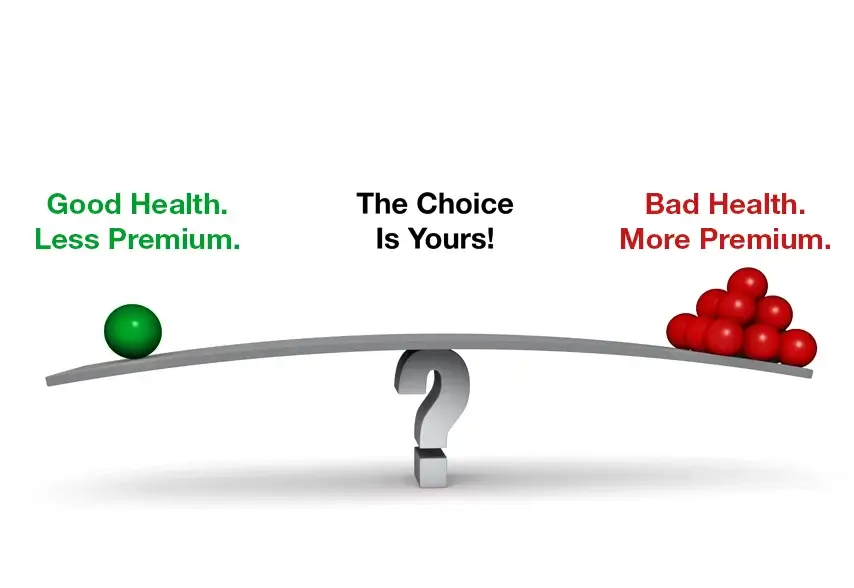

We can never over emphasise the importance and benefits of life insurance protection but there is one more important aspect of life that life insurance upholds. That is the importance of living healthy and maintaining a healthy lifestyle. All types of life insurance, including health and life insurance, support healthy living as your current health status has a direct impact on the insurance premium amount.

There are several components and factors that are taken into consideration by insurers while calculating the premium. However, apart from sum assured, health conditions have the most significant impact on the premium cost.

There are smart ways to bring down the cost of premiums without lowering the coverage and benefits of life insurance. Taking care of your health is one of the cheapest and most effective methods. If you want to understand how your present health affects your life insurance premium, stay with us.

Pre-existing Medical Conditions

If you suffer from diabetes, high blood pressure, cancer, obesity, heart disease and other medical conditions, you will have to pay more for life insurance cover. As in the case of smokers, individuals with pre-existing medical conditions are high-risk for insurers, therefore they charge extra for insuring such people. Don’t suppress facts about your pre-existing medical conditions because it may lead to claim rejection and your family won’t get the benefits of life insurance in the event of your death.

According to the Insurance Regulatory Development Authority of India (IRDAI), a pre-existing disease is one for which medical consultation, diagnosis or treatment was sought 48 months prior to the purchase of the policy.

Smokers Have to Pay Higher Premiums

The bad habit of smoking impacts you negatively in every aspect of life. Not just your physical health but your mental health, your family and your life insurance premium as well. In all types of life insurance plans, insurers consider smokers as high-risk insurance because there is a high likelihood of claims due to critical illnesses, disability or premature death. Thus, there is a significant difference between premiums for smokers and non-smokers.

For a smoker, the premium with the same sum assured and term is 40-60% higher than those for a non-smoker. You will not only save your life but a lot of money if you can kick that smoking habit. Whether you are an occasional smoker or a chain smoker, insurance companies consider one a smoker if he/she has smoked a tobacco product in the last 12 months. [1] You can’t get away by hiding this fact because the insurance company will find out when you submit the claim.

| Age | Annual Income (Rs) | Sum Assured (Rs) | Non-smoker Premium (Rs) | Smoker Premium (Rs) | Difference |

|---|---|---|---|---|---|

|

30 years |

10,00,000 |

1 Crore |

10,232 |

14,159 |

3,927 |

|

35 years |

10,00,000 |

1 Crore |

12,841 |

19,017 |

6,176 |

|

40 years |

10,00,000 |

1 Crore |

16,942 |

27,527 |

10585 |

|

45 years |

10,00,000 |

1 Crore |

19,897 |

33,226 |

13,329 |

|

50 years |

10,00,000 |

80 lakhs |

27,761 |

46,284 |

18,523 |

*annual premium, excluding taxes, applicable to male smoker/non-smoker under Future Generali Flexi Online Term Plan.

Family’s Medical History

Insurers are not only interested in your personal medical history but your family’s medical history as well. It helps them identify if you are genetically predisposed to suffer from any critical illness such as cancer, diabetes, heart disease, COPD etc. If yes, they will increase your life insurance premium.

Drinking Habits

If you are a heavy drinker, insurers will consider you to be at-risk of serious liver and kidney diseases; this will again hike your premium cost.

It all seems cold-hearted but insurers have to calculate your risk profile or your life expectancy based on your current health status to arrive at the appropriate premium amount for coverage. If all individuals with the same sum assured and policy tenure were charged equally, it would be unfair for those who maintain good health. On the other hand insurers would suffer great losses if people that are high-risk would take large coverage and make frequent claims. Apart from your health condition, there are other factors that affect the cost of life insurance premium; learn here about those factors that increases your life insurance premium.

Whatever the type of insurance, buying it early will help you save on premium costs because after health, age is another important factor that drives insurance costs. If you are planning to buy life insurance that offers flexibility of paying for a limited period and staying invested for a longer period, as well as helps you save taxes, we recommend the Future Generali Assure Plus traditional insurance plan. The plan offers lump sum payment that includes sum assured, vested bonus and terminal bonus on maturity or death.

Comments