Your financial needs are as unique as your life experiences and goals. You may be planning to buy a house, send your children for higher studies or even retire early. No matter what your milestones, you need a protection solution that is tailored to help you prepare for different life events.

Presenting Future Generali Care Plus – a term life insurance plan that is designed keeping your needs and preferences in mind. So that you can secure your family’s lifestyle, today and tomorrow.

Offers comprehensive long term protection at affordable rates

Customised plan to suit your individual requirements

Flexibility to choose your policy term and premium payment terms

Depending on your protection needs, you can choose from any one of the following options:

Option 1: Life Cover

Option 2: Extra Life Cover (Life Cover with Accidental Death Benefit)

Your premium amount will vary according to the option you have chosen. The option has to be chosen at inception and cannot be changed during the term of the policy.

The plan gives you the flexibility to choose the period of protection and the period of premium payment (minimum policy term and premium payment term of 5 years).

The Policyholder can choose lump sum payout, fixed monthly payout or a combination of both payouts to receive the Death Benefit upon death of Life Assured. The policyholder can choose to change any of the payout options during the Policy Term but before the occurrence of insured event.

Claim Service Guarantee will be available to the beneficiary in all eligible policies which have been in- force for a continuous period of 3 or more years, in which death benefit amount is up to Rs 1 Crore per life assured and the claim does not warrant any further investigation.

You may be eligible for availing tax benefits according to the provisions of Income Tax Laws. These benefits are subject to change as per the prevailing tax laws.

Choose a protection option that works for you

Choose the amount of insurance cover (Sum Assured) you desire under this policy.

Choose the duration of cover (Policy Term) and Premium Payment Term as per your convenience.

Note:

| Parameter | Criterion | |

|---|---|---|

| Entry Age (As on last Birthday) | 18 years to 65 years | |

| Maturity Age (As on last Birthday) | 23 years to 85 years | |

| Policy Term | Premium Payment Term | ||||

|---|---|---|---|---|---|

| (55/60/65/70/75/80/85 less age at entry) years subject to Policy Term greater than Premium Payment Term |

|

||||

| 5 years to (85 less age at entry) years subject to Policy Term equal to Premium Paying Term | 5 years to (85 less age at entry) years subject to Policy Term equal to Premium Paying Term |

| Sum Assured | Minimum – Rs. 25 Lacs Maximum – As per Board approved Underwriting policy |

| Accidental Death Sum Assured | Minimum –Rs. 5 Lacs Maximum– Base Sum Assured or Rs. 2 Crores, whichever is lower (Subject to Board Approved Underwriting policy) |

| Premium Payment Type | Regular Pay | |

|---|---|---|

| Premium Payment Term | 25 years | |

| Policy Term | 25 years | |

| Age at entry | Option 1: Life Cover(Base Sum Assured = Rs. 1 crore) | Option 2: Extra Life Cover (Life Cover with Accidental Death Benefit)(Base Sum Assured = Rs. 1 crore) |

| 30 | 8,580 | 14,580 |

| 30 | 12,430 | 18,430 |

| 35 | 18,810 | 24,810 |

| 40 | 29,190 | 35,190 |

| 45 | 39,570 | 45,570 |

| 50 | 63,890 | 71,390 |

Note for:-

The Death Benefit shall be the highest of the following:

Let us understand this benefit with the help of examples:

