Why you need this Plan?

Two options to choose from

Depending on your protection needs, you can opt between the following options. However, premium will vary depending upon the choice of option

Option A: Lump sum Protection or

Option B: Income Protection

Select your own Policy Term and Premium Payment Term

The plan gives you the flexibility to choose the period of protection and the period of premium payment.

Option to enhance your coverage

You can strengthen your cover by opting for the Future Generali Accidental Benefit Rider (UIN: 133B027V02) which provides additional benefit by paying a nominal incremental premium.

Assured return of premium

On survival, at the end of the policy term, depending on the type of cover option you have chosen, you will receive 100% (for Option A) or 115% (for Option B) of the premiums you have paid (excluding taxes, rider premium, modal loading and extra underwriting premium, if any).

Tax benefits

Tax Benefits under section 80 C and 10 (10 D) may be available as applicable. Tax Benefits are subject to change in law from time to time. Please consult your tax advisor for more details.

Lower premium rates for female lives

How it Works

- Choose Option A - Lump sum Protection, if you want your nominee to receive a

single payout as death benefit - Choose Option B - Income Protection, if you want your nominee to receive a

monthly income for the chosen payout period as death benefit

Step 2: Choose the amount of insurance cover (Sum Assured) you desire under this policy

Step 3: Choose the duration of cover (Policy Term) and Premium Payment Term as per your

convenience

Step 4: Get your premium calculated, fill the application form and get a customised quote.

Our advisor will help you with the calculations

Step 5: Start paying premiums regularly and stay financially protected

Step 2: Choose the amount of monthly income you think your nominee will require in your absence.

This amount will be paid to your family, in case of unfortunate demise of the Life Assured.

Step 3: Choose the number of years (Payout Period) for which the regular income is to be paid to

your nominee, in case of death of the Life Assured

Step 4: Choose the duration of cover (Policy Term) and Premium Payment Term as per your

convenience.

Step 5: Get your premium calculated, fill the application form and get a customised quote. Our

advisor will help you with the calculations

Step 6: Start paying premiums regularly and stay financially protected

Plan Summary

| Parameter | Criterion |

|---|---|

| Entry Age (as on last Birthday) | 18 years - 55 years |

| Maturity Age | 28 years - 75 years |

| Plan Options | Option A: Lump sum Protection Option B: Income Protection |

| Policy Term | 10 year - 35 years |

| Premium Payment Term | 10 years - 15 years |

| Payout Period (Applicable only for Option B) | 10 / 15 / 20 years |

| Sum Assured | Minimum - Option A: Option B: (For a minimum Monthly Income of Maximum - As per Board Approved Underwriting Policy |

| Monthly Income (Applicable only for Option B) | Minimum - Maximum - As per Board Approved underwriting policy |

| Premium Payment Frequency | Yearly, Half Yearly, Quarterly & Monthly |

| Premium amount. | Minimum Premium: Maximum Premium: No Limit (as per Sum Assured) |

| Premium rates for female lives | An age setback of two years shall be applied to female lives for for female lives calculation of the premium rates. For females lives aged 18 & 19 years, premium rates of 18 years male shall apply. |

Note: Premiums mentioned above are excluding taxes, rider premium and any extra premium paid as a part of underwriting requirements, if any

BENEFITS

1. Death Benefit

In case of unfortunate demise of Life Assured, during the Policy Term, the nominee shall receive Death Sum Assured, The Death Sum Assured shall be highest of the following:

- 10 times Annualised Premium (excluding taxes, rider premium, loading for modal premiums and extra premiums, if any), or

- 105% of total premiums paid as on date of death (excluding taxes, rider premium and extra premiums, if any), or

- Guaranteed Maturity Sum Assured; or

- Absolute amount assured to be paid on death, which is equal to Sum Assured

Where Sum Assured is equal to:-

Option A: Sum assured chosen at the outset Option B: Lump sum death benefit as discounted value of monthly payouts. The monthly payouts will be discounted using discount rate of 6.25% per annum compounded yearly.

