Unique Product Benefits

- Flexibility to choose any combination of Policy Term and Premium Payment Term based on your financial goals.

- Opportunity to enhance your Maturity Payout by way of Bonuses.

- Option to choose between 2 Death Benefit Payout Options.

- Tax Benefits under section 80C and 10(10D) as per the prevailing tax laws.

Riders

To enhance your financial protection and to secure yourself/your family against accidental disability or demise, we present to you Future Generali Accidental Benefit Rider (UIN:133B027V02) rider which you may choose as an additional protection.

Future Generali Accidental Benefit Rider (UIN:133B027V02)

The premium pertaining to health related or critical illness riders shall not exceed 100% of premium under the basic product, the premiums under all other life insurance riders put together shall not exceed 30% of premiums under the basic product and any benefit arising under each of the above mentioned riders shall not exceed the sum assured under the basic product.

Please refer to the respective rider brochure for more details

How does it work?

Choose the Death Benefit option and amount of insurance cover you desire under this policy.

Choose the Policy Term and Premium Payment Term as per your financial goal.

Our sales representative will help you calculate your Premium and provide you a customised Benefit

Illustration – a detailed break-up of what you pay and what you get.

What are your Benefits?

Maturity Benefit:

Once your policy matures at the end of the Policy Term and if you have paid all your due premiums, you will receive Maturity Benefit as per the chosen option-

- Option 1

- Guaranteed Maturity Sum Assured equal to Sum Assured plus Vested Compound Reversionary Bonuses, if any, plus Terminal Bonus, if any, shall be paid

- Option 2:

- Guaranteed Maturity Sum Assured equal to Sum Assured plus Vested Compound Reversionary Bonuses, if any, plus Terminal Bonus, if any, shall be paid

- Even in case of death of the Life Assured, the Maturity Benefit will be payable if all Installment premiums due till date of death of the Life Assured have been received in full.

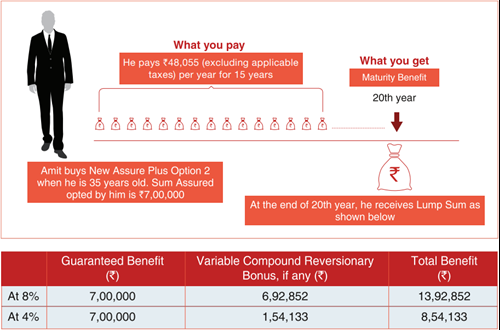

Let’s understand this benefit with the help of an example:

Amit is 35 years o ld and has purchased New Assured Plus – Option 2. He has opted for Rs. 7,00,000 Sum Assured for a Policy Term of 20 years and Premium Payment Term of 15 years. He pays Rs. 48,055 premium (excluding taxes) annually for a term of 15 years.

ld and has purchased New Assured Plus – Option 2. He has opted for Rs. 7,00,000 Sum Assured for a Policy Term of 20 years and Premium Payment Term of 15 years. He pays Rs. 48,055 premium (excluding taxes) annually for a term of 15 years.

Please Note: Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your life insurance company. These assumed rates of return 8% and 4%, are not guaranteed and they are not upper or lower limits of what you might get back as the value of your policy is dependent on a number of factors including future investment performance.

Death Benefit during the Policy Term

Death Benefit in this plan secures your family in case of your unfortunate demise during the Policy Term. You have the option to choose between two Death Benefit Payout options

Option 1 – Lumpsum Death Benefit Payout:

Under this option, Death Benefit payable to your nominee shall be higher of:

- 105% of all the premiums paid (excluding taxes, rider premiums and extra premiums, if any) as on date of death; and

- Death Sum Assured plus vested Compound Reversionary Bonuses, if any plus Terminal Bonus, if any.

The Policy will terminate on payment of Death Benefit under Option 1

Option 2 – Lumpsum Death Benefit with Maturity Payout

Under this option, two payouts will be made to your nominee.

- Lumpsum Death Payout: The first payout which is the Lumpsum Death Payout will be paid at the time of death. Death Benefit payable to your nominee shall be higher of:

- 105% of all the premiums paid (excluding taxes, rider premiums and extra premiums, if any) as on date of death; and

- Death Sum Assured

- Maturity payout: The second payout equal to Guaranteed Maturity Sum Assured plus Reversionary Bonus (if any) plus Terminal Bonus (if any) will be paid at the time of Maturity of the Policy i.e. at the end of the Policy Term. The payout at the time of maturity is made, because the policy continues after the death of the insured person. No further premiums are payable under the policy after the death of the Life Assured. The policy continues to participate in profits even after the death of the Life Assured.

Nominee shall not have any right to avail loan, assignment and surrender as available to Policyholder under the Policy.

Death Sum Assured is defined as Higher of:

- 10 times Annualised Premium ( excluding taxes, rider premiums, underwriting extra premiums and loadings for modal premiums, if any)

- Guaranteed Maturity Sum Assured, which is equal to sum assured

- Absolute Amount payable on death, which is equal to sum assured

Note: The premiums above exclude taxes, rider premiums and extra premiums, if any as these are collected separately in addition to the regular premium for this product.

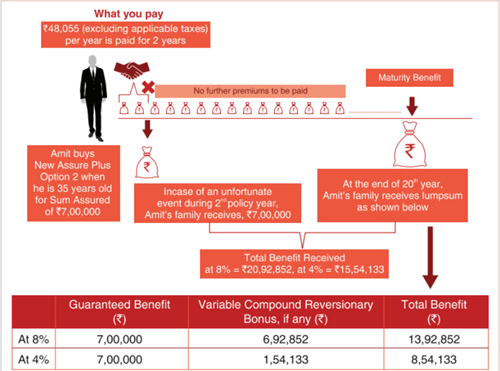

Let’s understand this benefit with the help of the previous example:

It is assumed that the death occurs in the 2nd policy year. The benefit payable to Amit’s nominee(s) will be:

Compounded Reversionary Bonus: At the end of each financial year, the Company may declare a bonus expressed as a percentage of the Sum Assured and all previous bonuses declared. The bonus of each year is added to the Sum Assured and the next year’s bonus is calculated on the enhanced amount.Please Note: Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your life insurance company. These assumed rates of return 8% and 4%, are not guaranteed and they are not upper or lower limits of what you might get back as the value of your policy is dependent on a number of factors including future investment performance.

