Your retirement from work should mean one and only one thing - simply enjoying life. And the only thing retirement should bring to your life is an abundance of time for yourself, without impacting your regular income. But for that, you need to plan now, and that planning need not be complicated or stressful. After all – life is best enjoyed with simplicity, then why should your retirement planning be complicated?

Presenting the Future Generali Saral Pension, a Single premium Immediate Annuity Plan which is easy to understand, own and maintain. This plan provides guaranteed regular income throughout your lifetime, to support your financial independence.

Pay once (Purchase Price) and get guaranteed income (Annuity) during your lifetime.

Choose among yearly, half-yearly, quarterly and monthly frequencies to receive annuity payment as per your need. Annuity payment shall be made in arrears only at the end of chosen annuity payment frequency from the date of purchase of the plan.

Option to take the plan on Joint Life basis with spouse to ensure Annuity payments continue for spouse after you.

Note:

| Parameter | Criterion | |

|---|---|---|

| Entry Age (As on last Birthday) |

Minimum | 40 years |

| Maximum | 80 years | |

| In case of joint life option, age limits apply to both the lives | ||

| Premium Payment Term | Single Pay | |

| Policy Term | Whole Life (as long as Annuitant(s) survive) | |

| Purchase Price | Depends on Annuity amount | |

| Annuity amount | Minimum |

|

| Maximum | No Limit | |

| Mode of Annuity Payment | Monthly, Quarterly, Half-Yearly and Yearly. (Annuity Payments shall be made in arrears) | |

Purchase Price mentioned above are excluding applicable taxes.

Minimum Annuity amount may change as per the regulations, circulars and clarifications thereof, as prescribed by the IRDAI from time to time.

| Single Premium or Purchase Price (excluding applicable taxes) | ₹ 10,00,000 | |

|---|---|---|

| Annuitant Age | Option 1: Single life annuity with Return of 100% of Purchase price (ROP) | Option 2: Joint Life^ Last Survivor Annuity with Return of 100% of Purchase Price (ROP) on death of the last survivor |

| 50 | ₹ 50,164 | ₹ 50,108 |

| 55 | ₹ 50,219 | ₹ 50,212 |

| 60 | ₹ 50,175 | ₹ 50,309 |

^Assuming both the annuitants are of same age for Joint Life

Annuity rates are subject to review from time to time & may be revised. However, once the policy is purchased, Annuity rates are guaranteed throughout the life of Annuitant(s).

The benefits payable are as under:

| Annuity Option | Single / Joint Life | Benefit Payable on survival | Benefit payable on death |

|---|---|---|---|

| Option 1: Life annuity with Return of 100% of Purchase price (ROP) | Single life | Annuity payments will be made in arrears for as long as Annuitant is alive, as per the chosen mode of annuity payment | On death of the Annuitant, the Annuity payment shall cease immediately. The Purchase Price shall be payable to Nominee(s) / legal heirs. |

| Option 2: Joint Life Last Survivor Annuity with Return of 100% of Purchase Price (ROP) on death of the last survivor | Joint Life | Annuity payments will be made in arrears for as long as the Primary Annuitant and/or Secondary Annuitant is alive, as per the chosen mode of Annuity payment. | On first death (of either of the covered lives): 100% of the Annuity amount shall continue to be paid as long as one of the Annuitants is alive. On death of the last survivor: The annuity payments will cease immediately. The Purchase Price shall be payable to the Nominee(s) / legal heirs. |