Maturity Sum Assured is equal to:-

Option A: 100% of total premiums paid (excluding taxes, rider premium, modal loading and extra underwriting premium, if any)

Option B: 115% of total premiums paid (excluding taxes, rider premium, modal loading and extra underwriting premium, if any)

Option A - Lump sum Protection

Under this option, the Death Benefit shall be paid to the nominee as a lump sum in the event of death.

Option B - Income Protection

Under this option, the Death Benefit shall be payable as Monthly Income (payouts made each month) to your nominee during the payout period as chosen by you at inception of policy.

Your nominee also has an option to take the Death Benefit as a lump sum benefit which is equal to outstanding monthly payouts discounted at 6.25% per annum compounded yearly.

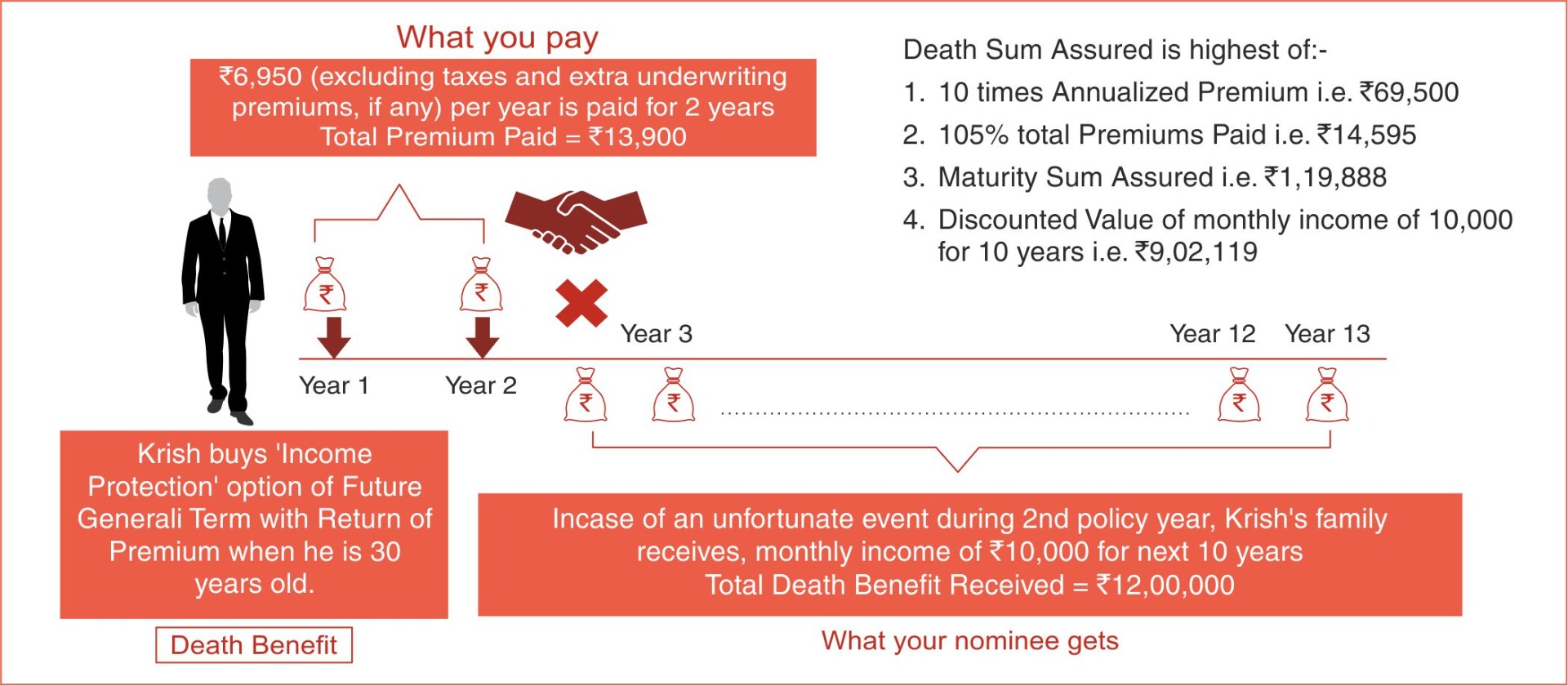

Let's understand this benefit with the help of an example:

