What is Section 80G?

Contributions made to certain relief funds and charitable institutions can be claimed as a deduction under Section 80G of the Income Tax Act. All donations, however, are not eligible for deductions under Section 80G.

Let’s find out how this works.

Who can claim 80G deduction?

If you are eligible to pay tax, you are automatically qualified to claim a tax deduction under Section 80G. It does not matter that you - the taxpayer – is an individual, company, firm, HUF, or any other person. However, you need to either be a resident Indian or a non-resident Indian (NRI) with an Indian passport. In both cases, you should have a taxable income in India to qualify for an exemption.

What donations are eligible for tax deduction under Section 80G?

- Donations should be made to approved recipients.

- In addition to the receipt for such donations, a certificate is required to take advantage of the deduction.

- A donation made in kind cannot be deducted.

- If a cash donation exceeds Rs. 2,000, it cannot be deducted. (i.e. The donation should be made in any mode of payment other than cash if it exceeds Rs. 2,000)

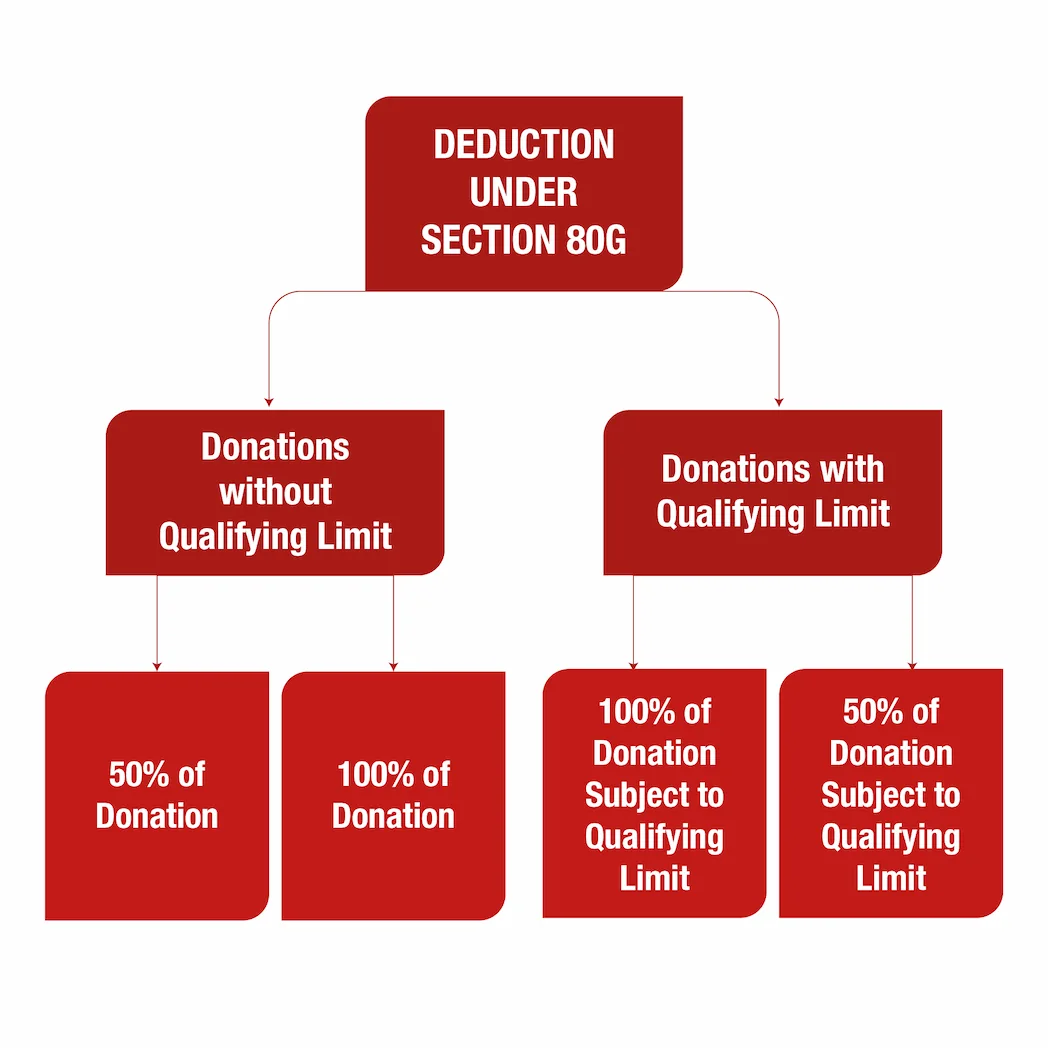

What is amount of tax deduction available under Section 80G?

