- Home

- Insurance Plans

- Term Insurance Plans

- Flexi Online Term Insurance Plan

Key Benefits of Our Online Term Plan

- Product Benefits

- Period

- Tax Benefits

Product Benefits

-

Longer Protection

Provides life cover up to the age of 75 years

-

Lower Premium Rates For Women

-

High Sum Assured Discount

Discount in premium rate in case you opt for a Higher Sum Assured

Period

Free Look period: In case you disagree with any of the terms and conditions of the policy, you can return the policy to the company within 15 days (30 days if policy is sold through direct marketing mode) of its receipt for cancellation, stating your objections. Future Generali will refund the policy premium after the deduction of proportionate risk premium for the period of cover, stamp duty charges, cost of medical examination, if any.

Grace Period: You get a grace period of 30 days if you have opted for annual premium payment or 15 days if you have opted for monthly premium payment from the premium due date to pay your missed premium. During these days, you will continue to be insured and be entitled to receive the death benefits subject to deduction of due premiums.

Tax Benefits

The Premium(s) paid by you are eligible for tax benefit as may be available under the provisions of Section(s) 80C, 80 CCC (1), 80D, 10(10D) as applicable. For further details, consult your tax advisor. Tax benefits are subject to change from time to time.

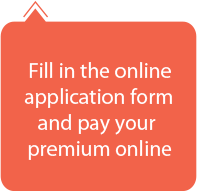

How This Online Term Plan Works

-

1 Basic Life Cover

-

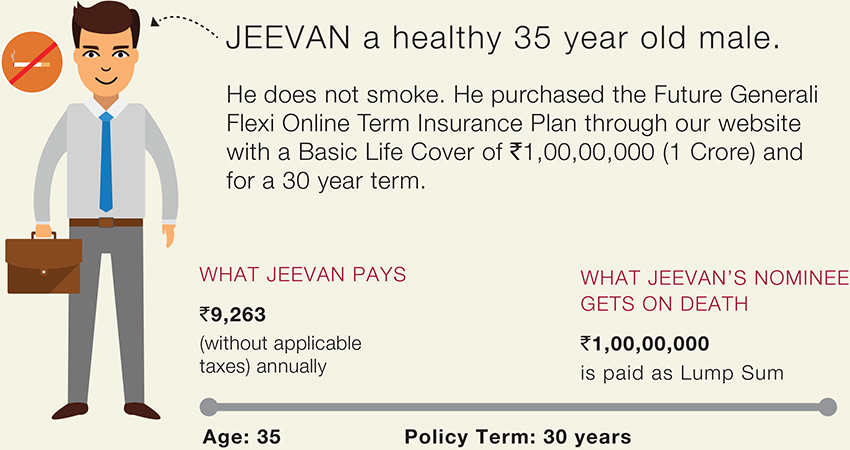

2 Fixed Income Protection

-

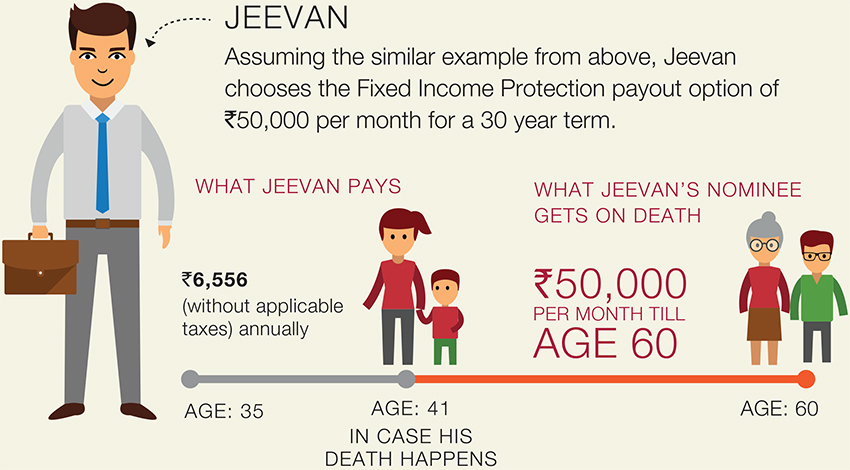

3 Increasing Income Protection

-

4 My Protection Plan

1Basic Life Cover

In case of death any time during the policy term, Jeevan's nominee will receive Rs. 1,00,00,000 as a one-time Lump Sum payout. The policy will end after the payment is made.

2Fixed Income Protection

In case his death happens immediately after payment of 7th annual premium, i.e. when he has turned 41 years old, his nominee would start receiving ![]() 50,000 every month, till such time when Jeevan would have attained 60 years of age.

50,000 every month, till such time when Jeevan would have attained 60 years of age.

