We all want a little extra something in life. Same is true for our investments as well, so we have created a Unit Linked Insurance Plan just for that. With us, you can now dream much more.

Presenting the Future Generali Big Dreams Plan, a comprehensive Unit Linked Insurance Plan, that lets you create wealth while enjoying the benefits of an insurance plan at the same time.

So go on and secure your long-term future and dreams!

Boost your returns with extra allocation, from 1% to 7% on your each instalment premium if the due premium is paid within the Grace Period. This ensures you reach your financial goals faster.

Benefit with Zero Allocation and Zero Admin charge and watch your wealth grow faster.

Enjoy the benefit of life cover and secure your family’s future against the uncertainties of life.

Fulfil your life’s goals by choosing from 3 available options – Wealth Creation, Retire Smart and Dream Protect.

Avail Systematic Partial Withdrawal (under Option 1: Wealth Creation and Option 2: Retire Smart only) and receive money in your account monthly to help you meet specific financial requirements.

Get the flexibility to change your funds and always be in complete control of your wealth.

Avail tax benefits under Section 80C and Sec 10(10D) of the Income Tax Act of 1961. These benefits are subject to change as per the prevailing tax laws.

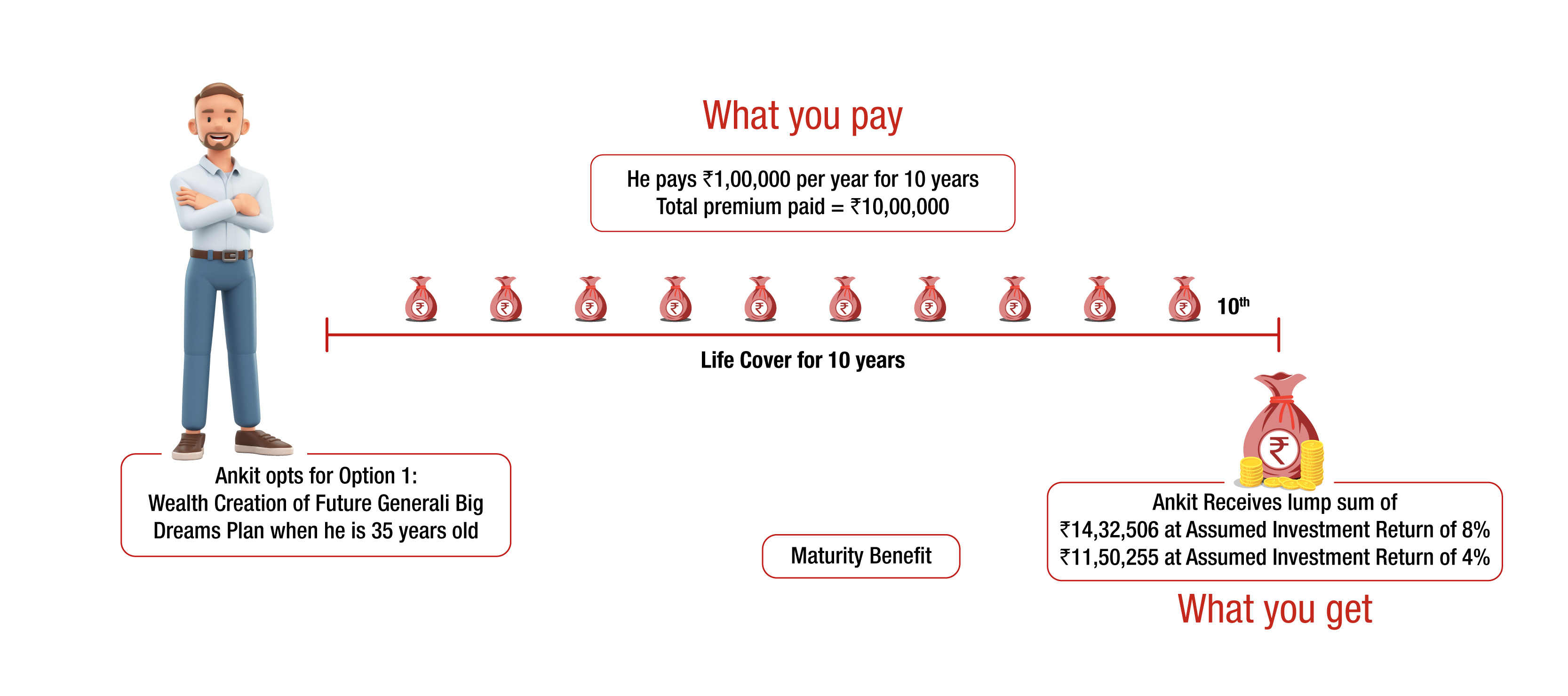

Ankit is 35 years old and has chosen to invest in Option 1: Wealth Creation of the Future Generali Big Dreams Plan, with a Policy Term of 10 years, an annual premium of Rs. 1,00,000 for 10 years, His Death Benefit Multiple is 10 times and a Sum Assured (cover amount) of Rs. 10,00,000.

Note: For the purpose of illustration, we have assumed 8% p.a and 4% p.a as the higher and lower values of investment returns. These rates are not guaranteed, and they are not the upper or lower limits of returns of the Funds selected in your policy, as the performance of funds depends on several factors including future investment performance. These rates in no way signify our expectations of future returns and the actual returns may be higher or lower.

Future Generali Big Dream Plan (UIN: 133L081V03)

This Product is not available for online sale.Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@futuregenerali.in For further details please access the link: https://life.futuregenerali.in/customer-service/grievance-redressal-procedure.