Amount of Deduction is based on the Donee to whom the Donation is made. The following amount of Deduction is available based on categories of donation:

- 100% of Category 1 donation

- 50% of Category 2 donation

- 100% of Category 3 - Subject to the qualifying limit (maximum limit is called qualifying limit)

- 50% of Category 4 - Subject to the qualifying limit (maximum limit is called qualifying limit)

Tax Deduction Available under Section 80G

Tax Deduction Available under Section 80GWhat is the Qualifying Limit?

All donations made to donees (recipients) listed in Category 3 and 4 combined should not exceed 10% of Adjusted Gross Total Income.

What are the categories of donations?

Donations fall into the following categories:

Category 1 - Donations eligible for 100% deduction without qualifying limit

- National Defence Fund set up by the Central Government

- Prime Minister’s National Relief Fund

- National Foundation for Communal Harmony

- An approved university/educational institution of National eminence

- Zila Saksharta Samiti constituted in any district under the chairmanship of the Collector of that district

- Fund set up by a state government for the medical relief to the poor

- National Illness Assistance Fund

- National Blood Transfusion Council or to any State Blood Transfusion Council

- National Trust for Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation, and Multiple Disabilities

- National Sports Fund

- National Cultural Fund

- Fund for Technology Development and Application

- National Children’s Fund

- Chief Minister’s Relief Fund or Lieutenant Governor’s Relief Fund with respect to any State or Union Territory

- The Army Central Welfare Fund or the Indian Naval Benevolent Fund or the Air Force Central Welfare Fund, Andhra Pradesh Chief Minister’s Cyclone Relief Fund, 1996

- The Maharashtra Chief Minister’s Relief Fund during October 1, 1993, and October 6, 1993

- Chief Minister’s Earthquake Relief Fund, Maharashtra

- Any fund set up by the State Government of Gujarat exclusively for providing relief to the victims of the earthquake in Gujarat

- Any trust, institution or fund to which Section 80G(5C) applies for providing relief to the victims of the earthquake in Gujarat (contribution made during January 26, 2001, and September 30, 2001)

- Prime Minister’s Armenia Earthquake Relief Fund

- Africa (Public Contributions – India) Fund

- Swachh Bharat Kosh (applicable from FY 2014-15)

- Clean Ganga Fund (applicable from FY 2014-15)

- National Fund for Control of Drug Abuse (applicable from FY 2015-16)

Category 2 - Donations eligible for 50% deduction without qualifying limit

- The Jawaharlal Nehru Memorial Fund,

- Prime Minister’s Drought Relief Fund,

- Indira Gandhi Memorial Trust,

- Rajiv Gandhi Foundation.

Category 3 - Donations eligible for 100% deduction subject to qualifying limit

- Donation to Government or any approved local authority for the promotion of Family Planning.

Category 4 - Donations eligible for 50% deduction subject to qualifying limit

- Donations to Charitable institutions who provide a certificate.

What changes are made under Budget 2020?

The following modifications to Section 80G will take effect from FY 2020-21:

- Currently, the taxpayer (donor) must manually enter the complete data of the donee (the person to whom the donation is made). However, it was proposed that the donee's information be prefilled in the Income Tax Returns to make the process easier.

- The donee must provide a statement of all donations received on the assumption that the doner would be eligible for a deduction under Section 80G. If the donee fails to provide such a statement, a penalty and fee will be imposed.

- In accordance with the new tax rates announced in the Budget for FY 2020-21 (AY 2021-22), the taxpayer can claim the reduced tax rate if they choose not to take advantage of various deductions and exemptions, except Section 80CCD(2) and Section 80JJAA. If you want to claim tax benefits under Sections 80C, 80D, 80G, HRA, etc., then you should opt for old tax rates.

Suggested Read: Old Tax Regime vs New Tax Regime: Which one should you choose?

How to calculate the deductible amount under Section 80G?

The following are the steps to calculate the deduction under Section 80G:

- Determine which category the fund/charitable organisation belongs to (100 percent or 50% deduction with or without a maximum / qualifying limit). For your convenience, we have the entire list is mentioned earlier is this blog.