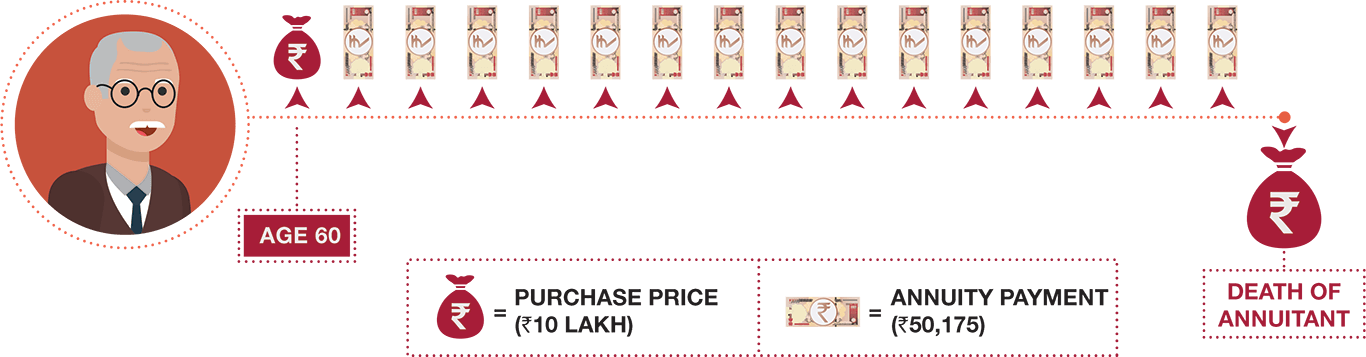

Scenario – 1:

Amit is a 60 years old male and has purchased the Future Generali Saral Pension – Option 1: Life annuity with Return of 100% of Purchase price (ROP). He has opted for a Purchase Price of ₹ 10 Lakh (excluding applicable taxes) and yearly mode for annuity payment. Amit will start receiving yearly annuity amount of ₹ 50,175 every year starting from end of 1st policy anniversary.

What Amit Pays = ₹ 10 lakh

(excluding applicable taxes)

In case of death of Amit, the Purchase Price (excluding taxes) of ₹ 10 Lakh will be returned to his Nominee.

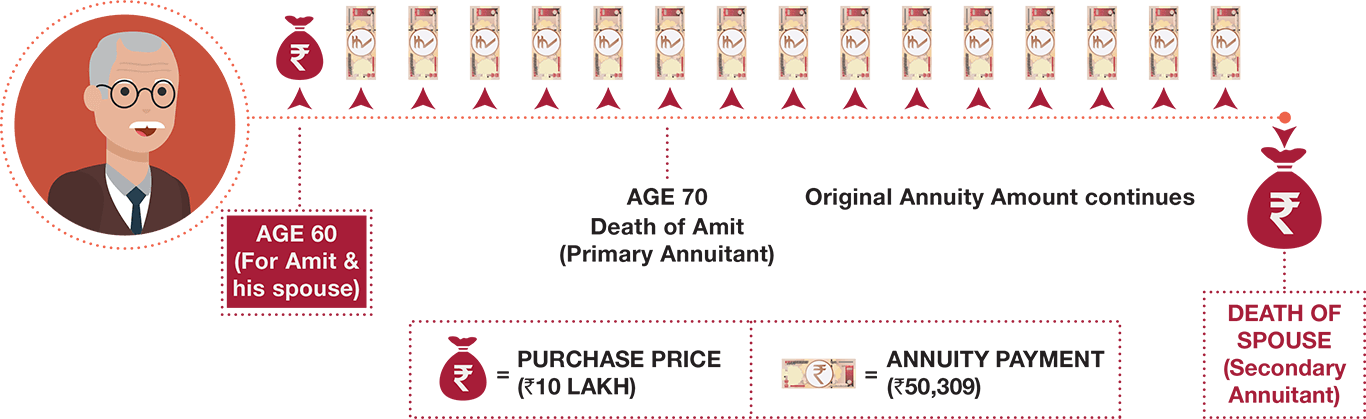

Scenario – 2:

Amit is a 60 years old male and he chooses Future Generali Saral Pension – Option2: Joint Life Last Survivor Annuity with Return of 100% of Purchase Price (ROP) on death of the last survivor, with his wife aged 60 years as the secondary annuitant. They opt for a Purchase Price of ₹ 10 Lakh (excluding applicable taxes) and yearly mode for annuity payment.

Amit will start receiving yearly annuity amount of ₹ 50,309 every year starting from end of 1st policy anniversary. In case of Amit’s death before his wife, his wife will continue to receive the same amount as long as she survives.

Upon death of both the annuitants, the Purchase Price (excluding applicable taxes) ₹ 10 Lakh will be returned to his Nominee.

There is no Maturity Benefit under this Policy.

Definitions of Terms used:

If you disagree with the terms and condition of the Policy, you can return the Policy within 15 days of receipt of the Policy Document (30 days if You have purchased this Policy through Distance Marketing Mode or in case of electronic policies). To cancel the Policy, you can send us a request for cancellation, along with the reason for cancellation. We will cancel this Policy and refund the Premium received after deducting stamp duty charges and Annuity paid, if any.

