A first paycheck is a source of delight and pride for every individual, whether it comes at 18 or 21 or 27. It is what gives a person a sense of financial independence and security. In the event of a stagnant world economy and increasing risks of a crisis, millennials, who form 46% of the workforce, need to plan their finances better. 91% of millennials believe in making their own financial decisions.(1)

Source: https://www.tomorrowmakers.com/financial-planning/how-does-indias-youth-invest-its-money-topical-article

However, they always need some help at the beginning, as they are more focussed on spending and might be a little clueless about saving. To guide them for a perfect balance, here are five basic things that ought to be done with that ceremonious first paycheck.

Get Life or Health Insurance

It might seem a little early for a lot of millennials to get insurance in their early 20s. However, they need to keep in mind the premium they will have to pay when they start their policy earlier. It might not sound like the best decision at a time when one seeks instant gratification, but it is sort of a thumb rule to have life insurance and health insurance cover. Health insurance protects one from critical illness that could arise even at a young age. Life insurance provides security to family members who could be dependent on the earning member now or in future.

Invest in Equity

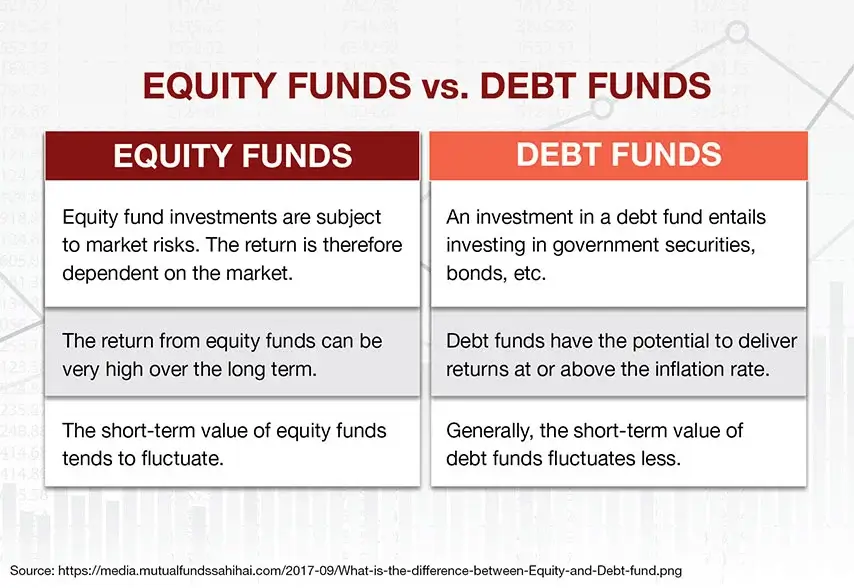

56% of millennials invest in market-linked products like Mutual Funds. They are a generation that has understood the benefits of investing.(2) Earlier, the norm was saving, not investing. More and more youngsters are now becoming financially literate. They have begun to understand that all investments don’t have to be high-risk investments. They can always invest in low risk and moderate risk funds. Life insurance products like ULIPs give the option to choose the type of funds (high and/or low risk, equity and/or debt). And if this habit starts with the first salary itself, one can have a greater amount available for big expenses and emergencies such as critical illness. Another benefit of investing early is that one learns the volatile nature of the market and understands how to manage investments better for the future.

Source: https://media.mutualfundssahihai.com/2017-09/What-is-the-difference-between-Equity-and-Debt-fund.png

Plan Your Finances

It is not a wise decision to save, invest or spend without proper planning. There should be a plan for the percentage one wants to save, invest, and spend. This breakup entirely depends on the salary, the necessary expenses, and the expected growth in salary. Before the first paycheck arrives, a plan should be ready. Planning allows one to offset financial crises in the future. This is when millennials realize that the notes their mothers make for monthly spending are lessons in financial planning. This plan doesn’t have to be an independent effort, it is better to take help from parents or from friends who have been earning for a long time.

Treat Yourself

Everything that one does with a first salary doesn’t have to be about savings and investments. One deserves to celebrate as well. Whether it is a simple dinner with family or a lavish celebration with friends and colleagues, it is only fair that one gets to derive happiness out of their first salary. The only thing one should be careful about is that the amount of spending on celebration, too, has to be planned. Once well planned, this celebration could also be a trip. A new beginning should be marked with a high. Whether the celebration is small or huge depends on the salary. But one thing needs to be remembered- the celebration should not be with parents’ money, otherwise it loses its genuinity and also the pride that comes with it.

Set Aside Emergency Savings

Emergency savings is something that every millennial has probably done right since their school days with their pocket money. This money is needed to immediately tap into when an unfortunate event or a sudden need arises. This could include a critical illness, a death in the family, a loss of employment, or any other sudden need that arises. If these savings are started right with the first salary, they can help one avoid borrowing and scouting for favours at the time when need arises. Although investments could always be withdrawn, they should ideally be kept for crucial expenses like further education, buying a house, buying other property, etc.

With the increasing level of wisdom that the young generation is gaining about savings and investments, they are bound to make smarter decisions than their predecessors. This is just a starter kit for what to do with a first paycheck. The actual planning is going to take a lot more factors into consideration and a lot of suggestions from parents, elders, and seniors. However, this can be the basic framework or decision-making.

References: 1.https://economictimes.indiatimes.com/wealth/plan/are-millennials-financially-wiser-than-their-parents-find-out/articleshow/65268296.cms

2.https://www.livemint.com/Money/cclXG8TD2kBVPIKksT2EGJ/91-millennials-make-their-own-financial-decisions-only-56.html

Comments