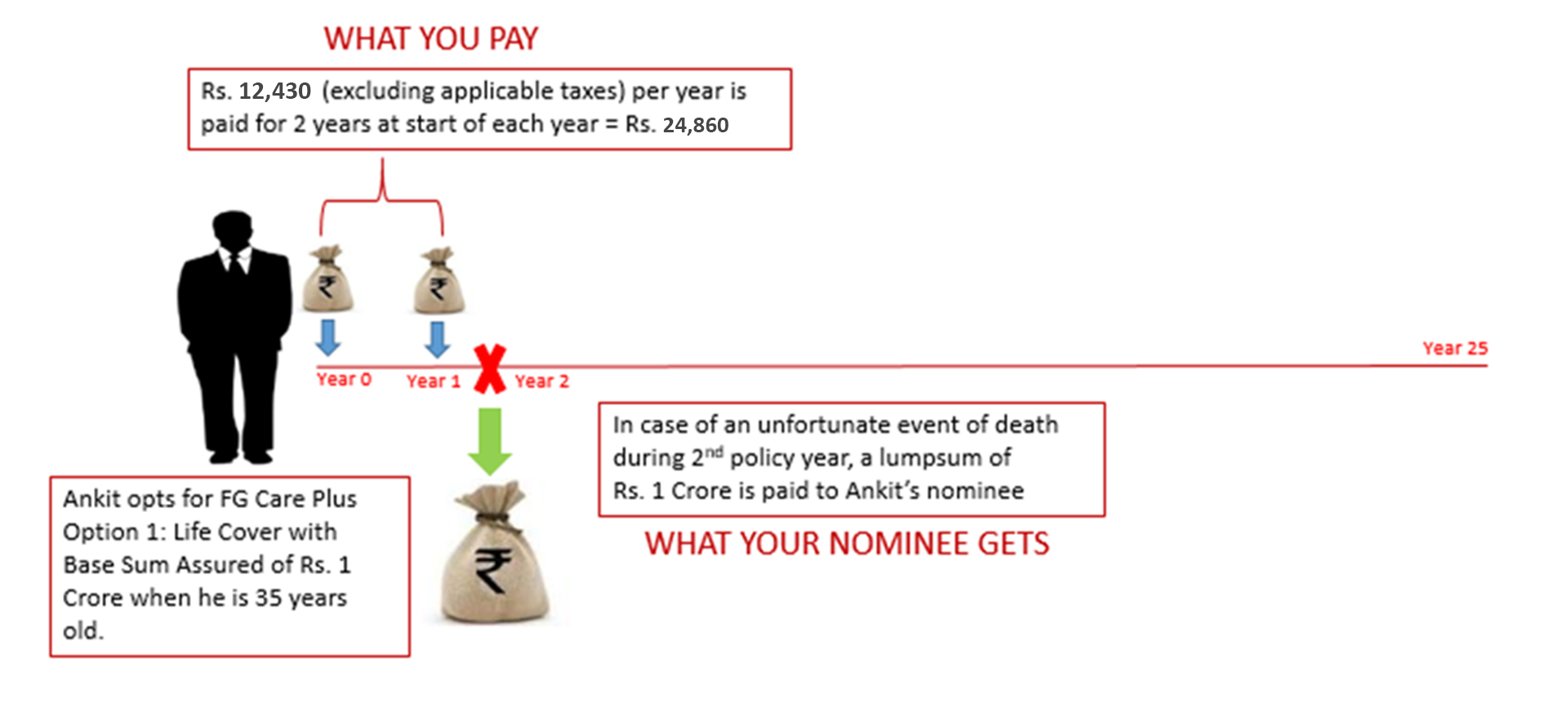

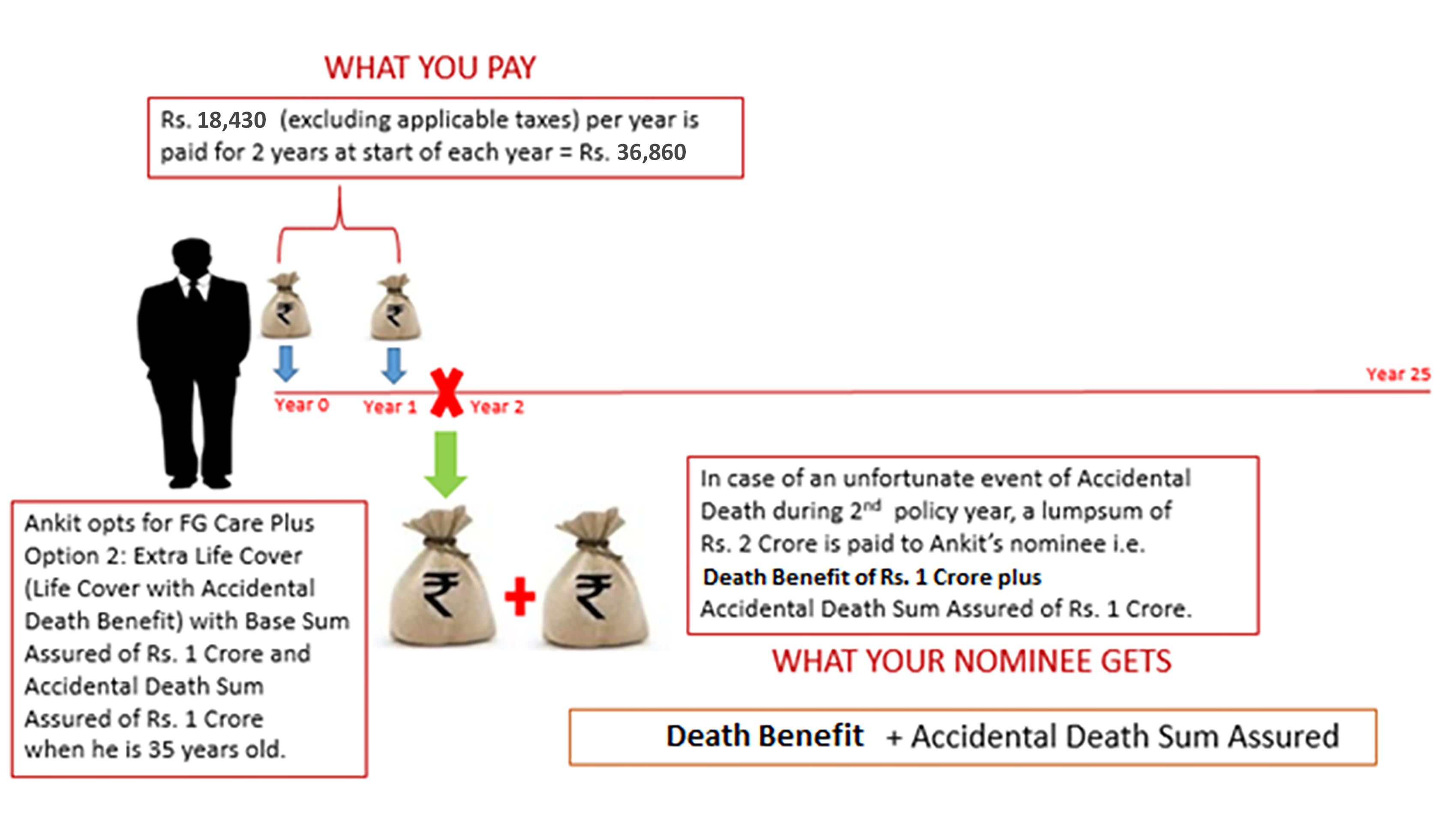

Ankit is a 35 years old healthy non-smoker male. He buys the Future Generali Care Plus for 25 years and chooses to pay annual premium for 25 years.

Example 1: He chooses Option 1: Life Cover with Base Sum Assured of Rs. 1 Crore

Example 2: He chooses Option 2: Extra Life Cover (Life Cover with Accidental Death Benefit) with Base Sum Assured of Rs. 1 crore and Accidental Death Sum Assured of Rs. 1 Crore.

Note: In the above example, in case of death other than due to accident under Option 2: Extra Life Cover (Life Cover with Accidental Death Benefit) only Death Benefit of Rs 1 Crore shall be payable and no Accidental Death Sum Assured shall be payable.

The Accidental Death Benefit is payable only under Option 2, where Accidental Death Benefit is equal to Accidental Death Sum Assured.

If the life assured sustains any bodily injury resulting solely and directly from an accident caused by outward, violent and visible means and such injury shall within a period of 180 days of the occurrence of the accident; solely, directly and independently of all other causes, result in the death of the life assured, then the accidental death benefit shall be payable.

In case the “event” which has caused death due to accident has occurred during the policy term and accidental death occurs after the policy term but within 180 days from the date of accident, the accidental death benefit shall be payable.

There are no maturity benefits under this plan.