The treatment of the Policy shall be as follows:

Note: Distance Marketing means insurance solicitation/lead generation by way of telephone calling/ Short Messaging Service (SMS)/other electronic modes like e-mail, internet & Interactive Television (DTH)/direct mail/ newspaper and magazine inserts or any other means of communication other than that in person.

Your annuity will be payable in arrears at the end of chosen annuity payment mode from the date of purchase of the plan. This implies that

Annuity instalments for mode other than yearly mode shall be as specified below:

| Annuity Payment Mode | Annuity Instalments as per Mode |

|---|---|

| Monthly | 96% of Annual Annuity Amount x 1/12 = 8% |

| Quarterly | 97% of Annual Annuity Amount x 1/4 = 24.25% |

| Half-Yearly | 98% of Annual Annuity Amount x ½ = 49% |

| Yearly | 100% of Annual Annuity Amount |

The mode of annuity payment is chosen at inception of the Policy and cannot be subsequently changed during the currency of the Policy.

The annuity rates vary by purchase price band also and therefore you would benefit from higher annuity rates if the purchase price is above ₹ 2,00,000. The purchase price bands are as specified below.

| Band | Single Premium ( Purchase Price ) in ₹ | Additional Annual Annuity Amount in ₹ per ₹ 1000 Single Premium (Purchase Price) |

|---|---|---|

| Band 1 | Less than ₹ 2,00,000 | 0.00 |

| Band 2 | ₹ 2,00,000 to less than ₹ 5,00,000 | 0.50 |

| Band 3 | ₹ 5,00,000 to less than ₹ 10,00,000 | 1.50 |

| Band 4 | ₹ 10,00,000 to less than ₹ 25,00,000 | 1.70 |

| Band 5 | ₹ 25,00,000 and above | 1.90 |

You may avail a Loan any time after six months from the Date of Commencement of the Policy. Maximum amount of loan that can be granted under the Policy shall be such that the effective annual interest amount payable on loan does not exceed 50% of the annual Annuity amount payable under the Policy. Under Joint Life Option, the loan can be availed by the Primary Annuitant and on death of the Primary Annuitant, it can be availed by the Secondary Annuitant.

Any change in the basis of determination of loan interest rate shall be only after prior approval of the IRDAI.

We encourage you to continue your policy as planned and receive annuity payments for life. However, you have the option to surrender the policy for immediate cash requirement, in case of an emergency as defined below:

The Policy can be surrendered any time after six months from the Date of Commencement, if the Annuitant / Primary Annuitant /Secondary Annuitant, or spouse or any of the children of the Annuitant is diagnosed as suffering from any of the critical illnesses as defined in Annexure 1 below, based on the documents produced to the satisfaction of the medical examiner of the Company. On approval of the surrender, 95% of the Purchase Price shall be paid to the Annuitant, subject to deduction of any outstanding loan amount and loan interest, if any. On payment of the Surrender Value, the Policy stands terminated. For the purpose of Surrender Value calculation, the Purchase Price excludes taxes, if any. Any change in the Surrender Value calculation method shall be applicable only after prior approval of IRDAI.

Nomination shall be in accordance with Section 39 of Insurance Act, 1938 as amended from time to time.

Assignment shall be in accordance with Section 38 of Insurance Act, 1938 as amended from time to time.

Section 41 of the Insurance Act 1938 as amended from time to time states:

Section 45 of the Insurance Act 1938 as amended from time to time states:

For further information, Section 45 of the Insurance laws (Amendment) Act, 2015 may be referred.

(First Heart Attack of specific severity)

Future Generali India Life Insurance Company Limited offers an extensive range of life insurance products, and a distribution network which ensures that we are close to you wherever you go.

At the heart of our ambition is the promise to be a life-time partner to our customers. And with the help of technology we are making the shift from not only offering protection to our customers but also providing personalized services to them.

It starts with our extensive agent base who is at the core of this transformation. Through our distribution network we ensure that there is always a caring touch while servicing the individual needs of our customers. With this philosophy, we aim to make simplicity, innovation, empathy and care synonymous with our brand - Future Generali India Life Insurance Company Limited.

Future Generali Saral Pension Plan (UIN : 133N089V01)

This Product is not available for online sale.

For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the policy document and consult your advisor, or, visit our website (life.futuregenerali.in) before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. You are advised to consult your tax consultant. Future Group’s and Generali Group’s liability is restricted to the extent of their shareholding in Future Generali India Life Insurance Company Limited.

Future Generali India Life Insurance Co. Ltd. (IRDAI Regn. No. 133)