Linked Saving Scheme (ELSS) 7. Investment in Unit Linked Insurance Plan (ULIP) 8. Investment Tax Saving Fixed Deposit (five-year fixed deposit (FD) of Scheduled Bank or Post Office) 9. Contribution to Approved Superannuation Fund 10. Senior Citizen Saving Scheme 12. Repayment of Housing Loan Principal amount 13. Tuition Fees of any college, school, university or other educational institutions within India for full-time education for maximum 2 children.

Each of the above investments and payments has its own lock-in period, interest rate, and other requirements to qualify for deduction under Section 80C. |

| Amount of Deduction |

The maximum deduction under Section 80C is Rs. 1,50,000, subject to Section 80CCE. |

Deduction under Section 80CCC

| Eligible Taxpayer |

Individuals who have paid or deposited any amount in a specified pension funds that are offered by a life insurance. HUF (Hindu Undivided Family) is not eligible for exemption under Section 80CCC. These provisions apply to both residents as well as non-residents individuals. |

|---|---|

| Condition | No deductions can be claimed under Section 80C if a deduction is claimed under this section. |

| Amount of Deduction | The Section 80CCC allows a deduction of Rs. 1,50,000 subject to section 80CCE. |

| Other Points |

The following amounts will be taxable during the year they are received:

|

Deduction under Section 80CCD

The government of India has notified deductions for contributions to pension schemes. The deductions fall into three categories:

| Section | 80CCD(1) | 80CCD(1B) | 80CCD(2) |

|---|---|---|---|

| Eligible Assessee |

An individual who deposits into his or her pension account as per National Pension Scheme or the Atal Pension Yojana, whether he or she is salaried or self-employed. |

Individual taxpayer who have deposited the money in the National Pension Scheme will have an additional deduction. |

Contributions made by the employer to the pension account of the employee.

A deduction u/s 80CCD(2) may be made after the employer's contribution is included in the employee's salary. |

| Contribution of | Employee | Own | Employer |

| Amount of Deduction |

Salaried Individuals - 10% of salary (i.e. basic salary and dearness allowance) (subject to section 80CCE) Self Employed Individual - 20% of Gross Total Income (subject to section 80CCE) |

Rs. 50,000 regardless of whether a deduction is allowed under Section 80CCD(1). |

Maximum 14% of the salary (in case the employer is CG)/10% of Salary (in case of other employer) |

Deduction under Section 80CCE

There can be a maximum deduction of Rs. 1, 50,000 under section 80C, 80CCC, and 80CCD(1). The breakdown is as follows:

| Section | Investment/ Contribution | Ceiling Limit |

|---|---|---|

| 80C |

Specified Investments |

Rs. 1,50,000 |

| 80CCC |

Contribution to Certain Pension Funds |

Rs. 1,50,000 |

| 80CCD(1) |

Contribution to NPS of Government |

|

| 80CCE |

Aggregate Deduction under above Sections |

Rs. 1,50,000/- |

The following table lists the ceiling limits under other sections, which do not exceed the limit of Rs. 1,50,000 specified under section 80CCE:

| Section | Investment/ Contribution | Ceiling Limit |

|---|---|---|

| 80CCD(1B) |

Contribution to NPS of Central Government |

Rs. 50,000 |

| 80CCD(2) | Contribution by employer to NPS of Central Government | Maximum 14% of the salary (in case the employer is CG)/10% of Salary (in case of other employer) |

Deduction under Section 80D

| Eligible Taxpayer | Individual or HUF |

|---|---|

| Expenditure |

The following expenditure should be incurred:

The expenditure can be incurred by the taxpayer being:

|

| Amount of Deduction |

For Individuals paying for Self, Spouse and Dependent Children below 60 years: Rs. 25,000. For Individuals paying for Self, Spouse and Dependent Children above 60 years: Rs. 50,000. An additional Deduction is allowed if paid for Parents:

|

| Mode of Payment |

Any payment mode is allowed other than cash. However, the payment of Preventive Health Checkups can be paid in cash. |