Krish is a 30 year old healthy man. He makes the following choices while buying the Future Generali Term with Return of Premium Plan

- Protection Option: Option B - Income Protection

- Monthly Income to be paid to the nominee:

10,000

10,000 - Coverage Term: 35 years

- Premium Payment Term: 15 years

- Premium Payment Frequency: Yearly

- Payout Period: 10 years (The monthly income of

10,000 will be paid to the nominee for 10 years)

10,000 will be paid to the nominee for 10 years)

Premium Payable: As per the choices made above, his annual premium works out to ![]() 6,950 (excluding taxes)

6,950 (excluding taxes)

Benefit Payable: And If Krish's death occurs in the 2 policy year after paying his premium for initial 2 years, the benefit payable to Krish's nominee(s) will be:

• Monthly Income payouts of ![]() 10,000 for next 10 years

10,000 for next 10 years

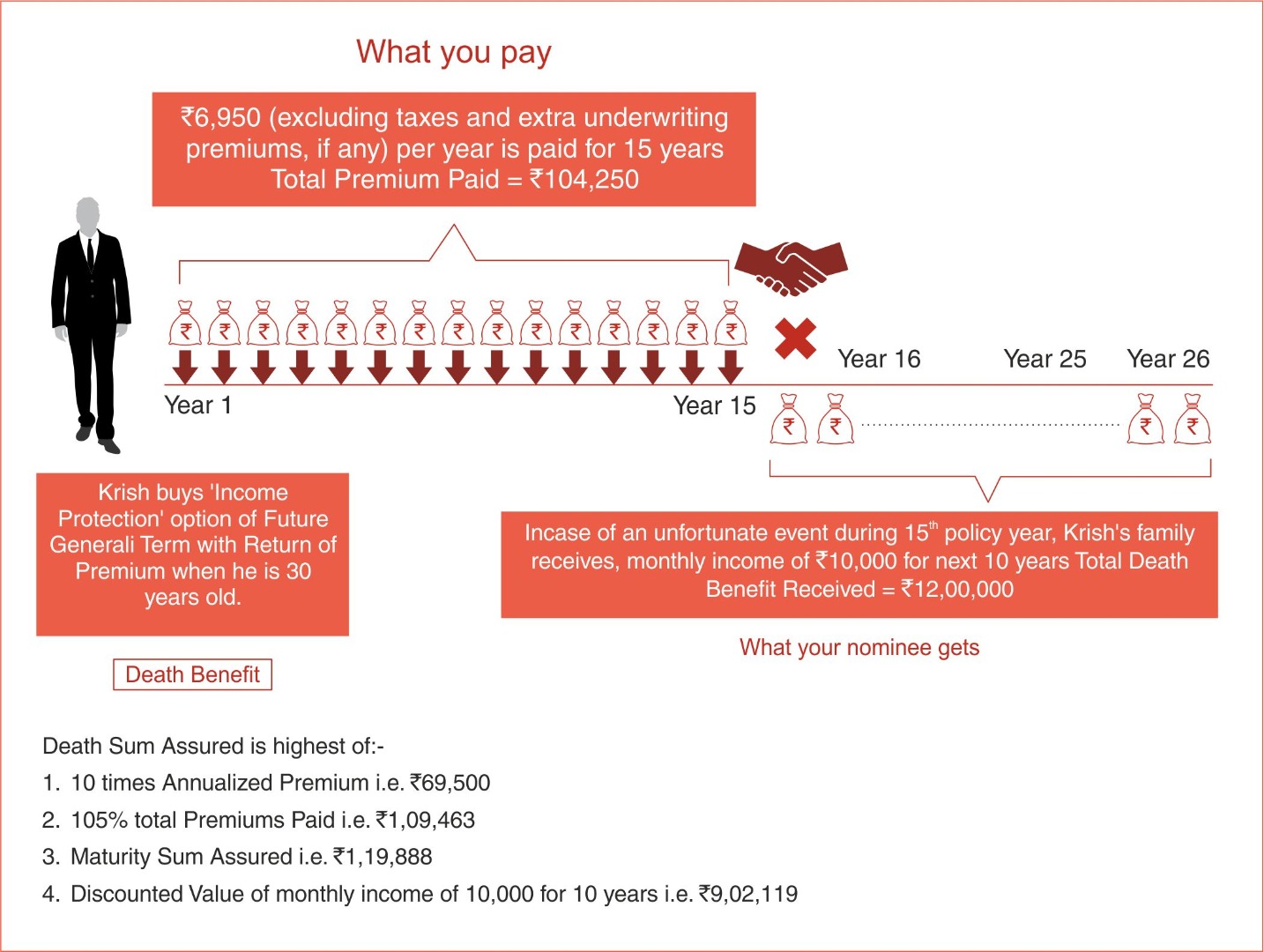

Scenario 2: If Krish's death occurs in the 15th policy year after paying his premium for 15 years, the benefit payable to Krish's nominee(s) will be:

• Monthly Income payouts of ![]() 10,000 for next 10 years

10,000 for next 10 years

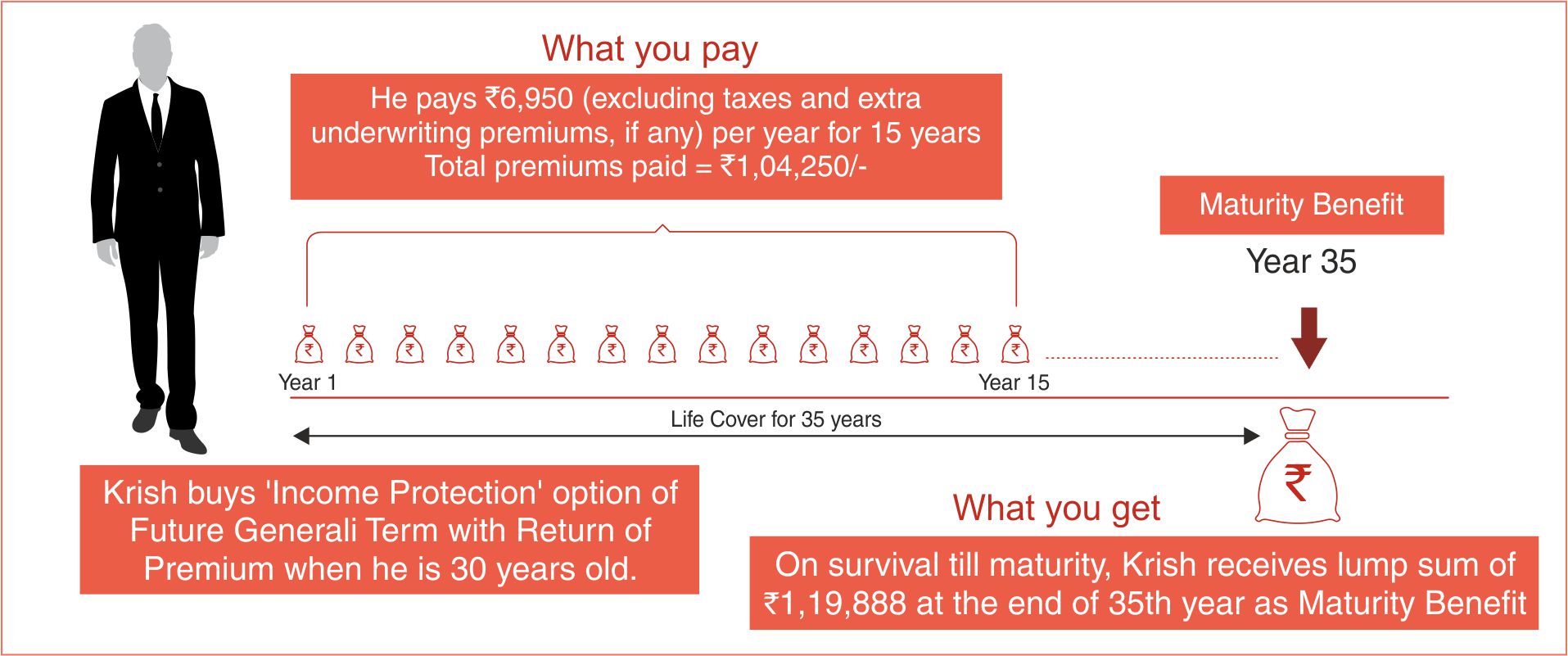

2. Maturity Benefit:

If you have paid all your due premiums, you will receive a Maturity Benefit as per your chosen option, on survival, at the end of the Policy Term

Maturity Benefit under Option A - Lump sum Protection

You will receive Guaranteed Maturity Sum Assured which is equal to 100% of total premiums payable (excluding taxes, rider premium, modal loadings and extra underwriting premium, if any) under the policy.