In each of the policy options, the policyholder can choose to receive the Death Benefit as per the following payout options. The default payout option is Lump-sum payout. The policyholder can change to any of following the payout options during the policy term but before the occurrence of insured event.

If you disagree with the terms and conditions of the policy, you can return the policy within 30 days of receipt of the Policy Document (whether received electronically or otherwise). To cancel the policy, you can send us a request for cancellation along with the reason for cancellation. We will cancel this policy if you have not made any claims and refund the Instalment Premium received after deducting proportionate risk premium for the period of cover, stamp duty charges and expenses incurred by us on the medical examination of the Life Assured (if any)

If the Policy is opted through Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:-

You get a grace period of 30 days for Yearly, Half-yearly and Quarterly Premium Payment Frequency and 15 days for Monthly Premium Payment Frequency from the due date, to pay your missed premium. During these days, you will continue to be covered and be entitled to receive all the benefits subject to the deduction of due premiums. If any Instalment Premium remains unpaid at the end of the Grace Period, the policy shall Lapse.

| Half-yearly Premium | 52.0% of annual premium |

|---|---|

| Quarterly Premium | 26.5% of annual premium |

| Monthly Premium | 8.83% of annual premium |

The Company will offer waiver of modal premium loadings for Annualized Premium of Rs. 1 crore and above.

