Vinod is a doctor, married with a single kid aged five. He is in his late 30s, and his expenses include home loan EMIs, insurance premiums, and half-yearly travel vacations. As he would turn 40 in a few years, he realizes the need to start saving for retirement. He wishes to retire by 65, and he wonders how much money he would need to save for his retirement, to live comfortably and maintain his current lifestyle. Unfortunately, there is no one-size-fits-all, and Vinod would have to arrive at a figure by factoring inflation costs, monthly expenses depending on the age of retirement.

Retirement saving might seem like a distant goal, particularly when the retirement timeline is more than two decades away from the present. Given that an individual is committed to fulfilling short-term financial goals like family, child education and medical expenses in his prime age, he may think his financial planning is on the right track of saving for the future. In the process of achieving these goals, an individual tends to overlook the long-term goal of retirement savings, making it difficult to arrive at a concrete figure of retirement money essential for comfortable retirement life. Arriving at that necessary figure of retirement money may initially seem daunting, not if one knows the desired age of their retirement and the kind of lifestyle, they would adapt post retirement. Here’s a guide that can aid an individual in knowing the amount of money needed to save for retirement:

Age of Retirement

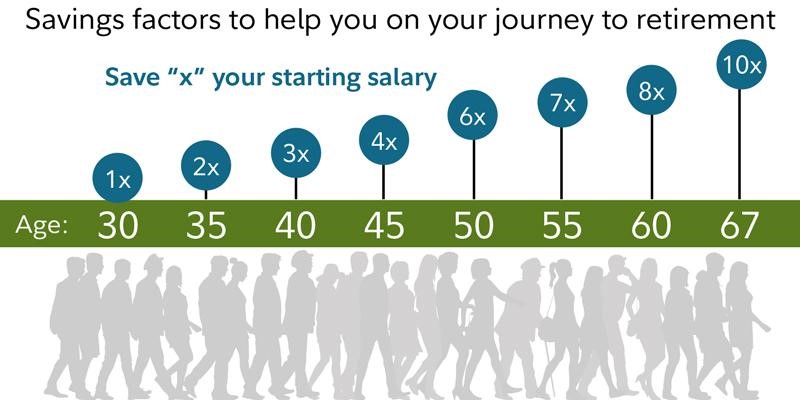

The age of retirement can have a profound impact on the required amount of savings, and the milestones along the way. The earlier retirement age, the higher the savings factor to accumulate the desired retirement money. An advanced retirement age does not allow enough time for the personal savings to grow, and thus shoots up the savings factor. A research conducted by Fidelity Investments in 2018, estimated a variety of saving factors for a given age of retirement as shown below:

The saving factors have been estimated based on the assumption that an individual saves 15 percent of his annual income beginning at the age of 25, invests more than 50 percent of savings in stocks during their lifetime, retires at 67, and would want a pre-retirement lifestyle in retirement. Based on the above assumption, saving 10 times of pre-retirement income by age 67 can ensure a comfortable post-retirement life. This goal of 10x may seem ambitious at first, but the age-based goals in terms of 1x of income by age 30, 3x by 40, 6x by 50 and 8x by 60 shall help an individual remain on track to accomplish the required target of retirement saving. Similarly, if an individual wants to retire at 65, he must have saved nearly 12x of his pre-retirement income.

Post-retirement lifestyle

The post-retirement lifestyle of an individual also impinges upon the amount of money needed to save for retirement. Three kinds of lifestyles – essential, comfortable or luxurious can determine the amount of money to be accumulated for post-retirement life. If the post-retirement expenses of an individual go down below the current level of spending by barely affording to foot the grocery and utility bills, the individual is inclined to adopt an essential or below average lifestyle. If the post-retirement spending remains unchanged, the individual is likely to prefer a comfortable or an average lifestyle. A rise in post-retirement expenses would mean the individual wishes for a luxurious or above average lifestyle in retirement.

For instance, Rahul, Raj and Vishwas are three investors who wish to retire at 67. Rahul wants to downsize his expenses and live a simple life in retirement. He can afford to have a savings factor closer to 8x than 10x of his pre-retirement income. Raj wants to maintain his current comfortable lifestyle post-retirement, and thus can manage with a savings factor of 10x in retirement. On the other hand, Vishwas is fond of cars and plans to own a new car every five years, even in retirement. To be able to maintain his luxurious lifestyle, he shall have to save more with a higher savings factor beyond 10x, say 12x of his pre-retirement income.

Keeping Track

Investing and saving from an early age provides enough time for the retirement corpus to multiply by the desired retirement age. As there is no one-size-fits-all, a retirement planning calculator can come in handy in calculating the required retirement corpus for a given retirement age by factoring in current expenses, savings and inflation costs. Despite starting to save early towards retirement, it is important to keep track and periodically review the savings plan on reaching every intermediate goal post. This holds even more true during the middle ages when the individual shoulders much of the financial responsibilities towards his family and health, and there is every chance of a digression from retirement planning. A diversified investment portfolio with a mix of equities and savings plans can bring the savings wheel back on track during the middle ages and ensure a rich life during retirement.

While every individual wants to retire at a desired age, uncertain factors such as health and job availability can play spoilsport on their retirement plans. Despite uncertainties, the fact remains - early investing and working longer can help an individual reach savings goals easier.

Comments