An education loan can save you a significant amount of tax in addition to helping you pay for your higher studies. The interest on any education loans you have taken out and are currently repaying may be deducted from your gross income under Section 80E if you qualify.

What is Section 80E?

If you have taken an education loan and are repaying the same, then the interest paid on that education loan is allowed as a deduction from the total income under Section 80E.

However, only the interest portion of the EMI is eligible for the deduction. The primary portion of the EMI has no tax benefits.

Hence it can help you not only finance your studies but it can save you a lot of tax as well.

- Who can claim this deduction?

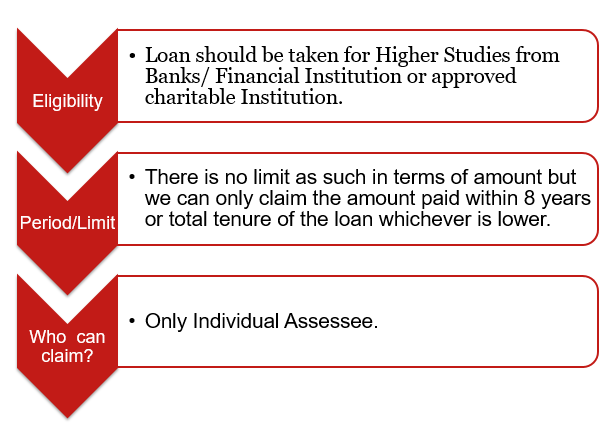

Deduction is only available for Individual as per Income Tax act and not extended to HUF or any other kind of tax payer. The loan should be taken for the higher education of self, spouse or children or for a student for whom the individual is a legal guardian.

- Where can this loan be taken?

The loan should be taken from any bank / financial institution or any approved charitable institutions under category of education loan only (Personal loan won’t be eligible for this deduction). Loans taken from friends or relatives don’t qualify for this deduction.

- What will be the purpose of the loan?

Loan should be taken for higher studies whether it is in India or outside India. It includes both vocational as well as regular courses.

- What will be the deduction amount?

Interest paid on Education loan will be eligible for deduction without any threshold limit supported by certificate provided by bank segregating Principal and Interest amount as there should not be any deduction on principal amount only interest portion is deductible.

- What will be the period of deduction?

It is only available for 8 years starting from the year in which you start repaying the loan or until the interest is fully repaid whichever is earlier.

Tax Benefits of Education Loan under Section 80E?

- What will be the maximum available deduction under section 80E?

There is no limit on the maximum amount which is allowed as deduction but we should keep this in our mind that the tenure of the loan should be planned in a manner that we should be done with Interest payment in 8 years itself otherwise post 8 years there will not be any deduction which we can claim under this section.

- How to calculate the deductions for section 80E?

Deduction should be for Interest amount paid on Education Loan supported by Interest certificate provided by Banks/ Financial Institution or approved charitable Institution.

Eligibility for Tax Deduction under Section 80E

Loan has been taken for Higher Studies from Banks/ Financial Institution or approved charitable Institution.

How to claim 80E Tax Deductions

We need to disclose this separately while filing our ITR under section 80E how much Interest we have paid on such Education Loan.

What are the documents required to claim a deduction under Section 80E?

Interest Certificate is required to claim the deduction to support the deduction amount and to segregate it in Principal and Interest balance out of Total EMI.

However we don’t need upload this document at the time of ITR Filing, It is only required wherever it is asked by AO.

Comments