Suggested Read: Section 80D Deduction - Eligibility, Deduction & Calculation

Deduction under Section 80DD

| Eligible Taxpayer | Resident Individual and Resident HUF |

|---|---|

| Conditions |

Expenditures should be made as follows:

|

| Amount of Deduction |

The amount of deduction is Rs. 75,000 (Where disability is 40% or more but less than 80%) In case of severe disability (person with 80% or more disability), the amount of deduction will be Rs. 1,25,000. |

Deduction under Section 80DDB

| Eligible Taxpayer | Resident Individual and Resident HUF |

|---|---|

| Conditions |

|

| Amount of Deduction |

The amount of deduction is:

The deduction is allowed in respect of the amount actually paid for the medical treatment of such disease or ailment of the specified persons. If the taxpayer or dependent receives medical treatment through insurance or an employer reimburses the taxpayer for medical treatment, the deduction amount will be reduced by such amount as reimbursed. |

Deduction under Section 80E

| Eligible Taxpayer | Individual |

|---|---|

| Conditions |

|

| Period of Deduction |

A total of 8 years or repayment in full, whichever comes first. |

| Meaning |

Higher Education: Any course after 12th standard. Relative: Spouse and/or Children |

| Amount of Deduction |

No maximum or minimum deduction limit specified under section 80E. This section provides a deduction on the actual interest amount paid during the financial year. |

Deduction under Section 80EE

| Eligible Taxpayer | Individual |

|---|---|

| Conditions |

|

| Amount of Deduction |

Interest paid on the Housing Loan is up to Rs. 50,000 |

Suggested Read: Section 80EE: Income Tax Deduction for Interest on Home Loan.

Deduction under Section 80EEA

| Eligible Taxpayer | Individual |

|---|---|

| Conditions |

|

| Amount of Deduction |

Interest paid on the Housing Loan is up to Rs.1,50,000 |

Deduction under Section 80EEB

| Eligible Taxpayer | Individual |

|---|---|

| Conditions |

|

| Amount of Deduction |

Interest paid on the Loan is up to Rs.1,50,000. |

Suggested Read: Section 80EEB Deduction: Tax Benefit of Buying an Electric Vehicle

Deduction under Section 80G

| Eligible Taxpayer | Any Taxpayer (individual/ firm/ LLP or any other person). |

|---|---|

| Categories of Donations |

Donations fall into the following categories:

|

| Amount of Deduction |

Amount of Deduction is based on the Donee to whom the Donation is made. The following amount of Deduction is available based on categories of donation:

|

| Other Points |

|

List of Donee (recipients) in Category 1:

- The National Defence Fund set up by the Central Government

- Prime Minister’s Relief Fund

- Prime Minister’s Armenia Relief Fund

- The Africa (Public Contributions - India) Fund

- The National Children’s Fund

- The National Foundation for Communal Harmony

- Approved University or educational institution of national eminence

- Maharashtra Chief Minister’s Earthquake Relief Fund

- Any Fund set up by the State Government of Gujarat exclusively for providing relief to the victims of the Gujarat Earthquake

- Any Zila Saksharta Samiti for primary education in villages and towns and for literacy and post-literacy activities

- National Blood Transfusion Council or any State Blood Transfusion Council whose sole objective is the control, supervision, regulation or encouragement of operation and requirements of blood banks

- Any State Government Fund set up to provide medical relief to the poor.

- The Army Central Welfare Fund or Indian Naval Benevolent Fund or Air Force Central Welfare Fund established by the armed forces of the Union for the welfare of past and present members of such forces or their dependants.