Terminal Bonus: The Company may declare a terminal bonus which may be payable on death or on maturity of the plan.

Large Sum Assured Discount

| Discount on premium per Rs.1000 Sum Assured | |||||

| Sum Assured/Premium Payment Term | 5 | 6-10 | 11-15 | 16-20 | 21-30 |

| 1,00,000-1,99,999 | Nil | ||||

| 2,00,000-4,99,999 | 6 | 4 | 1 | 0 | 0 |

| 5,00,000 and above | 11 | 8 | 5 | 3 | 2 |

Target Group

For the customers who are looking for tax saving life insurance plan that offers flexibility of paying for a limited period and staying invested for a longer period to reap higher benefits with potential upside through bonuses.

EXCLUSION

Suicide exclusion: In case of death due to suicide within 12 months from the date of commencement of risk under the policy or from the date of revival of the policy, as applicable, the nominee or beneficiary of the policyholder shall be entitled to 80% of the total premiums paid till the date of death or the surrender value available as on the date of death whichever is higher, provided the policy is in force.

Eligibility

| Parameter | Criterion | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Entry Age (as on last Birthday) | 3 years – 55 years | |||||||||||||||

| Maturity Age | 18 years - 70 years

|

|||||||||||||||

| Policy Term | 10 to 30 years | |||||||||||||||

| Premium Payment Term | Benefit Payout Option 1: 5 years to Policy term (including both) Benefit Payout Option 2: 5 years to (Policy term less 5 years) (including both)

|

|||||||||||||||

| Sum Assured | Minimum – Rs. 1,00,000 Maximum – No Limit |

|||||||||||||||

| Premium Payment Frequency | Yearly, Half Yearly, Quarterly & Monthly | |||||||||||||||

| Premium amount | Minimum Annualized Premium- Rs. 10,000 subject to Minimum SA of Rs. 1,00,000 | |||||||||||||||

| Maximum Premium - No Limit | ||||||||||||||||

DISCLAIMERS

Future Generali New Assure Plus

UIN: 133N065V02

- Tax benefits are subject to change as per tax laws.

- For more details on the risk factors and the terms and conditions please read the sales brochure and/ or sample policy document on our website carefully, and/ or consult your advisor before concluding the sale.

FREE LOOK CANCELLATION:

In case you disagree with any of the terms and conditions of the policy, you can return the policy to the Company within 15 days (30 days if the policy is sold through the Distance Marketing Mode) of its receipt for cancellation, stating your objections. Future Generali will refund the policy premium after the deduction of proportionate risk premium for the period of cover, stamp duty charges, cost of medical examination, if any.

If the Policy is opted through Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:-

- For existing e-Insurance Account: Computation of the said Free Look Period will commence from the date of delivery of the e mail confirming the credit of the Insurance Policy by the IR.

- For New e-Insurance Account: If an application for e-Insurance Account accompanies the proposal for insurance, the date of receipt of the ‘welcome kit’ from the IR with the credentials to log on to the eInsurance Account(e IA) or the delivery date of the email confirming the grant of access to the eIA or the delivery date of the email confirming the credit of the Insurance Policy by the IR to the eIA, whichever is later shall be reckoned for the purpose of computation of the Free Look Period.

Note: Distance Marketing means insurance solicitation by way of telephone calling/ Short Messaging Service (SMS)/other electronic modes like e-mail, internet & Interactive Television (DTH)/direct mail/ newspaper and magazine inserts or any other means of communication other than that in person.

Grace Period You get a grace period of 30 days for Yearly, Half yearly and Quarterly Premium Payment Frequency and 15 days for Monthly Premium Payment Frequency from the premium due date to pay your missed premium. During these days, you will continue to be covered and be entitled to receive all the benefits subject to deduction of due premiums.

Flexibility to make changes We allow you to make change in the mode of premium payment under the policy which shall be applicable from the next policy anniversary.

Loan You may avail of a loan once the policy has acquired surrender value. The maximum amount of loan that can be availed is up to 85% of the Surrender Value. For more details, please refer the policy document.

The current interest rate for the financial year 2019-20 applicable on loans is 9% per annum compounded half yearly. Please contact our branch office or call us to know the current applicable interest rate.

Tax Benefits Premium(s) paid are eligible for tax benefit as may be available under the provisions of Section(s) 80C and 10(10D) as applicable. For further details, consult your tax advisor. Tax benefits are subject to change from time to time.

Life Insurance Made Simple

-

Decoding Your Policy’s Fine Print

The fine print in a policy can come in the way of making an informed purchase. We’ve simplified the fine print into big print.

-

Ensure Your Claims Are Always Settled

Read the terms and conditions carefully. Ensure that your current health, occupation or lifestyle habits do not exclude you from getting the policy benefits.

-

Protecting Your Policy – Do’s & Don’ts

Do's and don’ts to protect your life insurance policy from unauthorised elements posing as company representatives.

-

Are You Financially Prepared For Your Future?

Find out how prepared you are to meet your financial goals, with our FutureReady calculator.

-

12 Questions to Ask Before You Buy

Buying a life insurance policy without asking your advisor the right questions is as good as crossing a road blindfolded.