Sandeep, a 35-year-old advocate purchased a 10-year ULIP type-I with an annual premium of Rs. 1,20,000 and a sum assured of Rs. 12,00,000. The death benefit payable in this ULIP is higher than the sum assured or the fund value. In case of Sandeep’s sudden demise in the 5th year of the policy term, the death benefit entitled to the nominee would be higher than the fund value which is expected to have grown to Rs. 7 lakhs or the sum assured of Rs. 12 lakhs. In such a case, the nominee shall be paid a death benefit of Rs. 12 lakhs. There are many charges associated with a ULIP policy and Mortality charge is one of them. This risk of providing life cover is borne by the insurer in case of the insured’s unexpected demise, mortality charges are levied on the policy to cover this risk.

What is mortality charge in ULIP?

When an individual subscribes to a ULIP , the insurer levies a charge for insurance protection upon his death and to cover other expenses, known as mortality charge. It is usually deducted along with other charges, before investing the policyholder’s money.

Mortality charge is based on the sum at risk, i.e., the sum assured minus fund value. The sum at risk is the amount that the insurer has to pay from his pocket in the event of the insured’s death, and the charge ideally decreases with increase in the fund value during the policy term.

How is mortality charge in ULIP calculated?

Mortality charge in ULIP is measured at per 1000 of the cover or the sum at risk per annum. So, the key parameter required to calculate the mortality charge in ULIP is the sum at risk. The sum at risk differs based on the type of ULIP – I or II:

- In a type-I ULIP, the nominee gets higher of the sum assured and fund value as death benefit, as demonstrated in the above scenario. In this case, as the fund value grows, the sum at risk decreases.

- In a type-II ULIP, the nominee receives the total sum assured and the fund value as death benefit. So, the sum at risk remains constant at sum assured.

In addition to the sum at risk, the mortality charge in ULIP also depends on factors such as the life expectancy ratio of a country, age of the policyholder, gender, financial status, living location, and occupation. The monthly mortality charge in ULIP can be calculated using the formula:

Mortality charge = [Mortality rate (for attained age) * Sum at Risk/1000] * 1/12

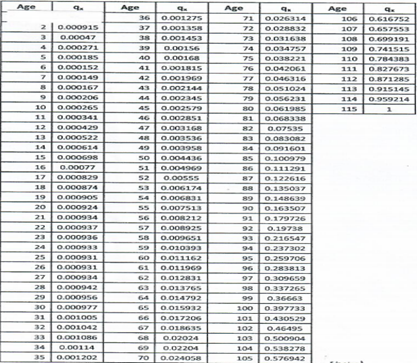

Life insurance companies use mortality rate figures from the revised Indian Assured Life Mortality Table 2012-14, published by the Institute of Actuaries of India and prescribed by the IRDAI for calculation of mortality charges as given below:

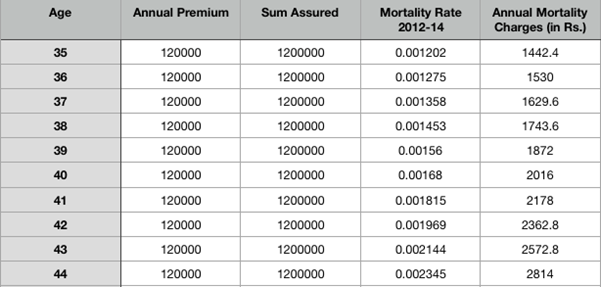

Here’s a sample illustration of the annual mortality charges applicable for Sandeep’ ULIP Type – I policy discussed in the beginning:

Mortality Charges Illustration

As can be seen from the illustration, the mortality charges of a ULIP increases as the policyholder’s ages. Also, the mortality charges in ULIPs are much higher for a lower sum assured, virtually lapping up a major proportion of the sum assured or sum at risk.

When shall lower mortality charges apply?

As mortality rates are lower for youngsters, lower mortality charges may apply for the ULIP. One can benefit from the lower mortality charges if the ULIP is bought at a younger age, with the only exception of child ULIPs which usually carry a higher mortality charges for ages 7 to 14 when the mortality rates are also usually high based on the premiums paid and sum assured.

When a ULIP product is sold online, there is no need to pay a commission on purchase and this benefit is directly passed on the customer. Purchasing a ULIP online like the Future Generali Big Dreams Plan benefits the policyholder with relatively lower mortality charges. The plan is a systematic investment ULIP that provides a life cover along with the added benefit of wealth creation by promoting the habit of saving systematically over a long term through annual or monthly payment modes. The plan levies mortality charges on sum at a risk which is higher and (the sum assured less deductible partial withdrawal and 105 percent of premiums paid) minus the fund value of the policy. For female lives, the mortality charges are calculated on a 3-year set back on male lives, barring the ages between 0-9 years. So, mortality charges for a 30-year old female shall be that of a 27-year old male.

Comments

F