Maturity Benefit under Option B - Income Protection

You will receive Guaranteed Maturity Sum Assured which is equal to 115% of total premiums payable (excluding taxes, rider premium, modal loadings and extra underwriting premium, if any) under the policy.

The policy terminates on payment of maturity benefit.

Let's understand this benefit with the help of the previous example:

Benefit payable:

If Krish survives till the end of the policy term of 35 years, then he is entitled to receive ![]() 1,19,888 as Maturity Benefit provided that he has paid all his premiums for 15 years.

1,19,888 as Maturity Benefit provided that he has paid all his premiums for 15 years.

Target Group

For the customers who are looking for tax saving whole life insurance plan that offers dual benefits of Lumpsum benefit alongwith potential upside through bonuses and cover till 100 years of age.

Riders

You have the option to enhance your cover by opting for the following rider-

Future Generali Accidental Benefit Rider (UIN: 133B027V02)

Please refer to the respective rider brochure for more details.

Note:

The premium pertaining to health or critical illness riders shall not exceed 100% of the premium under the basic plan. The premiums under all other life insurance riders put together shall not exceed 30% of the premiums under the basic plan and any benefit arising under each of the above-mentioned riders shall not exceed the sum assured under the basic plan.

Exclusions

Suicide exclusion:

In Case of death due to suicide within 12 months from the date of commencement of risk under the policy or from the date of revival of the policy, as applicable, the nominee or beneficiary of the policyholder shall be entitled to 80% of the total premiums paid till the date of death or the surrender value available as on the date of death whichever is higher, provided the policy is in force.

DISCLAIMERS

Future Generali Term with Return of Premium (UIN: 133N068V02)

- Riders are not mandatory and are available for an additional cost

Free Look Period

In case you disagree with any of the terms and conditions of the policy, you can return the policy to the Company within 15 days (30 days if the policy is sold through the Distance Marketing Mode) of its receipt of policy document for cancellation, stating your objections. Future Generali will refund the premium paid after the deduction of proportionate risk premium for the period of cover, stamp duty charges and cost of medical examination, if any.

Note: Distance Marketing means insurance solicitation/lead generation by way of telephone calling/ Short Messaging Service (SMS)/other electronic modes like e-mail, internet & Interactive Television (DTH)/direct mail/ newspaper and magazine inserts or any other means of communication other than that in person.

If the Policy is opted through Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:-

- For existing e-Insurance Account: Computation of the said Free Look Period will commence from the date of delivery of the e mail confirming the credit of the Insurance Policy by the IR.

- For New e-Insurance Account: If an application for e-Insurance Account accompanies the proposal for insurance, the date of receipt of the welcome kit from the IR with the credentials to log on to the e-Insurance Account(e IA) or the delivery date of the email confirming the grant of access to the e-IA or the delivery date of the email confirming the credit of the Insurance Policy by the IR to the e-IA, whichever is later shall be reckoned for the purpose of computation of the Free Look Period.

Life Insurance Made Simple

-

Decoding Your Policy’s Fine Print

The fine print in a policy can come in the way of making an informed purchase. We’ve simplified the fine print into big print.

-

Ensure Your Claims Are Always Settled

Read the terms and conditions carefully. Ensure that your current health, occupation or lifestyle habits do not exclude you from getting the policy benefits.

-

Protecting Your Policy – Do’s & Don’ts

Do's and don’ts to protect your life insurance policy from unauthorised elements posing as company representatives.

-

Are You Financially Prepared For Your Future?

Find out how prepared you are to meet your financial goals, with our FutureReady calculator.

-

12 Questions to Ask Before You Buy

Buying a life insurance policy without asking your advisor the right questions is as good as crossing a road blindfolded.