- The Andhra Pradesh Chief Minister’s Cyclone Relief Fund, 1996

- The National Illness Assistance Fund

- The Chief Minister’s Relief Fund or Lieutenant Governor’s Relief Fund

- The National Sports Fund set up by the Central Government

- The National Cultural Fund set up by the Central Government

- The Fund for Technology Development and Application set up by the Central Government

- National Trust for welfare of persons with Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities

- The Swachh Bharat Kosh, set up by the Central Government

- The Clean Ganga Fund, set up by the Central Government (only Residents are eligible for deduction)

- The National Fund for Control of Drug Abuse

Suggested Read: Section 80G Deduction: Tax Benefits on Donation Made to NGO

Deduction under Section 80GG

| Eligible Taxpayer | Individual self-employed, or salaried not receiving HRA at any time during the year |

|---|---|

| Conditions |

|

| Amount of Deduction |

If any deduction is made, it will be the lowest of:

|

| Meaning of Adjusted Total Income |

Adjusted Total Income is defined as Gross Total income after reducing:

Note that deduction under under Section 80GG is to be excluded. |

| Other requirements |

The taxpayer needs to file Form 10BA containing details of payment of rent. |

| Example |

Mr. Raj Kumar pays a monthly rent of Rs. 10,000. Prior to deductions under Section 80GG, he earned Rs. 4,80,000. In accordance with section 80GG, he will be entitled to the following deduction:

|

Deduction under Section 80GGB

| Eligible Taxpayer | An Indian companies. |

|---|---|

| Conditions |

Any mode of contribution other than cash is acceptable. |

| Amount of Contribution |

Contribution made in full. |

| Contribution to whom? |

Electoral trust or political party. The term Political Party refers to any Political Party that has registered under section 29A of the Representation of the People Act. |

Deduction under Section 80GGC

| Eligible Taxpayer | All taxpayers, other than an Indian companies, local authorities, and artificial juridical persons wholly or partly funded by the government. |

|---|---|

| Conditions |

Any mode of contribution other than cash is acceptable. |

| Amount of Contribution |

Contribution made in full. |

| Contribution to whom? |

Electoral trust or political party. The term Political Party refers to any Political Party that has registered under section 29A of the Representation of the People Act. |

Suggested Read: Donation to Political Party - Sections 80GGC and 80GGB Tax Deductions

Deduction under Section 80TTA

| Eligible Taxpayer | Individual (Other than Resident Senior Citizen) or HUF |

|---|---|

| Conditions |

Interest income on deposits in Savings Bank Accounts of Banks, Co-Operatives Banks or Post Office. |

| Amount of Deduction |

The amount of interest earned or Rs. 10,000, whichever is less. |

| Other Points |

The deduction does not apply to interest on bonds, partner's capital, FD interest, sweep TD interest, etc. |

Suggested Read: Section 80TTA: Claim Tax Deduction on Savings Account Interest Income

Deduction under Section 80TTB

| Eligible Taxpayer | Individual (Only Resident Senior Citizen: age 60 years or more) |

|---|---|

| Conditions |

Interest income on deposits in Savings Bank Accounts of Banks, Co-Operatives Banks or Post Office, banking company, cooperative, society engaged in the banking business etc. |

| Amount of Deduction |

The amount of interest earned or Rs. 50,000, whichever is less. |

Deduction under Section 80U

| Eligible Taxpayer | Resident Individual |

|---|---|

| Conditions |

When filing an income tax return, the taxpayer should provide a copy of the certificate issued by the appropriate medical authority. |

| Amount of Deduction |

Rs. 75,000 is the amount of deduction (having a disability of 40% or more). If the person has 80% or more disability, the deduction will be Rs. 1,25,000. |

| Other Points |

It is a fixed deduction and is not based on actual expenses. |

The deductions under Chapter VIA are beneficial and efficient. Because a majority of these investments not only help you save money but also grow it. In the end, you would want to expand your corpus and protect it. Chapter VIA deductions can help you do both.

The best time to start investing in various Chapter VIA instruments and make the most of your money is now if you haven't already done so. Connect with our trusted financial experts today!

Comments

A

s

V