In case of death during the policy term, Jeevan's nominee will receive a fixed amount every month, similar to Jeevan's monthly Income, for a period till Jeevan would have attained 60 years of age or for 120 months from the date of death, whichever period is higher.

Alternately, Jeevan's nominee has an option to take all monthly installments as a lump sum at the time of claim settlement. All monthly payouts will be discounted at 6.5% per annum compounded. The option of taking lump sum benefit cannot be exercised once the fixed income protection payment has commenced.

*Tax laws are subject to change

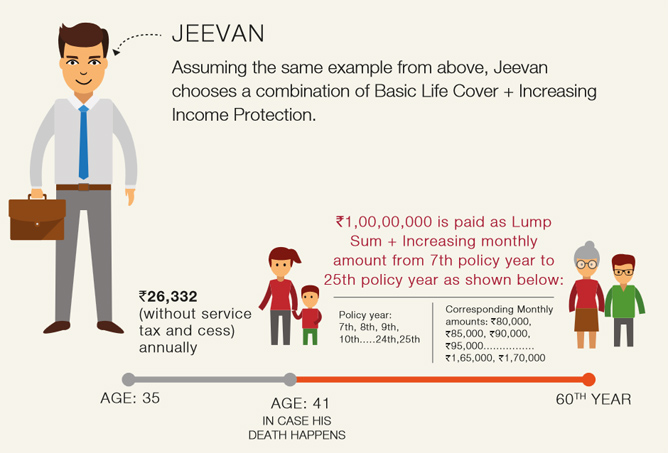

3Increasing Income Protection

In case his death happens immediately after paying 7th annual premium, i.e. when he has turned 41 years old, his nominee would start receiving Rs 80,000 every month in the 7th policy year, which will increase every subsequent year, at a simple rate of 10% of the monthly payout chosen at inception, till such time when Jeevan would have attained 60 years of age.

Your coverage increases every year under this option to secure you and your family from the impact of rising costs due to inflation. You can choose the monthly amount which will increase at a simple interest rate of 10% from second policy year and thereafter every policy year.

In case of your death during the policy term, the increased monthly amount corresponding to the policy year of death will start getting paid to your nominee and this amount will still continue to increase every year for the period till you would have attained 60 years of age or for 120 months from date of death, whichever is higher.

Your nominee also has an option to take the monthly payouts as a Lump Sum benefit at the time of claim settlement. All monthly payouts will be discounted at 6.5% per annum compounded. The option of taking Lump Sum benefit cannot be exercised once the Increasing Income Protection payment has commenced.

The Death Sum Assured shall be the higher of:

1. 10 times Annualised Premium(excluding the taxes, rider premiums, underwriting extra premiums and loadings for modal premiums, if any) , or

2. 105% of total premiums paid (excluding any extra premium, any rider premium and taxes) as on date of death ,or

3. Absolute amount payable on death which is equal to the Sum Assured

Where Sum Assured is equal to

• Option 1: - Sum Assured chosen at the outset

• Option 2:- Discounted value of fixed Income protection payments as on date of death discounted at a rate of 6.5% p.a. compounded yearly

• Option 3:- Discounted value of increasing Income protection payments as on date of death discounted at a rate of 6.5% p.a. compounded yearly.

*Tax laws are subject to change

4My Protection Plan

Supposing his death happens after he has paid 7 annual premiums, i.e. when he has turned 41 years old, his nominee would receive a Lump Sum payment of Rs. 1,00,00,000 at the time of claim settlement. Additionally, his nominee would also start receiving ![]() 80,000 every month in the 7th policy year. This amount will increase every subsequent year at a simple rate of 10% of the monthly payout chosen at inception, till such time when Jeevan would have attained 60 years of age.

80,000 every month in the 7th policy year. This amount will increase every subsequent year at a simple rate of 10% of the monthly payout chosen at inception, till such time when Jeevan would have attained 60 years of age.

DEATH/ MATURITY BENEFIT

The Death Sum Assured shall be the higher of:

10 times Annualised Premium(excluding the taxes, rider premiums, underwriting extra premiums and loadings for modal premiums, if any) , or

105% of total premiums paid (excluding any extra premium, any rider premium and taxes) as on date of death ,or

Absolute amount payable on death which is equal to the Sum Assured

Where Sum Assured is equal to

Option 1: Sum Assured chosen at the outset

Option 2: Discounted value of fixed Income protection payments as on date of death discounted at a rate of 6.5% p.a. compounded yearly

Option 3: Discounted value of increasing Income protection payments as on date of death discounted at a rate of 6.5% p.a. compounded yearly.

Maturity Benefits:

There are no benefits payable to you on maturity of the policy.