No riders available for this product.

There are no loans available under this policy.

Premium rates are guaranteed for the entire policy term.

In case of death of Life Assured due to suicide within 12 months from the date of commencement of risk under the Policy or from the date of Revival of the Policy, as applicable, the Nominee or beneficiary of the Policyholder shall be entitled to at least 80% of the total premiums paid till the date of death or the policy cancellation value available as on the date of death whichever is higher, provided the Policy is in-force.

This exclusion will not be applicable to conditions, ailments or injuries or related condition(s) which are underwritten and accepted by Us at inception or at reinstatement.

For Regular Pay policy where premium payment term is equal to policy term:

For Limited Pay policy where premium payment term is lesser than policy term:

On revival, the simple interest rate of 9% p.a. (applicable for FY 2024-2025) maybe charged by the company. The interest rate applicable for the Financial Year will be declared at the start of the Financial Year, basis current market interest rate on 10-year Government Securities (G-Sec) as on 31 st March every year + 2% rounded to nearest 1%. However, the company may decide to increase the interest charged on revival from time to time with a prior approval from IRDAI.

There is no Paid Up benefit available under this product.

In case you have any grievances on the solicitation process or on the Product sold or any of the Policy servicing matters, you may approach the Company in one of the following ways:

We will provide a resolution at the earliest. For further details please access the link: https://life.futuregenerali.in/customer-service/grievance-redressal-procedure

There is no surrender value available under this product. However, Policy Cancellation Value shall be applicable under this product as defined below.

For Regular Premium where premium payment term is equal to policy term: No policy cancellation value is available under regular premium policies.

For Limited Premium Payment Term where premium paying term is lesser than policy term: We encourage you to continue your policy as planned, however, you have the option to cancel the same any time after the payment of first three (3) consecutive full policy years’ premiums i.e. after which the policy acquires a cancellation value.

Policy Cancellation Value for Limited Premium Payment policy is equal to: Policy Cancellation Value Factor * {Total Premium paid till date including extra premium for substandard lives, if any (exclusive of taxes) – (Total Premium Payable/Policy Term in Years) * Policy Year of Cancellation}

Policy Cancellation Value Factor will be as below:

| Policy Year of Cancellation | Factor |

|---|---|

| 1-2 | 0% |

| 3-5 | 30% |

| 6-9 | 40% |

| 10-14 | 50% |

| 15 and above | 60% |

Policy Cancellation value will not be payable if the policy is cancelled in the last policy year.

The policy terminates on policy cancellation and no further benefits are payable under the policy.

Nomination shall be in accordance with Section 39 of Insurance Act, 1938 as amended from time to time.

Assignment shall be in accordance with Section 38 of Insurance Act, 1938 as amended from time to time.

Section 41 of the Insurance Act 1938 as amended from time to time states

Section 45 of the Insurance Act 1938 as amended from time to time states

For further information, Section 45 of the Insurance laws (Amendment) Act, 2015 may be referred.

This Product is not available for online sale.

For detailed information on this product including risk factors, terms and conditions etc., please refer to the policy document and consult your advisor or visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. You are advised to consult your tax consultant. Future Group’s and Generali Group’s liability is restricted to the extent of their shareholding in Future Generali India Life Insurance Company Limited.

Life Coverage is included in this Product. If you have any request, grievance, complaint or feedback, you may reach out to us at care@futuregenerali.in For further details please access the link: https://life.futuregenerali.in/customer-service/grievance-redressal-procedure.

Future Generali India Life Insurance Co. Ltd. (IRDAI Regn. No. 133) CIN:U66010MH2006PLC165288 Regd. and Corporate Office address: Future Generali India Life Insurance Co. Ltd, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S. Marg, Vikhroli (W), Mumbai – 400083.

Email - care@futuregenerali.in

Call us at - 1800-102-2355 800 102 23

Website: life.futuregenerali.in

Fax: 022-40976600

UIN: 133N030V06