- If the payment is made to the first category, no additional calculations are required; simply claim 100% or 50% of the donation amount as taxable income.

- Before making a payment to the second category, you must first determine the maximum/qualifying limit. 10% of "adjusted gross total income" is the highest / qualifying limit.

Further, to calculate the amount of deduction, use this formula:

- Gross Qualifying Limit = All donations made to Category - 2

- Net Qualifying Limit = It is 10% of the “adjusted gross total income”.

- Amount Deductible = 100% or 50% of the donation amount subject to the qualifying limit.

What is “adjusted gross total income”?

For calculation of tax exemption under Section 80G, the "adjusted gross total income" refers to the total amount of your earnings under all headings less (minus) the following amounts:

- Deductible amount under Sections 80C and 80U of the Income Tax Act (Except 80G)

- Income from which no tax is due (payable)

- Under Section 112 and Section 112A, long-term capital gains that have been included in gross total income.

- Under Section 111A the short-term capital gains

- Income described in Sections 115A, 115AB, 115AC, or 115AD of the Income Tax Act.

Example of Calculation of tax deduction under Section 80G

Vimala Sharma, an Indian taxpayer, has taxable salary of Rs 5,00,000. She has deposited Rs 40,000 in Public Provident Fund and Rs 40,000 in her company’s provident fund. She donates Rs 45,000 to CRY (Child Relief and You) trust. Presuming she has no other income, her taxable income will be calculated as follows:

|

Gross salary |

Rs.500000 |

|

Less (Minus): Deduction under Section 80C |

Rs.80000 |

|

Gross total income (before 80G) |

Rs.420000 |

After making donation to CRY, his qualifying amount for 80G will be:

|

Actual amount of donation |

Rs. 45000 |

|

10% of Gross total income as computed above |

Rs. 42000 |

Since 42,000 is lower, the qualifying amount will be Rs 42,000.

Finding out actual deduction

The next question that arises is how much would be the actual deduction? In the case of donations to private trusts, the actual amount of donation would be 50 per cent of the qualifying amount. Therefore, in the example given above, since the donation is made to a private trust, the deduction will be 50 per cent of the qualifying amount i.e. 50% of Rs 42,000 = Rs 21,000.

|

Gross total income (before 80G) |

Rs.4,20,000 |

|

Less (Minus): Deduction 80G |

Rs. 21,000 |

|

Total Taxable Income |

Rs. 3,99,000 |

What details have to be submitted for claiming Section 80G deduction?

In order to claim tax deduction under Section 80G, the following details have to be submitted in your Income Tax Return (ITR):

- Full Name of the Donee Institution

- Amount of contribution made in the corresponding financial year

- PAN Number of Donee

- Address of Donee

What Documents are required to Claim tax deduction under Section 80G?

The following documents are required:

- Receipt

- Registration No. of Trust on Receipt

- Photocopy of 80G certificate

What is the difference between Section 80G Section 80GGB, and Section 80GGC?

Section 80G, Section 80GGB, and Section 80GGC have significant differences. People frequently confuse Section 80G with Section 80GGC or Section 80GGB while filing tax returns.

Since all three sections deal with claiming tax deductions for charitable contributions made in the previous financial year, they differ in the following ways:

- Donations to charitable organizations and trusts are tax deductible under Section 80G.

- Section 80GGB allows registered Indian firms to claim tax deductions for donations to political parties.

- Other taxpayers, such as individuals, HUFs, and corporations, can claim tax deductions for donations given to political parties under Section 80GGC.

- If you want to get tax benefits when you are donating to an NGO, remember to make the payment either through cheque, demand draft, online banking, net banking or through your debit or credit card.

- Any donations to charitable organizations above the amount of ₹ 2000 should not be made in cash. You will not be avail tax deductions if you donate in the form of cash

- You will need to get a receipt with the amount that you have donated to the organization with its stamp as proof, for you to avail the tax benefit.

- Details such as the full name, address and PAN of the NGO should be clearly mentioned along with your name and the amount received from you as a donation.

- Check if your donation qualifies for a 100% tax deduction. Request the NGO for Form 58 which contains details such as the total project cost, the authorised amount, as well as the funds collected so far by the institution. Without this form, your tax claim stands rejected.

Comments