Target Group

For the customers who want to buy a tax saving term plan directly from the company, are value conscious and internet savvy, looking at high level of protection at most affordable rates

ELIGIBILITY

|

Parameter |

Criterion |

||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Basic Life Cover |

Income Protection |

||||||||||||||||||||||||||||||||

|

Entry Age (as on last birthday) |

18 - 55 years |

25 - 55 years |

|||||||||||||||||||||||||||||||

|

Maturity Age |

Minimum: |

28 years |

Minimum: |

45 years |

|||||||||||||||||||||||||||||

|

Maximum: |

Smoker: 65 years |

Maximum: |

65 years |

||||||||||||||||||||||||||||||

|

Policy Term |

Minimum: |

10 years |

Minimum: |

10 years (subject to minimum maturity age of 45 years) |

|||||||||||||||||||||||||||||

|

Maximum: |

Smoker: 65 years minus Entry Age |

Maximum: |

65 years minus Entry Age |

||||||||||||||||||||||||||||||

|

Sum Assured |

|

||||||||||||||||||||||||||||||||

|

Premium Payment Term |

Equal to the Policy Term for all options |

||||||||||||||||||||||||||||||||

|

Premium Payment Frequency |

Annual and Monthly |

||||||||||||||||||||||||||||||||

Riders

To enhance your financial protection and to secure yourself/your family against accidental disability or demise, we present to you Rider which you may choose as an additional protection. There is one rider option available under this plan. Future Generali Accidental Benefit Rider (UIN: 133B027V02). Please refer to the respective rider brochure for more details. The premium pertaining to health related or critical illness riders shall not exceed 100% of premium under the basic product, the premiums under all other life insurance riders put together shall not exceed 30% of premiums under the basic product and any benefit arising under each of the above mentioned riders shall not exceed the sum assured under the basic product.

Please refer to the respective rider brochure for more details.

Please refer to the sales brochure of this rider to understand the terms & conditions before concluding a sale.

Click here to download the sales brochure.

Click here to download the sample Policy Document.

Click here to download the sample Policy Schedule Document.

Disclaimers

- A written application from the policyholder along with the proof of continued insurability of the life assured as specified by the Company from time to time and

- On payment of all overdue premiums without any interest.

- For existing e-Insurance Account: Computation of the said Free Look Period will commence from the date of delivery of the e mail confirming the credit of the Insurance Policy by the IR.

- For New e-Insurance Account: If an application for e-Insurance Account accompanies the proposal for insurance, the date of receipt of the ‘welcome kit’ from the IR with the credentials to log on to the eInsurance Account(e IA) or the delivery date of the email confirming the grant of access to the eIA or the delivery date of the email confirming the credit of the Insurance Policy by the IR to the eIA, whichever is later shall be reckoned for the purpose of computation of the Free Look Period.

Future Generali Flexi Online Term Plan UIN 133N058V04

LAPSE

If your due premium remains unpaid at the end of the grace period, the policy shall lapse and no life cover will be provided to you during lapse period. You can revive the policy within 2 years from the date of last unpaid premium. The policy will be terminated for no value at the end of revival period.

SURRENDER VALUE - NIL

PAID UP VALUE - NIL

REVIVAL PERIOD - If due premiums are not paid during the grace period, the policy may be revived during the Policy Term within a period of two years from the due date of first unpaid premium. The revival will be considered on receipt of

NOMINATION AND ASSIGNMENT

Nomination, in accordance with Section 39 of Insurance Act, 1938 as amended from time to time is permitted under this policy.

Assignment, in accordance with Section 38 of Insurance Act, 1938 as amended from time to time is permitted under this policy.

Exclusions

In case of death due to suicide within 12 months from the date of commencement of risk under the policy or from the date of revival of the policy, as applicable, the nominee or beneficiary of the policyholder shall be entitled to 80% of the total premiums paid till the date of death or the surrender value available as on the date of death whichever is higher, provided the policy is in force.

FREE LOOK CANCELLATION:

In case you disagree with any of the terms and conditions of the policy, you can return the policy to the company within 15 days (30 days if you have purchased this policy through distance marketing mode) of its receipt for cancellation, stating your objections. Future Generali will refund the policy premium after the deduction of proportionate risk premium for the period of cover, stamp duty charges, cost of medical examination, if any.

If the Policy is opted through Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:-

Life Insurance Made Simple

-

Decoding Your Policy’s Fine Print

The fine print in a policy can come in the way of making an informed purchase. We’ve simplified the fine print into big print.

-

Ensure Your Claims Are Always Settled

Read the terms and conditions carefully. Ensure that your current health, occupation or lifestyle habits do not exclude you from getting the policy benefits.

-

Protecting Your Policy – Do’s & Don’ts

Do's and don’ts to protect your life insurance policy from unauthorised elements posing as company representatives.

-

Are You Financially Prepared For Your Future?

Find out how prepared you are to meet your financial goals, with our FutureReady calculator.

-

12 Questions to Ask Before You Buy

Buying a life insurance policy without asking your advisor the right questions is as good as crossing a road blindfolded.